-

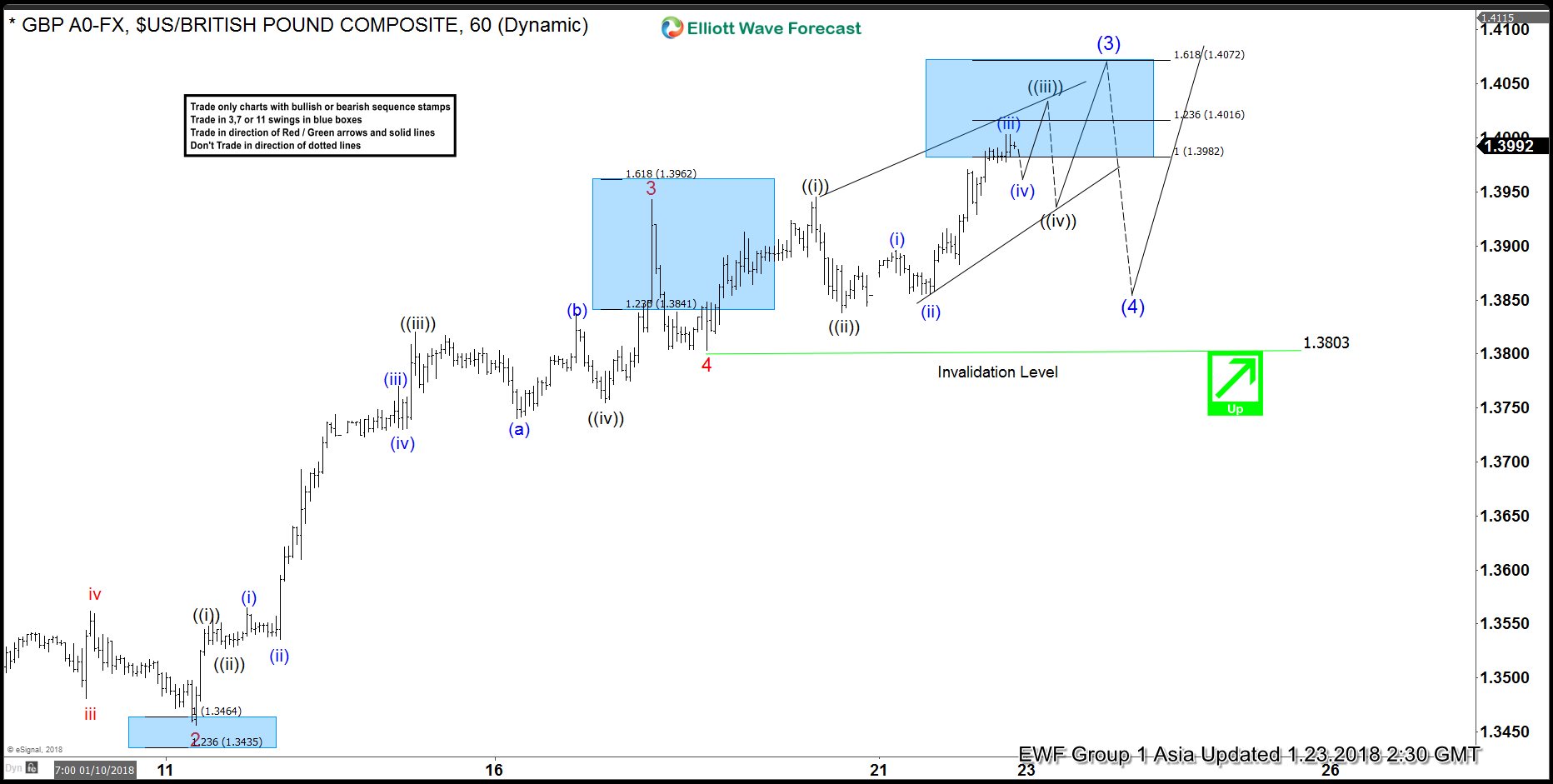

Elliott Wave Analysis: GBPUSD doing an ending diagonal

Read MoreGBPUSD Short Term Elliott Wave view suggests that the pair rallies as 5 waves impulse Elliott Wave structure from 16 December 2017 low. Up from 16 December 2017 low (1.33), Minor wave 1 ended at 1.3613, pullback to 1.3456 ended Minor wave 2, rally to 1.3943 ended Minor wave 3, and Minor wave 4 ended at 1.3803. […]

-

GBPUSD Elliott Wave Analysis: More Upside Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that rally from 16 December 2017 low is unfolding as 5 waves impulse Elliott Wave structure. Up from 16 Dec 2017 low (1.33), Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, and Minor wave 4 ended at 1.3803. Pair has […]

-

AUDCAD Trade from 12 Jan 2018 Live Trading Room

Read MoreAUDCAD Trade Video Clip from 12 Jan 2018 Live Trading Room We started always with the higher degree time frame and explained to members that the pair shows a bullish sequence from 6 Dec 2017 low (from 0.957) favoring more upside. The rally from there looks to be unfolding in a zigzag (5-3-5) and it […]

-

SPX Elliott Wave Analysis: More Upside Expected

Read MoreSPX Short Term Elliott Wave view suggests that Index is rallying as 5 waves impulse Elliott Wave structure from 12/2/2017 low. Up from 12/2/2017 low (2605.52), Minute wave ((i)) ended at 2665.19, Minute wave ((ii)) ended at 2624.75, Minute wave ((iii)) ended at 2807.54, and Minute wave ((iv)) ended at 2768.87. Index has since broken above Minute […]

-

Nifty Trade from 16 Jan 2018 Live Trading Room

Read MoreNifty Trade Video Clip from Tuesday 16 Jan 2018 Live Trading Room We told members early this week that Nifty is showing a nice structure to trade. The Index has a bullish sequence from Sept 2017 low which favors more upside. In addition, the Index also shows what looks to be a 5 waves up […]

-

Elliott Wave Analysis: SPX Resumes Higher

Read MoreSPX Short Term Elliott Wave view suggests that the rally from 12/2/2017 low is unfolding as 5 waves impulsive Elliott Wave structure where Minute wave ((i)) ended at 2665.19, Minute wave ((ii)) ended at 2624.75, Minute wave ((iii)) ended at 2807.54, and Minute wave ((iv)) ended at 2768.64. Index has broken above Minute wave ((iii)) at 2807.54 […]