-

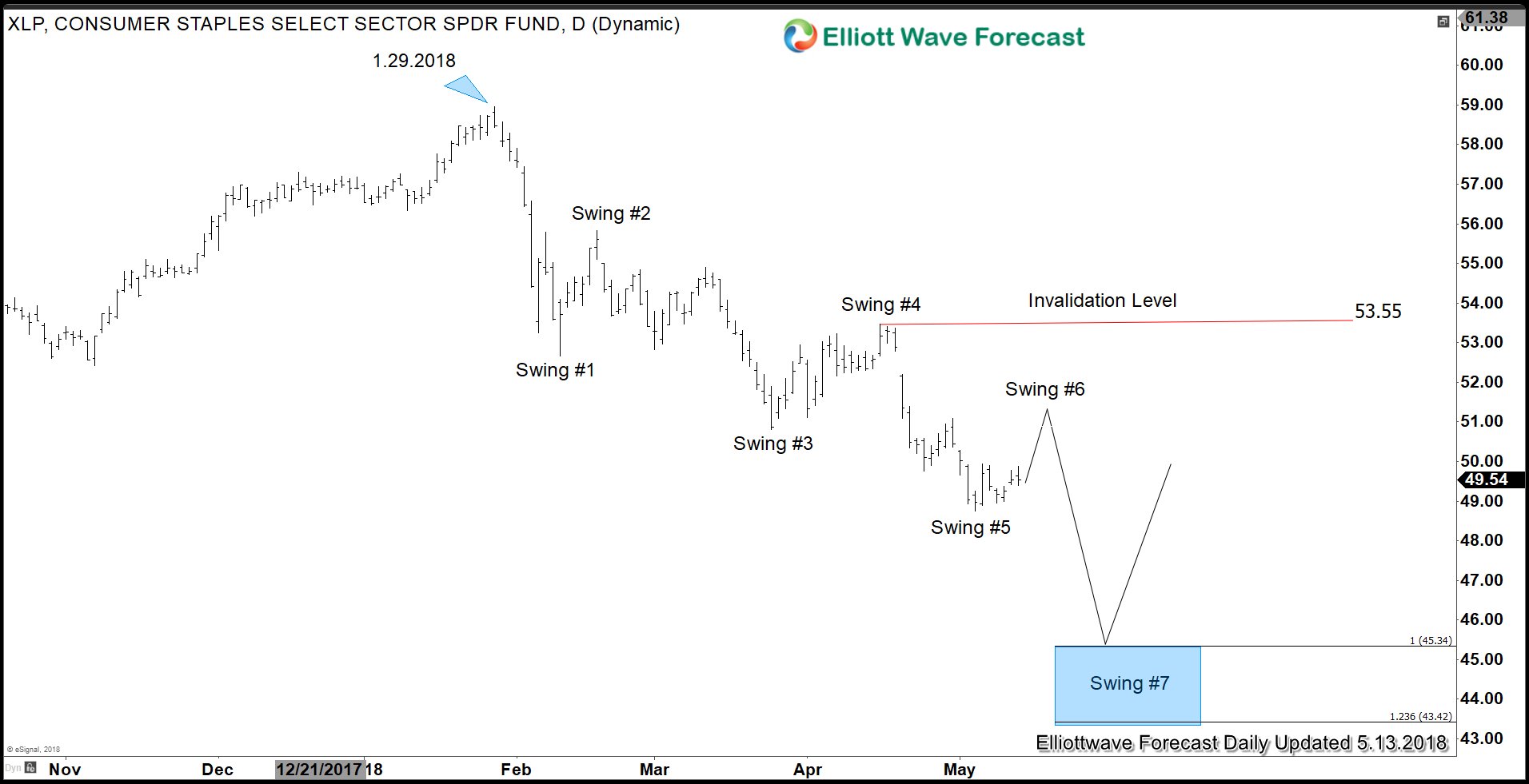

Relative Weakness in Consumer Staple Sector

Read MoreConsumer Staple Sector (XLP) is Underperforming Consumer Staples Select Sector SPDR ETF (XLP) is a basket of 34 companies in the consumer staple sector from the S&P 500. The fund’s holdings are nearly all large-caps. This sector usually shows comparative strength during period of market turmoil. They have also been a popular choice for income […]

-

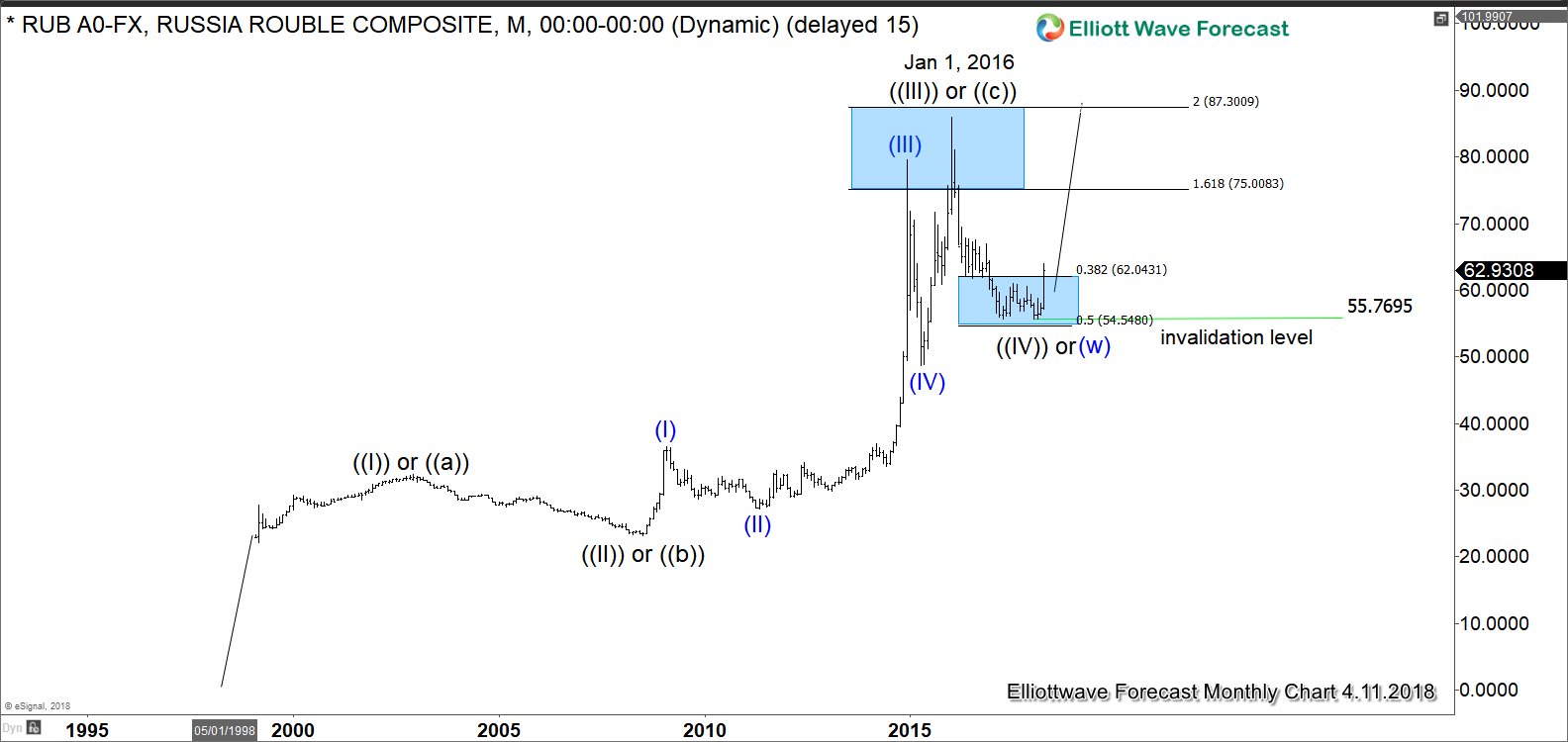

Geopolitical Tension Could Be Catalyst for Gold’s Rally

Read MoreRising Geopolitical Tension between U.S. and Russia The geopolitical tension between the United States and Russia escalated rapidly in the past two weeks. Two weeks ago, the U.S. Treasury Department announced fresh sanctions against Russian oligarchs and companies due to “Russia’s malign activity around the globe”. This new sanctions have caused economic pain to Moscow […]

-

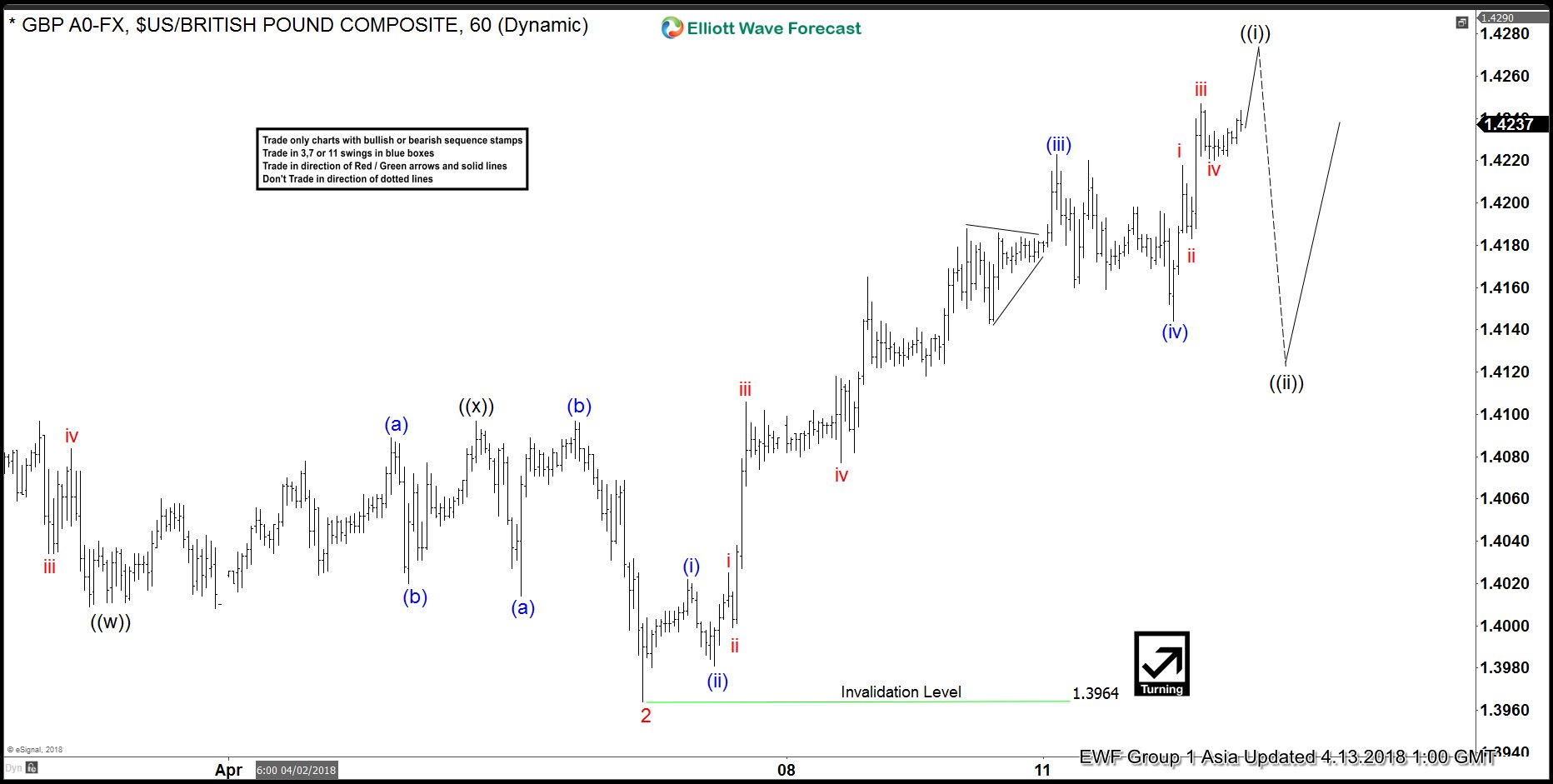

Elliott Wave Analysis: GBPUSD Strength Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 3.1.2018 low (1.371) is unfolding as a 5 waves impulse Elliott Wave Structure. Up from 3.1.2018 low, Minor wave 1 ended at 1.4245 and Minor wave 2 ended at 1.3964. Pair has since broken above Minor wave 1 at 1.4245, suggesting that the sequence from […]

-

Elliott Wave Analysis: USDCAD Moving in Impulsive Structure

Read MoreUSDCAD Elliott Wave view suggests that the decline from 3/19 high (1.313) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 1 ended at 1.2819, Minor wave 2 ended at 1.2943, and Minor wave 3 is in progress. Internal of Minor wave 3 also unfolded as an Elliott Wave impulse structure in […]

-

Elliott Wave Analysis: Gold Short-term View

Read MoreGold short term Elliott Wave view suggests that the yellow metal is in a sideways move, typical characteristic of a triangle Elliott Wave structure. A triangle is a sideways range structure with ABCDE label. In the case of Gold, decline from 1/25/2018 peak ($1366.06) ended in Minor wave A at $1302.6. Minor wave B bounce […]

-

Ruble Falls Following US Sanctions Against Russia

Read MoreNew U.S. Sanctions Hurt Russia’s Ruble and Benchmark Index Last Friday, as part of the U.S. effort to punish Moscow for “malign activity around the globe”, the U.S Treasury Department targeted numerous Russian oligarchs, officials, and companies by freezing their assets under U.S. jurisdiction. In addition, the U.S. also prohibits U.S. citizens or entities from […]