-

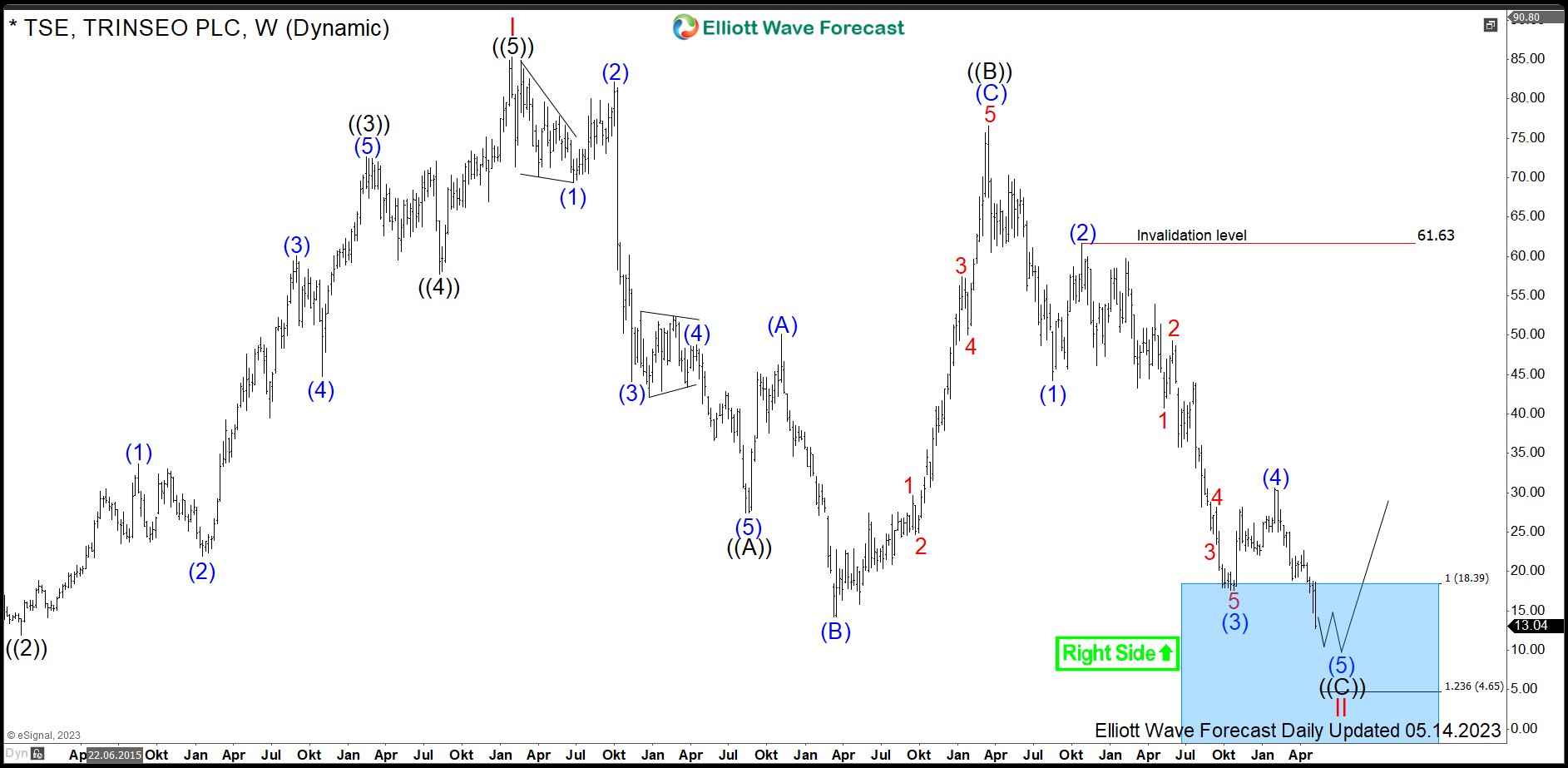

$TSE: Long Opportunity against All-Time Lows in Materials Company Trinseo

Read MoreTrinseo (formerly Styron) is a global materials company based in Berwyn, Pennsylvania, USA. The stock being a component of the Russel2000 index can be traded under ticker $TSE at NYSE. Trinseo offers a broad line of plastics, latex and synthetic rubber. The primary markets are automotive, appliances, electronics, packaging, tire industries, among others. In long […]

-

$KGH: Metals Producer KGHM Reacting Higher from Bluebox Area

Read MoreKGHM Polska Miedź S.A. is a multinational corporation which has its headquarters in Lubin, Poland. Traded under tickers $KGH at WSE and $KGHPF in US in form of ADRs, it is a component of the WIG30 index. KGHM has been a major copper and silver producer for more than 50 years. As a matter of fact, it […]

-

$OR: Cosmetics Manufacturer L’Oréal Remains Supported

Read MoreL’Oréal S.A. is the world largest cosmetics and beauty company. Headquartered in Clichy, France, the field of activities concentrates on skin care, hair color, perfume, make-up, hair care, sun protection etc. L’Oréal is a part of Euro Stoxx 50 (SX5E) and CAC40 indices. Investors can trade it under the ticker $OR at Euronext Paris. In […]

-

ZL #F: Soybean Oil Provides a Long Opportunity in 3 Swings Pullback

Read MoreSoybean Oil is one of the grain & oilseed commodities, along with wheat, soybeans, corn, rice, oats and others. Just behind palm oil, it is the second most used vegetable oil, basically, for frying and baking. Also, soybean oil finds applications medically and, when processed, for printing inks and oil paints. One can trade Soybean […]

-

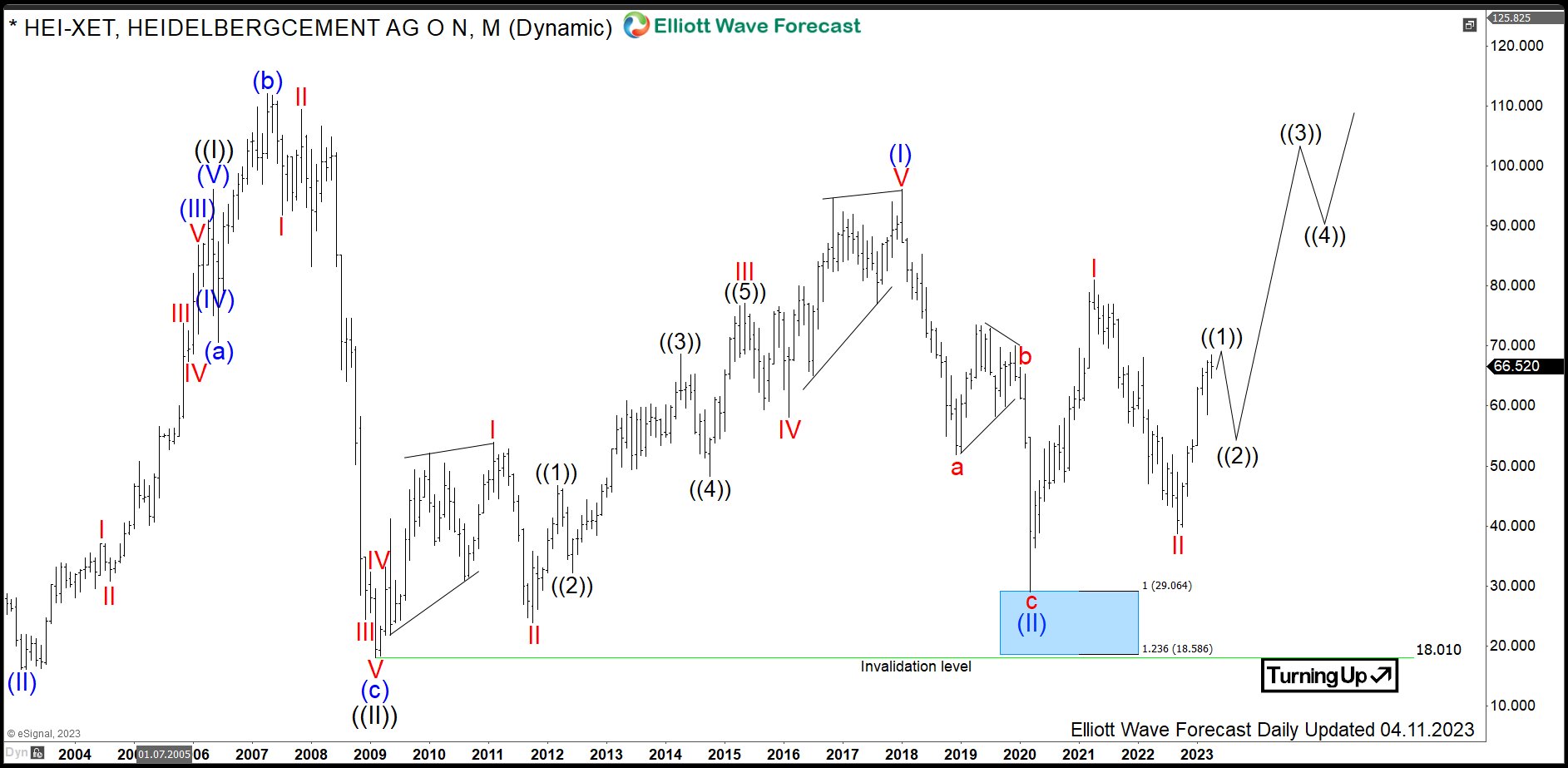

$HEI : German HeidelbergCement Reacting from Daily Buying Area

Read MoreHeidelbergCement is a German multinational building materials company. Today, it is the largest producer of construction aggregates in the world. It is number 2 in production of cement and number 3 worldwide in ready mixed concrete. Founded in 1874 and headquartered in Heidelberg, Germany, HeidelbergCement is a part of DAX40 index. One can trade it […]

-

AB InBev: Should One Buy Largest Beer Stock?

Read MoreAB InBev is a Belgian multinational drink and brewing company. It was formed back in 2008 through InBev (itself a merger between Interbrew from Belgium and AmBev from Brazil) acquiring Anheuser-Busch from the United States. In 2015, it has also acquired SABMiller. Today, AB InBev owns approximately 630 beer brands in 150 countries. Based in Leuven, Belgium, company has regional headquarters in New York, Bremen, […]