-

GBPAUD Trade from 8/2 Live Trading Room

Read MoreGBPAUD Trade Video Clip from 8/2 Live Trading Room We sold the pair on 8/2 at 1.666 with initial target of 1.609. In Wednesday 8/16 Live Trading Room, we adjusted our limit profit to 1.623 and reached this target for 430 pips profit. Below is a video clip of our trade recommendation from August 3rd […]

-

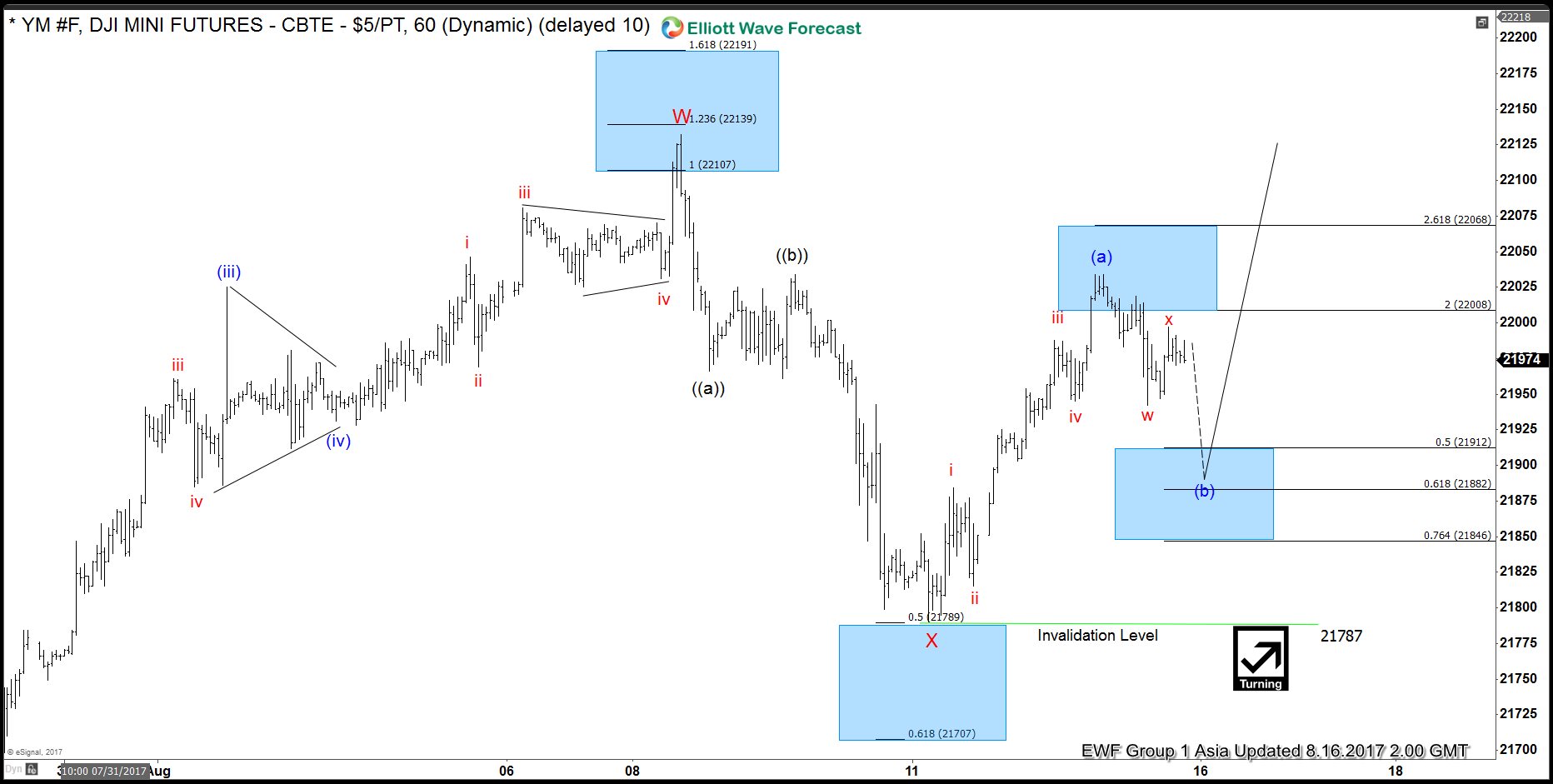

Dow Futures Elliott Wave View 8.17.2017

Read MoreShort term Dow Futures (YM_F) Elliott Wave view suggests that rally from 6/29 low is unfolding as a a double three Elliott wave structure. Up from 6/29 low (21138), Minor wave W ended at 22132 and pullback to 21790 ended Minor wave X. Rally from there is unfolding as an impulse Elliott wave structure. Up from 21790, […]

-

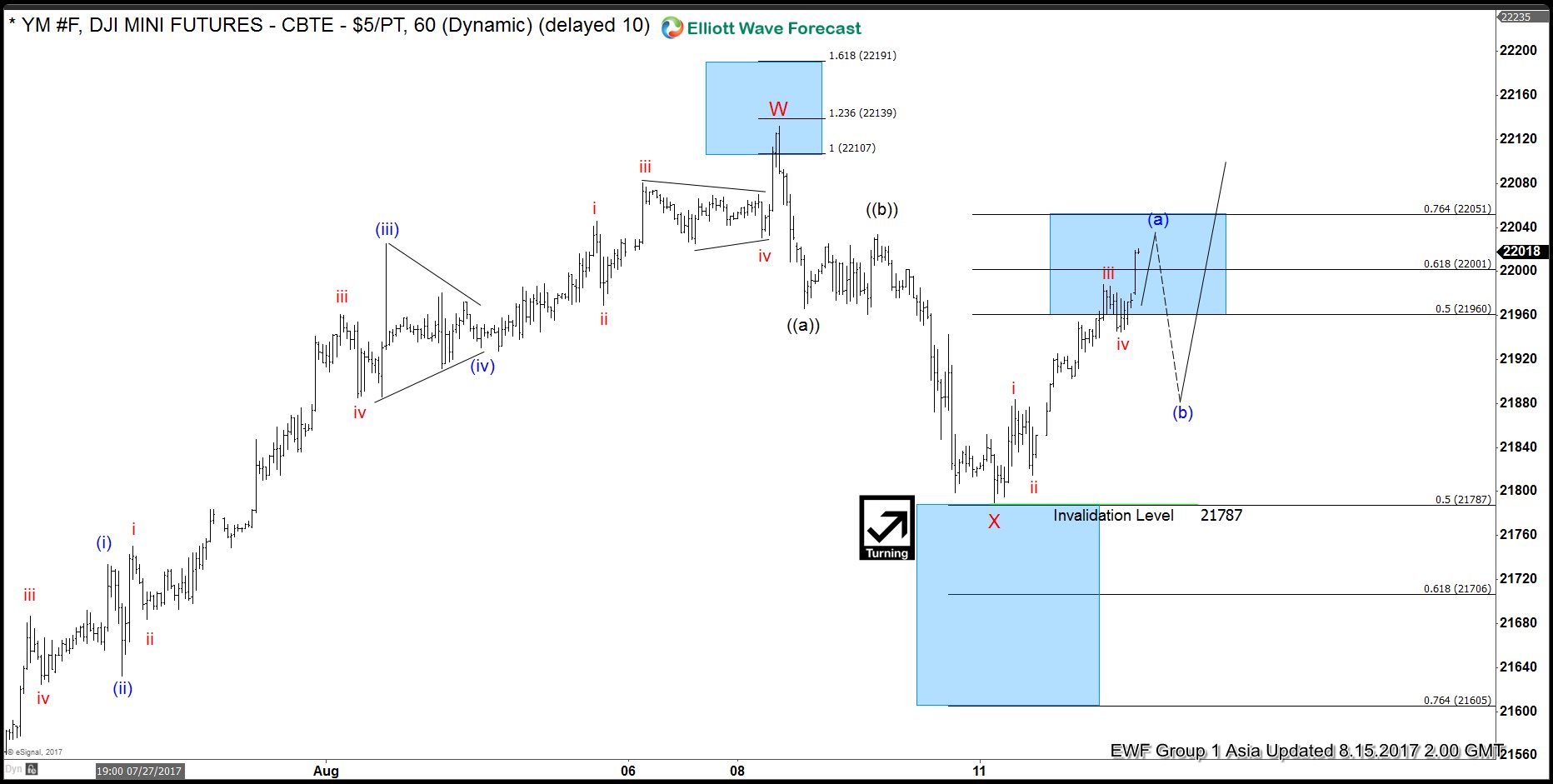

Dow Futures Elliott Wave View: 3 waves pullback

Read MoreShort term Dow Futures (YM_F) Elliott Wave view suggests that rally from 6/29 low is unfolding as a a double three Elliott wave structure. Up from 6/29 low (21138), Minor wave W ended at 22132 and pullback to 21790 ended Minor wave X. Rally from there is unfolding as an impulse Elliott wave structure. Up from 21790, […]

-

Dow Future Elliott Wave View: Resuming Higher

Read MoreShort term Dow Futures (YM_F) Elliott Wave view suggests that rally from 6/29 low is unfolding as a a double three Elliott wave structure. Up from 6/29 low (21138), Minor wave W ended at 22132 and pullback to 21790 ended Minor wave X. Rally from there is unfolding as an impulse Elliott wave structure. Up from 21790, […]

-

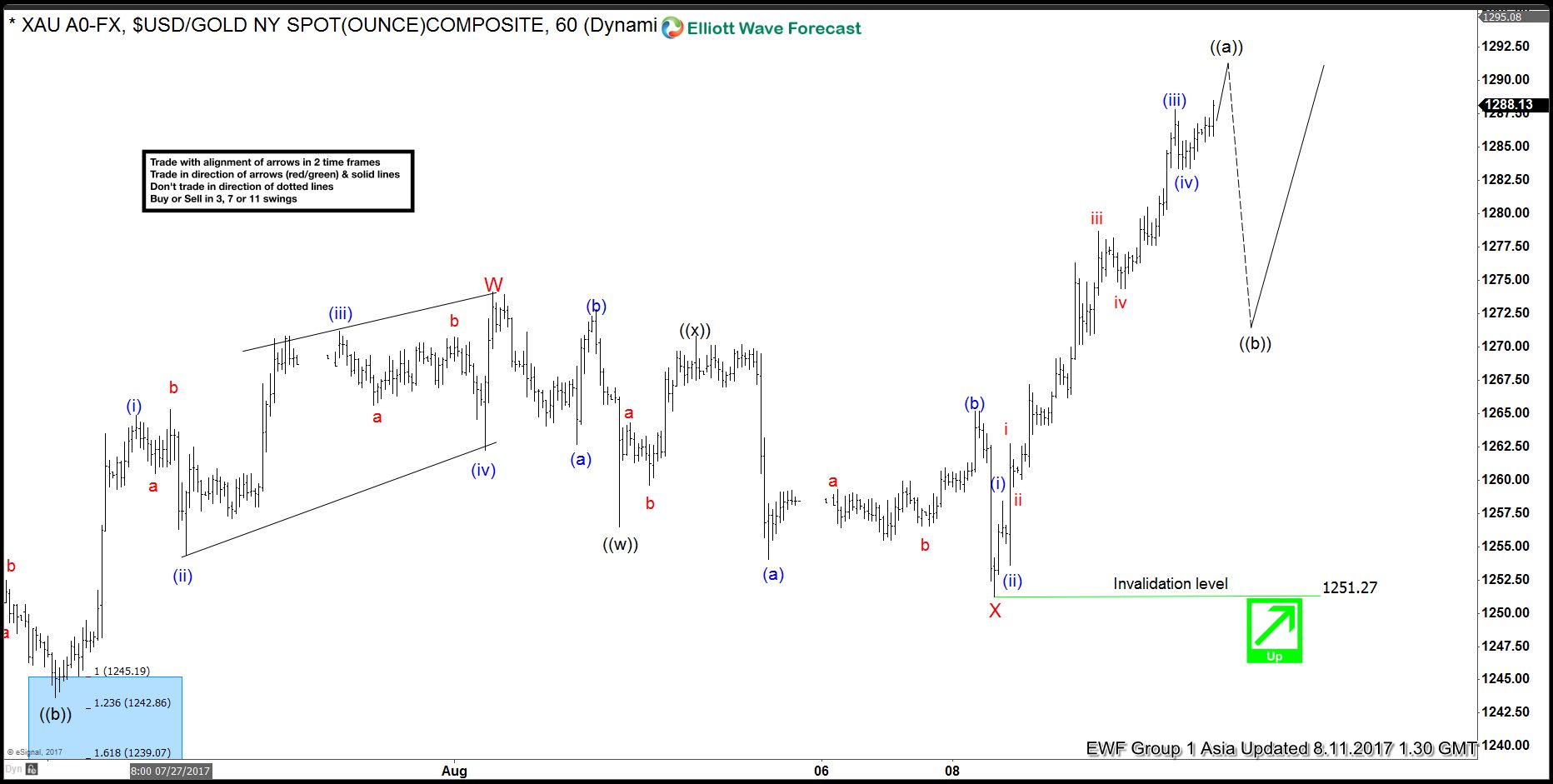

Gold Elliott Wave View: 8.11.2017

Read MoreShort term Gold (XAUUSD) Elliott Wave view suggests that rally from 7/10 low is unfolding as a a double three Elliott wave structure. Up from 7/10 low (1204.69), Minor wave W ended at 1274.11 and pullback to 1251.27 ended Minor wave X. Wave Y is currently in progress as a zigzag Elliott wave structure where Minute wave […]

-

Gold to Silver Ratio: Turning Lower

Read MoreGold to Silver ratio looks to have ended cycle from 7/4/2016 low (64.38) and should turn lower at least in 3 waves to correct cycle from 7/4/2016 low. The video below explains what the expected turn lower in the ratio means to Gold and Silver: Gold to Silver Ratio Correlation Chart Overlay of Gold-to-Silver […]