-

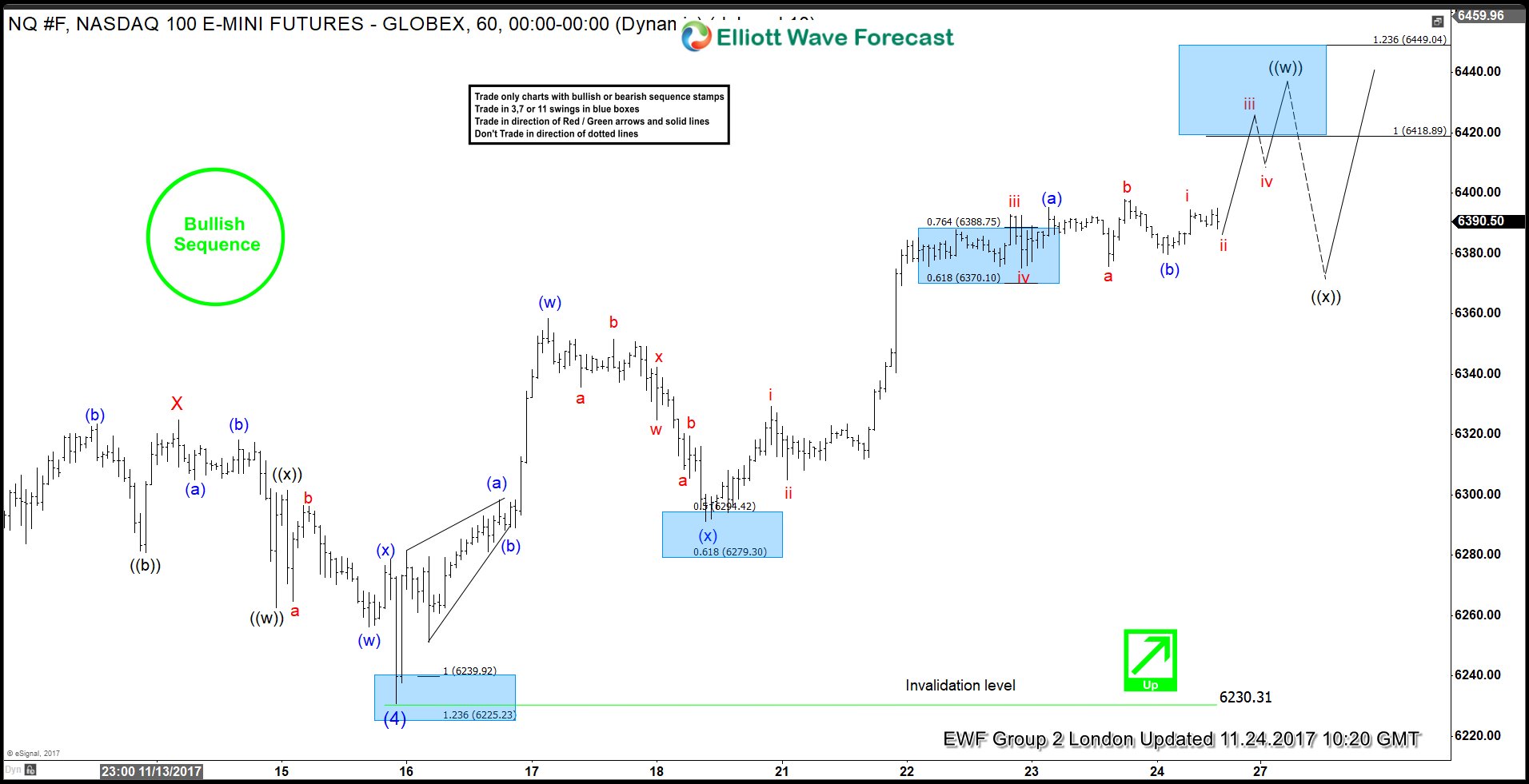

NASDAQ Elliott Wave view: 11.24.2017

Read MoreNASDAQ Short term Elliott Wave view suggests that the decline to 6230.31 on November 15 ended the intermediate wave (4) dip. A rally from there is unfolding as a double three Elliott wave structure and the index is already into new highs suggesting that next extension higher has started. As the structure of the 11/15 low 6230.31 low looks to be overlapping, […]

-

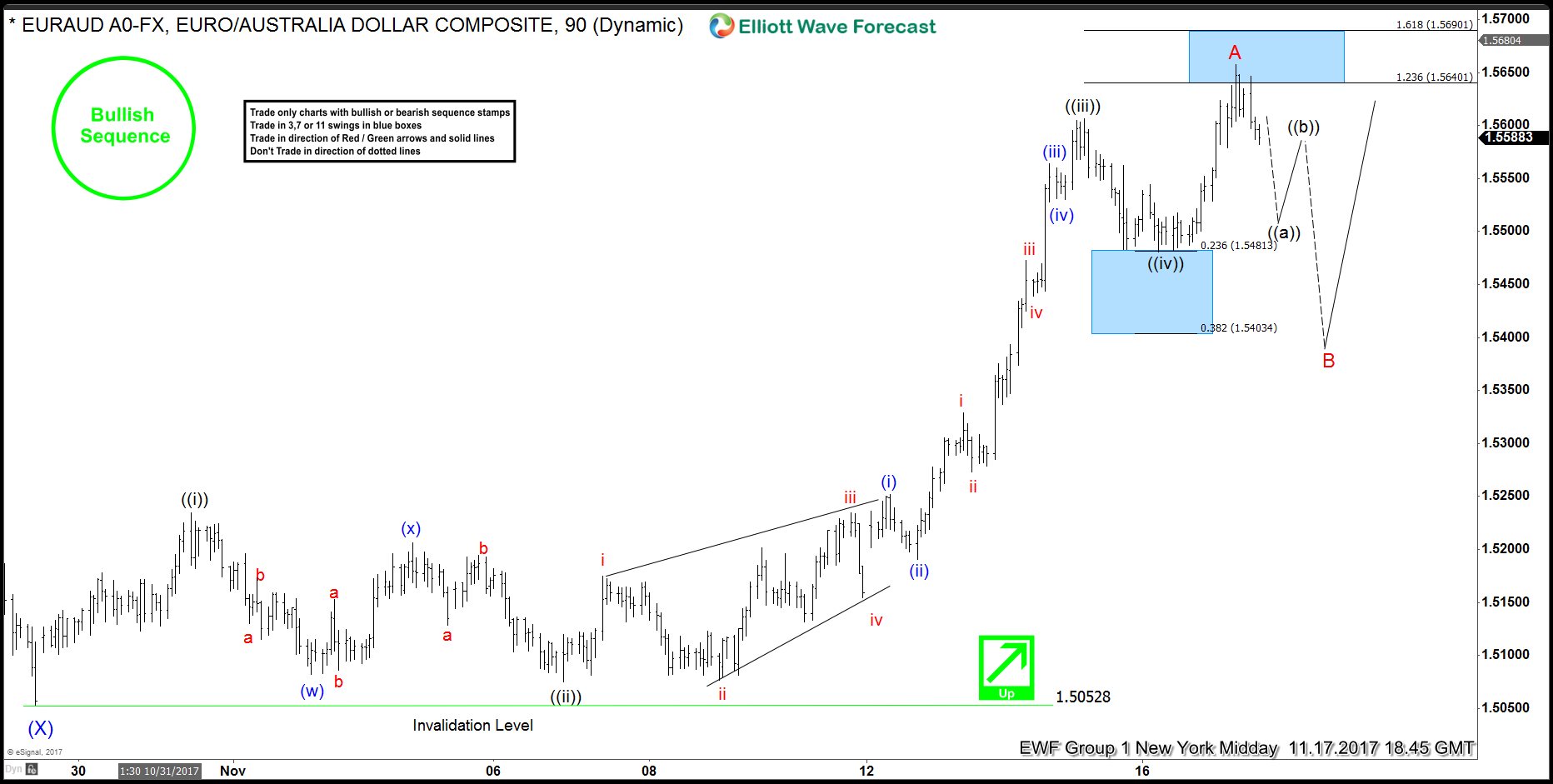

EURAUD Showing 5 Waves Impulse

Read MoreEURAUD Short term Elliott Wave view suggests that the decline to 10/27 low 1.5052 ended intermediate (X). A rally from there is unfolding as an impulse Elliott Wave structure with extension and showing bullish sequence in the pair. This 5 waves move should end Minor wave A of an Elliott wave zigzag structure. In which case, after 5 waves move ends, […]

-

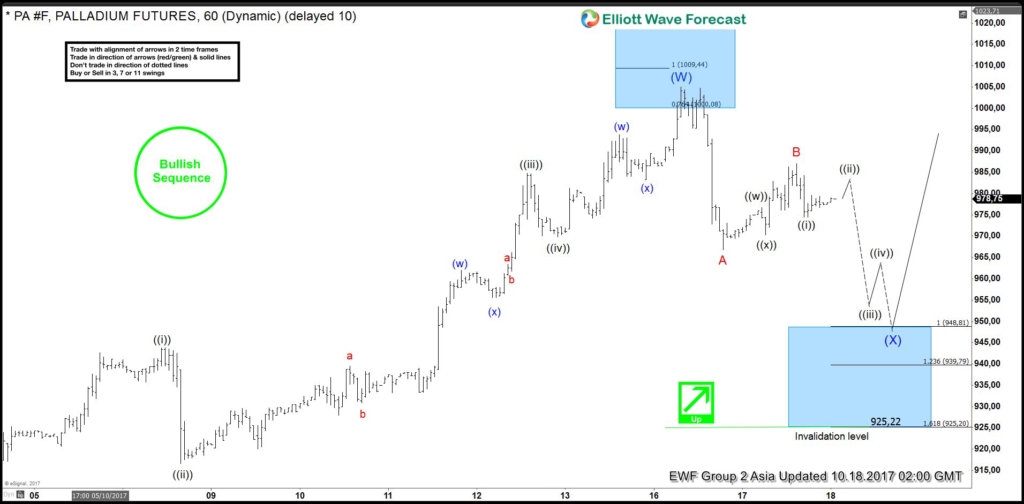

Palladium Buying the Elliott Wave dips

Read MoreIn this Technical blog, we are going to take a quick look at the past 1 hour Elliott Wave performance of Palladium. Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure from 10/16 (1005.21) cycle below. Palladium 1 Hour October 18 Asia updated Elliott Wave Chart A rally from 9/20 low (898.27) to 10/16 peak […]

-

AAPL Forecasting the Elliott Wave path

Read MoreIn this Technical blog, we are going to take a quick look at the past 1 hour Elliott Wave performance of AAPL stock. Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure from 6/29 low (141.70) cycle below. AAPL 1 Hour Elliott Wave Chart 8.1.2017 The cycle from 141.70 showed the 5 waves structure suggested […]

-

Gold Elliott wave view: Double three

Read MoreShort term Gold Elliott Wave view suggests that the rally from 10/06 low (1260.52) to 10/16 peak (1306.35) ended intermediate wave (X) then the decline from there is unfolding as a a double three Elliott wave structure. As the structure of the 10/16 peak looks to be overlapping, hence suggesting its corrective structure, either W, X, Y or W, […]

-

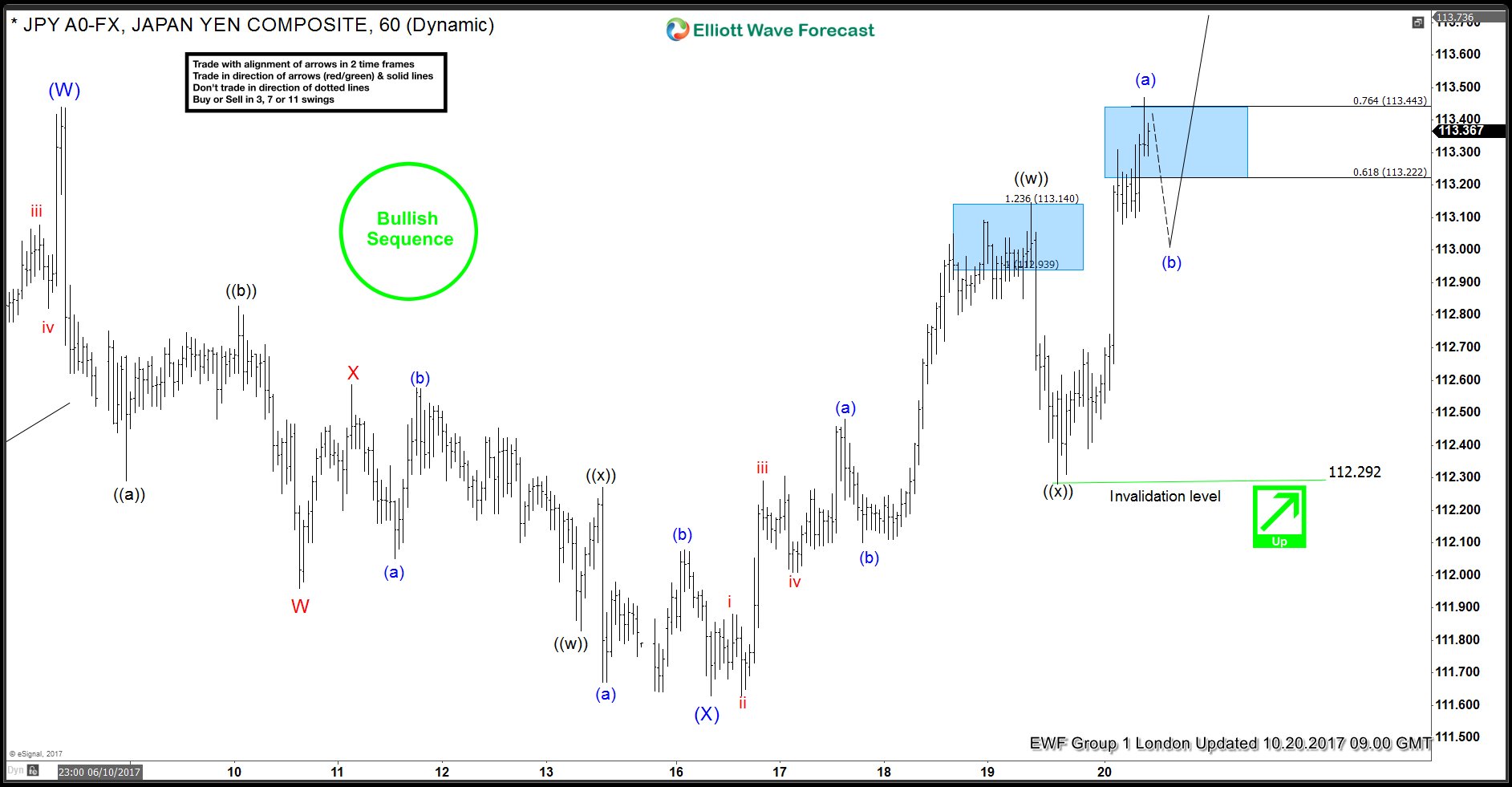

USDJPY Elliott Wave View 10.20.2017

Read MoreUSDJPY Short term Elliott Wave view suggest that the decline to 111.61 ended intermediate wave (X) on October 16 low. Up from there intermediate wave (Y) is in progress as a double three Elliott wave Structure and pair has managed to break the 10/06 peak (113.43) suggesting that next extension higher has started. The cycle from […]