-

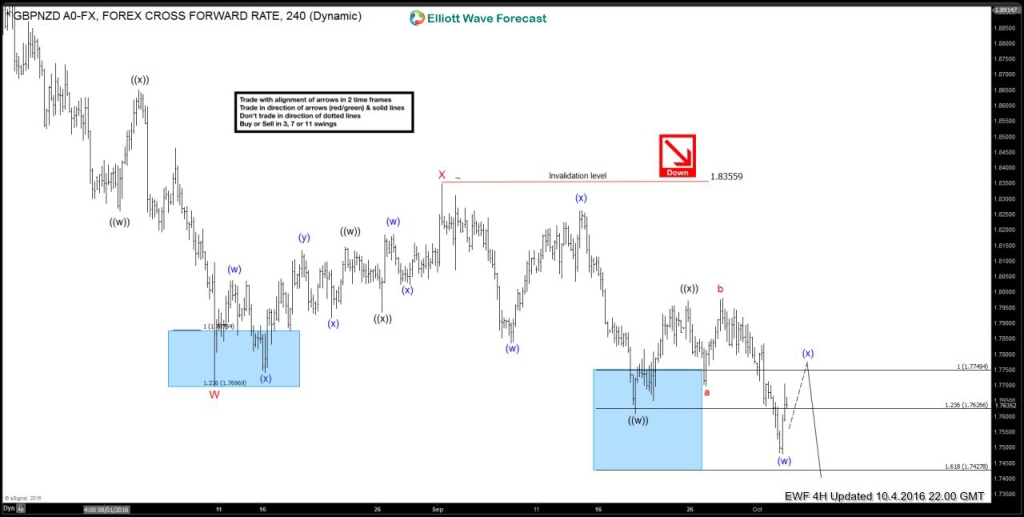

$GBPNZD: Calling lower based on Elliott Wave Swing Sequence

Read MoreIn this technical blog we are going to take a quick look at $GBPNZD 4 hour chart from October 4th 2016. Pair from July 21 2016 peak was following a lager Elliott wave bearish cycle for ideal downside target area at 1.70, Also from September 1st 2016 peak (1.83559) pair was forming a lower lows […]

-

TWTR (Twitter Inc) close to a bounce ?

Read MoreThe company was founded in 2006, Twitter is a social media platform that allows its users to post their thoughts in 140 characters or less, known as tweets. Twitter also allows users to broadcast and live-stream videos through its Vine and Periscope mobile applications. The company’s promoted products including promoted tweets, accounts, and trends help advertisers to […]

-

US Dollar outlook post FOMC

Read MoreThe Federal Reserve once again pushed back plans to raise interest rates at the September meeting, a widely expected after a series of mixed economic reports and various signals Fed officials measure. After its policy meeting two-day Federal Open market Committee voted to keep the federal funds rate from 0.25% to 0.50%, citing progress in […]

-

$FTSE Elliott Wave Strategy of the Day 9.8.2016

Read MoreOn 8th of September 2016, Our Strategy of the Day Video presented to clients viewed the pullback in $FTSE as a buying opportunity in the index. Long $FTSE 9.8.2016 $FTSE has rallied in 7 swing and reached 100% Fibonacci extension of first 3 swings up from February 2016 lows already, however some other Indices are still incomplete […]

-

The Case for Silver, Alexco, Hecla

Read MoreSilver rose to a new high of 2016 in the second quarter as a result of strong investor and speculative demand amid an environment macro support for precious metals. Overall this year silver has been a star performer. White metal ingots outshone well, marking an increase of 37 % compared to 22% increase in Gold. […]

-

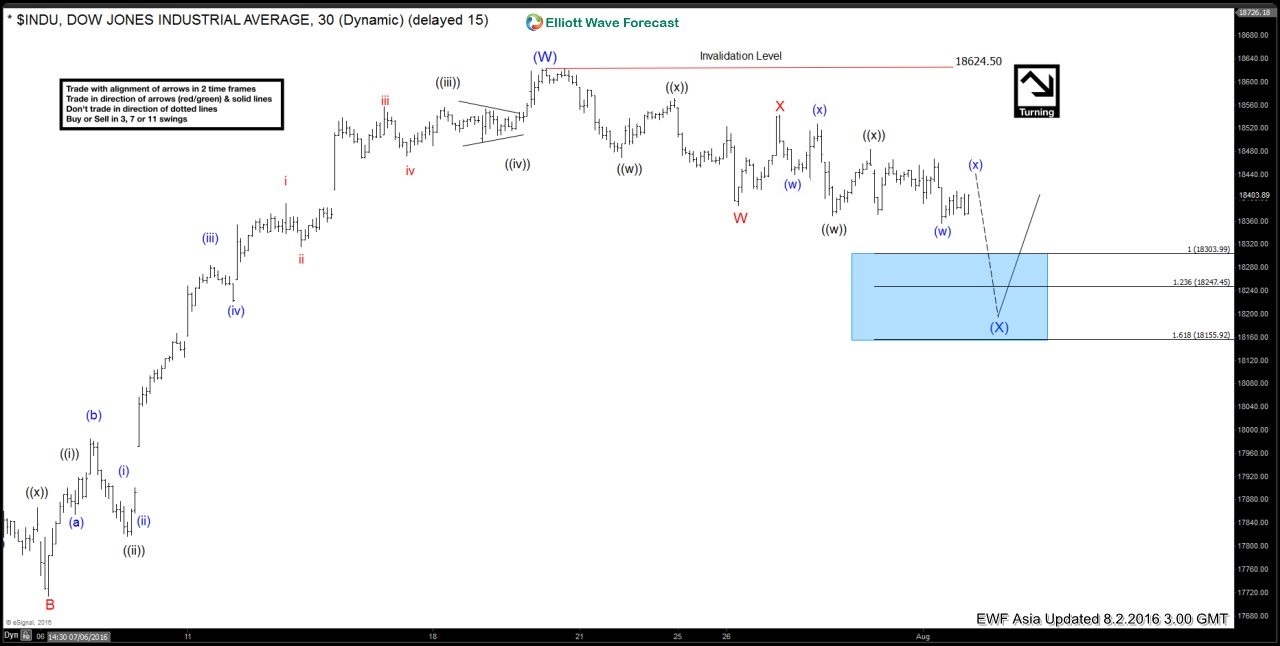

$INDU-DOW Double three Elliott Wave Structure

Read MoreGlobal Indices have seen an impressive start of Q3 as the major US indices are not tired of hitting new highs occasionally. With applause July dissemination among equity investors, capital bulls are flexing their muscles in August as well. At the beginning of last week, the indices hits fresh highs as US retail sales and […]