-

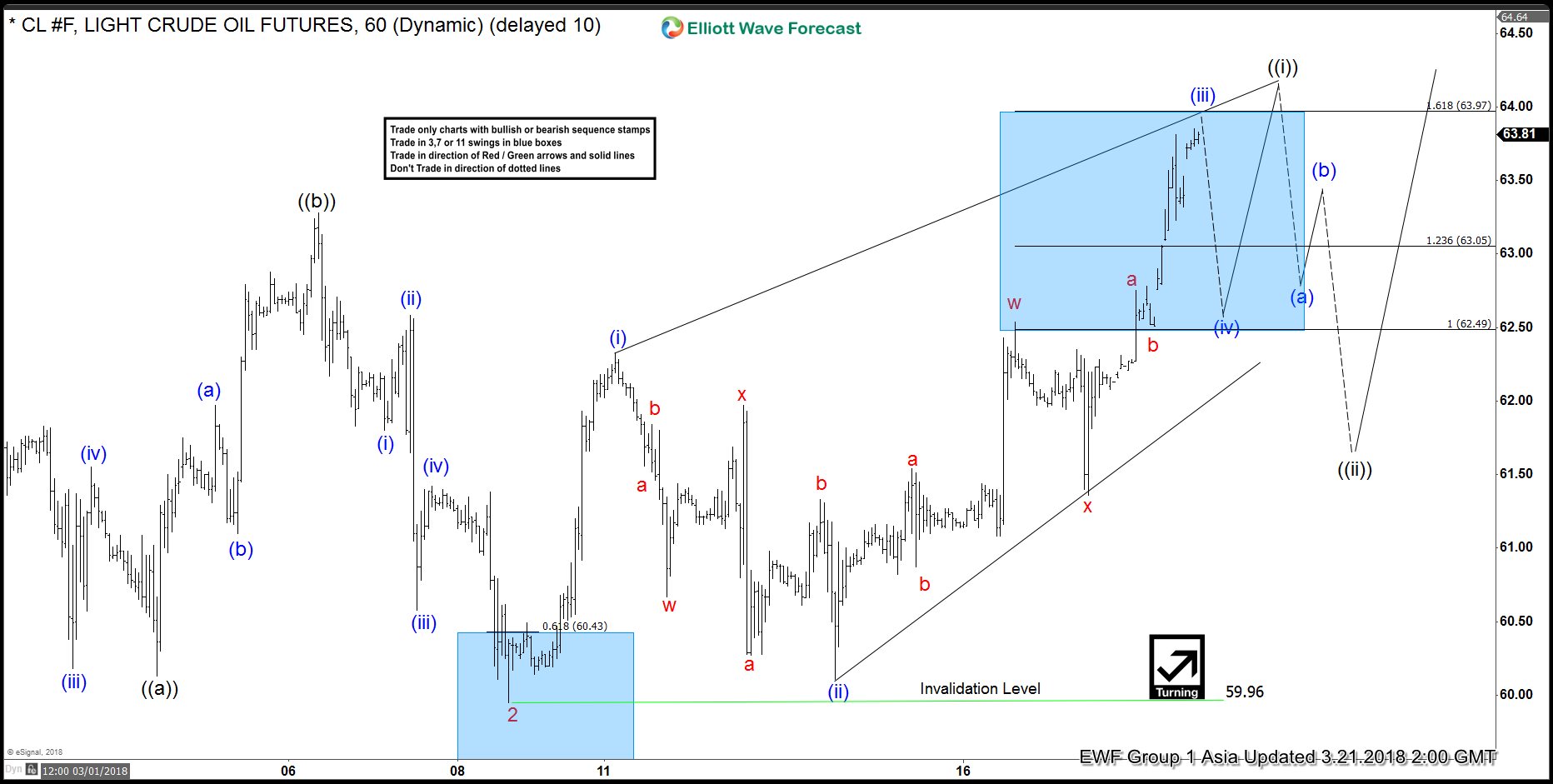

Elliott Wave Analysis: Oil (CL_F) Looking to Extend Higher in Wave 3

Read MoreOil (CL_F) Short Term Elliott Wave view suggests that the decline to 59.95 on 3/9 ended Minor wave 2. Minor wave 3 is unfolding as a 5 waves impulse Elliott Wave Structure where Minute wave ((i)) of 3 is currently in progress as a leading diagonal. Up from 59.96, Minutte wave (i) ended at 62.33, Minutte […]

-

Breakthrough in Brexit Negotiation Boosts Poundsterling

Read MoreBrexit Transition Period Agreement Breakthrough Yesterday the UK has struck a deal with the EU to the Brexit transition period. The transition period is the 21 month period which starts from 29 March 2019 (official Brexit day) to 31 December 2020. UK Prime Minister Theresa May likes to call this period an implementation phase. This […]

-

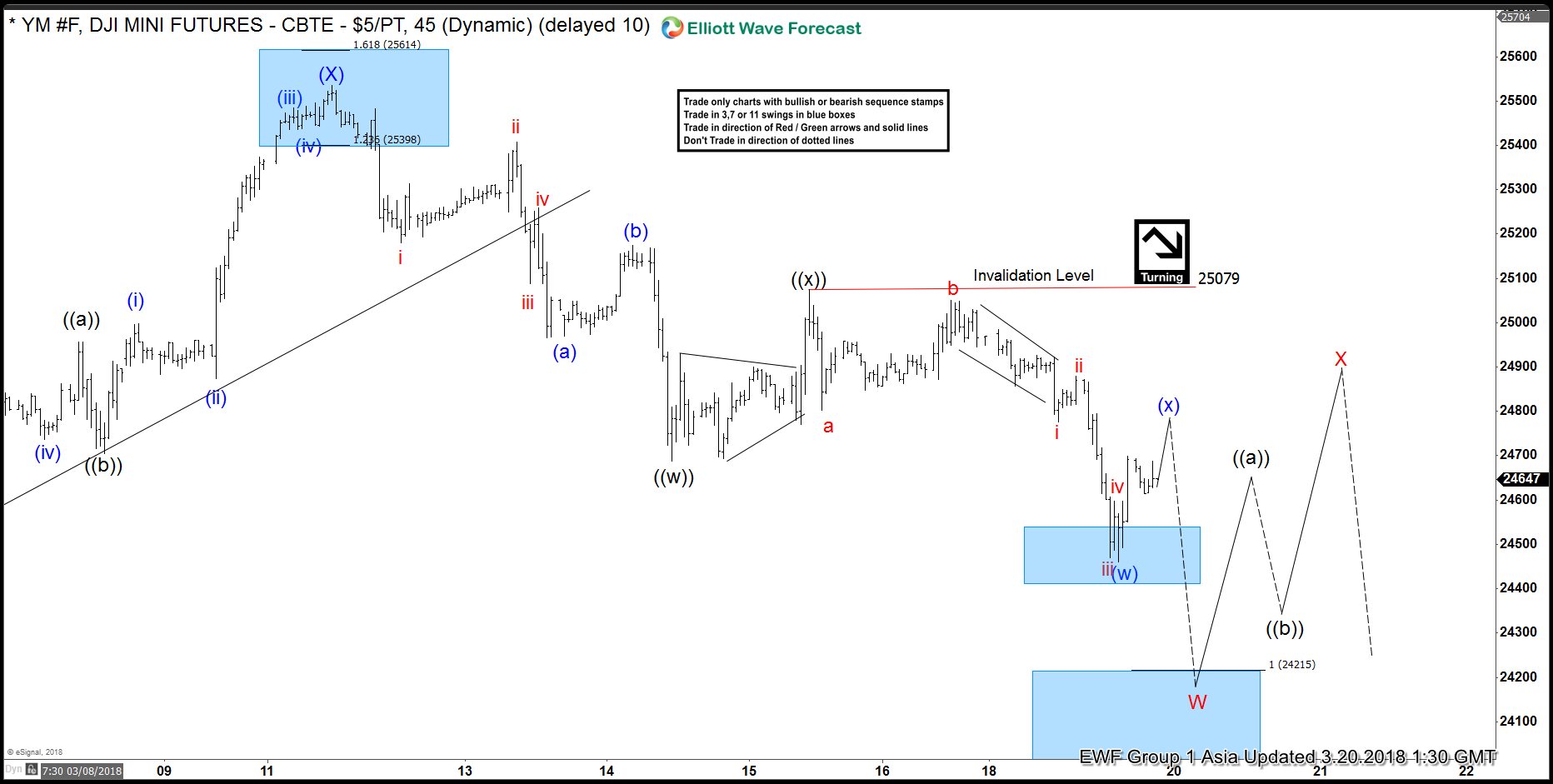

Dow Jones (YM_F) Elliott Wave Analysis: Further Weaknesses Expected to 24215

Read MoreDow Jones (YM_F) Short Term Elliott Wave view suggests that the rally to 25535 on 12 March 2018 ended Intermediate wave (X). Intermediate wave (Y) is currently in progress to the downside and subdivision of Intermediate wave (Y) unfolded as a double three Elliott Wave structure. Down from 25535, Minute wave ((w)) ended at 24688, and […]

-

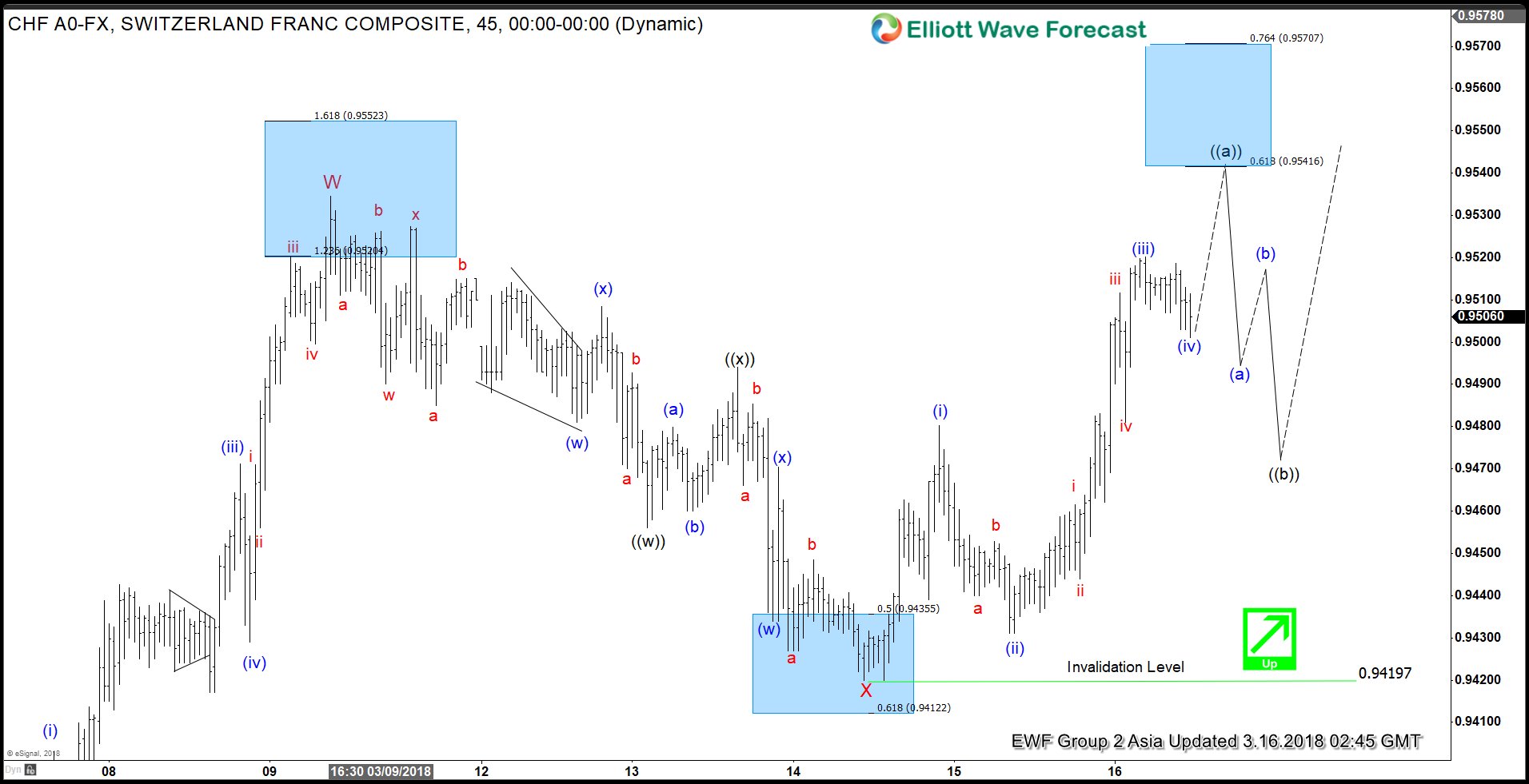

$USDCHF Elliott Wave Analysis: More Upside While Above 0.942

Read More$USDCHF Elliott Wave view suggests that the rally from 3.5.2018 low (0.9336) is unfolding as a double three Elliott Wave structure where Minor wave W ended at 0.9535. Below from here, Minor wave X ended at 0.942 and the internal subdivision unfolded as a smaller degree double three Elliott Wave structure. Down from 0.9535, Minute wave […]

-

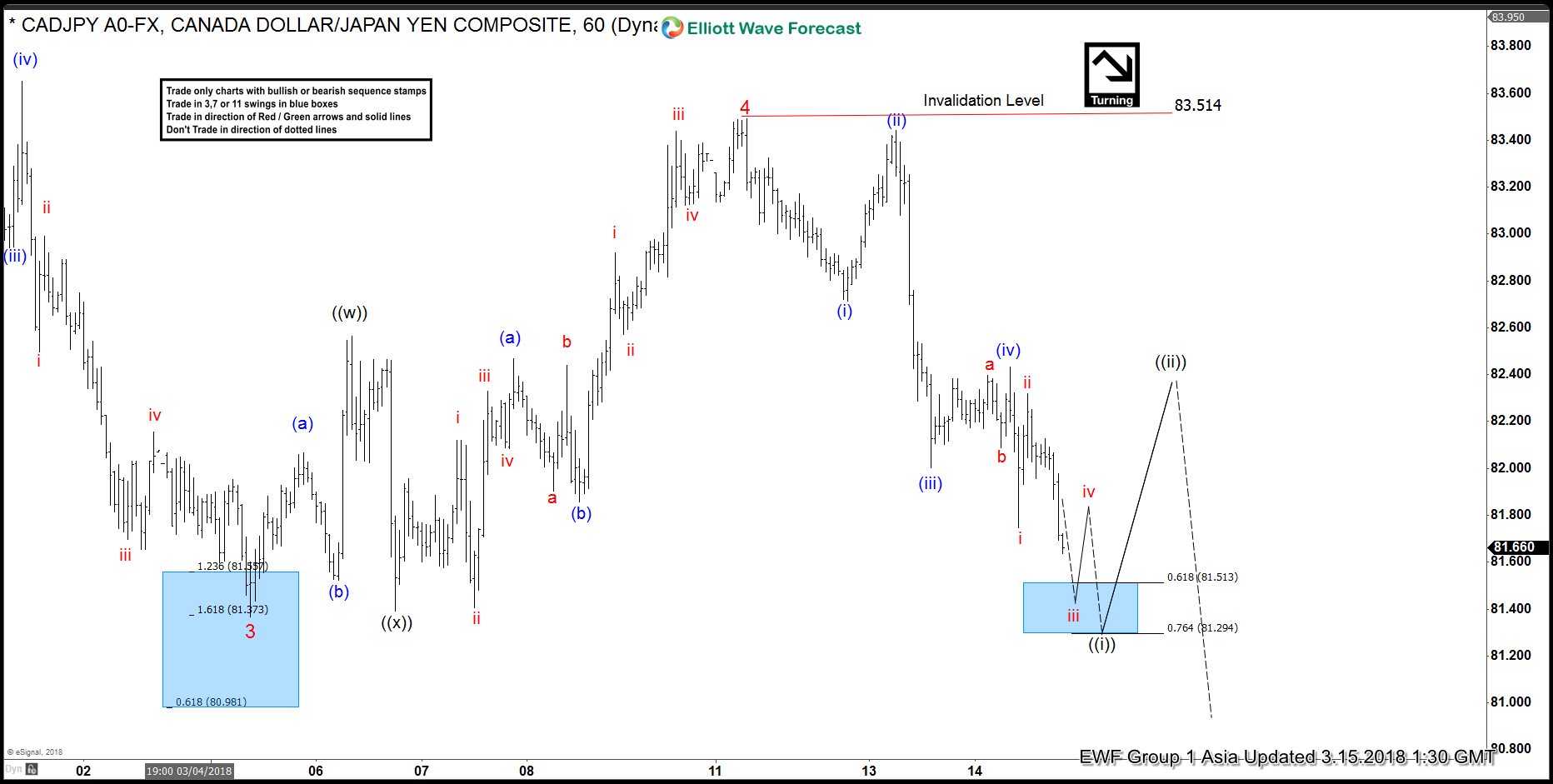

$CADJPY Elliott Wave Analysis: Further Downside to End Wave 5

Read More$CADJPY Elliott Wave view suggests that the decline from 1.5.2018 high (91.58) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 3 of this impulsive move ended at 81.36 on 3.5.2018 and Minor wave 4 ended at 83.51 on 3.12.2018. While bounces stay below 83.51, pair now has scope to extend lower to […]

-

USDCAD Elliott Wave Analysis: Potential Upside to 1.324

Read MoreUSDCAD Short Term Elliott Wave view suggests the rally from 1/31 low (1.2247) remains in progress as a triple three Elliott Wave Structure. A triple three is labelled as WXYZ and each leg in this structure is corrective, so we have 3-3-3-3-3 structure. Up from 1.2247, Intermediate wave (W) ended at 1.2689, Intermediate wave (X) […]