-

NZDCAD Elliott Wave Trade Setup Update 10.27.2016

Read MoreBelow is an update for NZDCAD active setup as of Oct 27, similar setup to what we present at Live Trading Room. The pair is showing a 5 swing Elliott wave sequence from 8/24 (0.8246) low, suggesting more upside is likely. Near term, while bounces stay below wave W at 0.9735, pair ideally makes another […]

-

FTSE Short-term Elliott Wave Analysis 10.27.2016

Read MoreBest reading of Elliott wave cycles suggests rally to 7091.7 ended wave ((w)). The Index is currently in wave ((x)) pullback as a double three where wave (w) ended at 6892 and wave (x) ended at 7040. While bounces stay below 7040, and more importantly below 7091.7, expect more downside in wave (y) of ((x)) towards 6788 […]

-

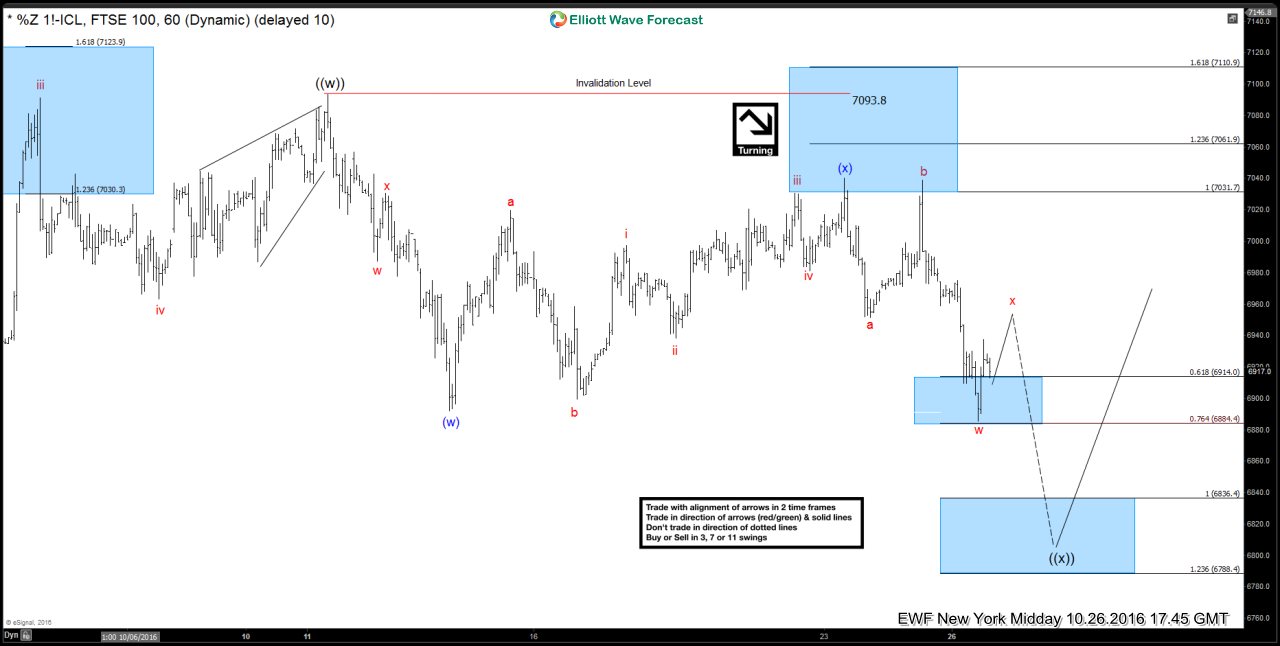

FTSE Short-term Elliott Wave Analysis 10.26.2016

Read MoreBest reading of Elliott wave cycles suggests rally to 7091.7 ended wave ((w)). The Index is currently in wave ((x)) pullback as a double three where wave (w) ended at 6892 and wave (x) ended at 7040. While bounces stay below 7040, and more importantly below 7091.7, expect more downside in wave (y) of ((x)) towards 6788 […]

-

USDCAD Trade Setup from Oct 19 Live Trading Room

Read MoreWe bought USDCAD at 1.3030 on Oct 19 in the Live Trading Room based on the Elliott wave structure and sequence and as of Nov 8 hit our trailing stop loss at 1.3308 for 272 pips profit. Below is the trade journal we provided to the member Below is a short clip when we proposed […]

-

EURAUD Short-term Elliott Wave Analysis 10.21.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high and this cycle is proposed complete with wave W at 1.418. Pair is currently in wave X bounce to correct the cycle from 9/15 (1.5096) peak or at least from 10/6 (1.4779) peak before the decline resumes. We don’t like buying […]

-

$TNX (10 Year Yields) Short-term Elliott Wave Analysis 10.14.2016

Read MoreShort term Elliott wave count suggests that pullback to 1.542 at 9/28 ended wave X. The rally from there looks to be unfolding as a 5 wave move and wave ((a)) is proposed complete at 1.801 . Wave ((b)) pull back is currently in progress to correct the cycle from 9/28 low (1.542) before the yields resume higher. We […]