-

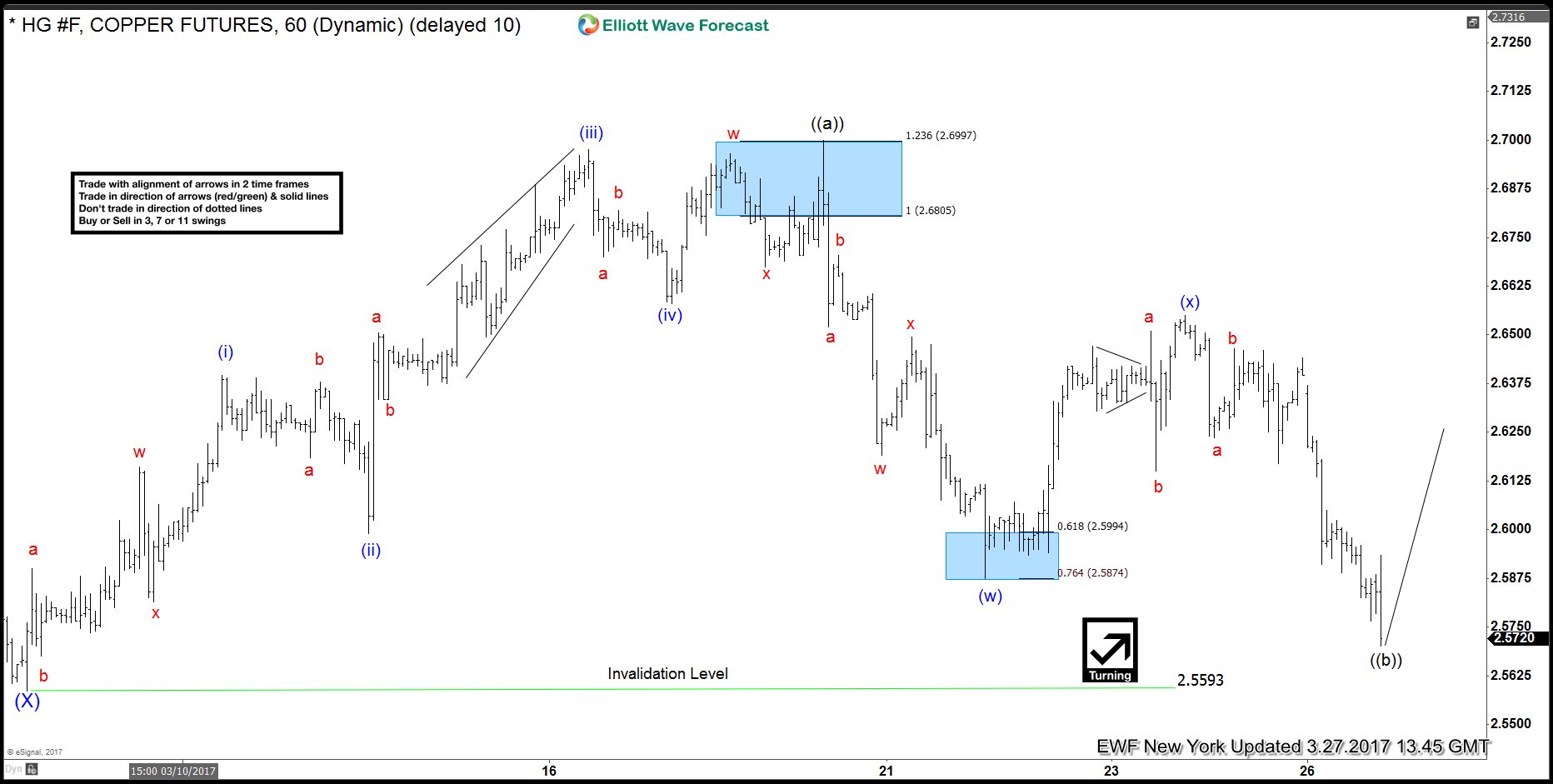

Copper Elliott wave view: 5 waves calling higher

Read MoreIn this technical blog, lets take a quick look at the 1 hour Copper Elliott wave view from March 09 lows. In which the the metal was showing 5 waves bounce from March 09 (2.5593) low & the bounce was impulsive rather then corrective sequence. Thus suggesting the cycle from (2.5593) low could be following the […]

-

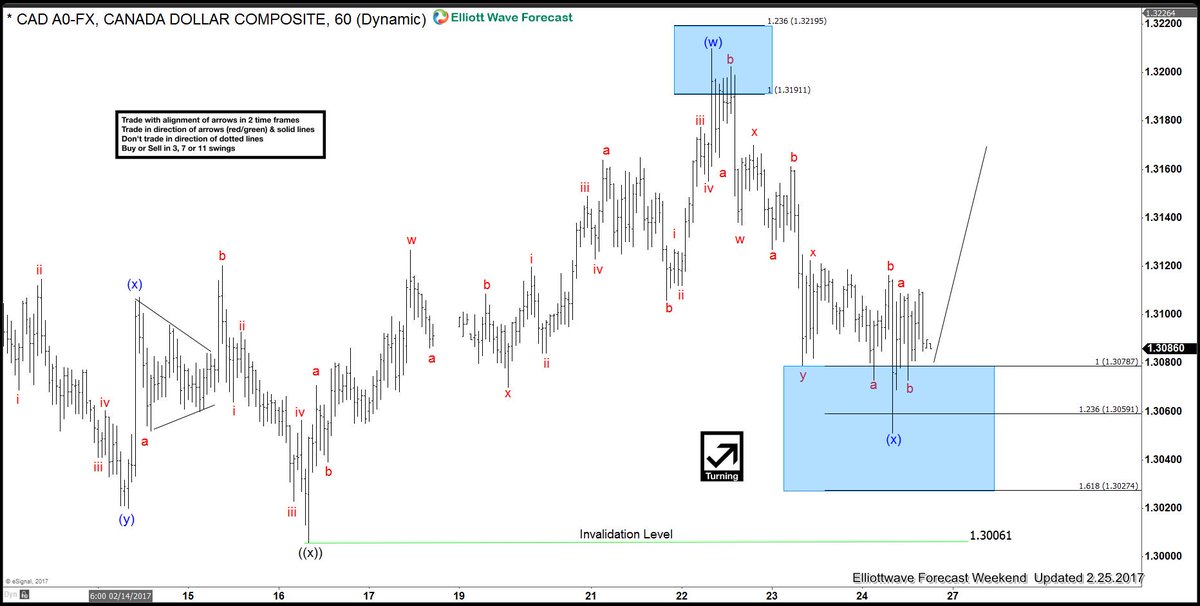

CAD (USDCAD) Elliott Wave Forecasting the rally

Read MoreIn this technical blog we are going to take a quick look at the USD CAD Elliott wave structure from January 31 cycle (1.2967), in which the pair was expected to do a double three Elliott wave, where wave Minute wave ((w)) ended at 1.3209 & Minute wave ((x)) at 1.3006, up from there Minutte wave (w) […]

-

SPX Elliott wave view: Wave 4 started

Read MoreShort term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301, Minor wave 2 ended at 2267, and Minor wave 3 ended at 2400.98. Internals of Minor wave 3 shows an extension and subdivided also as an […]

-

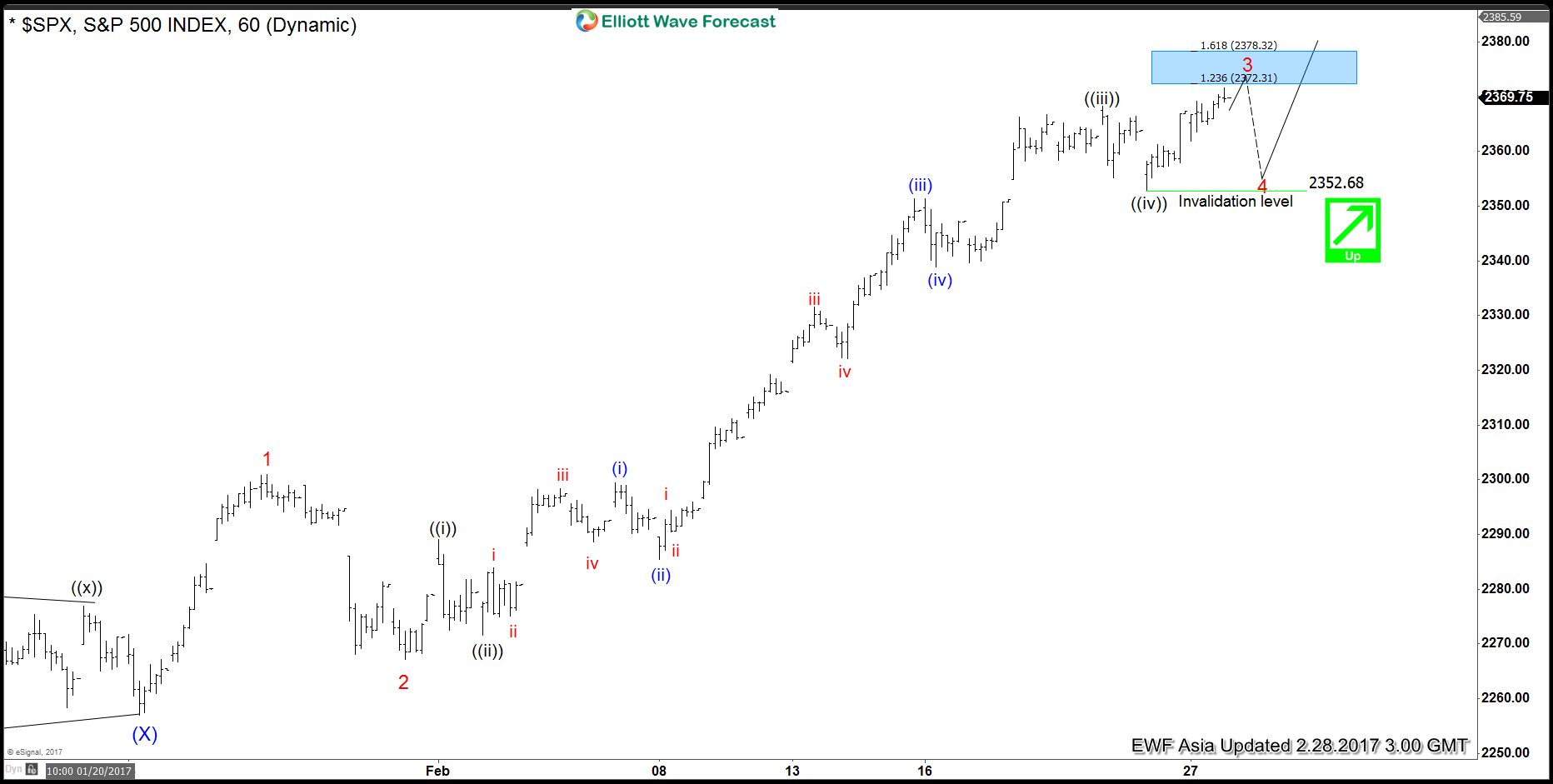

SPX Elliott Wave View: Still within wave 3

Read MoreRevised short term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301 and Minor wave 2 ended at 2267.2. The Index has erased momentum divergence at the peak suggesting it is likely still within Minor wave 3 […]

-

SPX Elliott wave view: Wave 4 started

Read MoreShort term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301, Minor wave 2 ended at 2267.2, and Minor wave 3 is proposed complete at 2371.5. Internal of Minor wave 3 shows an extension and subdivided also […]

-

SPX Elliottwave view: Ending Wave 3 soon

Read MoreShort term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301, Minor wave 2 ended at 2267.2, and Minor wave 3 remains in progress but close to ending. Internal of Minor wave 3 shows an extension and […]