-

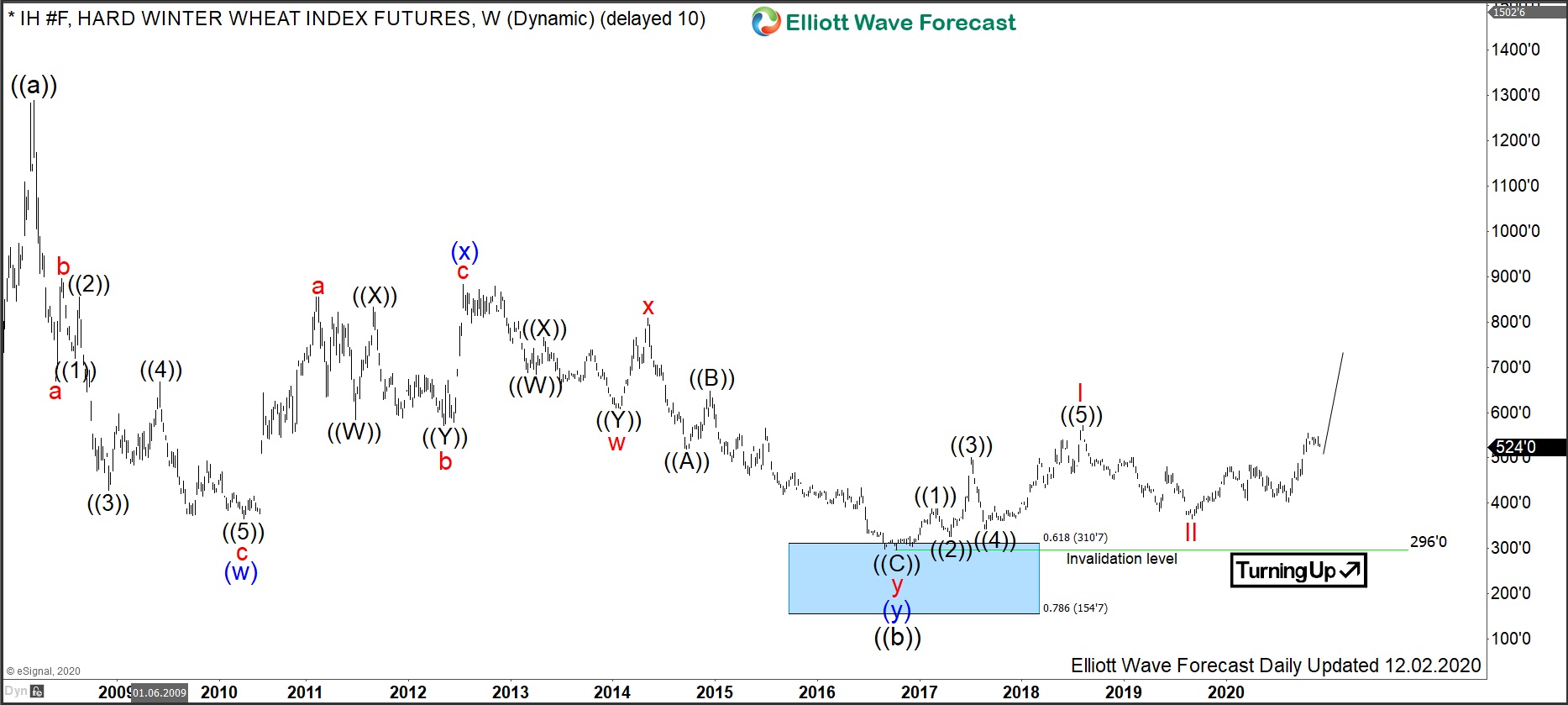

Will Rising Prices in Hard Red Winter Wheat Make Bread Lovers Suffer?

Read MoreHard Red Winter Wheat is one of the grain commodities, along with soft red wheat, corn, soybeans and others. Within the wheat family, first of all, there is a fundamental difference between two wheat types. Soft wheat is low in protein and is basically used in cakes in pastries. By contrast, hard wheat has a […]

-

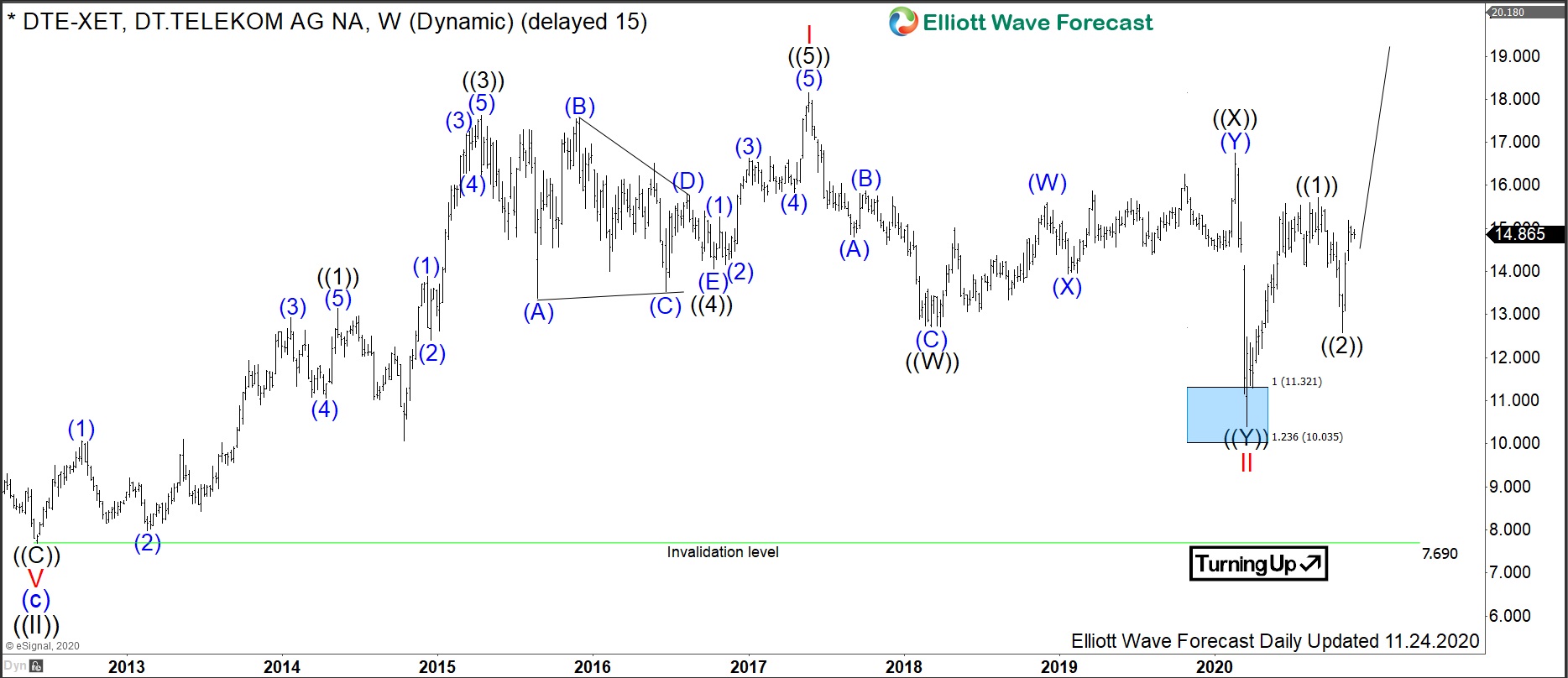

$DTE : Deutsche Telekom Should Soon Break Out

Read MoreDeutsche Telekom AG is a German telecommunications company and by revenue the largest telecommunications provider in Europe. Formed in 1995 and headquartered in Bonn, Germany, the company operates several subsidiaries worldwide. Deutsche Telekom is a part of both DAX30 and of SX5E indices. Even though the stock is highly appreciated by investors, the stock price […]

-

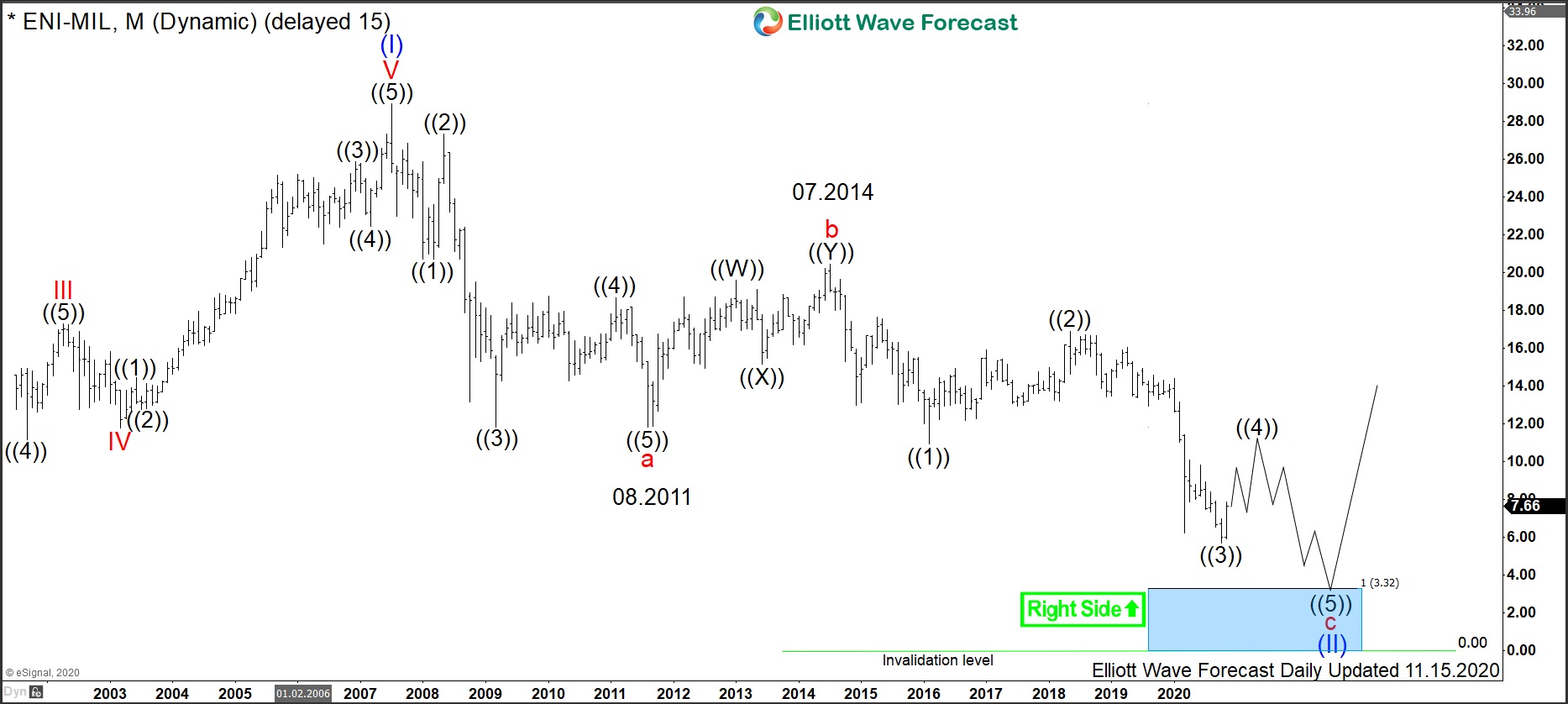

$ENI and $BP Stocks Help Locating Bottom in Energy Sector

Read MoreOil has found its bottom in April 2020. From the lows, it is extending higher and should become even more expensive in the coming years. Similarly, indices have found an important bottom in March 2020. From the lows, world indices like S&P500 and Nikkei have managed to break to new all-time highs. The mighty Energy […]

-

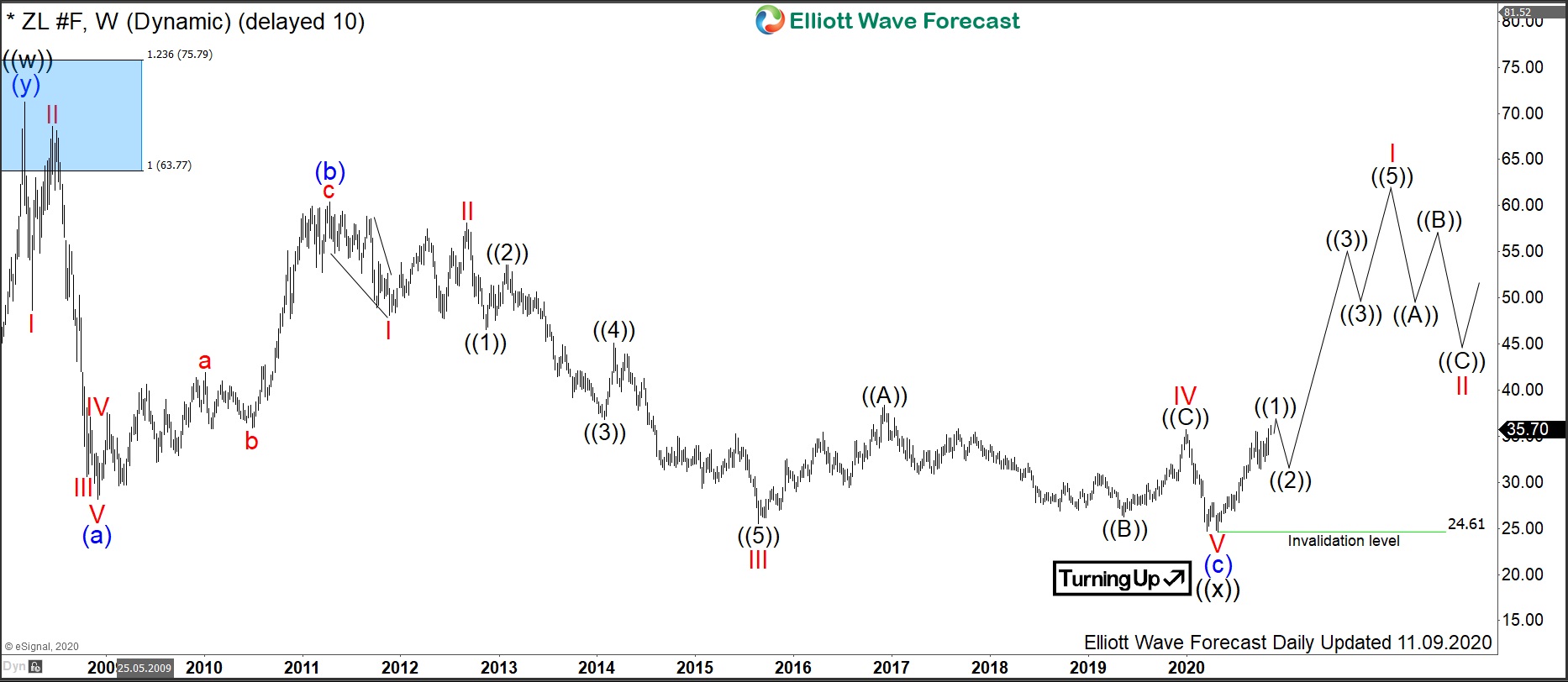

ZL #F: Soybean Oil Turning Higher Will Make Cooking Expensive

Read MoreSoybean Oil is one of the grain & oilseed commodities, along with wheat, soybeans, corn, rice, oats and others. Just behind palm oil, it is the second most used vegetable oil, basically, for frying and baking. Also, soybean oil finds applications medically and, when processed, for printing inks and oil paints. One can trade Soybean […]

-

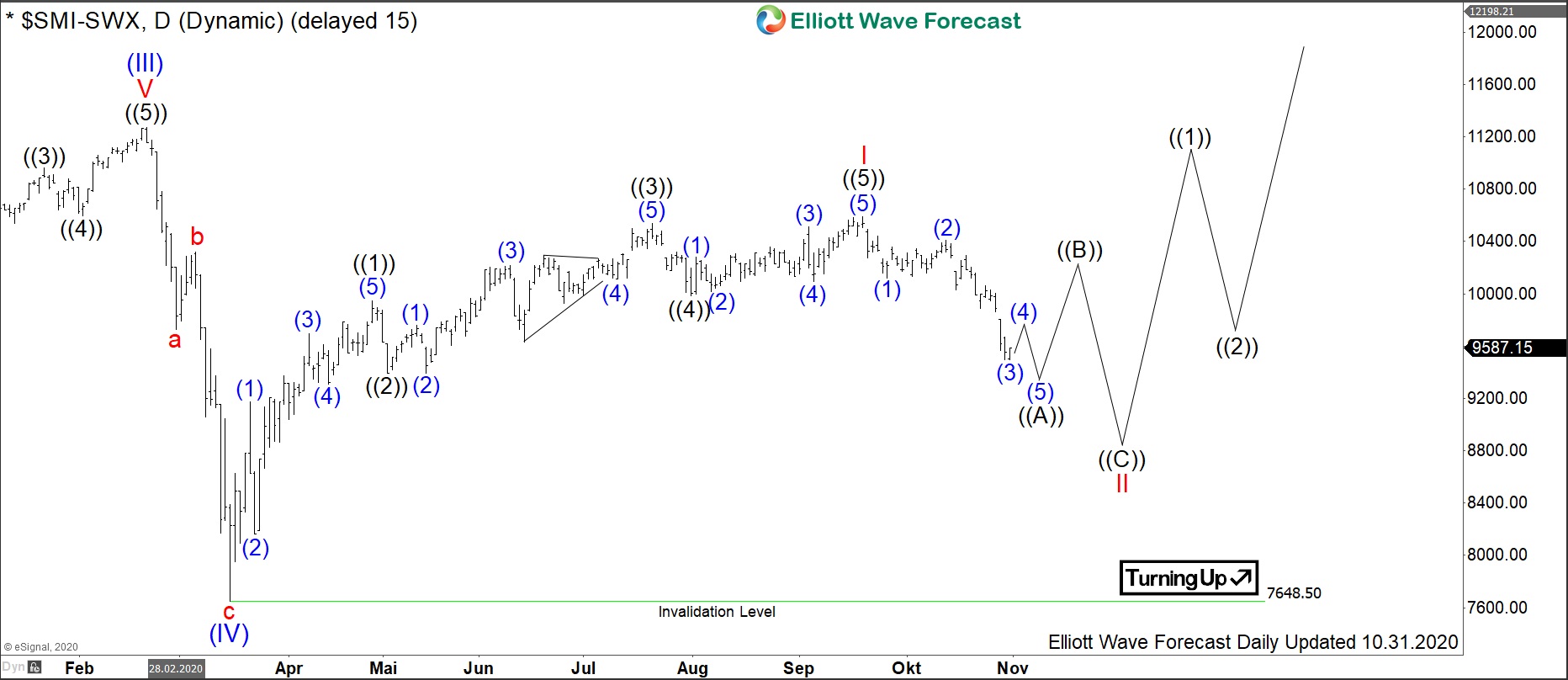

$SMI: Swiss Market Index SMI Provides an Opportunity in a Pullback

Read MoreSMI is a Swiss Market Index representing a capitalization-weighted measure of the 20 most significant stocks on the SIX Swiss Exchange in Zurich; the ticker is $SMI. The “COVID-19” drop in indices in February-March 2020 has marked most probably a significant low in world indices. It seems like $SMI has also found its bottom on march […]

-

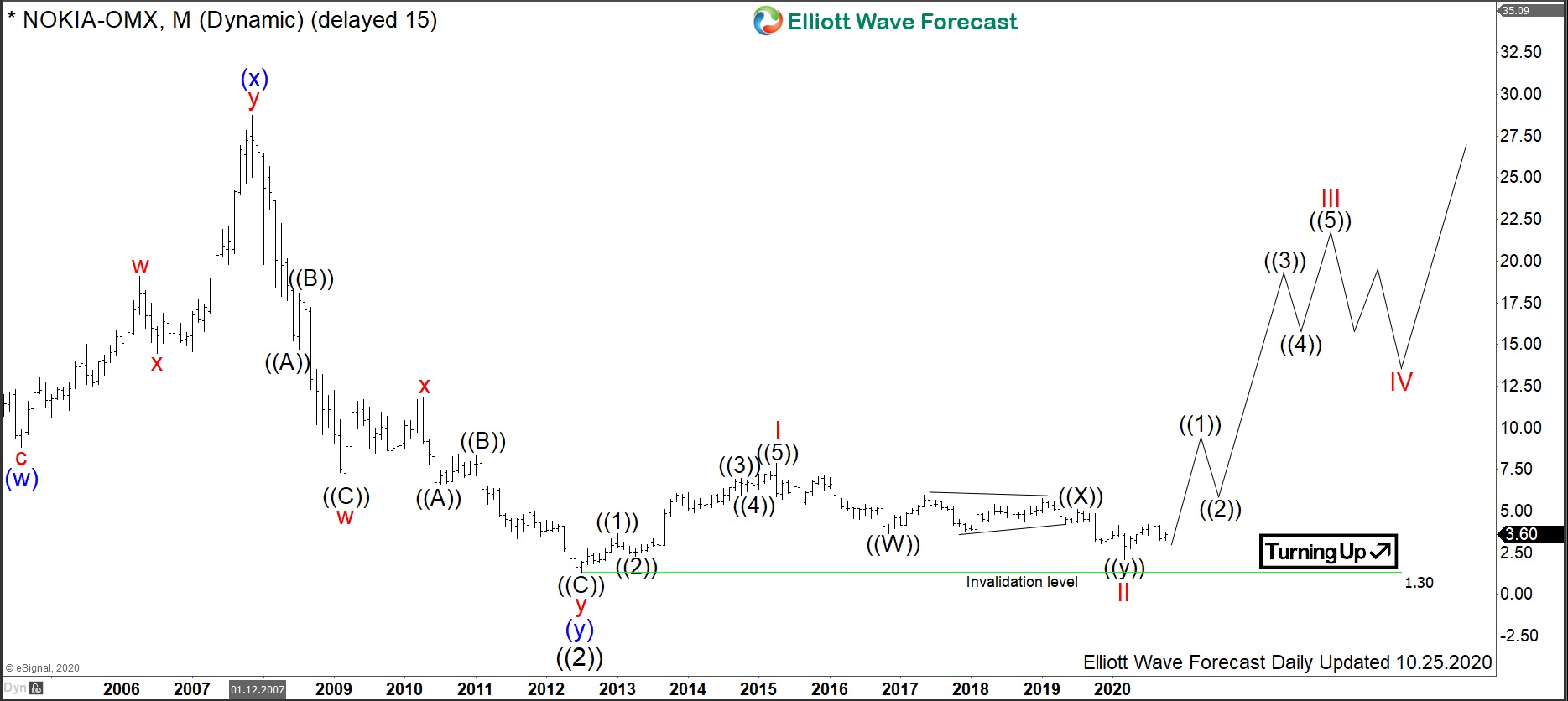

$NOKIA : Telecommunications Mammoth Nokia To Rise Again

Read MoreNokia is a Finnish multinational telecommunications, consumer electronics and information technology company. Founded 1865, it is headquartered in Espoo, Finland. Investors can trade it under the ticker $NOKIA at Nasdaq Nordic OMX and at Euronext Paris. The company is a part of Euro Stoxx 50 (SX5E) index. Also, one can trade Nokia under the ticker $NOK […]