-

Elliott Wave Analysis: SPX Bounce Expected to Fail

Read MoreSPX has broken below Oct 30 low (2603.54), i.e. Primary wave ((W)), opening further downside with incomplete bearish sequence from Sept 21 high (2940.91). Near term Elliott Wave view suggests the decline to 2603.54 on Oct 30 low ended Primary wave ((W)). Bounce to 2815.6 ended Primary wave ((X)) as a zigzag Elliott Wave structure. Up […]

-

Elliott Wave View Expects More Downside in Exxon Mobil (XOM)

Read MoreExxon Mobil (ticker: XOM) has broken below Nov 23 low ($74.7) and opens further downside in the stock with incomplete sequence from Sept 25 high ($87.36). Short Term Elliott Wave view suggests bounce to $81.97 on 12/5 high ended Minor wave X. Decline from there is unfolding as a double three Elliott Wave structure where […]

-

Will the Arrest of Huawei Executive Derail Trade War Truce?

Read MoreThe market celebrated the trade war truce between U.S. and China after the successful meeting last week between President Trump and Xi. Unfortunately, it only lasted for about 24 hours as news came in with the arrest of Huawei top executive Meng Wanzhou in Canada. Meng faces an extradition to the U.S. on the allegation that […]

-

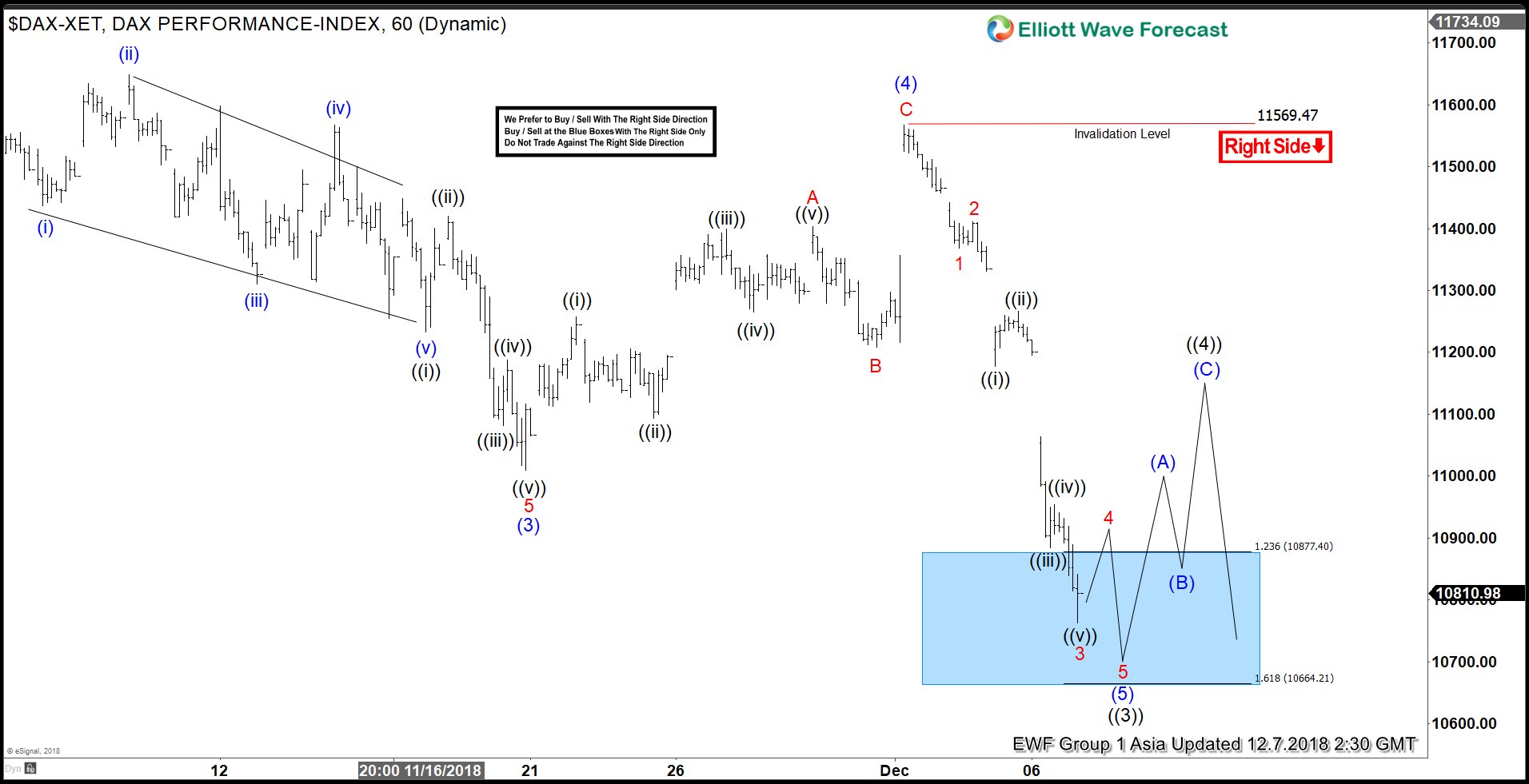

Elliott Wave View: DAX Looking for Further Downside

Read MoreDAX continues to make a new low and this week broke below 11/20 low (11009) suggesting that the move lower remains in progress. Near term Elliott Wave outlook calls for the decline to 11009.25 on 11/20 as Intermediate wave (3). From there, rally to 11566.97 ended Intermediate wave (4) as a zigzag Elliott Wave structure. […]

-

Elliott Wave View Supporting Further Strength in USDCAD

Read MoreUSDCAD has broken above 11/29/2018 high (1.336) as well as above 6/27/2018 high (1.3386) creating incomplete bullish sequence. Short term Elliott Wave view suggests the rally to 1.336 on 11/29 ended Intermediate wave (W) and the pullback to 1.3157 ended Intermediate wave (X). Internal of Intermediate wave (X) unfolded as a zigzag Elliott Wave structure […]

-

Elliott Wave Analysis: Further Weakness Expected in USDJPY

Read MoreShort term Elliott Wave view in USDJPY suggests that cycle from 11/12 peak (114.21) remains in progress as a double three Elliott Wave structure. Down from 114.21, Minute wave ((w)) ended at 112.27 and Minute wave ((x)) bounce ended at 114.03. Internal of Minute wave ((x)) unfolded as a zigzag Elliott Wave structure where Minutte […]