-

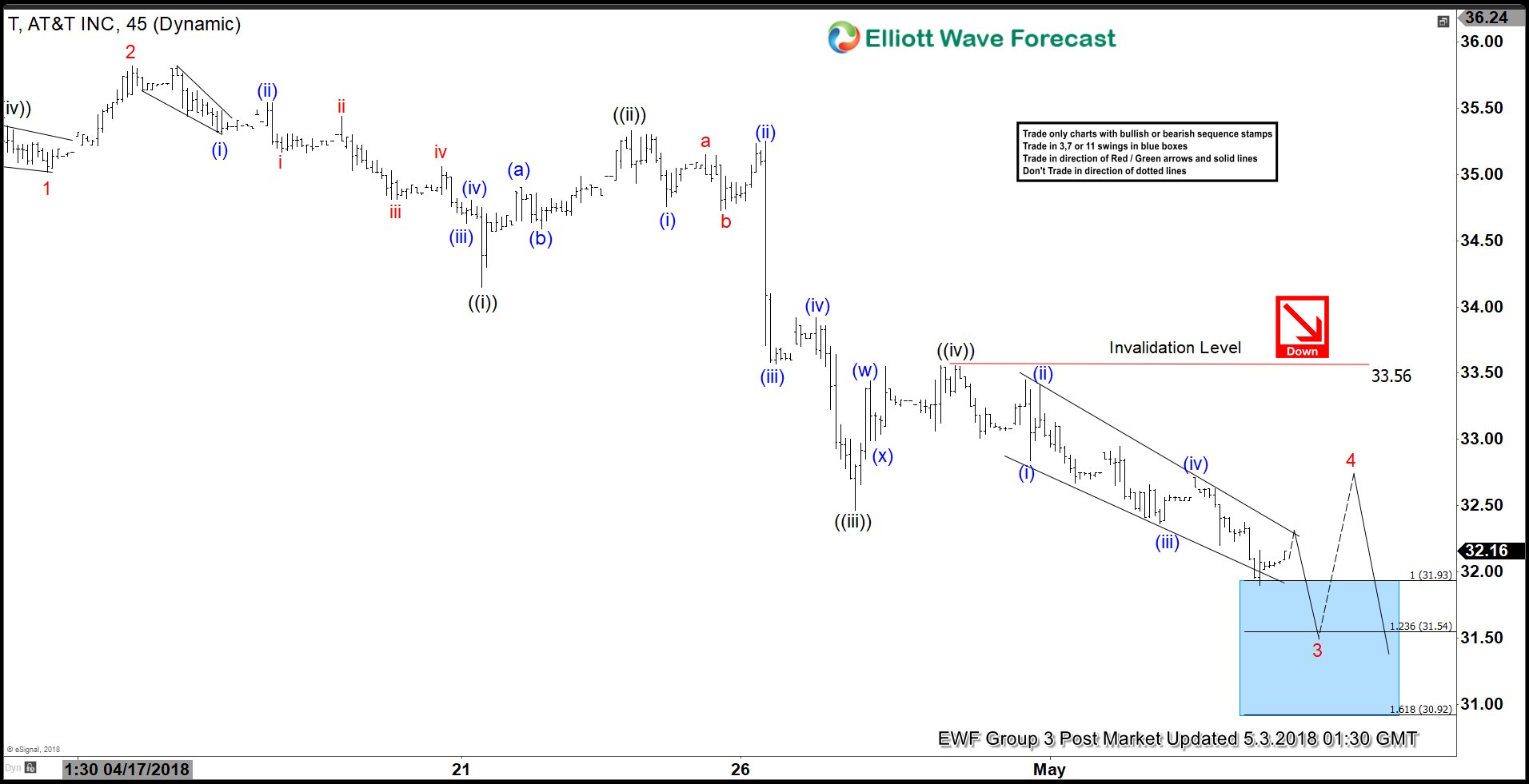

AT&T Elliott Wave View: Calling For 3 Wave Bounce

Read MoreAT&T ticker symbol $T short-term Elliott Wave view suggests that the decline from 4/10 peak is unfolding as an Impulse Elliott Wave structure. In the impulsive structure, wave 1, 3, and 5 should show 5 waves internal subdivision. Down from 4/10 peak ($36.39), Minor wave 1 ended in 5 waves structure at 35.02 low. Minor wave […]

-

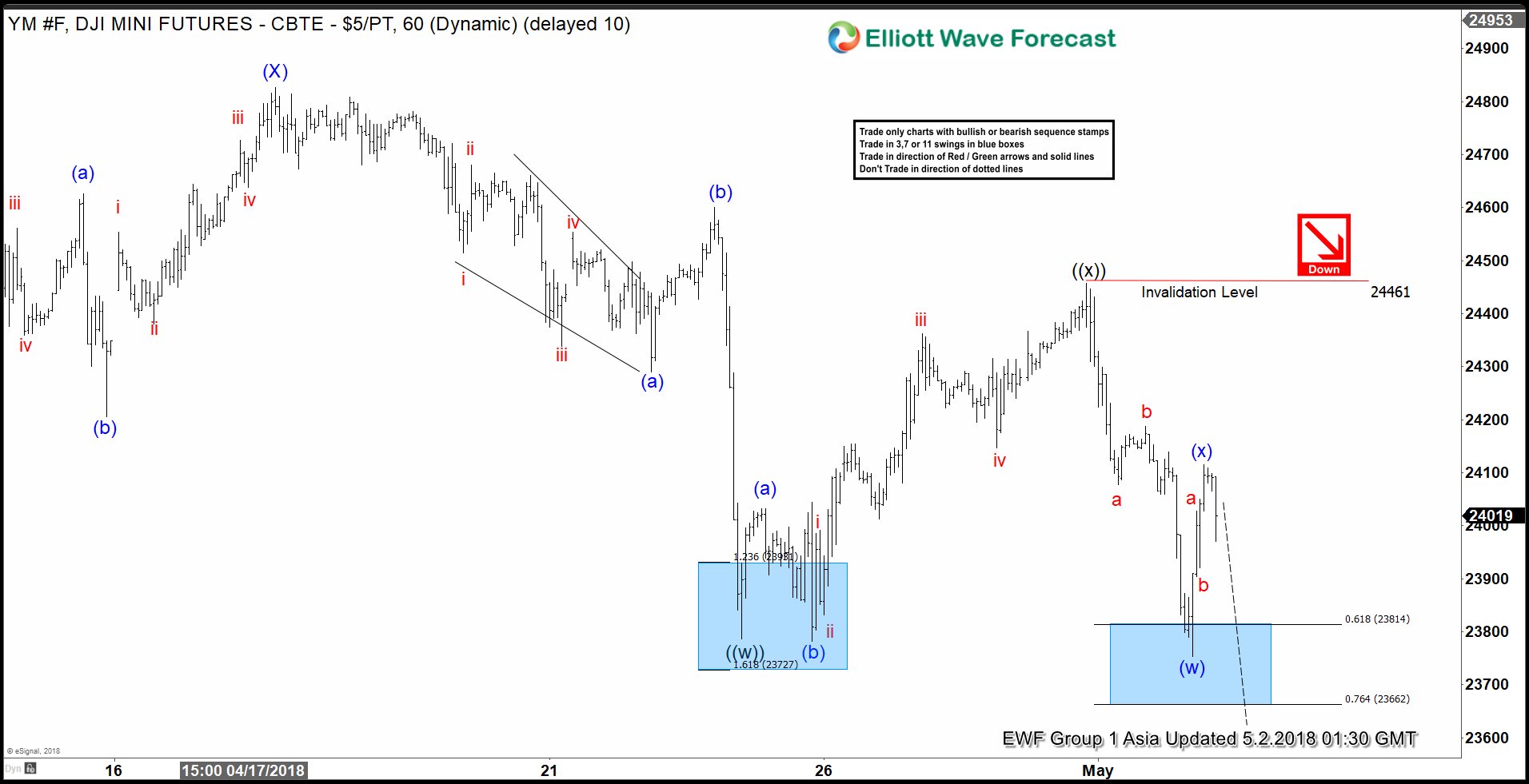

Dow Jones Elliott Wave View: Calling Lower

Read MoreDow Jones Elliott Wave view in short-term cycles suggests that the rally to 24827 on 4/17/2018 high ended Intermediate wave (X). Below from there, Intermediate wave (Y) remains in progress as overlapping structure suggesting that the move lower is corrective in nature. The move lower from 24827 peak is proposed to be unfolding as an Elliott […]

-

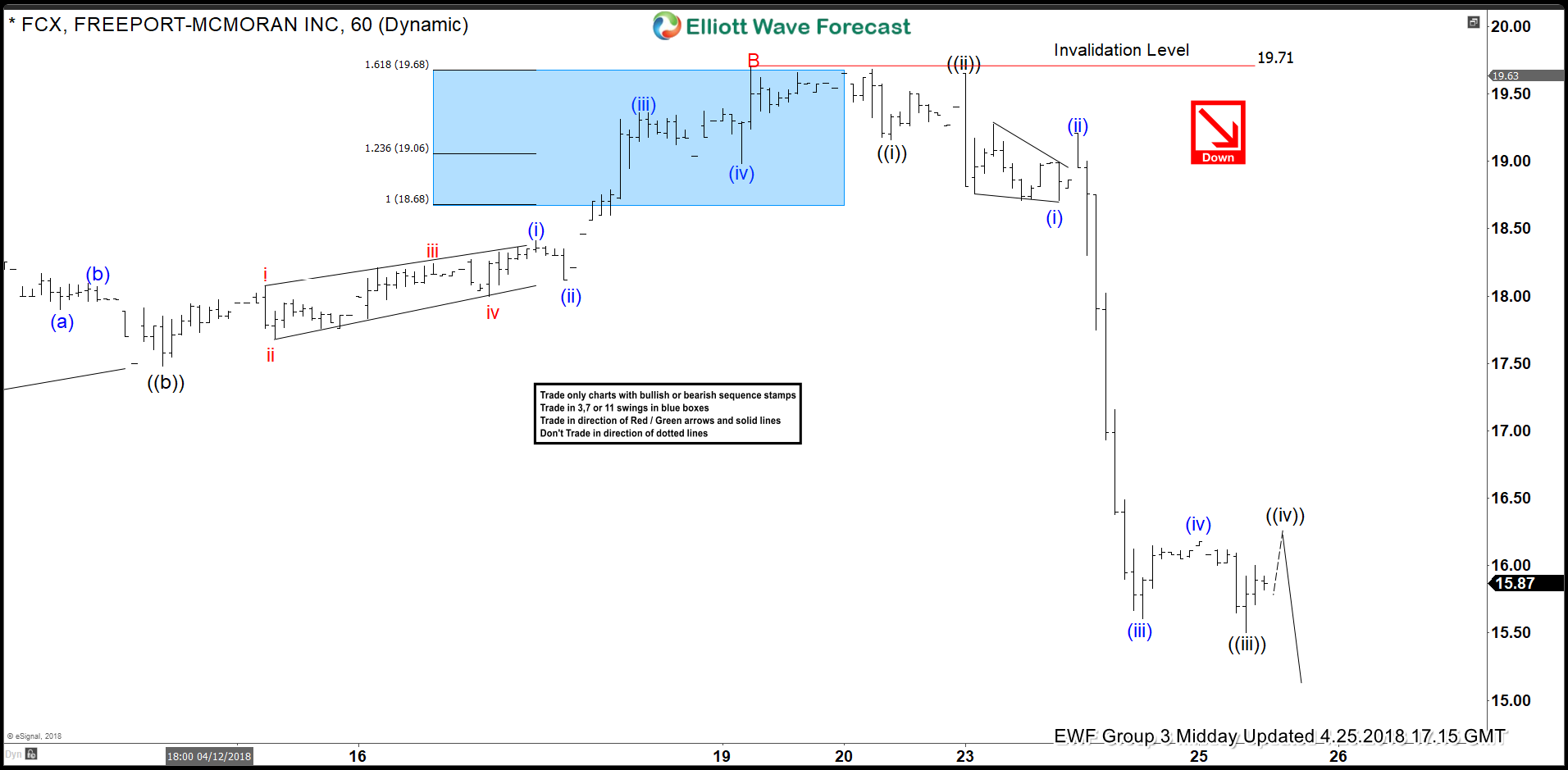

FCX Elliott Wave View: Extending Lower As Impulse

Read MoreFCX Elliott Wave view in short-term cycles suggest that the cycle from January 25th, 2018 peak is unfolding as Elliott wave flat correction. When Minor wave A ended in 3 swings at 16.51 and bounce to 19.71 April 19 high ended Minor wave B. Below from there, the stock reacted lower strongly and made new lows […]

-

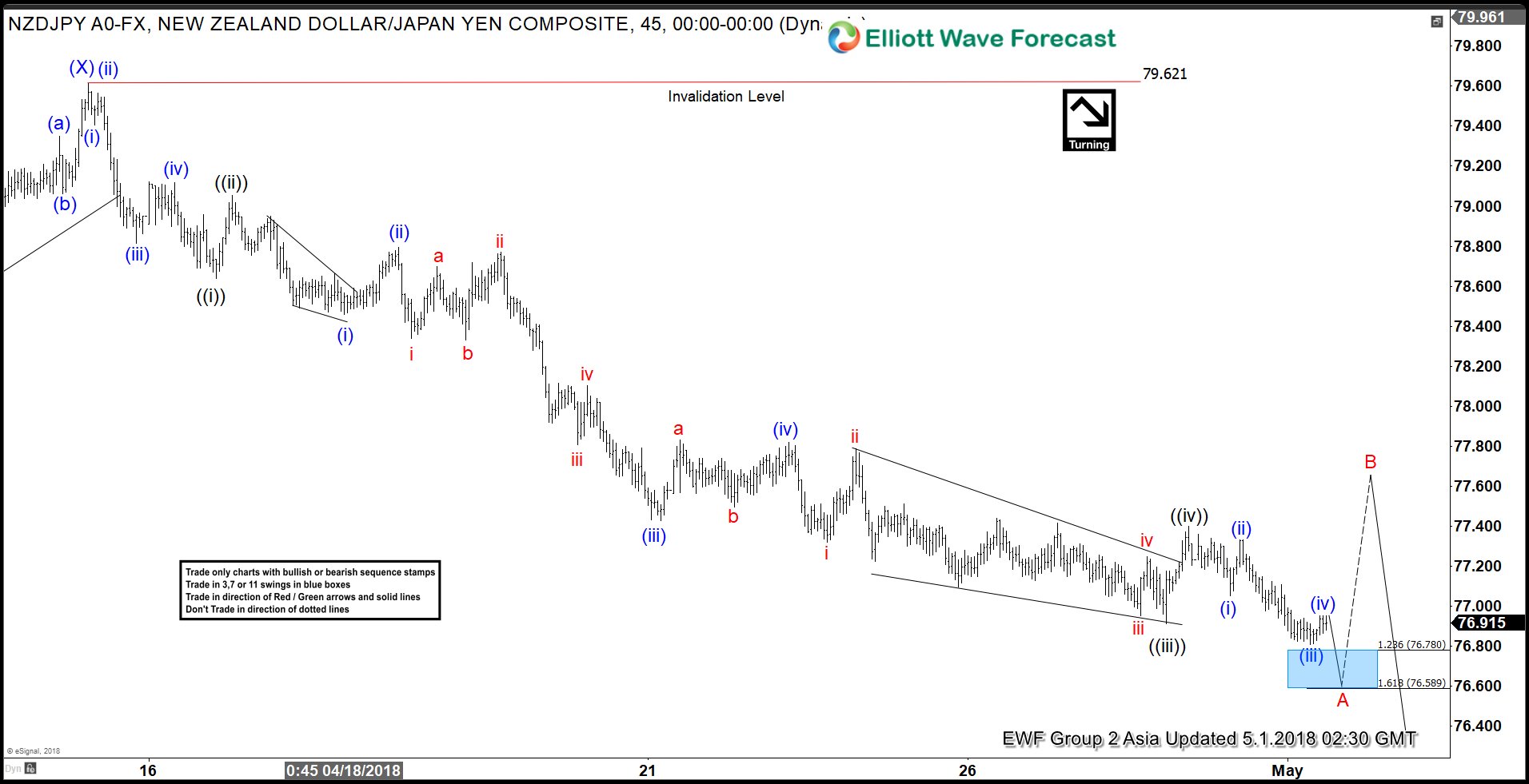

NZDJPY Elliott Wave View: Impulse Sequence In Progress

Read MoreNZDJPY Elliott Wave view in short-term cycles suggests that the bounce to 79.62 high ended Intermediate wave (X). Down from there, Intermediate wave (Y) remains in progress as a Zigzag Elliott Wave structure in which the first leg of the zigzag (Minor wave A) is unfolding as an impulse Elliott Wave structure looking to see another push lower before […]

-

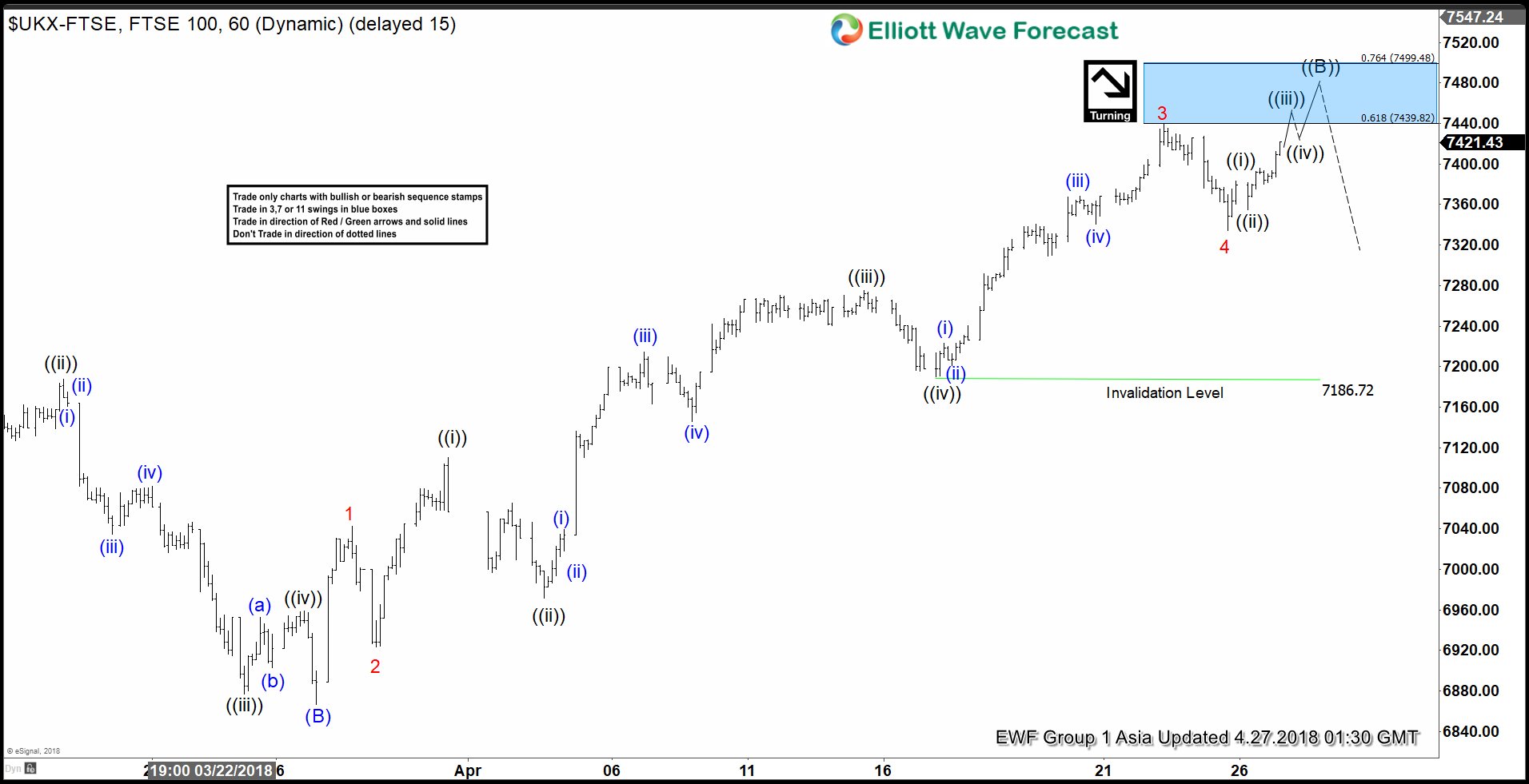

Does Elliott Wave View Suggest A Turn In FTSE Is Imminent?

Read MoreShort-term Elliott Wave view in FTSE suggest that the decline to 3/26/2018 low 6866.94 ended intermediate wave (B). Above from there, Intermediate wave (C) of ((B)) remains in progress with a strong rally to the upside unfolding as Impulse Elliott Wave structure. The internal distribution of each wave within the rally is unfolding as 5 waves […]

-

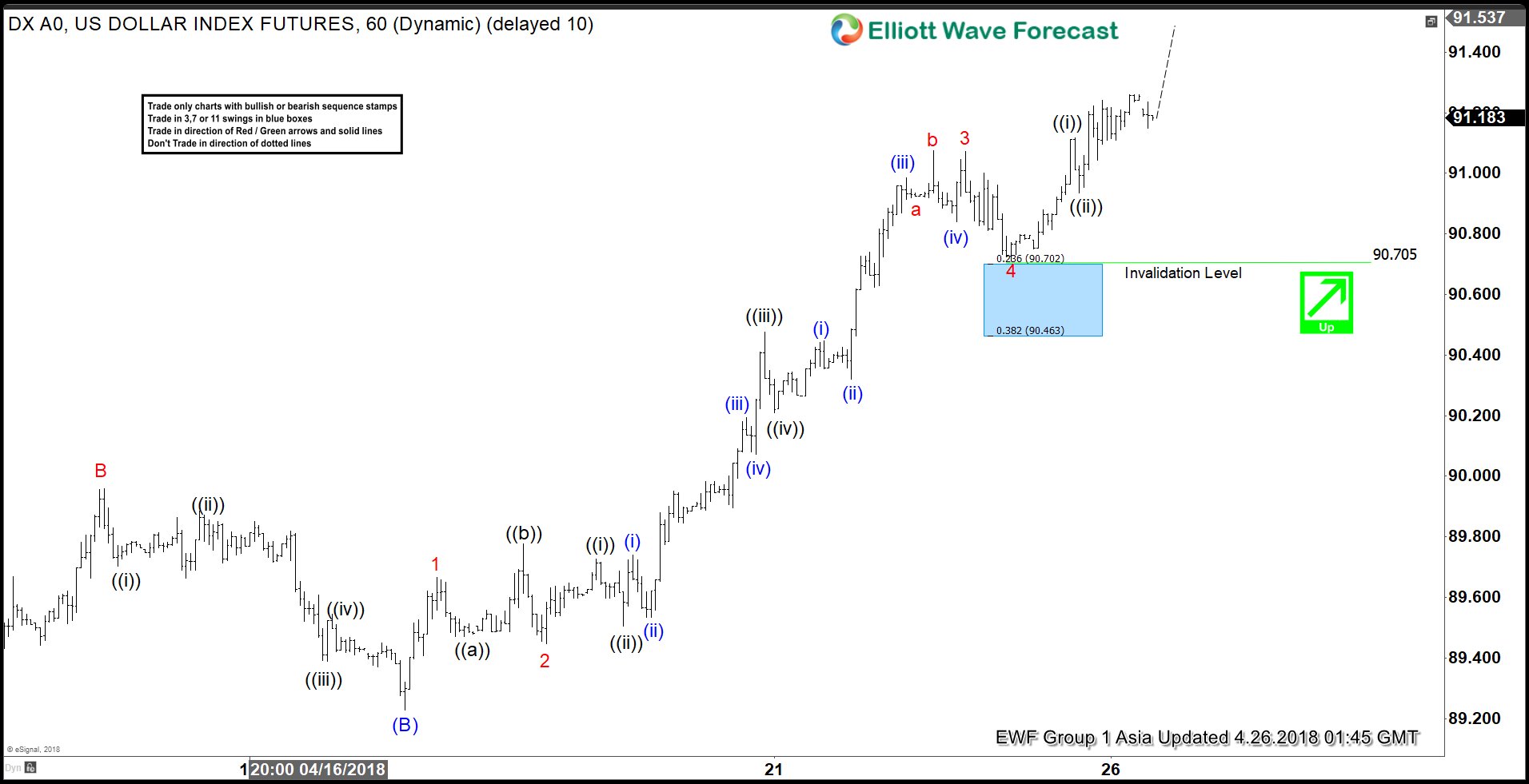

Elliott Wave Analysis: USDX Calling For More Upside

Read MoreUSDX Elliott Wave view in short-term cycle suggests that the decline to 89.22 low on 4.17.2018 ended as a Zigzag correction in Intermediate wave (B). Above from there, the rally is unfolding as 5 waves Impulse Elliottwave structure looking to extend higher 1 more leg in Minor wave 5 at least before ending the 5 waves structure. Above […]