-

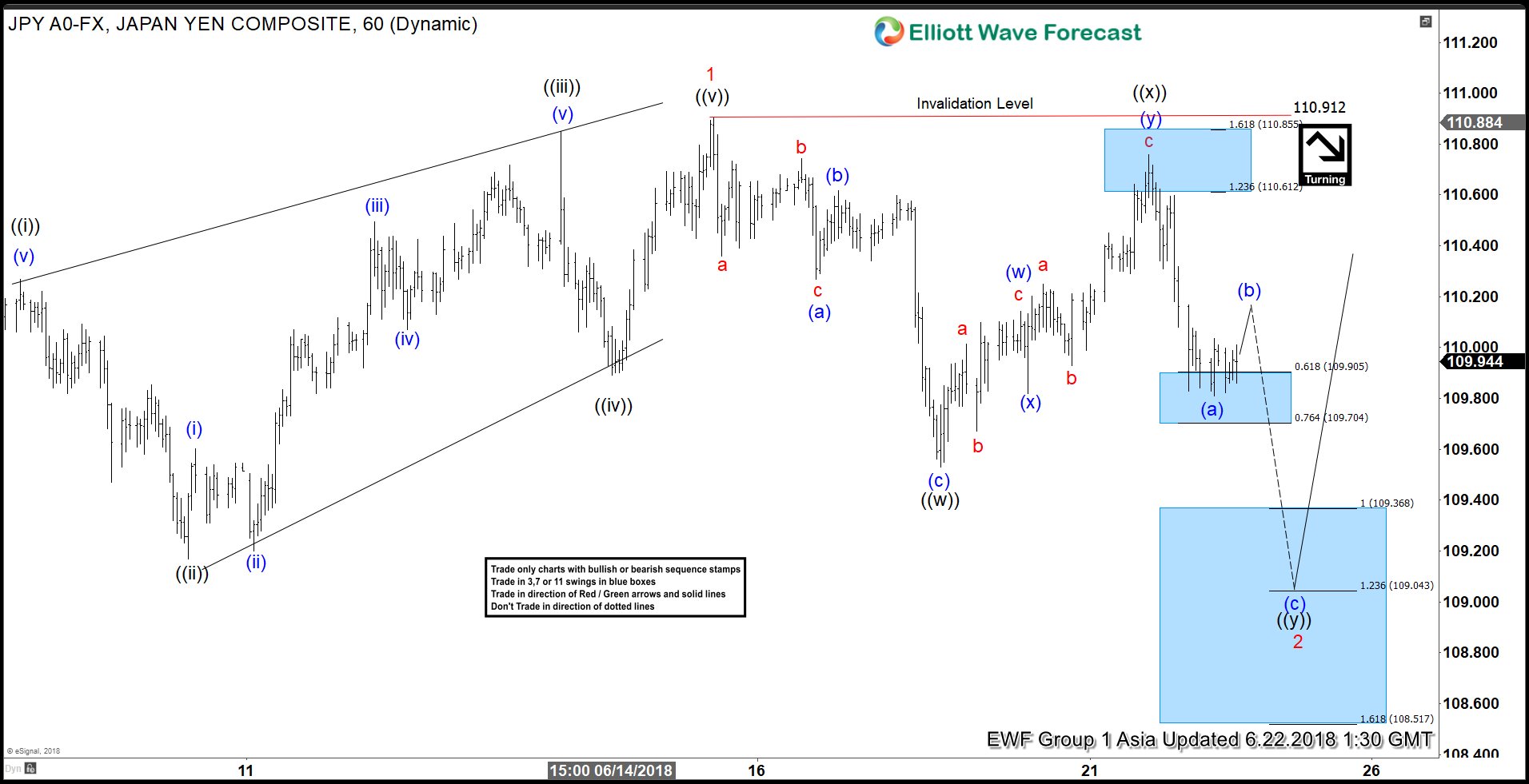

Elliott Wave View: USDJPY Support Around The Corner?

Read MoreUSDJPY short-term Elliott wave view suggests that the rally to 110.91 high ended Minor wave 1 & also the cycle from 5/29 low. The internals of that rally higher unfolded as Elliott wave leading diagonal where Minute wave ((i)) ended at 110.27 high in 5 waves, Minute wave ((ii)) pullback ended at 109.17, and Minute wave […]

-

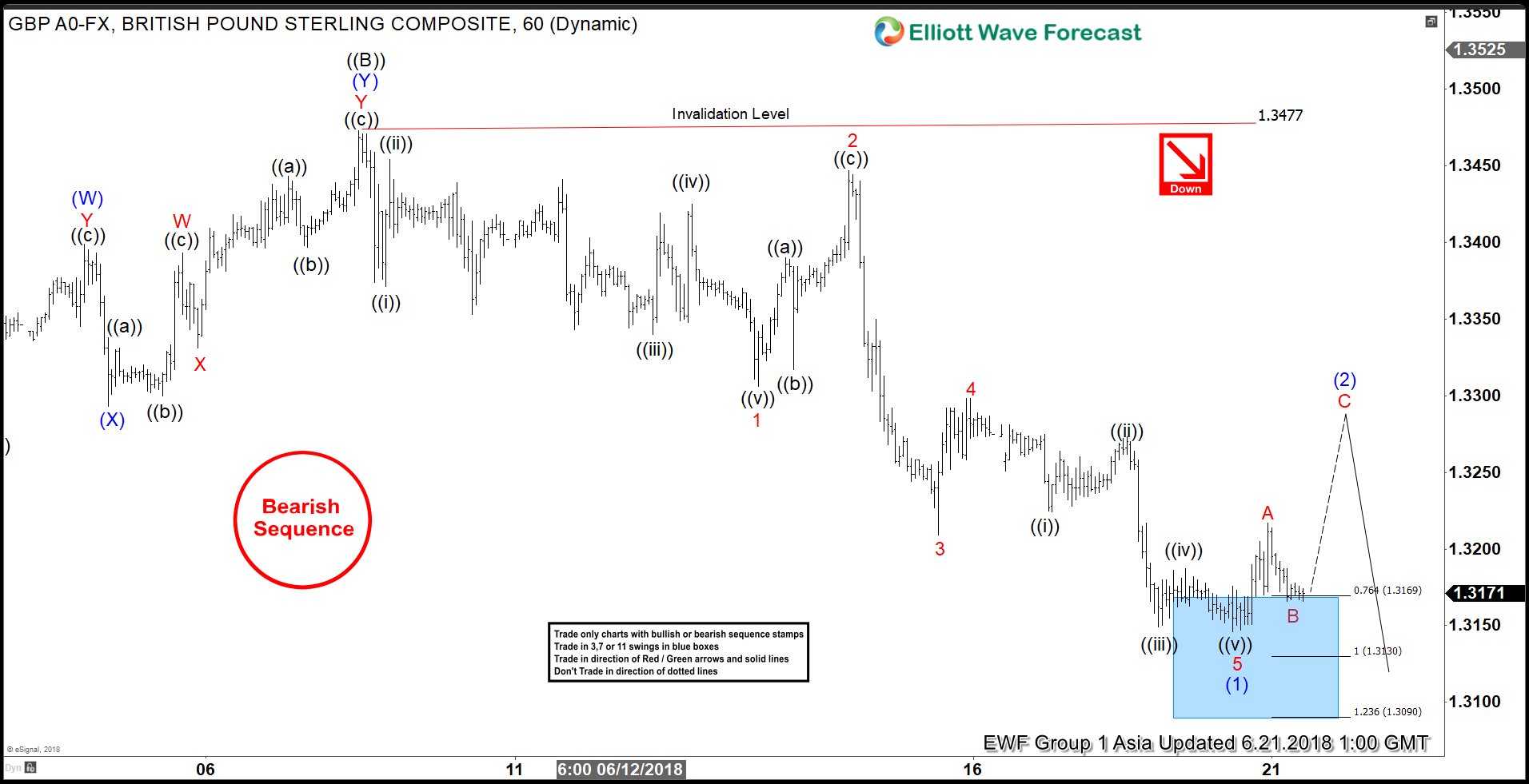

Elliott Wave Analysis: GBPUSD Showing Incomplete Sequence

Read MoreGBPUSD short-term Elliott Wave view suggests that the recovery to 1.3473 on 6/07/2018 peak ended primary wave ((B)) bounce as double three structure. Below from there, the pair has managed to break below the previous low on 5/29 (1.3203) to confirm the next extension lower in primary wave ((C)) has started. With this break lower, […]

-

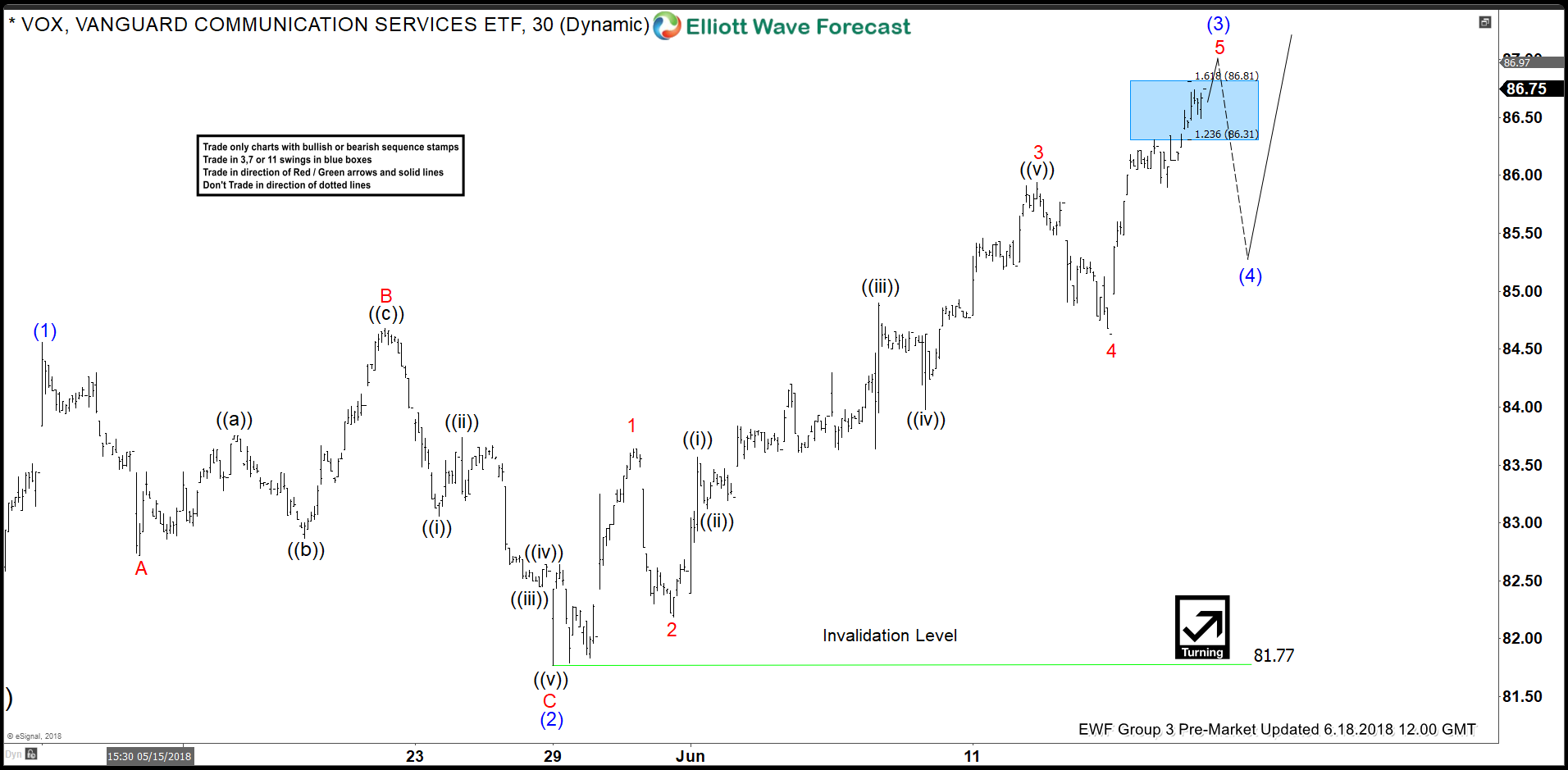

VOX Elliott Wave View: Extending Higher As Impulse

Read MoreVanguard communication services ticker symbol: VOX short-term Elliott Wave view suggests that the rally to 84.50 on 5/11 peak ended intermediate wave (1) as an impulse. Down from there, the pullback to 81.78 on 5/29 low ended intermediate wave (2) pullback as expanded Flat. The internals of a Flat correction ended Minor wave A at […]

-

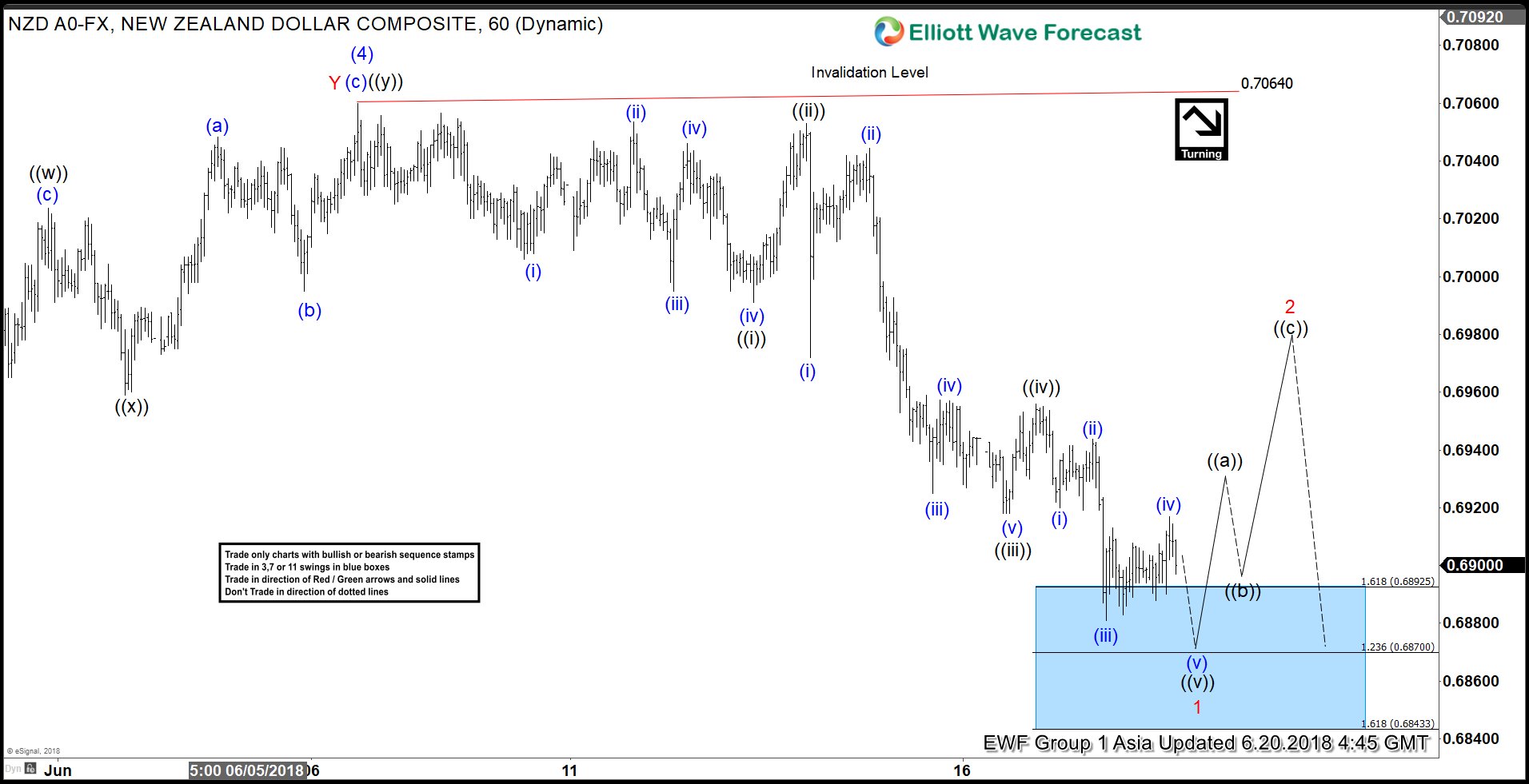

NZDUSD Elliott Wave Analysis: Ready For Recovery?

Read MoreNZDUSD short-term Elliott Wave view suggests that the bounce to 0.7060 high ended intermediate wave (4). Down from there, the decline is unfolding as Impulse Elliott Wave structure where sub-division of Minute wave ((i)), ((iii)) & ((v)) are unfolding in 5 waves within a lesser degree cycle. On the other hand, the corrective Minute degree wave ((ii)) & […]

-

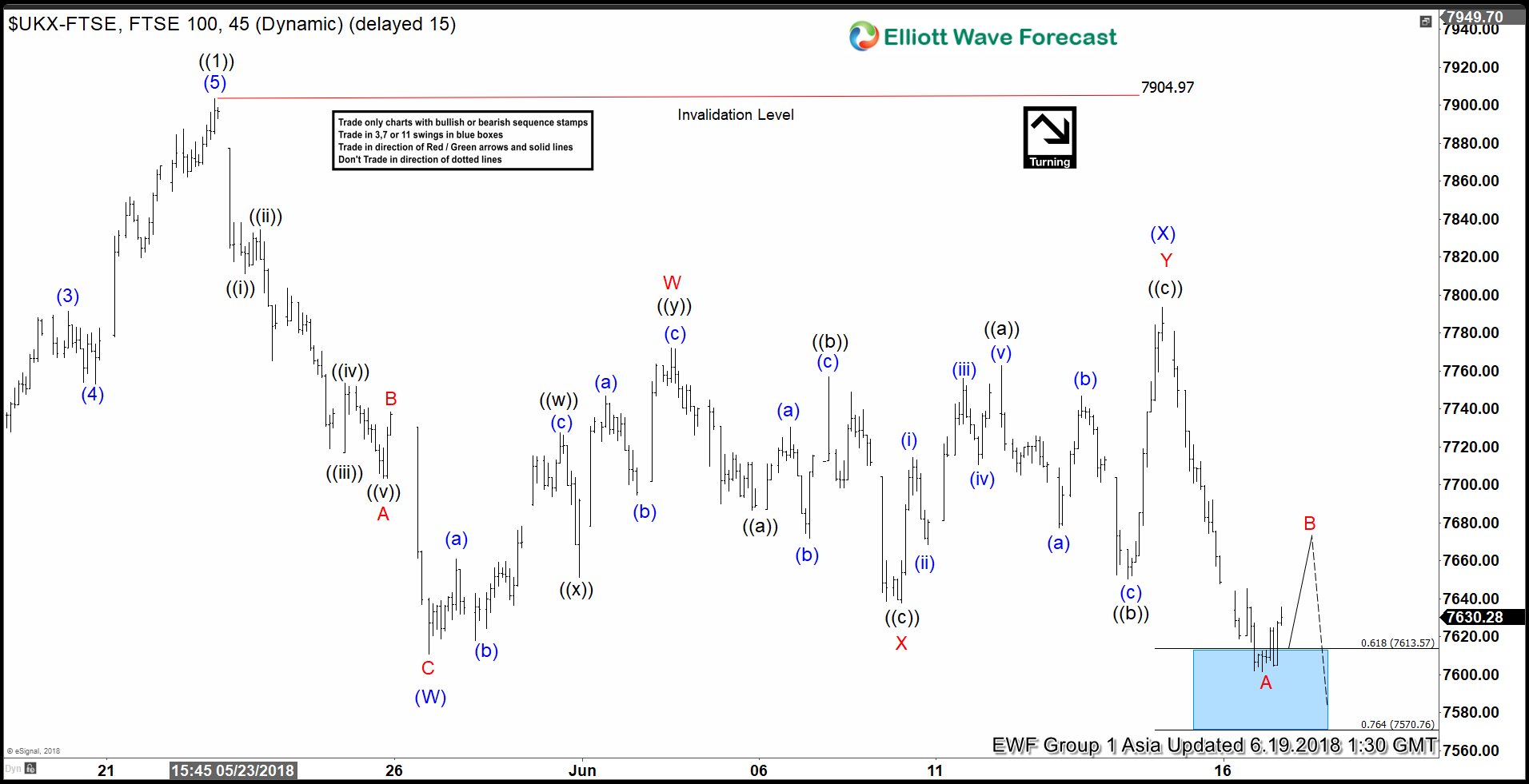

FTSE Elliott Wave View: Calling For Another Leg Lower

Read MoreFTSE short-term Elliott Wave view suggests that the bounce to 7904.97 high on 5/22/2018 peak ended primary wave ((1)). Below from there, the index is doing a pullback in Primary wave ((2)) in 3, 7 or 11 swings to correct cycle from 3/23/2018 low. Down from 7904.97 high, the decline to 7610.66 low ended the first leg […]

-

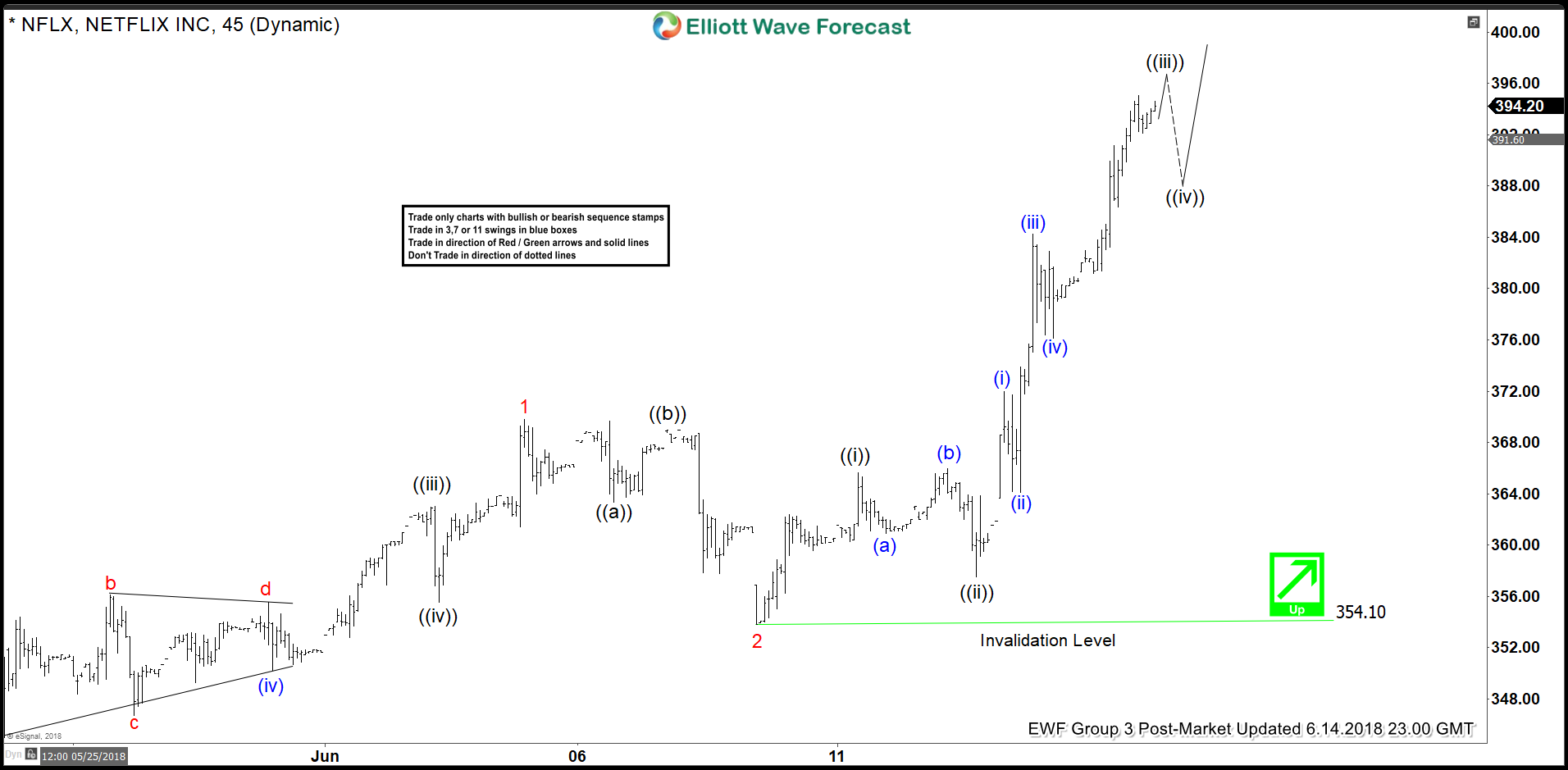

Netflix Elliott Wave View: More Strength is Expected

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave view suggests that the rally to $369.83 high on 6/05/2018 ended Minor wave 1. The internals of that rally unfolded as Elliott wave impulse structure with lesser degree 5 waves structure in Minute wave ((i)), ((iii)), and ((v)). Below from $369.83, the decline to $354.10 low on 6/08/2018 […]