-

Elliott Wave View: Dollar Index Correction In Progress

Read MoreDollar Index (DXY) cycle from January 6 low remains in progress as a double three. This article and video looks at the Elliott Wave path.

-

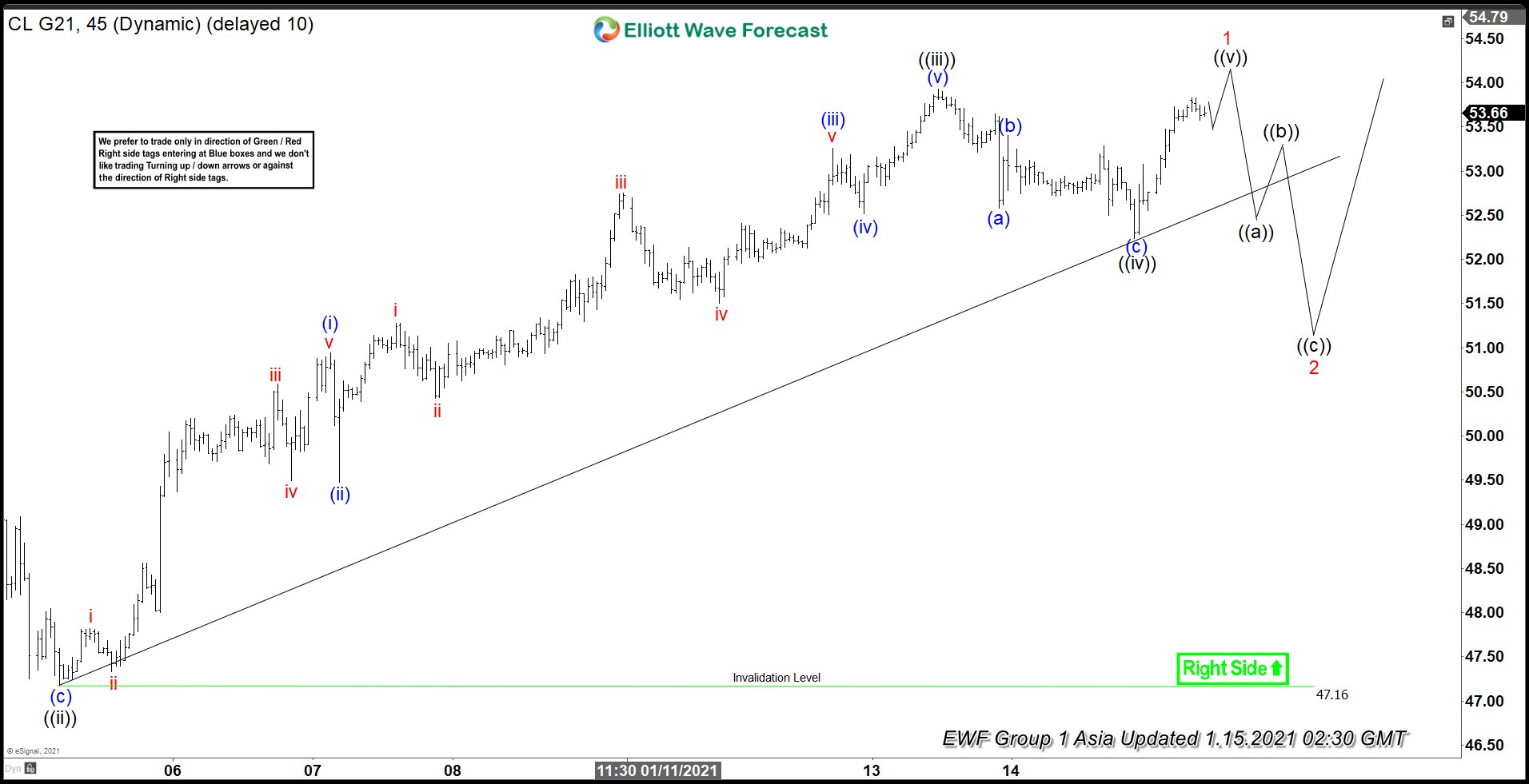

Elliott Wave View: Oil About to End Short Term 5 Waves Impulse

Read MoreCycle from December 23 low is about to end as a 5 waves. Oil may see a pullback soon in 3, 7, 11 swing but larger degree trend remains bullish.

-

Elliott Wave View: Nikkei May Pullback Short Term While Remains Bullish

Read MoreNikkei may end cycle from December low and see a pullback in short term, but trend remains bullish. This article and video look at the Elliottwave path.

-

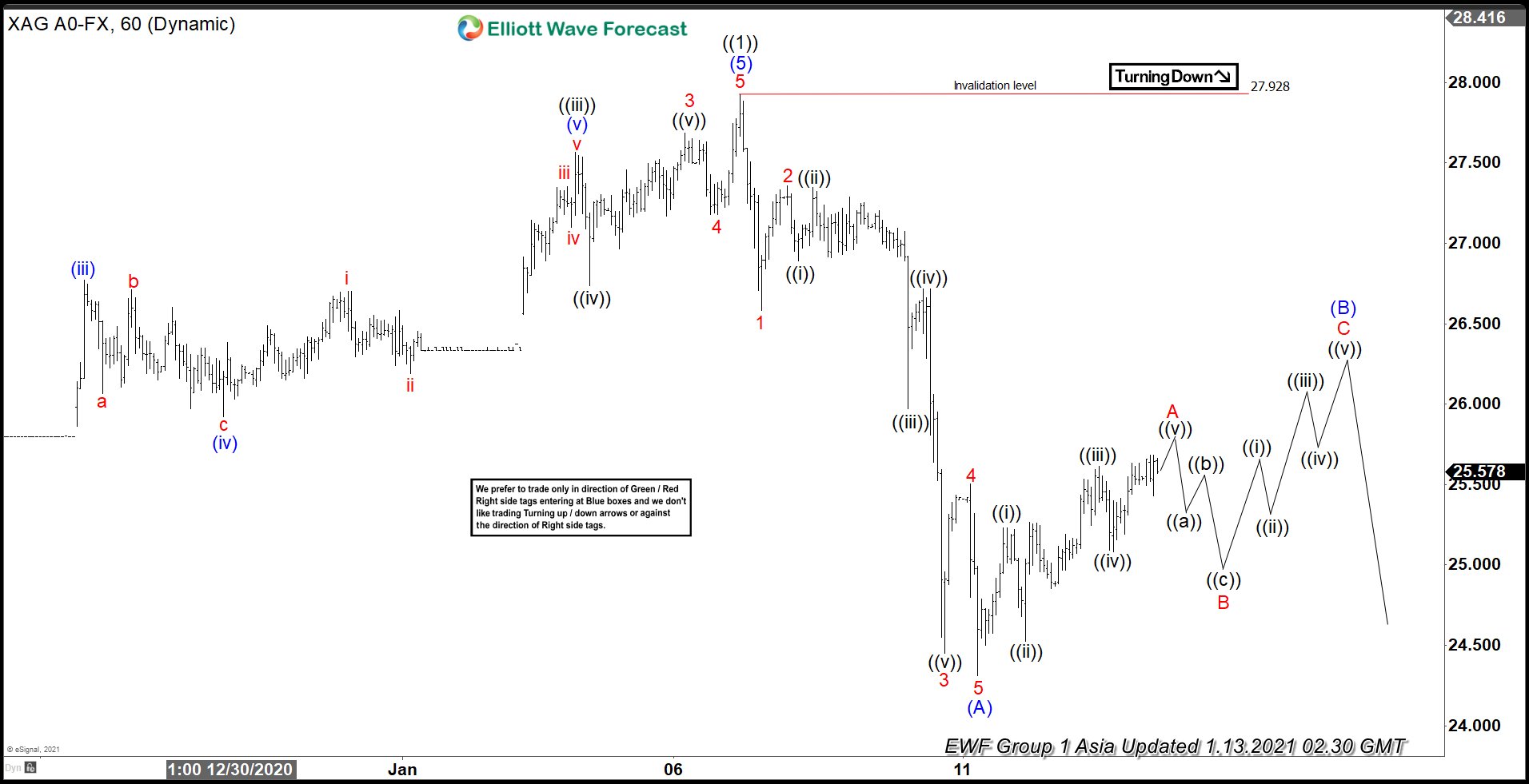

Elliott Wave View: Silver Still Consolidating Gain in 2020

Read MoreSilver is correcting cycle from September 24 low in larger 3 waves before the rally resumes. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Further Weakness in Ten Year Notes

Read MoreTen Year Notes decline from November 20 high shows an impulsive structure favoring more downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Bitcoin Within Wave (5) of a Parabolic Move

Read MoreSince forming the low in March of last year, Bitcoin has rallied impulsively in parabolic manner. This article & video looks at the Elliott Wave path.