-

GBPNZD Trade from 11/27 Live Trading Room

Read MoreGBPNZD Trade Video Clip from Monday 11/27 Live Trading Room Early this week we informed members that we have a good trading opportunity in GBPNZD. In the 1 Hour chart 11/28 below, we see there’s a bullish sequence stamp on the chart which means that the pair has a chance to extend to a new high. The […]

-

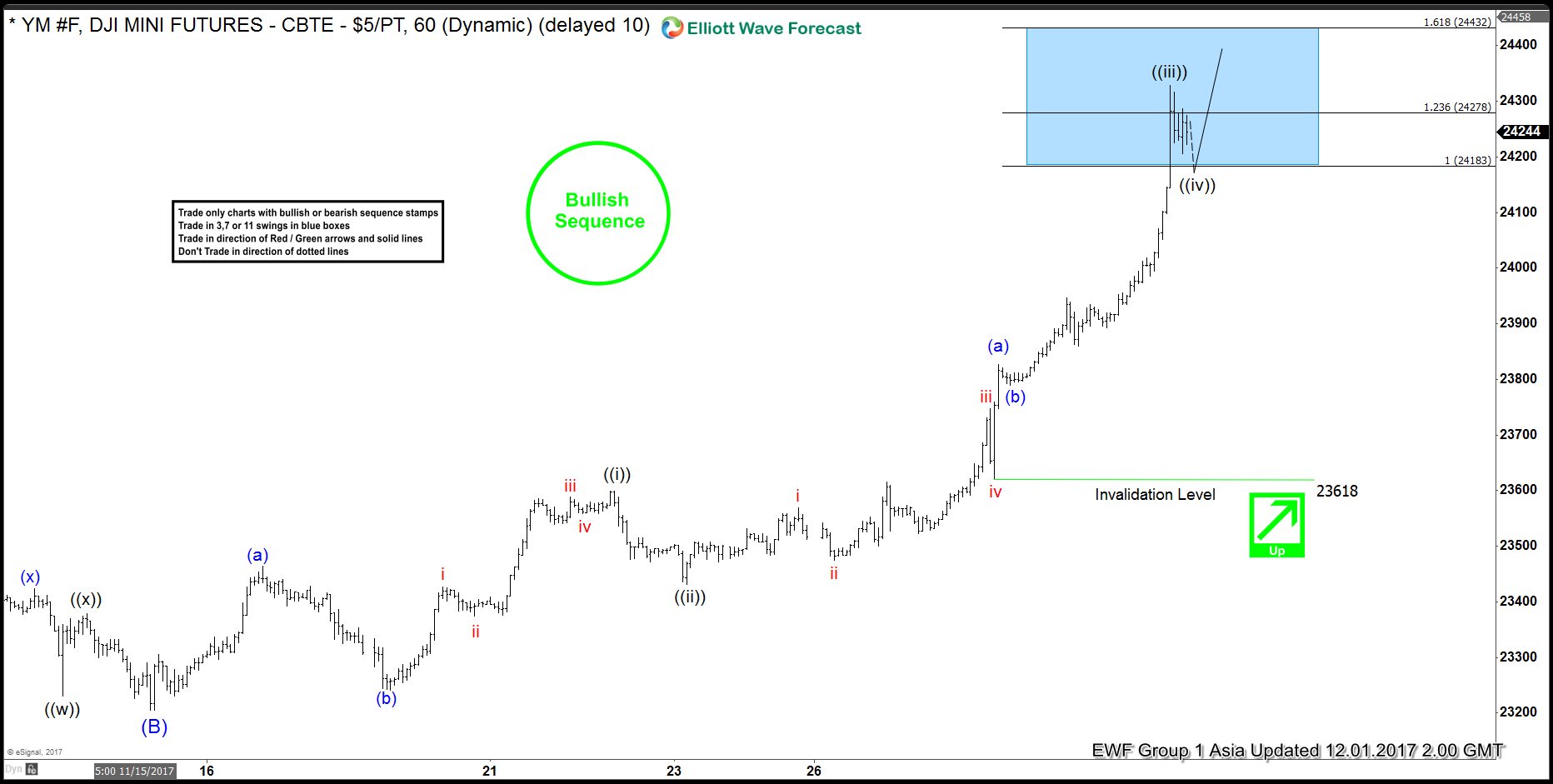

Dow Future Elliott Wave Analysis 12-1-2017

Read MoreDow Future Short term Elliott Wave view suggests that Intermediate wave (B) ended at 23204. The rally from there is proposed to be unfolding as a leading diagonal Elliott wave structure. Minute wave ((i)) ended at 23599, Minute wave ((ii)) ended at 23432, and Minute wave ((iii)) ended at 24328. Minute wave ((iv)) is in progress to correct cycle from 11/23 low and […]

-

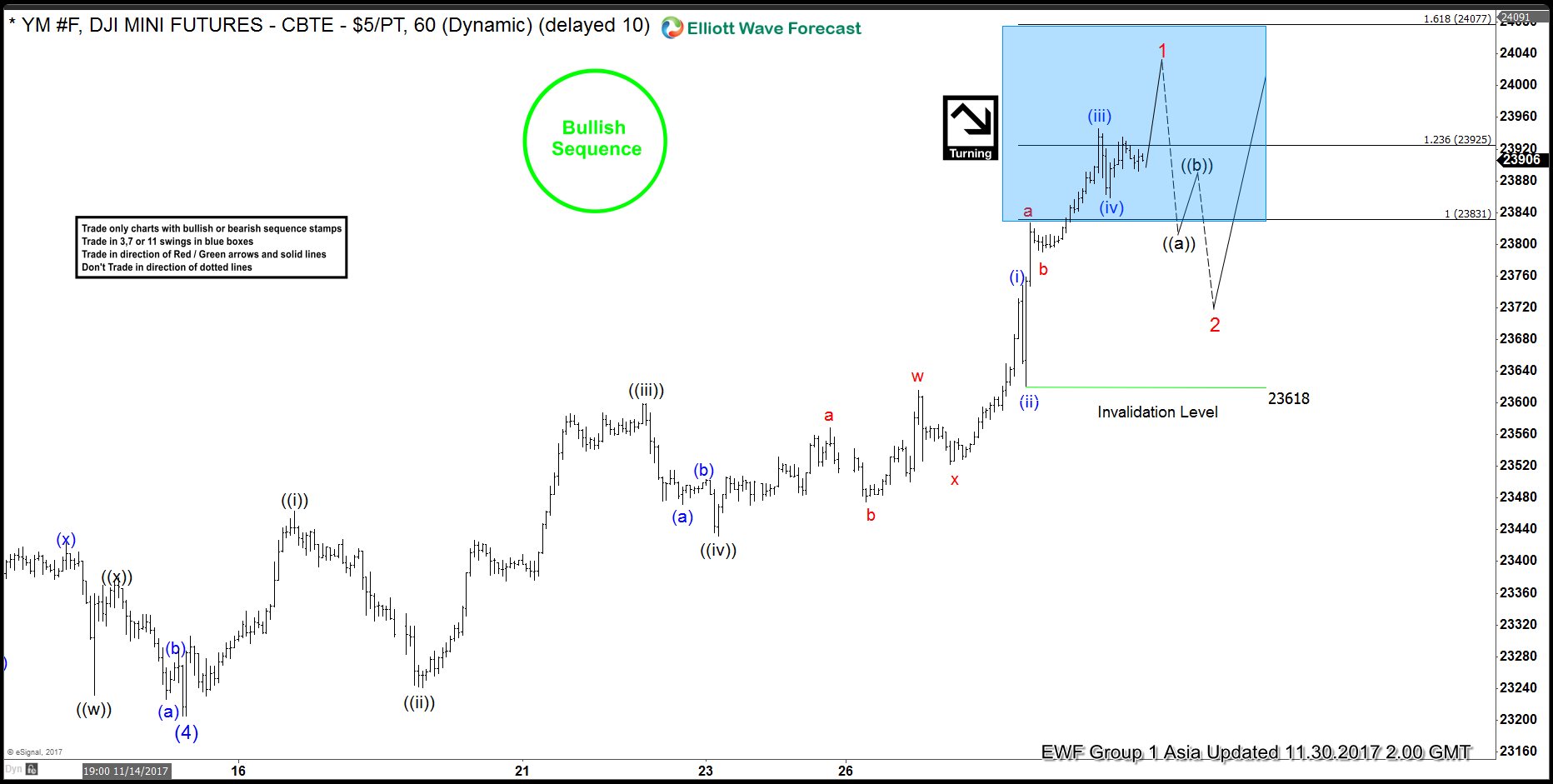

Dow Future Elliott Wave Analysis 11-30-2017

Read MoreDow Future Short term Elliott Wave view suggests that Intermediate wave (4) ended at 23204. The rally from there is proposed to be unfolding as a leading diagonal Elliott wave structure. Minute wave ((i)) ended at 23464, Minute wave ((ii)) ended at 23241, Minute wave ((iii)) ended at 23599 and Minute wave ((iv)) ended at 23572. Cycle from 11/15 low (23204) is mature […]

-

Is USDPLN telling us the path of US Dollar?

Read MoreTraders rarely look at the chart of Poland Zloty (USDPLN) and perhaps few even know the existence of the pair. We at Elliottwave-Forecast.com look at a lot of instrument from forex, commodities, and Indices to get an edge in our forecast. The Zloty, along with the Czech crown, is the top performing currency in the […]

-

Dow Future Elliott Wave Analysis 11.29.2017

Read MoreDow Future Short term Elliott Wave view suggests that Intermediate wave (4) ended at 23204. The rally from there is proposed to be unfolding as a double three Elliott wave structure. Minute wave ((a)) of 1 ended at 23599 and Minute wave ((b)) of 1 ended at 23432. Near term focus is on 23828 – 23922 to complete Minute wave […]

-

YM_F Dow Short Term Elliott Wave view

Read MoreYM_F Dow Short term Elliott Wave view suggests that Intermediate wave (4) ended at 23204. A rally from there is unfolding as a leading diagonal Elliott wave structure. Minute wave ((i)) ended at 23464, Minute wave ((ii)) ended at 23241, Minute wave ((iii)) ended at 23599, Minute wave ((iv)) ended at 23432, and Minute wave ((v)) remain in progress as a double three […]