-

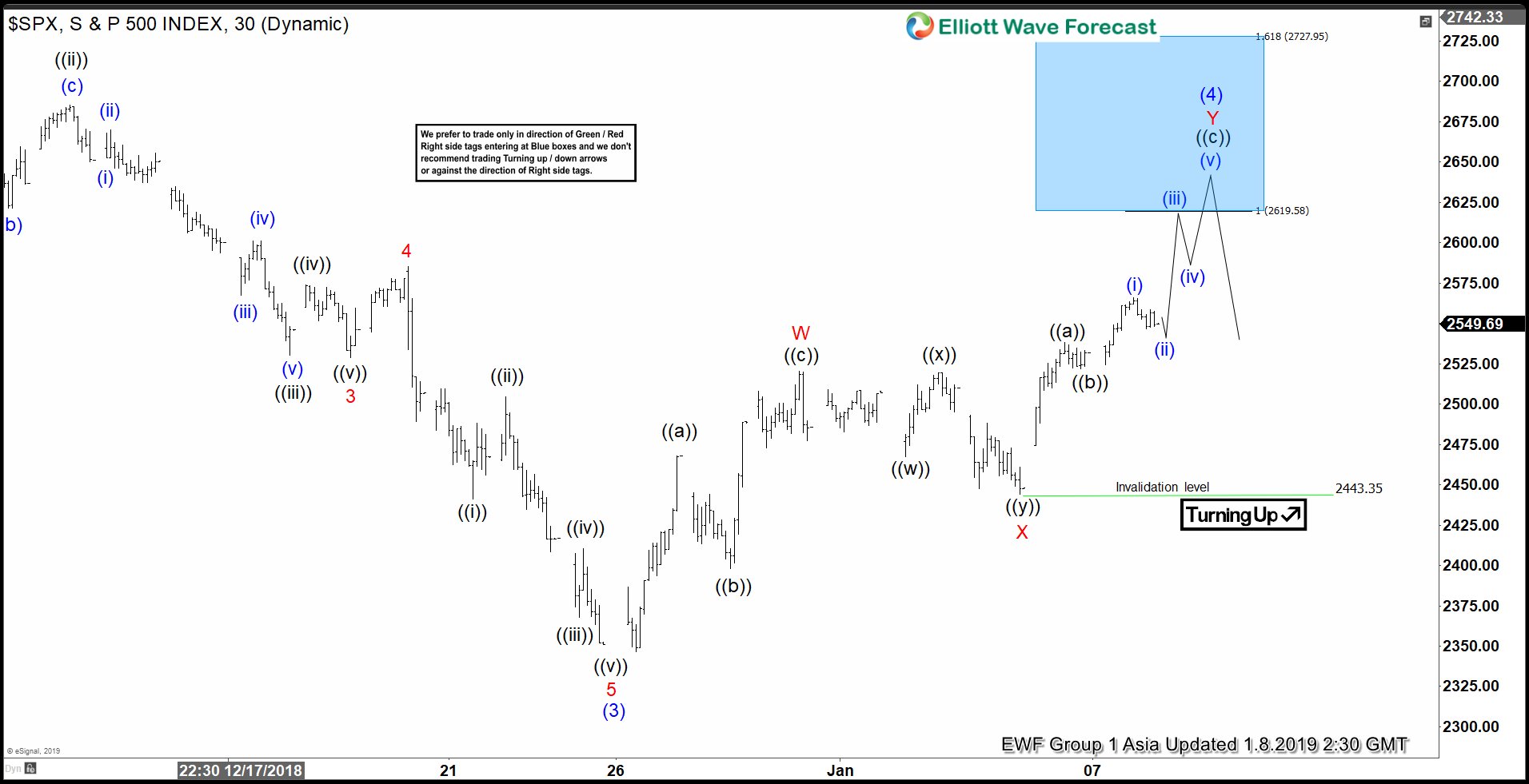

Elliott Wave View looking for SPX Rally to Fail

Read MoreShort term Elliott Wave view in SPX suggests that the decline to 2346.58 ended wave (3). The Index is currently correcting in wave (4) as a double three Elliott Wave structure. Up from 2346.58, wave W ended at 2520.27, wave X ended at 2443.96, and wave Y remains in progress towards 2619.58 – 2727.95 area […]

-

Japanese Yen Outlook In 2019

Read MoreIn this updated article and video below, we will follow up our view on Japanese Yen outlook in 2019. We wrote an article in late December last year titled “Will Yen Continue to Outperform in 2019?” In the article, we said that Japanese Yen can continue to strengthen against other major currency pairs in 2019. […]

-

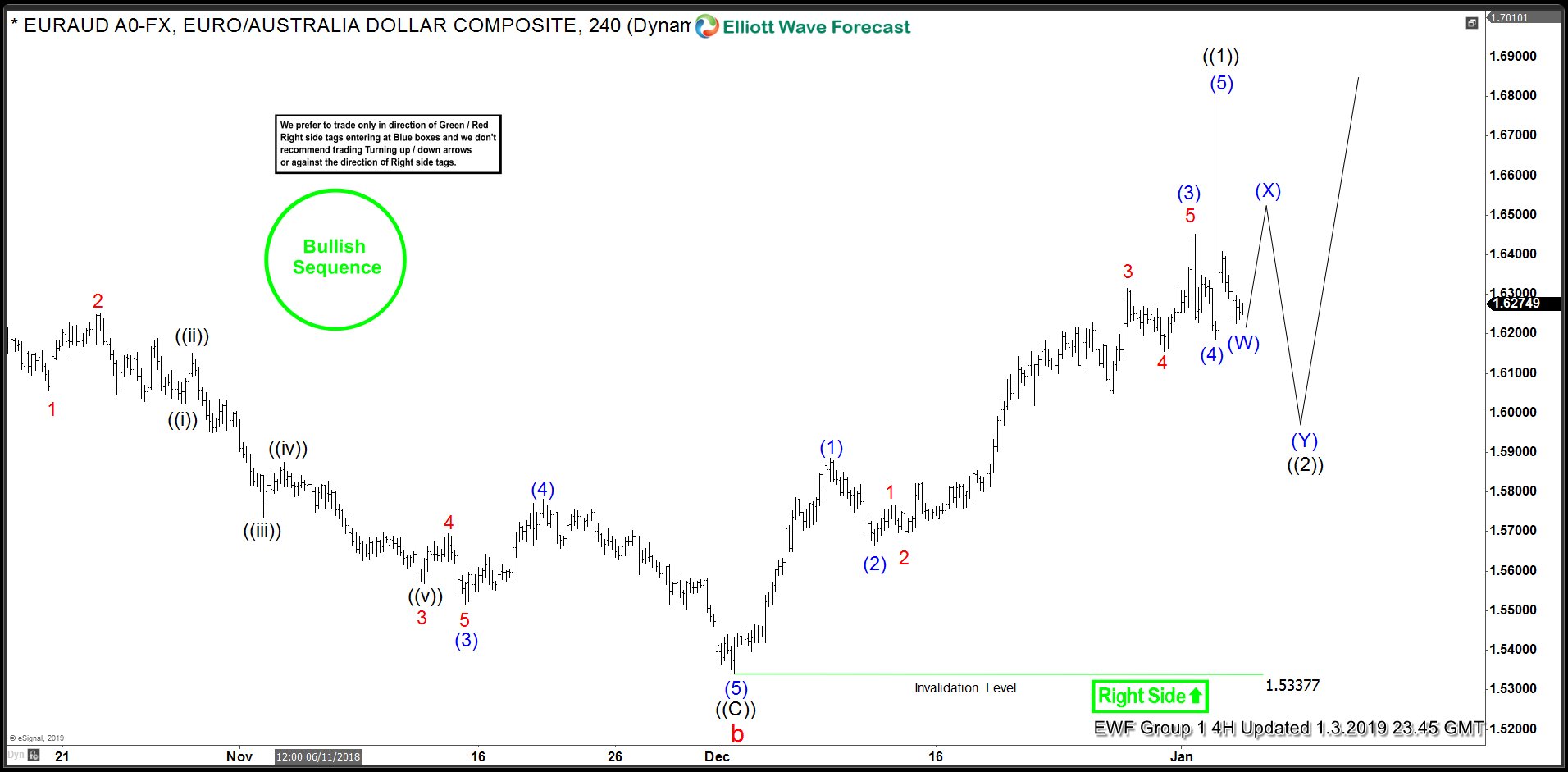

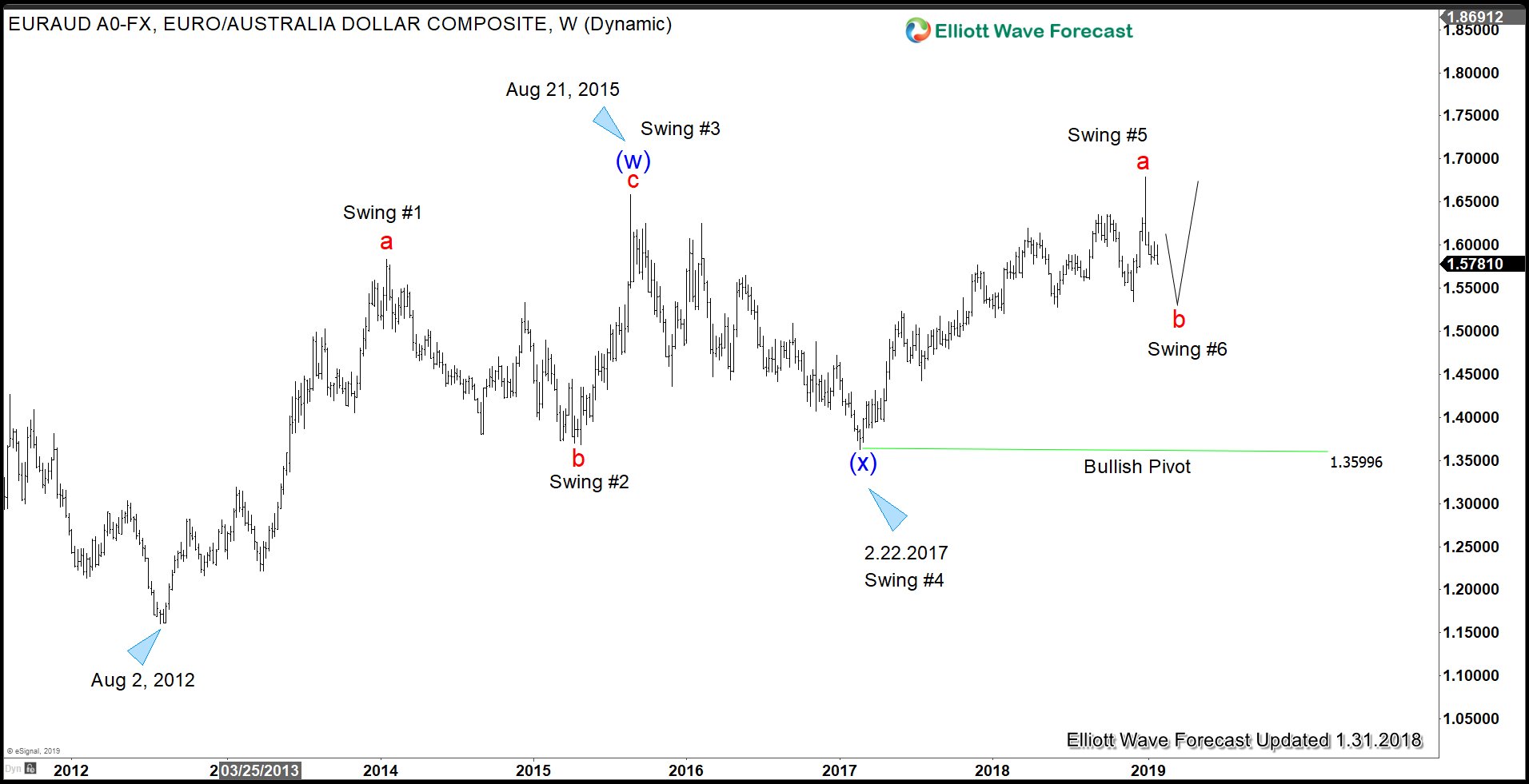

Elliott Wave View: EURAUD Bullish Sequence Favors More Upside

Read MoreElliott Wave view in EURAUD shows that the decline to 1.5337 low ended wave b. Rally from there unfolded as a 5 waves impulsive Elliott Wave structure. Up from 1.5337 low, Wave (1) ended at 1.5886, wave (2) ended at 1.566, wave (3) ended at 1.6453, wave (4) ended at 1.6184, and wave (5) ended […]

-

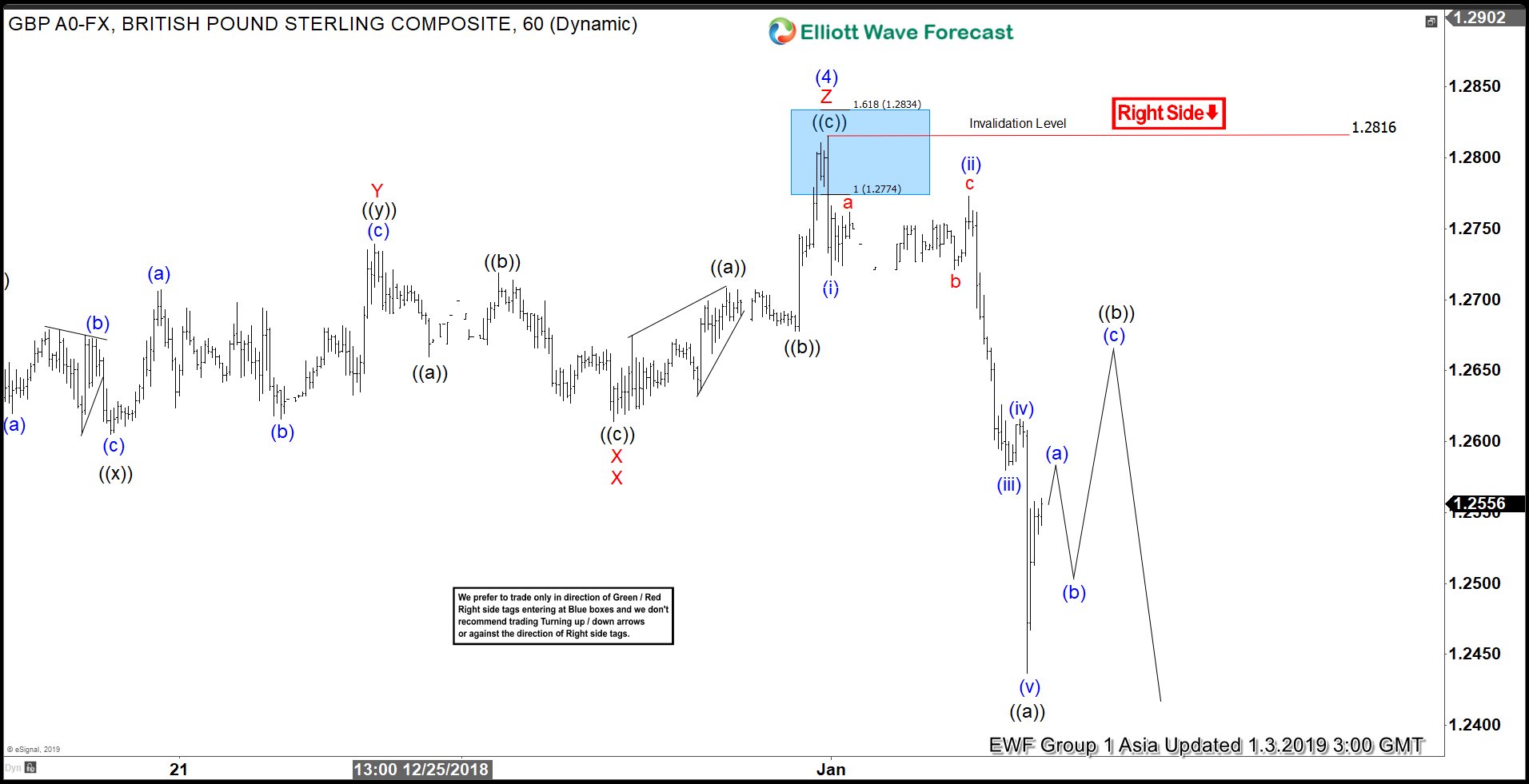

Elliott Wave Analysis: Further Downside Expected in GBPUSD

Read MoreShort term Elliott Wave view in GBPUSD shows that rally to 1.2816 ended wave (4). Internal of that rally unfolded as a triple three Elliott Wave structure. Up from wave (3) at 1.2476 on 12.12.2018 low, Wave W ended at 1.2687 and wave X ended at 1.2528. Rally to 1.2739 then ended Wave Y, second […]

-

Bullish Outlook in Euro Cross

Read MoreSix years ago in 2012, Euro zone was in the midst of crisis, with bailouts of Greece pushing the Euro to the verge of a collapse. Peripheral European countries like Greece, Portugal, Italy were unable to sell government bonds without offering significant yield. In order to convince international investor, ECB President Mario Draghi back in […]

-

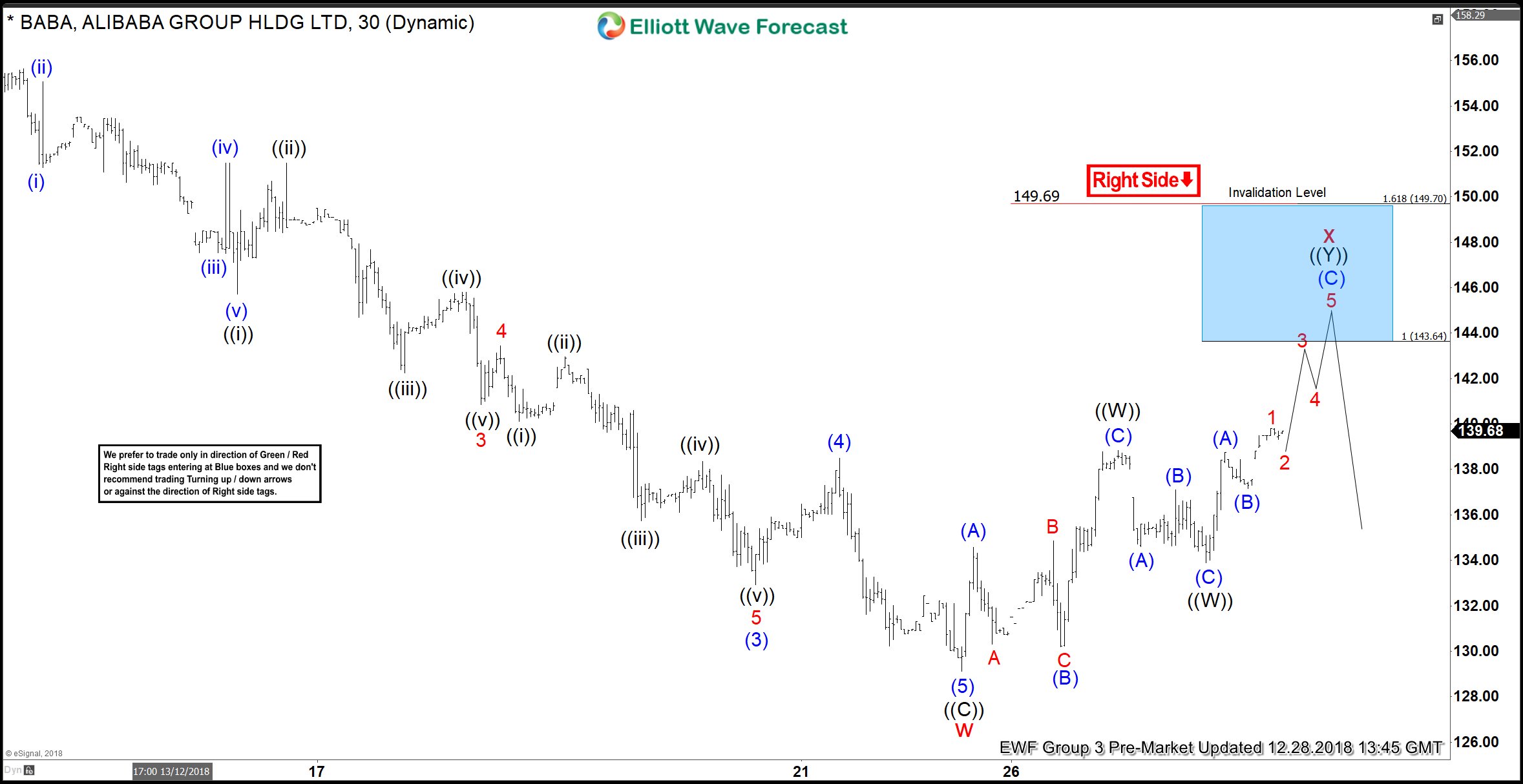

Alibaba Elliott Wave Structure Looking for Rally to Fail

Read MoreElliott Wave view in Alibaba (BABA) shows that the stock has an incomplete bearish sequence from 6.5.2018 high ($211.7). The 100% target in 7 swing comes at $88.3 and this view remains valid as far as the stock stays below 12.3.2018 high ($168.8). Near term, decline from 12.3.2018 high ended with Cycle degree wave w […]