-

FTSE Elliott Wave Analysis: Inflection Area for Next Leg Lower

Read MoreLatest Elliott Wave view in FTSE suggests that the Index ended Primary wave ((B)) at 7326.02 on 2/27/2018 high. From there, Index starts a decline which is unfolding as a 5 waves impulse Elliott Wave structure with an extension in wave (3). Down from 2/27/2018 high, Intermediate wave (1) ended at 7062.13, Intermediate wave (2) ended at 7256.33, […]

-

Elliott Wave Analysis: EURUSD in Sideways Consolidation

Read MoreCurrent Elliott Wave view in EURUSD suggests that the pair remains in sideways triangle Elliott Wave structure between 1.2153 low and 1.255 high. Triangle is a consolidation structure with ABCDE label. It has no particular trend and is usually a continuation structure. Since the previous trend in EURUSD up to 1.255 high on 2.16.2018 is bullish, […]

-

DAX Elliott Wave Analysis: Further Weakness Ahead?

Read MoreShort term Elliott Wave view in DAX suggests Primary wave ((B)) ended at 12434.7 on 3.16.2018. The decline from there is unfolding as a 5 waves impulse Elliott Wave structure. Down from 12434.7, Minor wave 1 ended at 12160, Minor wave 2 ended at 12375.5, Minor wave 3 ended at 11827, Minor wave 4 ended […]

-

Will Trade War Weigh on the Market?

Read MoreTrade war with China Hurt Global Economy Last week global stock market slumped due to the prospect of all-out trade war which could destabilize global economy. US market closed sharply lower for the week with S&P 500 falling 5.6% and Dow Jones Industrial Average falling 6%. Asia markets also skidded with Nikkei 225 falling 6.3%, […]

-

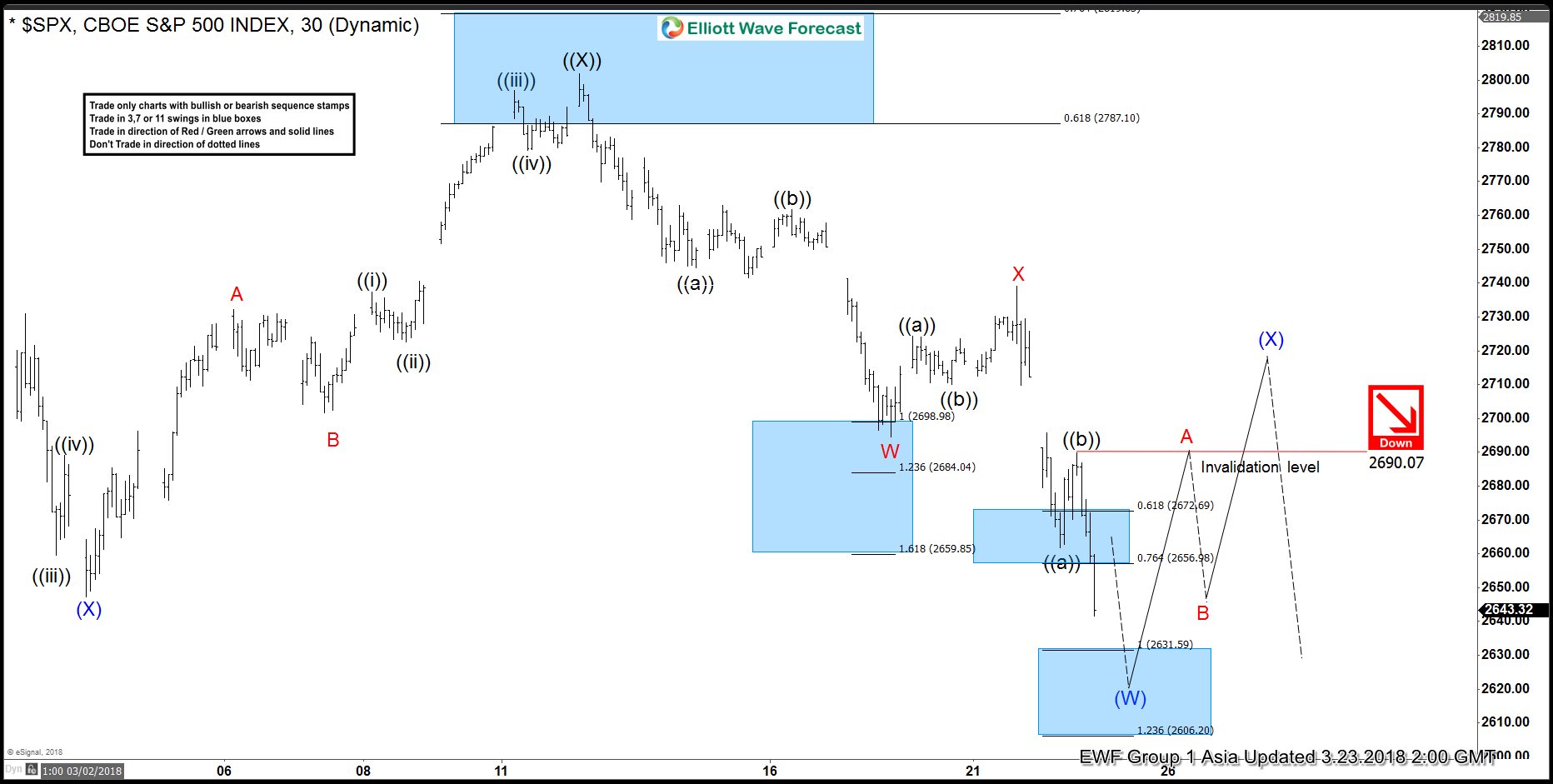

Elliott Wave Analysis: SPX Should See More Weakness

Read MoreSPX rally to 2801.9 on 3.13.2018 ended Primary wave ((X)). Since then, the decline from there is unfolding as a double three Elliott Wave structure where Minor wave W ended at 2694.59 and Minor wave X ended at 2739.14. A double three is a WXY structure where the subdivision of each leg is corrective. Subdivision […]

-

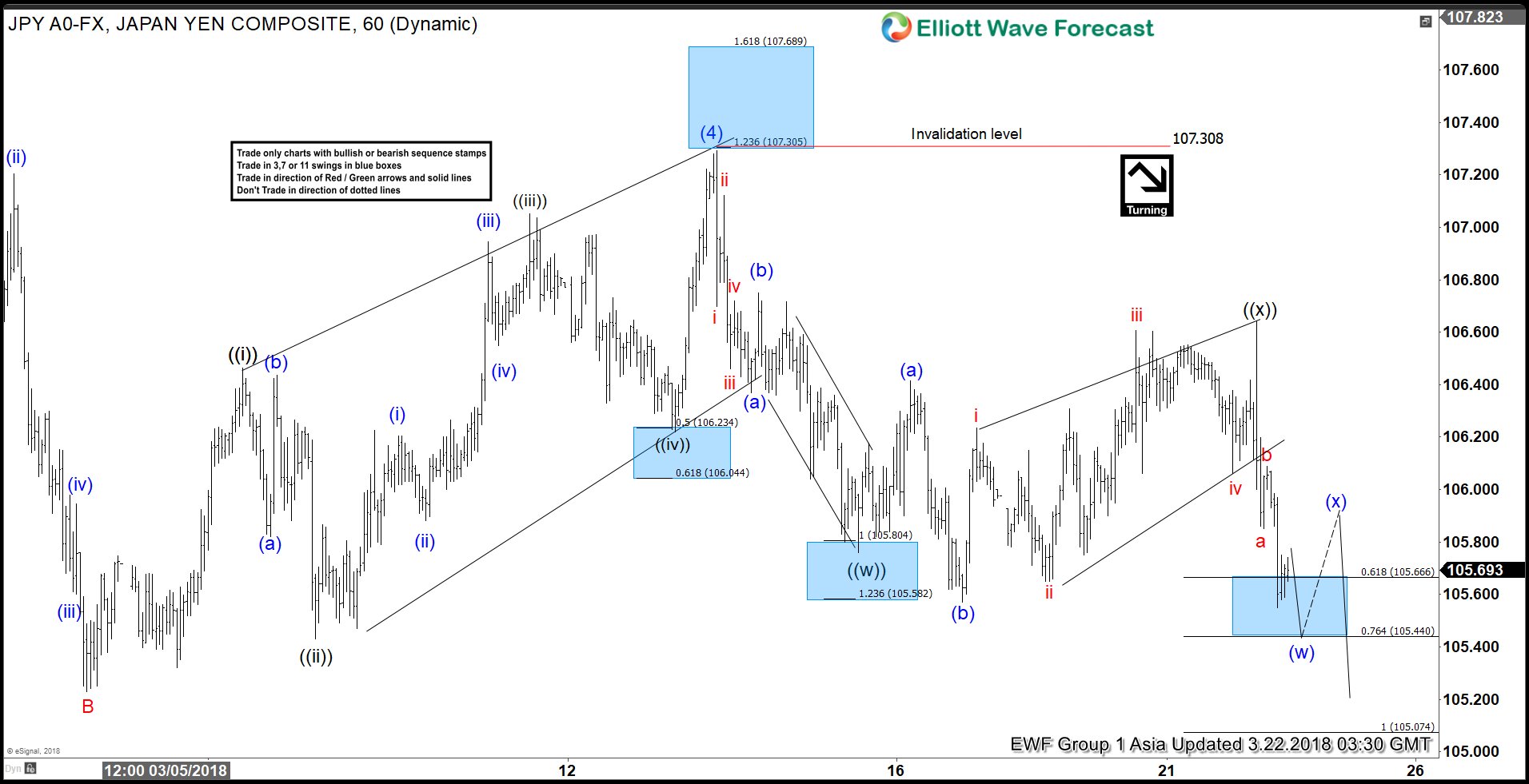

Elliott Wave Analysis: USDJPY Resumes Lower to 104

Read MoreUSDJPY Elliott Wave view suggests that the decline from 11.6.2017 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 11.6.2017 high (114.73), Intermediate wave (1) ended at 110.84, Intermediate wave (2) ended at 113.75, Intermediate wave (3) ended at 105.55, and Intermediate wave (4) ended at 107.3. Intermediate wave (5) is […]