-

Natural Gas ($NG_F) ready for winter rally?

Read MoreCold winters drive the demand for natural gas to power heating ovens or to generate electricity from natural gas to power heaters. The nymex natural gas prices reached a 17-year low of $ 1.64 on March 3, 2016, due to mild weather, weak demand, strong supplies and high inventories. As of December 1, prices rose […]

-

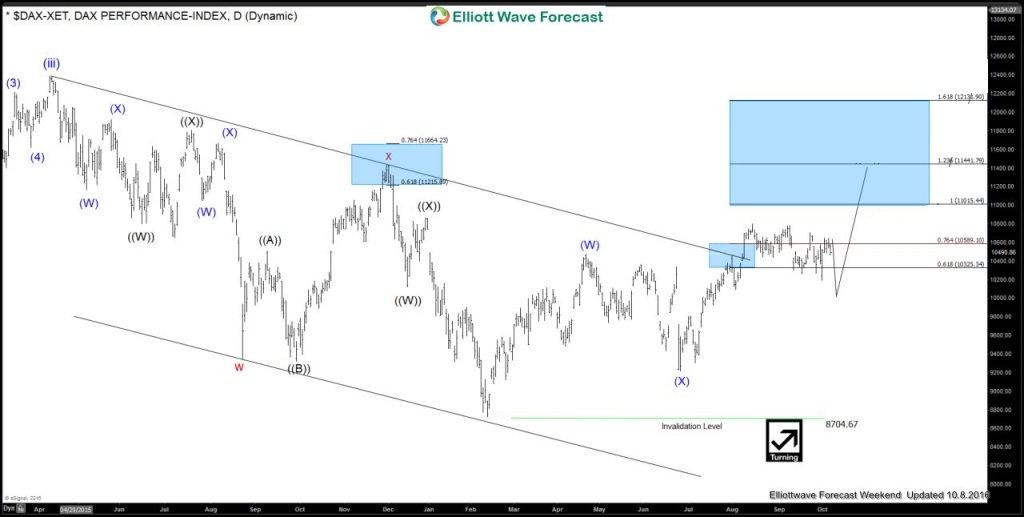

Forecasting the rally in DAX Index

Read MoreIn this technical blog, we will take a look at some charts of DAX Stock Index presented to clients of Elliottwave-Forecast.com over the last few weeks. For the last few months EWF members knew that Global Indices had been in a bullish cycle and it offered some nice buying opportunities in the dips in 3, 7 or […]

-

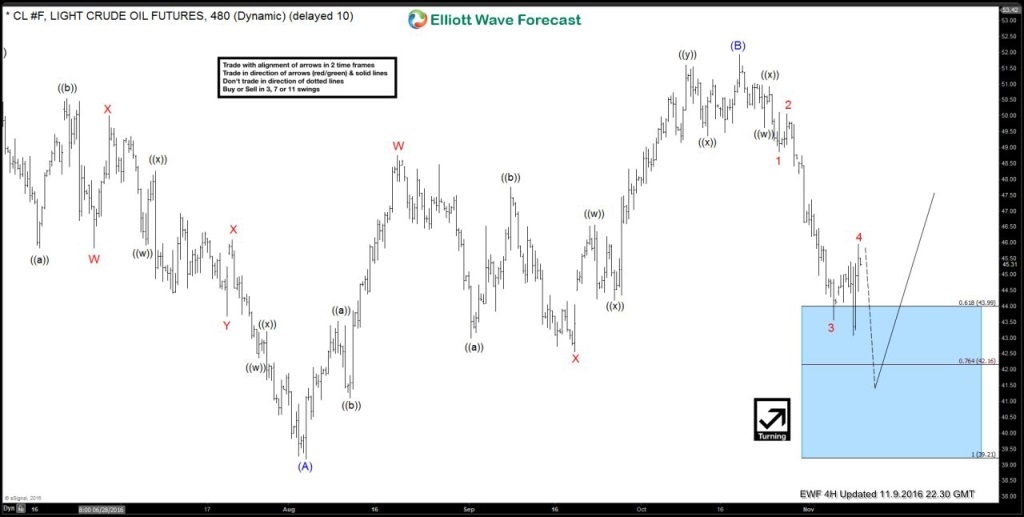

OIL (CL_F) Running Flat Elliott Wave Structure

Read MoreIn this Technical blog we are going to take a look at $CL_F (Oil) running flat structure we had from June’s peak, but before we go there lets talk about what “Running FLAT Elliott Wave structure” looks like. As per Elliott Wave Theory, running FLAT is a 3 wave corrective pattern which could be rarely found in […]

-

EURGBP forecasting the decline into the Election day

Read MoreIn this technical blog we are going to take a quick look at the $EURGBP 4 hour chart dated: 7th of November 2016. Pair since the October 7th peak (0.9224) was showing lower lows & lower highs, also was missing the extreme from the peak favored another push lower in the pair to happens to […]

-

$SPX Elliott waves calling the decline & then the bounce

Read MoreIn this Technical blog we are going to take a look at $SPX 4 hour October 13th 2016 chart. In which instrument was showing 5 swings from August 15th peak, which is incomplete bearish sequence in New Elliott wave theory. So the idea was selling the bounces against September 22nd peak in sequence of 3, […]

-

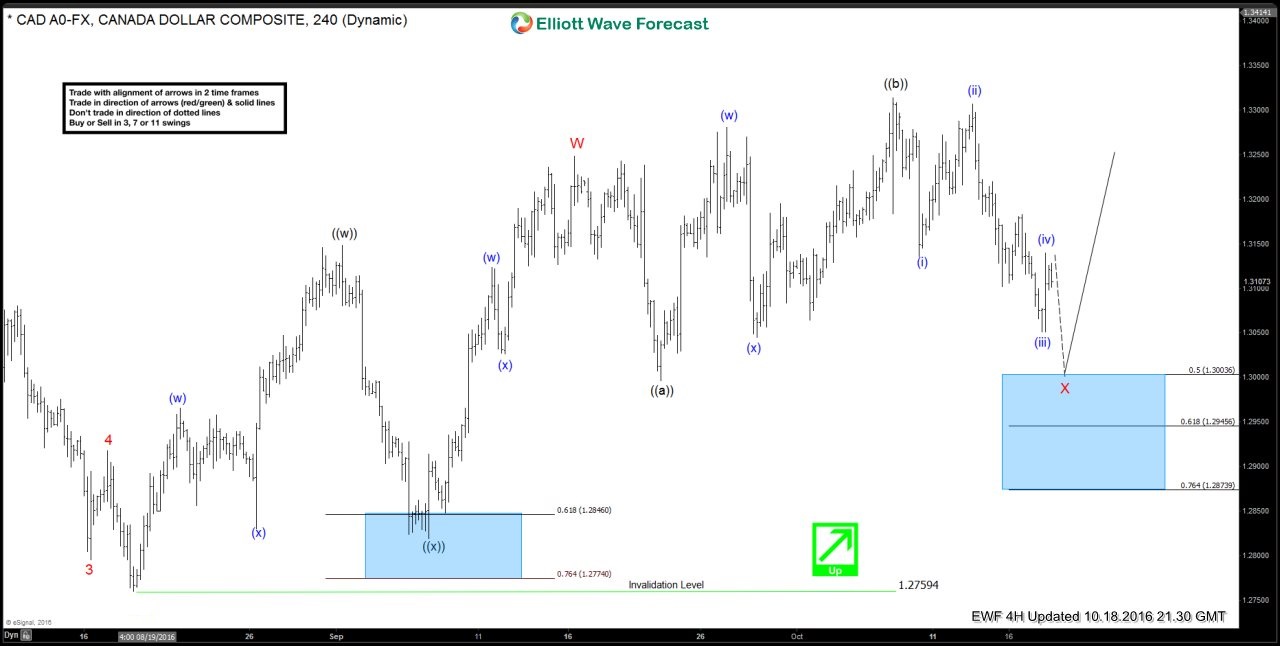

USDCAD: Buying the dips based on incomplete Elliott wave sequence

Read MoreIn this technical blog we are going to take a look at USDCAD October 18th 2016, 4 hour chart. In which pair was showing incomplete Elliott wave bullish sequence from May 3rd 2016 lows (1.2460) showing higher highs & higher lows. Hence, the strategy was to buy the dips in sequence of 3, 7 or […]