-

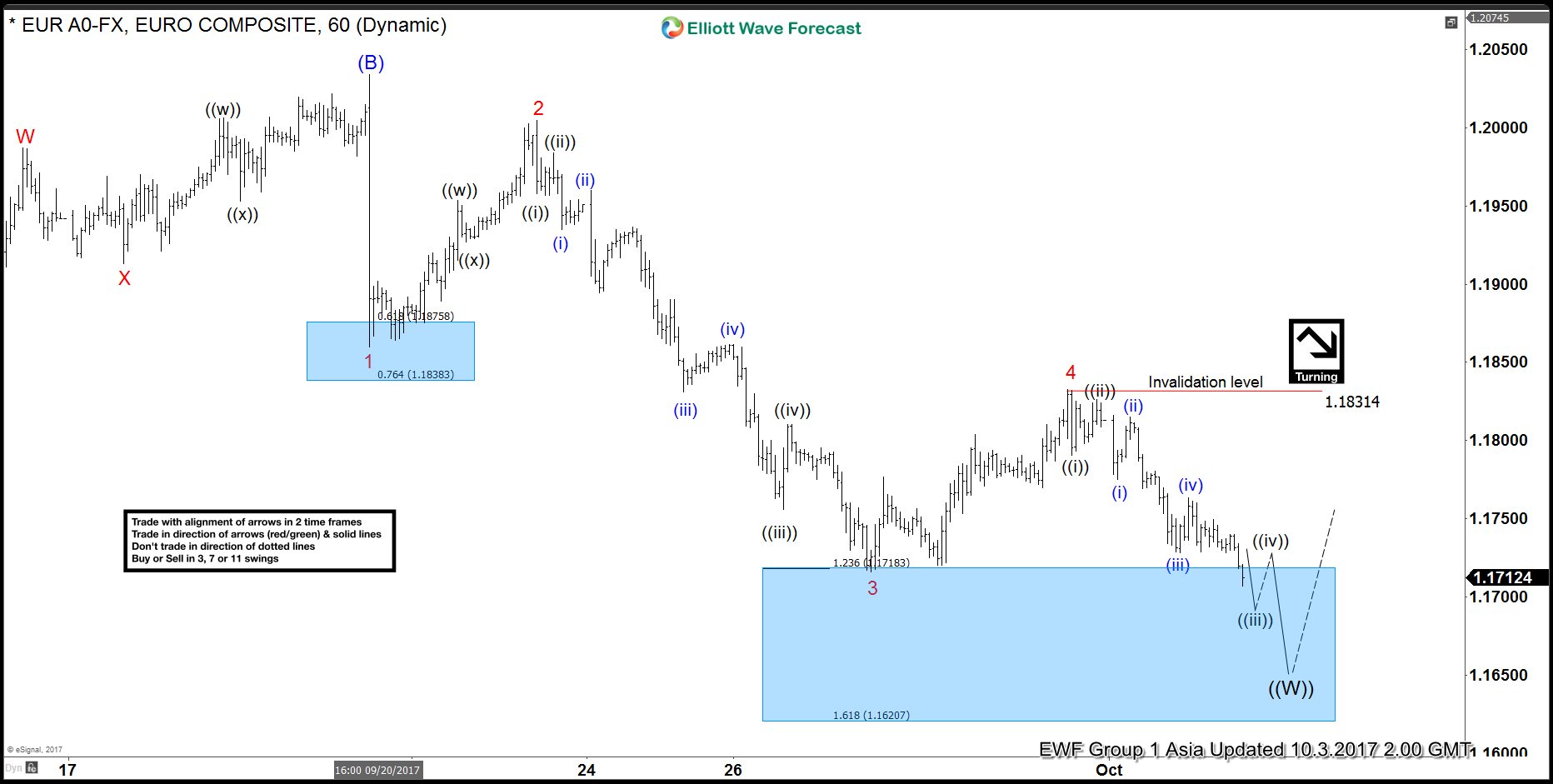

EURUSD Intra-Day Elliott Wave Analysis

Read MoreEURUSD Intra-Day Elliott Wave view suggests the decline from 9/8 peak remains in progress as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), pair ended Intermediate wave (A) at 1.837. Bounce to 1.2034 ended Intermediate wave (B). Intermediate wave (C) remains in progress and unfolding as 5 waves impulse where Minor wave 1 of […]

-

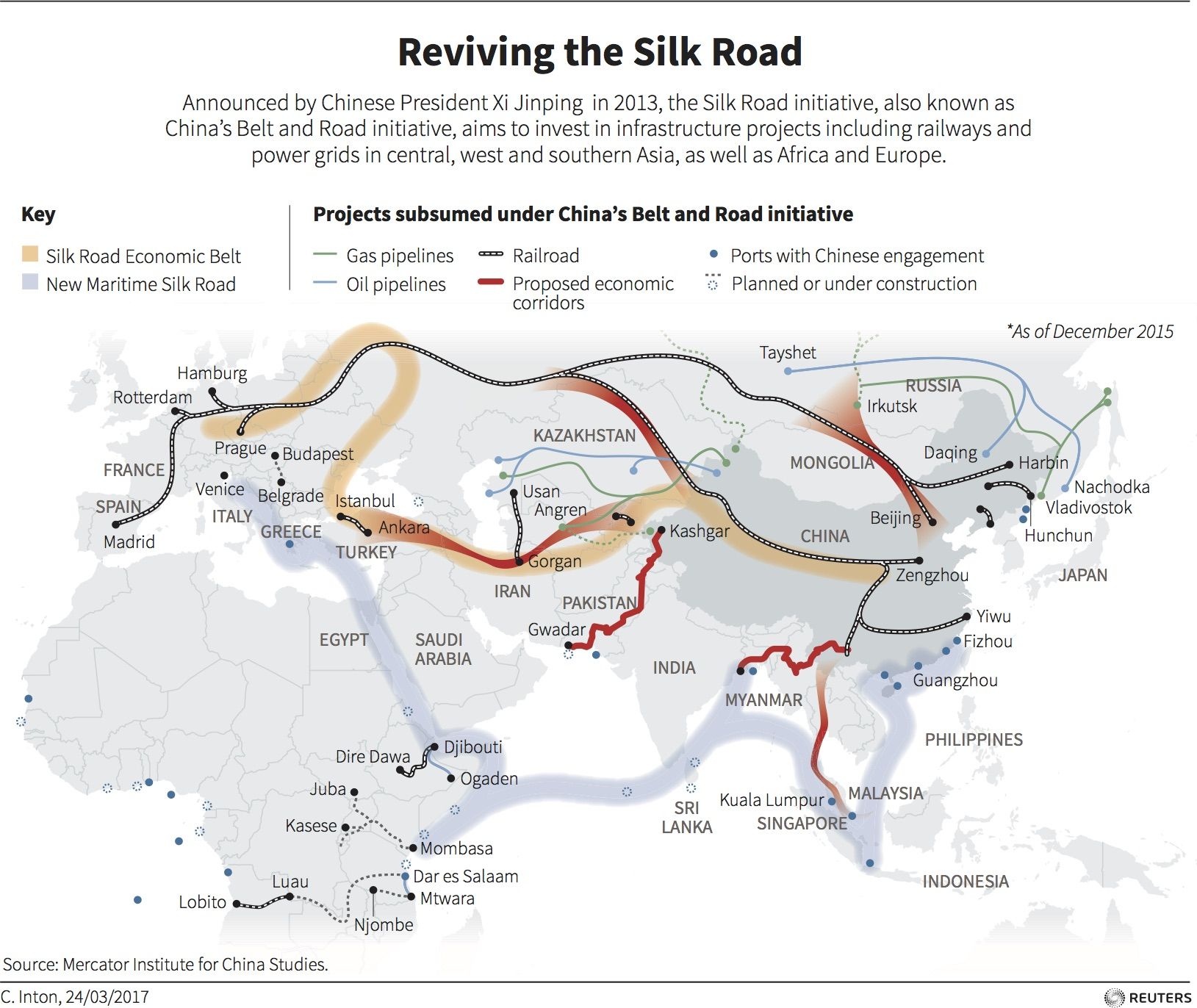

China’s One Belt One Road (OBOR) is Bullish Commodities

Read MoreWhat is OBOR (One Belt One Road) One Belt One Road (OBOR) is an initiative originally coming from China’s president Xi Jinping in 2013. The plan is the single biggest initiative since the opening up of China to foreign investment. President Xi called it a “project of the century”. In America, globalization has lost its […]

-

EURUSD Elliott Wave Analysis 10.5.2017

Read MoreEURUSD Short Term Elliott Wave structure suggests the decline from 9/8 peak is in progress as an expanded Flat Elliott Wave structure. From 9/8 high (1.2094), pair declined to 1.837 and ended Intermediate wave (A). Pair then bounced to 1.2034 and ended Intermediate wave (B). At present, Intermediate wave (C) remains in progress as 5 […]

-

EURUSD Short-term Elliott Wave Analysis

Read MoreEURUSD Elliott Wave view suggests the decline from 9/8 peak is unfolding as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), Intermediate wave (A) ended at 1.1837 and Intermediate wave (B) ended at 1.2034. Intermediate wave (C) remains in progress as 5 waves. Minor wave 1 of (C) ended at 1.186, and […]

-

Elliott Wave Analysis: EURUSD in a flat correction

Read MoreEURUSD Short Term Elliott Wave view suggests that the decline from 9/8 peak is unfolding as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), Intermediate wave (A) ended at 1.1837 and Intermediate wave (B) ended at 1.2034. Intermediate wave (C) is in progress as 5 waves. Minor wave 1 of (C) ended at […]

-

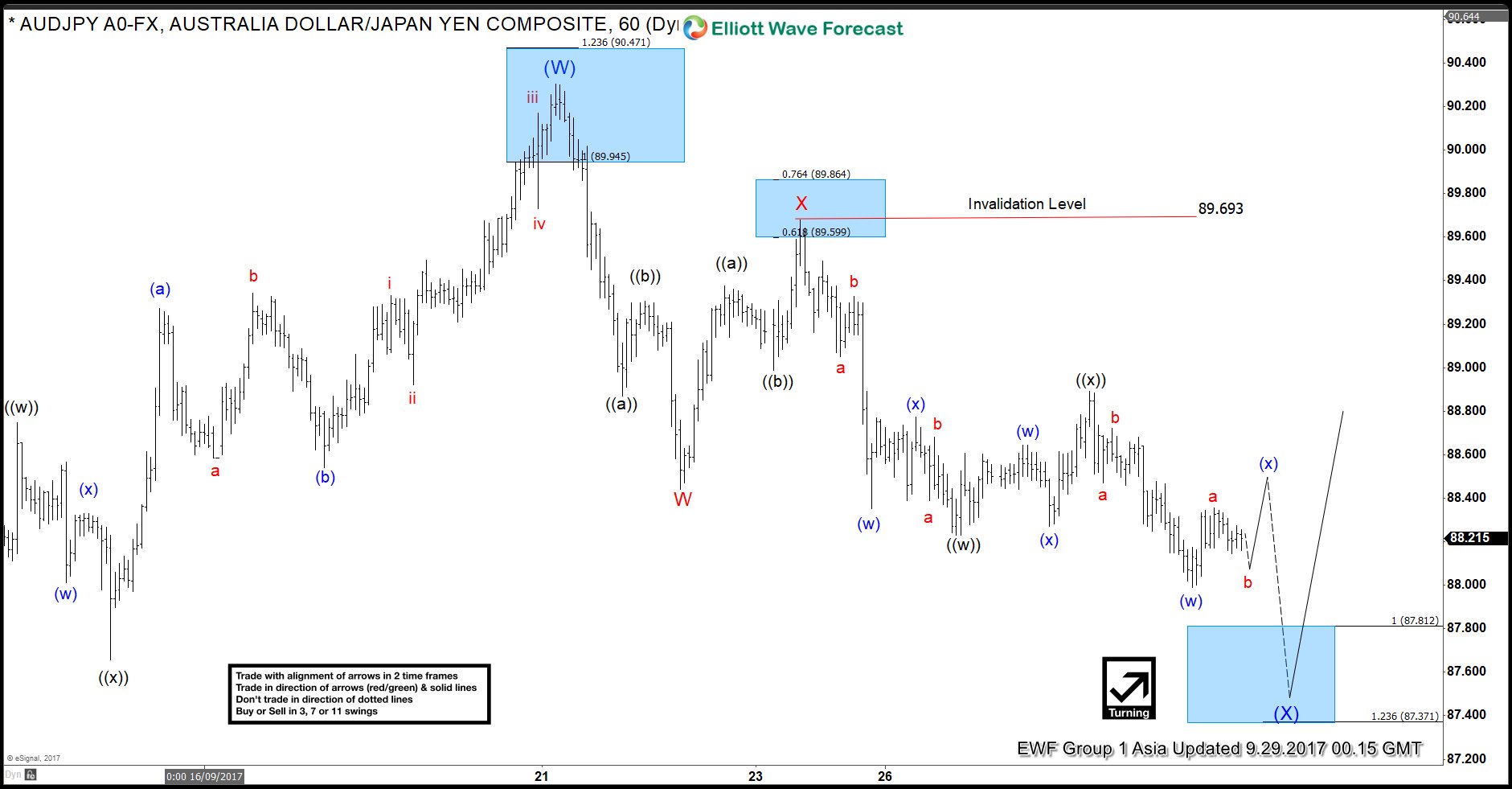

AUDJPY Elliott Wave Analysis 9.29.2017

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave W ended at 88.44 and Minor wave X ended at 89.68. Minor wave Y is unfolding also as a double three Elliott Wave structure. […]