-

Elliott Wave View: FTSE should extend higher after 5 waves move

Read MoreThis article and video explain the near term path for FTSE. Direction of the next move is likely higher provided it can hold the proposed invalidation level. An alternate count is also offered in case Index breaks below

-

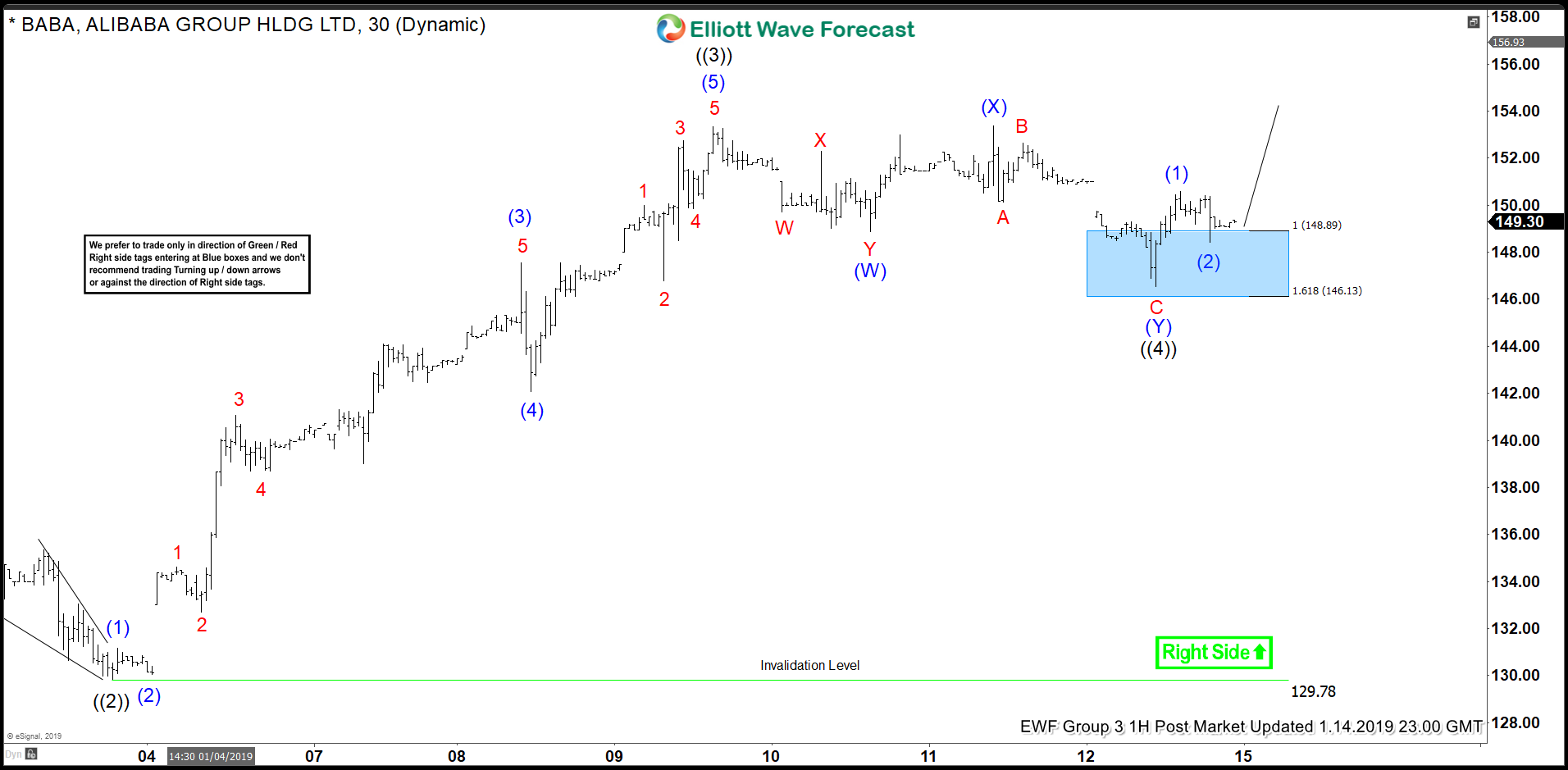

Elliott Wave View: 5 Waves Rally in Alibaba (BABA)

Read MoreAlibaba (BABA) shows what looks like an impulse move. This article and video talks about the short term Elliott Wave path for the stock. Next price target for the rally is provided as well as invalidation level and alternate view.

-

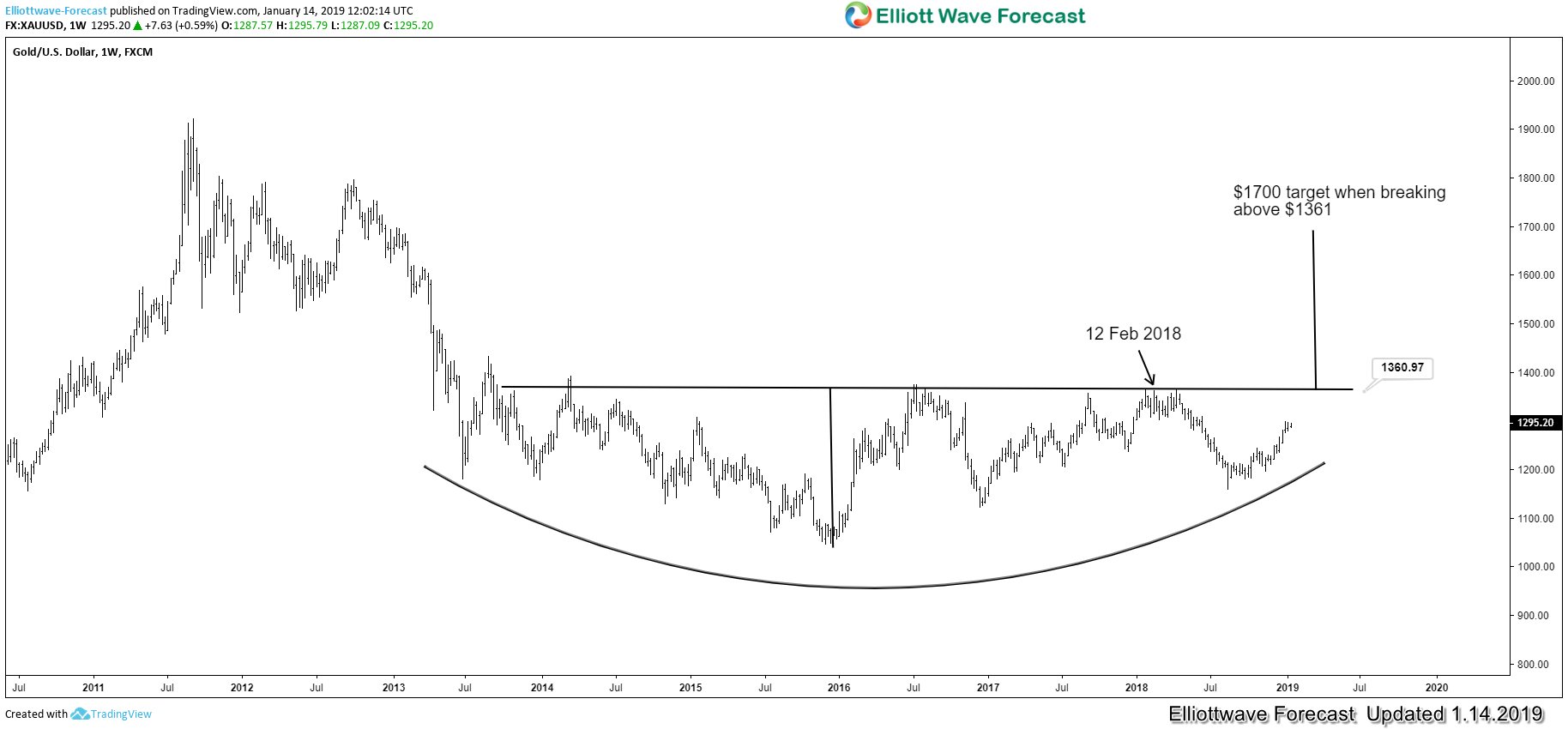

Has the Next Bull Market in Gold Started?

Read MoreGold has been used as the currency of choice throughout history, despite what the central banks of the world say. Ben Bernanke, then the Fed Chairman, famously said that Gold is not money in 2011 during congressional hearing with Senator Ron Paul. Since President Nixon removed Gold’s peg from the US Dollar in 1971, the […]

-

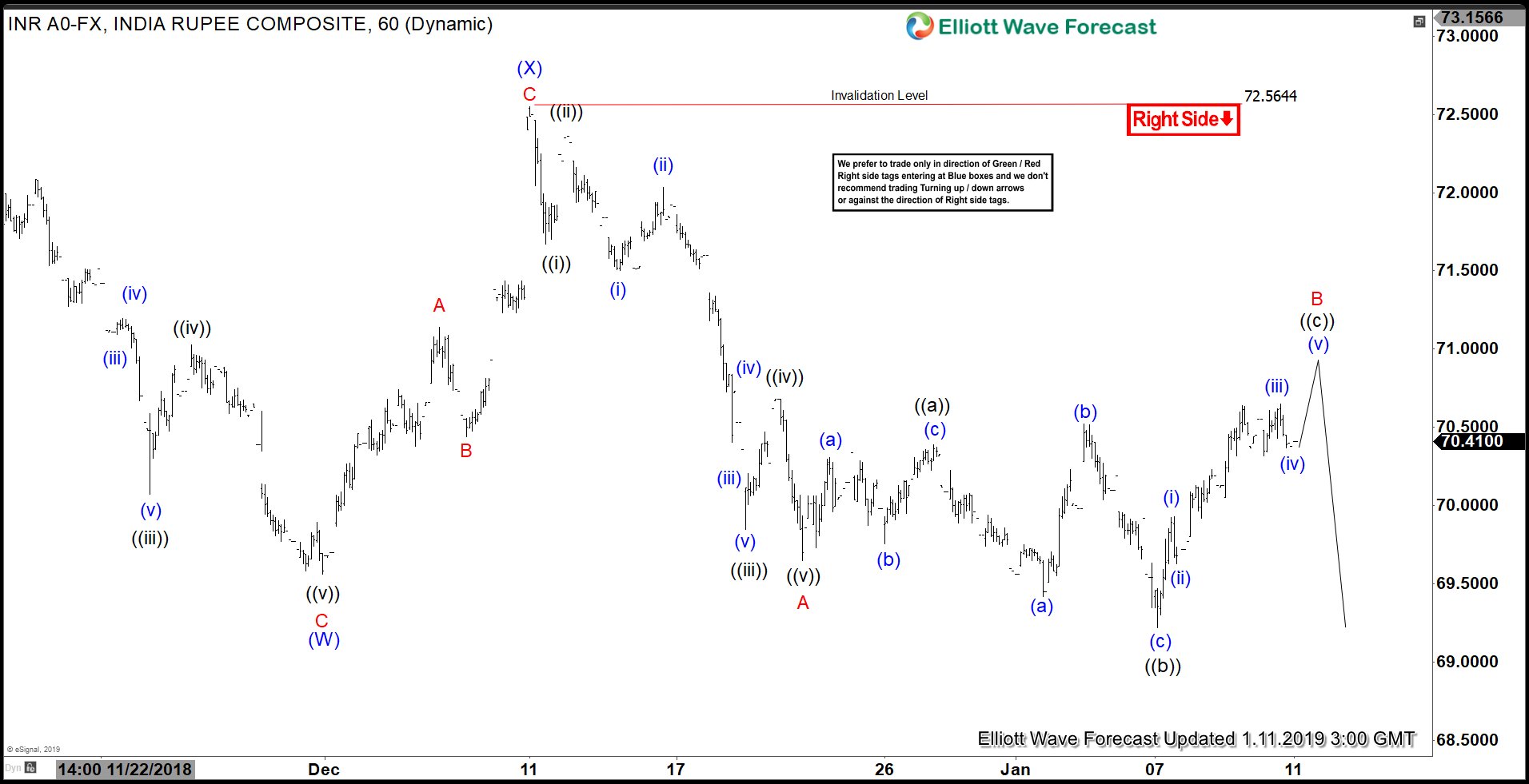

Elliott Wave View: Indian Rupee (USDINR) Should Turn Lower

Read MoreIndian Rupee (USDINR) is showing a bearish sequence from 10/11/2018 high. Elliott Wave analysis favors further downside in the pair as far as bounces stay below 12/11/2018 high. This article and video provides the future path of the pair as well as the inflection area.

-

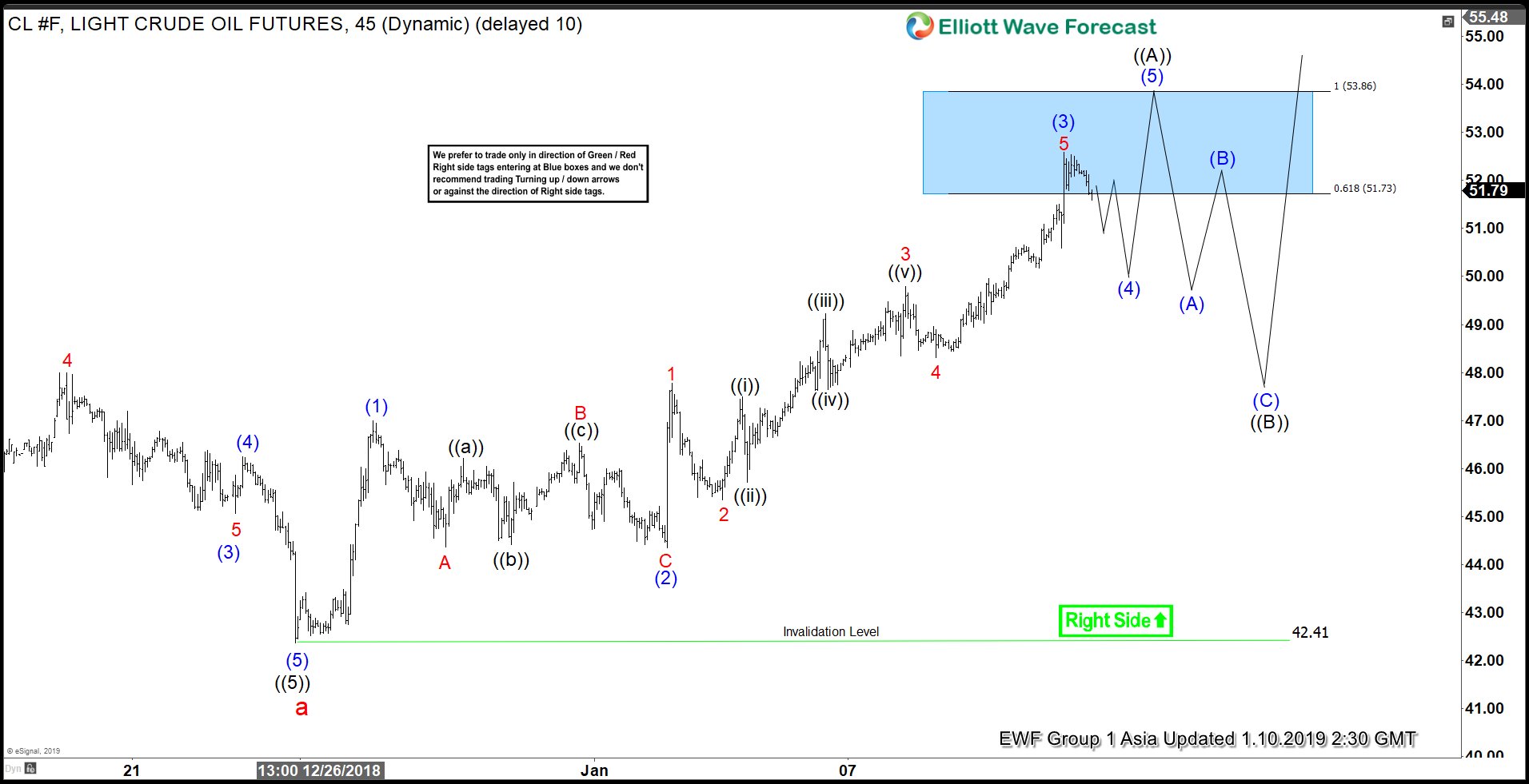

Short Term Elliott Wave View in Oil Favoring More Upside

Read MorePreferred Elliott Wave view suggests Oil has completed the cycle from 10/3/2018 peak and is now bouncing. Rally from $42.41 low appears impulsive and in this article we take a look at Elliott wave structure of the rally from $42.41 low and what we are expecting next.

-

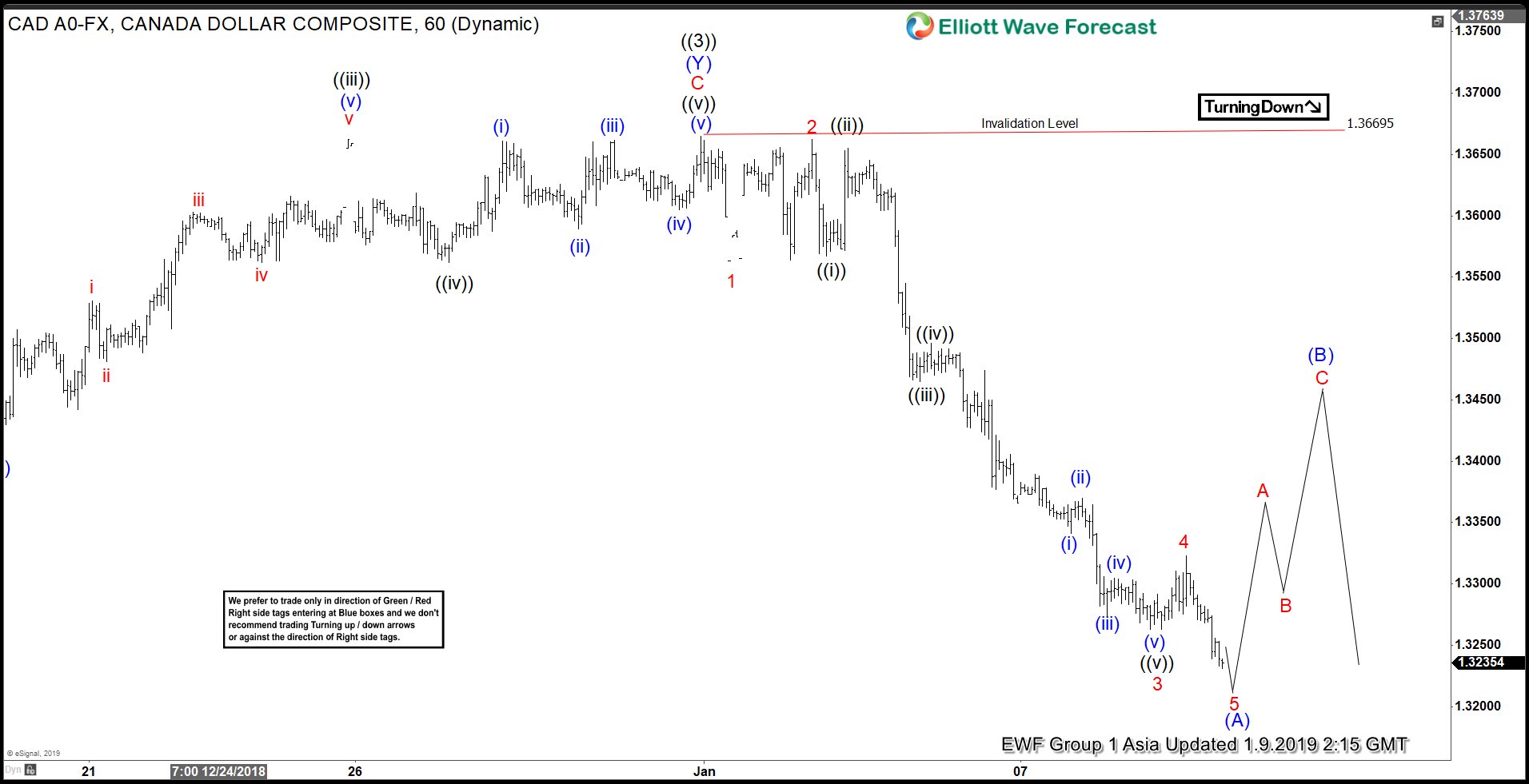

Elliott Wave Analysis: Impulse Move Suggests More Downside in USDCAD

Read MoreShort term Elliott Wave view in USDCAD shows that the decline from 12/31/2018 high (1.3669) is unfolding as a 5 waves impulse Elliott Wave structure. Down from 1.3669, Wave 1 ended at 1.3563, wave 2 ended at 1.3662, wave 3 ended at 1.3263, and wave 4 ended at 1.3323. We can see a momentum divergence […]