-

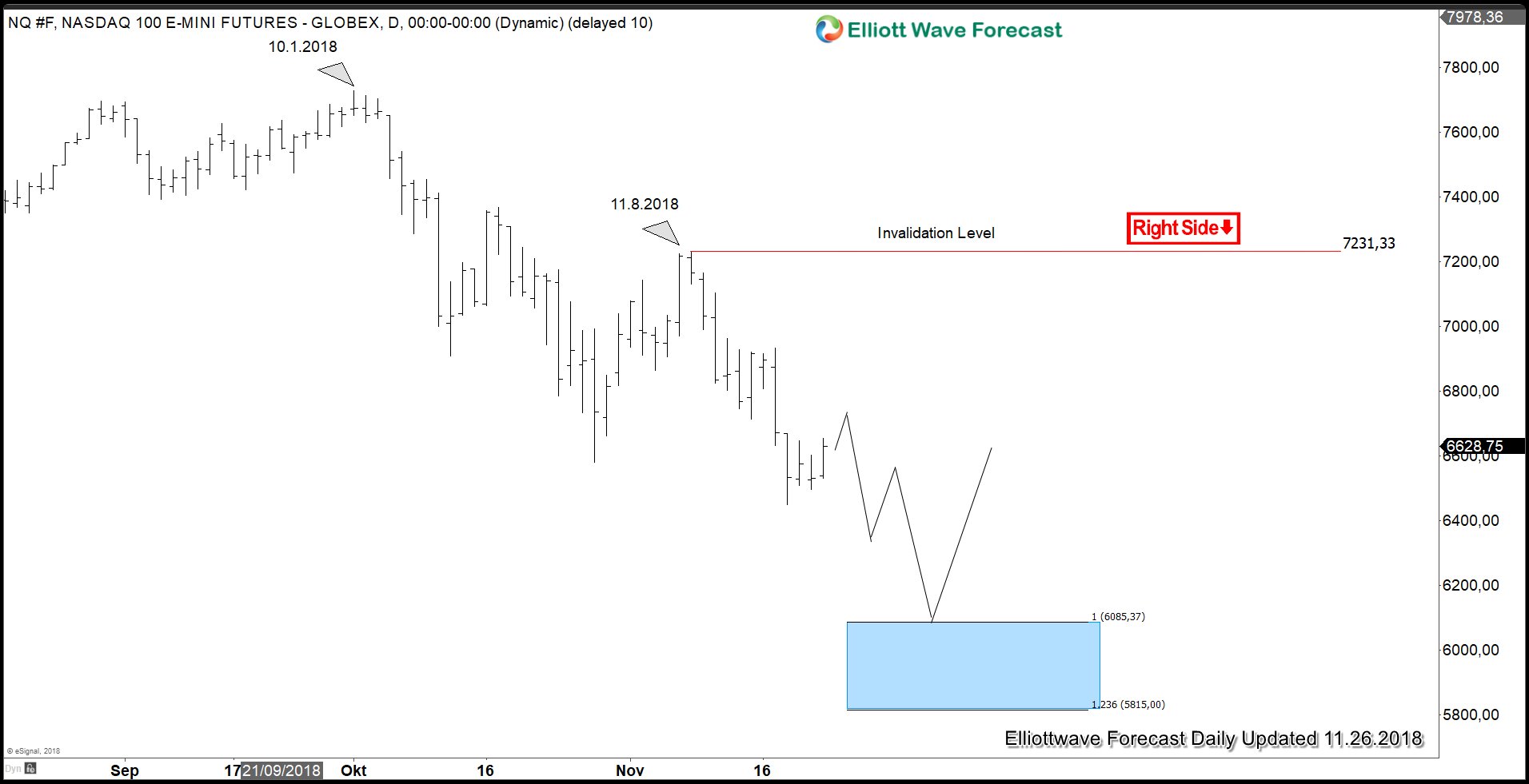

G20 Meeting Produces Trade War Truce between US and China – Will it last?

Read MoreDuring the dinner meeting at G20 summit in Buenos Aires last weekend, the U.S. and China agreed to suspend new tariffs for 90 days. The market reacts positively with stock market rallying around the world, creating a risk on environment for potential Santa Claus rally in December. However, has a real significant breakthrough made during […]

-

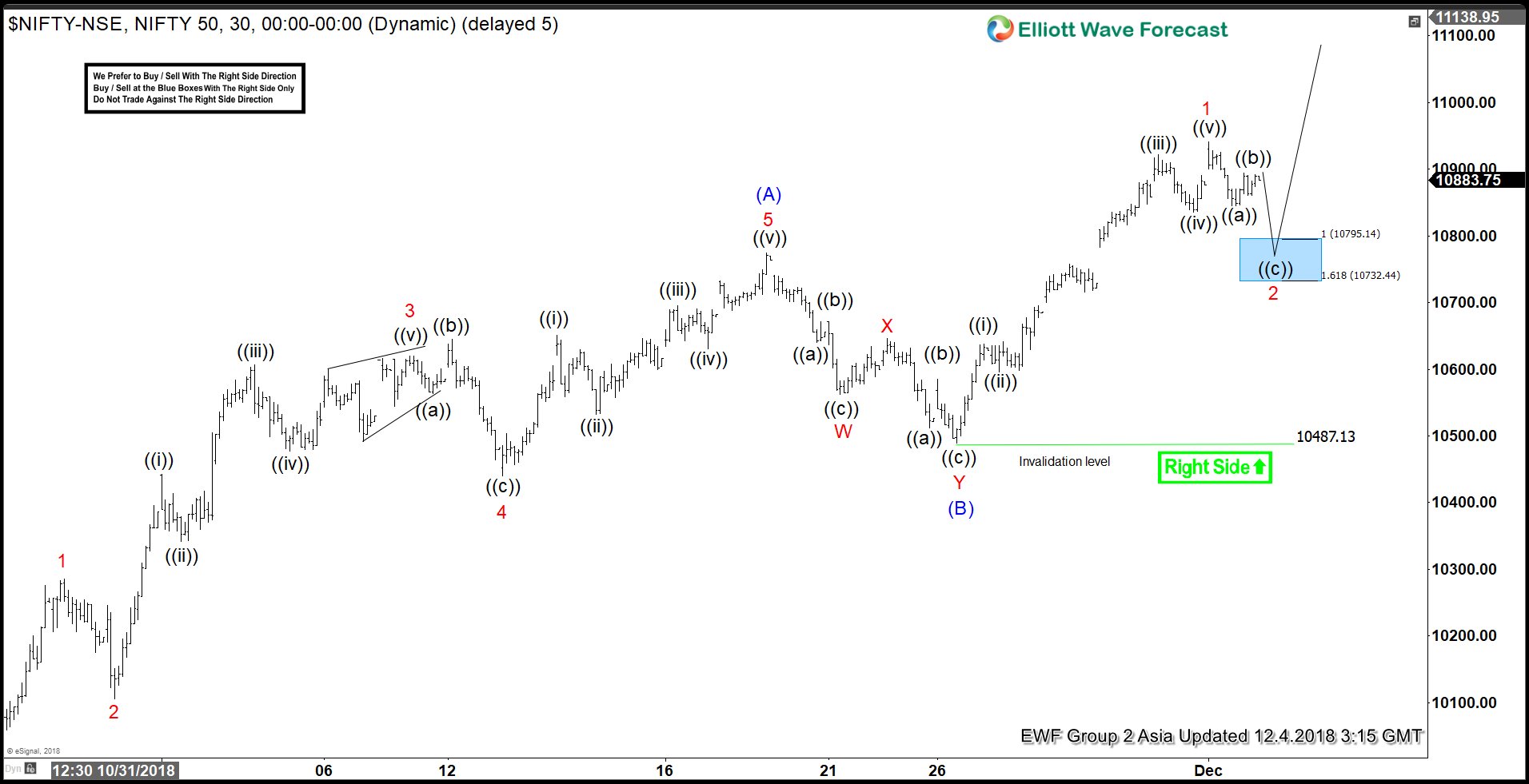

Elliott Wave View favoring more upside in NIFTY

Read MoreNIFTY is showing an incomplete sequence to the upside in the short term, favoring more upside while above 11/26 low (10487.1). Near term, cycle from 10/26 low (10004) remains in progress as a zigzag Elliott Wave structure. Intermediate Wave (A) ended at 10774.7 as 5 waves impulse Elliott Wave structure and Intermediate wave (B) ended […]

-

Elliott Wave Analysis: USDJPY Looking for Further Strength

Read MoreShort term Elliott Wave View in USDJPY suggests that the pullback to 112.27 ended Minute wave ((x)). Internal of Minute wave ((x)) unfolded as a zigzag Elliott Wave structure where Minutte wave (a) ended at 113.07, Minutte wave (b) ended at 113.7, and Minutte wave (c) of ((x)) ended at 112.27. Minute wave ((y)) rally […]

-

Elliott Wave Analysis: Amazon Rally Should Fail for Yet Another Low

Read MoreShort term Elliott Wave View in Amazon (ticker: AMZN) suggests that the bounce to 1784 ended Cycle degree wave x. Cycle degree wave y is currently in progress lower as a double three Elliott Wave structure. Down from 1784, Primary wave ((W)) ended at 1420 and Primary wave ((X)) bounce is in progress towards 1631.54 […]

-

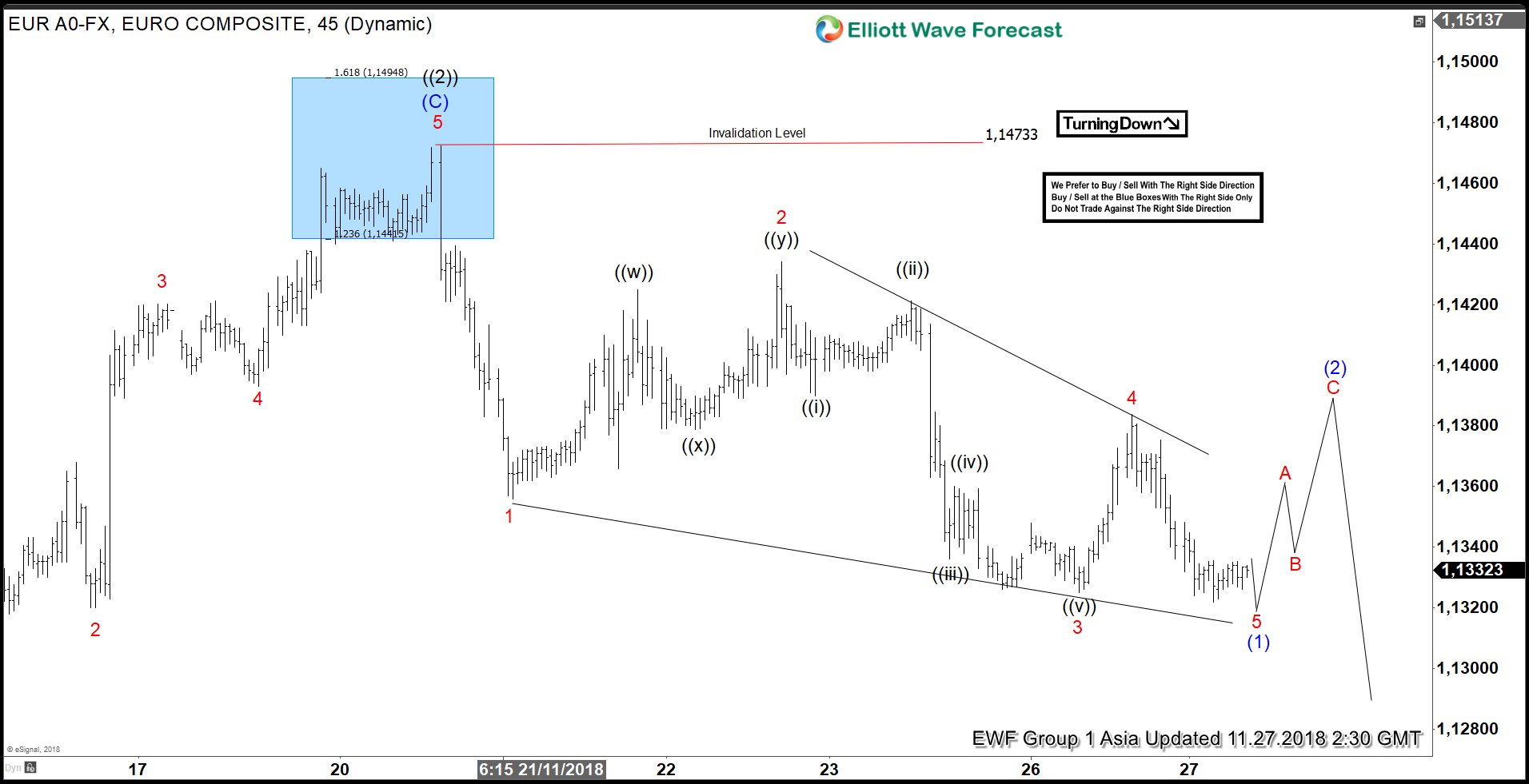

Elliott Wave Analysis: EURUSD 5 waves structure looking for more downside

Read MoreCycle from Sept 24 high (1.182) in EURUSD remains in progress as an Elliott Wave impulse structure where Primary wave ((1)) ended at 1.1214 and Primary wave ((2)) is proposed complete at 1.147. Pair still needs to break below Primary wave ((1)) at 1.1214 to validate this view. Until then, we still can’t rule out […]

-

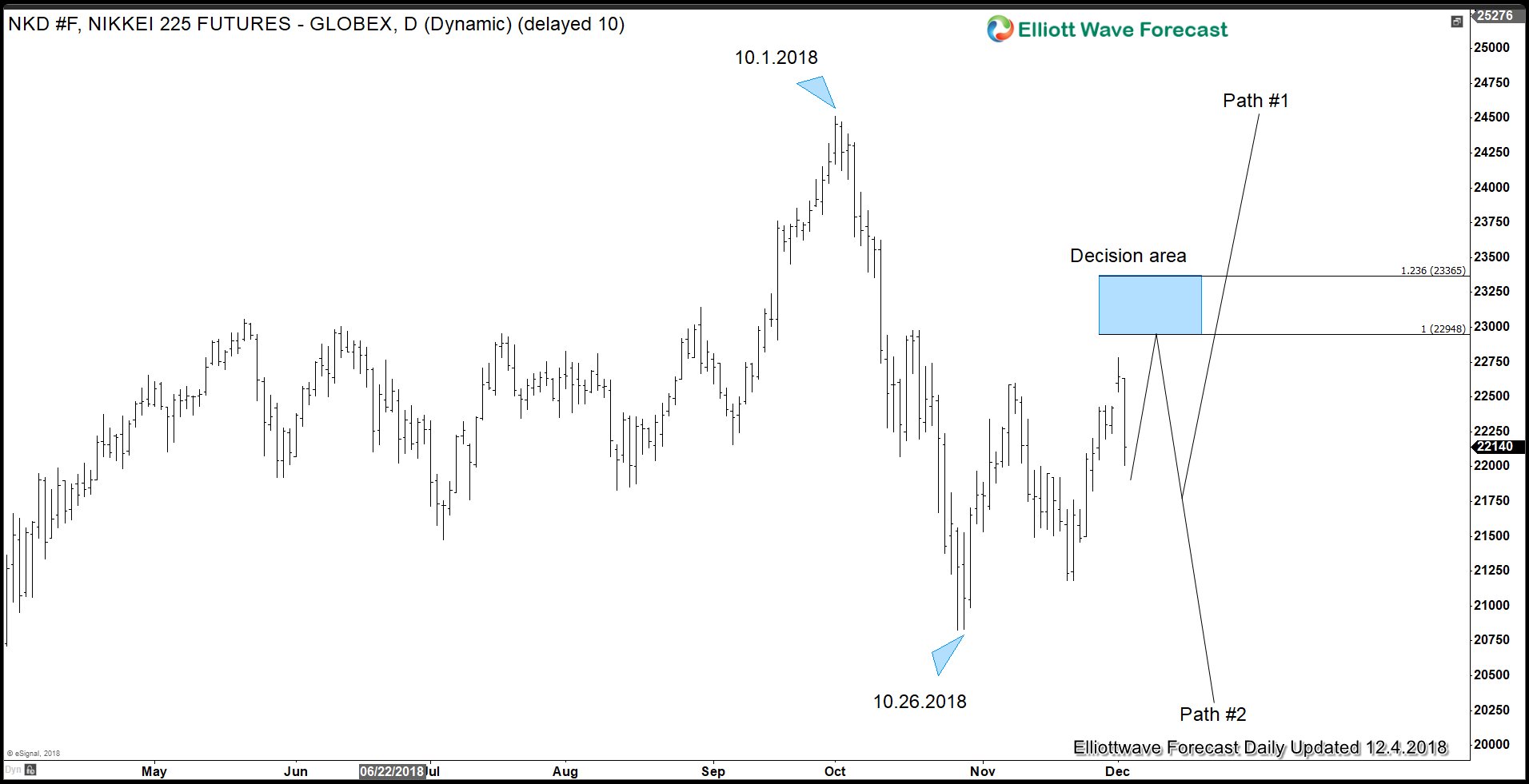

G20 Meeting May Dictate Path of Stock Market for Rest of the Year

Read MoreGlobal Indices continue to retreat in the fourth quarter of this year as the combination of Fed’s quantitative tightening and escalating trade wars threatens to derail the 10 year bullish market. Below is the Year-to-Date return of the Global Indices as of Friday Nov 24: Next week, global Indices will have a chance to find […]