-

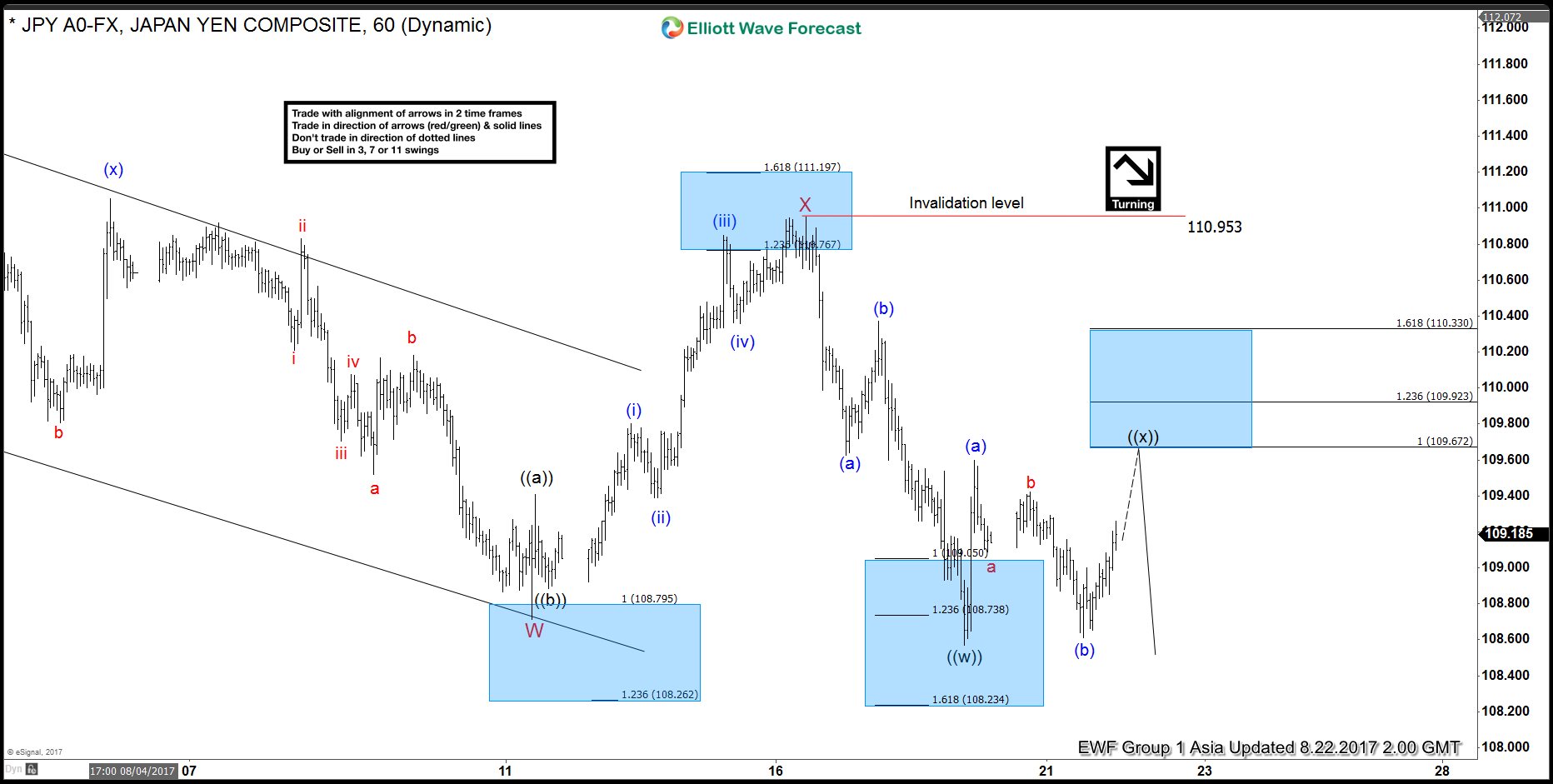

USDJPY Elliott Wave View: Ending bounce

Read MoreShort term USDJPY Elliott wave view suggest that the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and correction of that cycle ended in a Minor wave X at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute […]

-

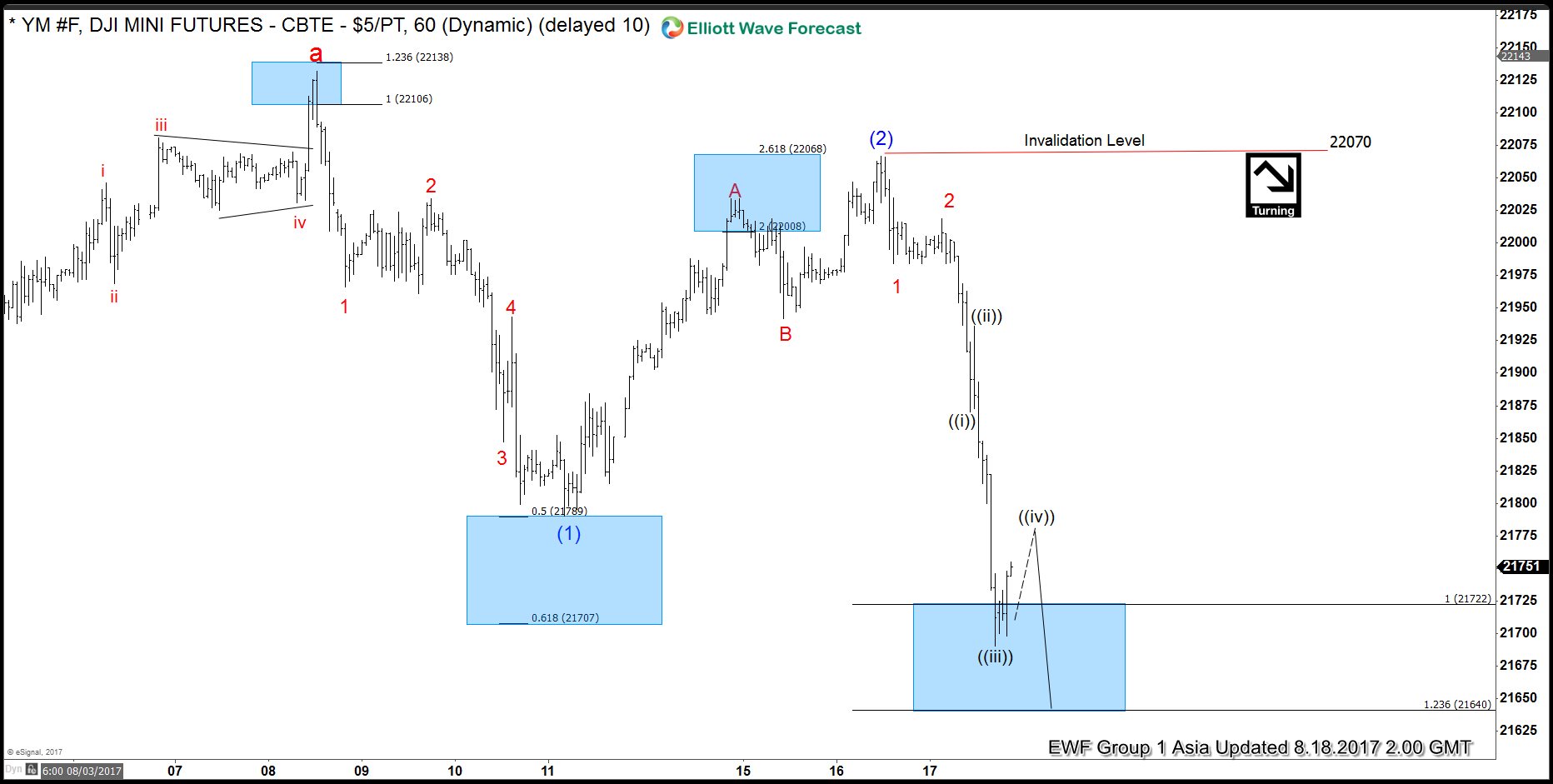

Dow Futures Elliott Wave view 8.18.2017

Read MoreShort term Dow Futures (YM_F) Elliott wave view suggest that the rally to 8/08 peak 22177 ended the “Cycle” from Feb 11, 2016 low. The decline from there is unfolding as an impulse suggesting the index could be following a Elliott Wave Zigzag pattern in larger degree correction. From there Intermediate wave (1) ended at 21789 in […]

-

USDX Elliott wave view: Double three

Read MoreShort term USDX index Elliott Wave view suggests that the decline to 8/02 (92.54) low ended intermediate wave (3) then the rally from there is unfolding as a a double three Elliott wave structure. As the structure from the 8/02 looks to be overlapping, hence suggesting it’s corrective structure, either W,X,Y or W,X,Y,Z. Where the first leg higher […]

-

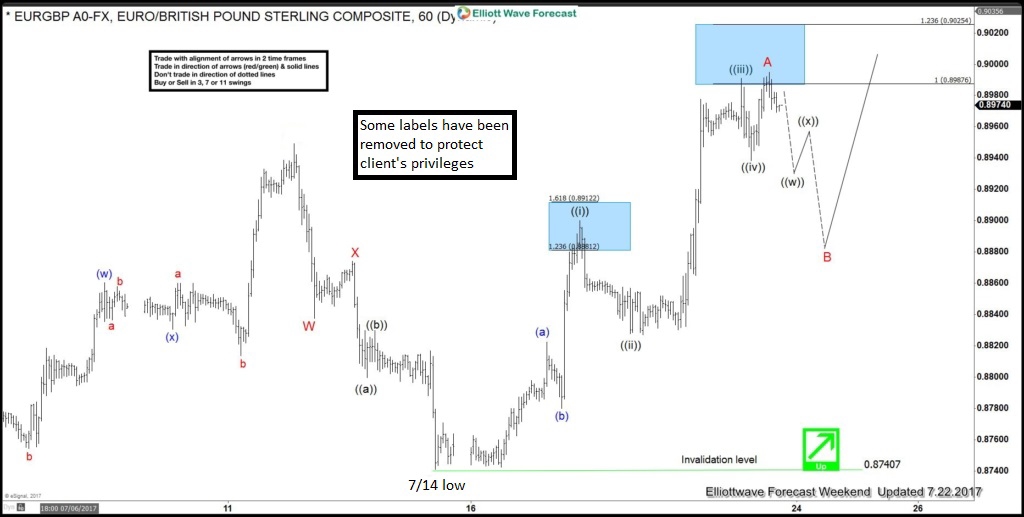

EURGBP Elliott wave view: Zigzag structure

Read MoreIn this Technical blog we are going to take a quick look at the past 1 hour Elliott Wave performance of EURGBP cycle from July 14 low, which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure from that cycle. EURGBP 1 Hour Elliott Wave Chart In this Technical blog, we are going to […]

-

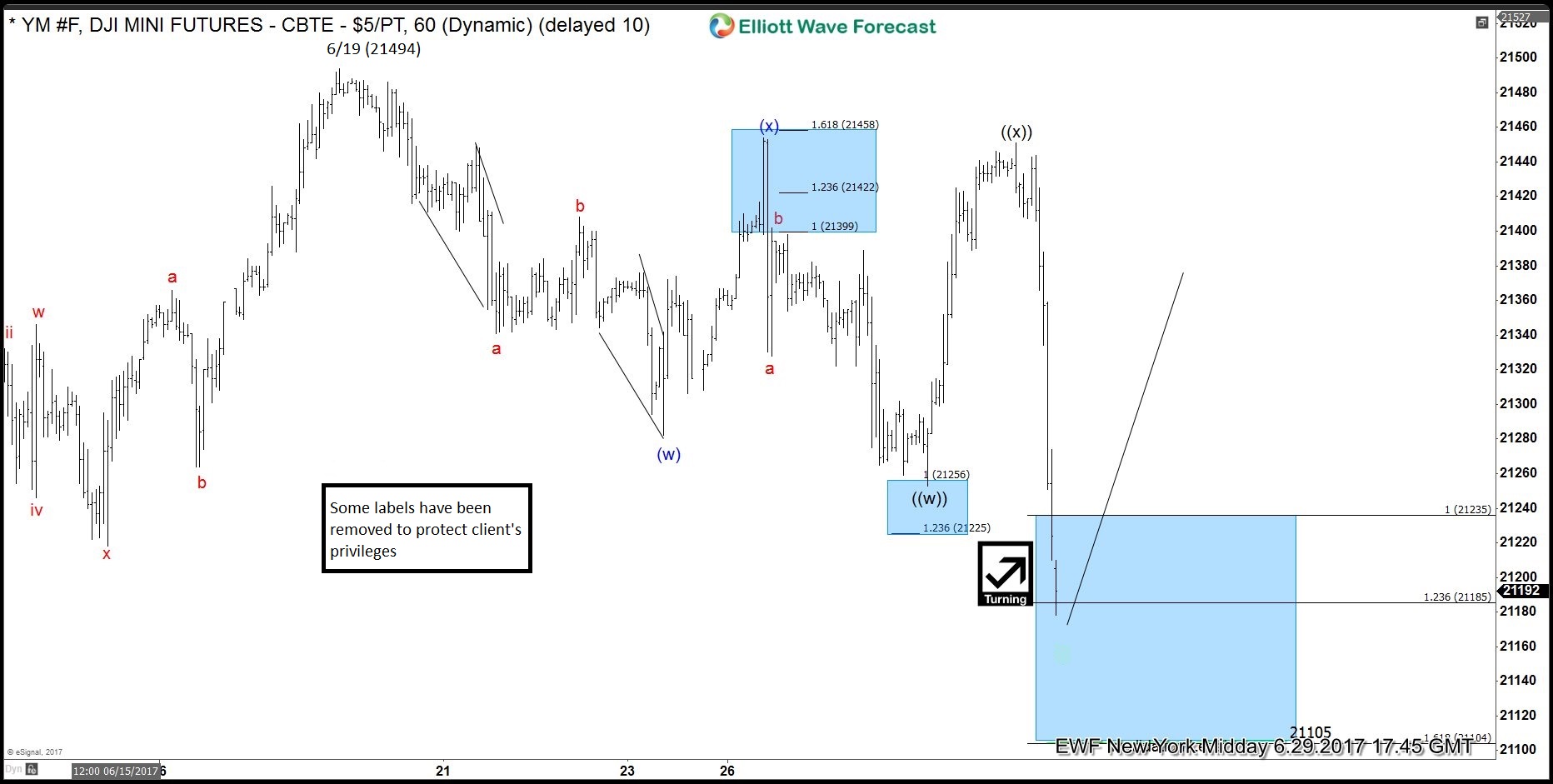

Dow E-mini Future Elliott wave calling upside

Read MoreIn this Technical blog we are going to take a quick look at the past 1 hour Elliott Wave performance of Dow E-Mini Future (YM_F ) cycle from June 19 peak, which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure from that cycle. Dow E-mini Future 1 Hour Elliott Wave Chart from June 29 […]

-

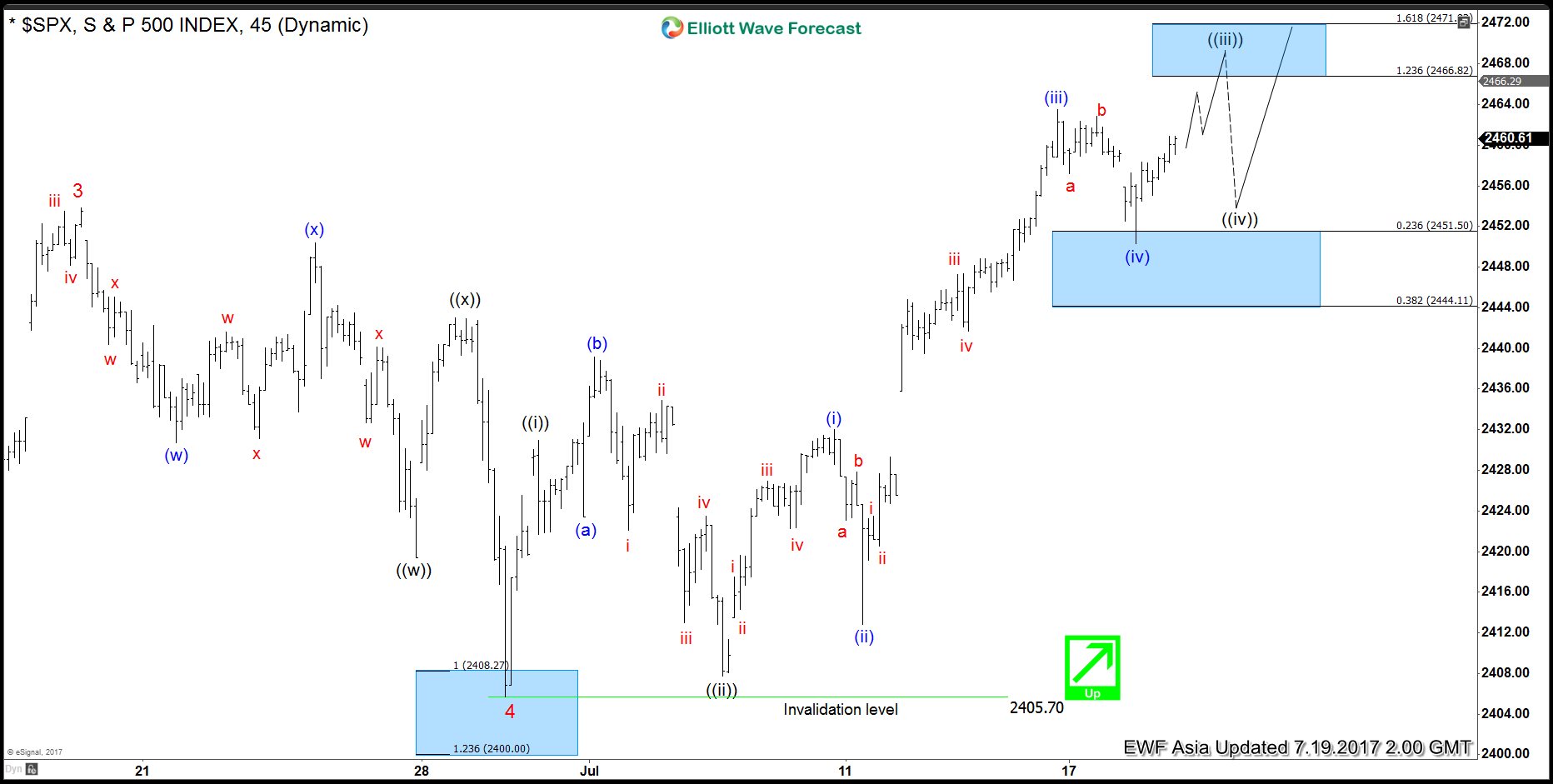

SPX Elliott wave view: Showing impulse

Read MoreShort term SPX Elliott Wave view suggests the rally from 5/18 low (2352.7) to 6/19 peak (2453.8) ended Minor wave 3. The pullback from 2453.8 to 2405.70 on 6/29 low ended Minor wave 4. Up from there, the rally is unfolding as an impulse Elliott Wave structure with extension. This 5 waves move could be Minute wave ((a)) of […]