-

CADJPY May See More Downside After BOC Cut Rates

Read MoreOn Friday, Bank of Canada (BOC) made another rate cut for the third time this month. The central bank lowered the interest rate by 50 basis points to 0.25%. This unscheduled rate cut is intended to provide support to the financial system and the economy during the COVID-19 pandemic. Prior to the cut, Canada has […]

-

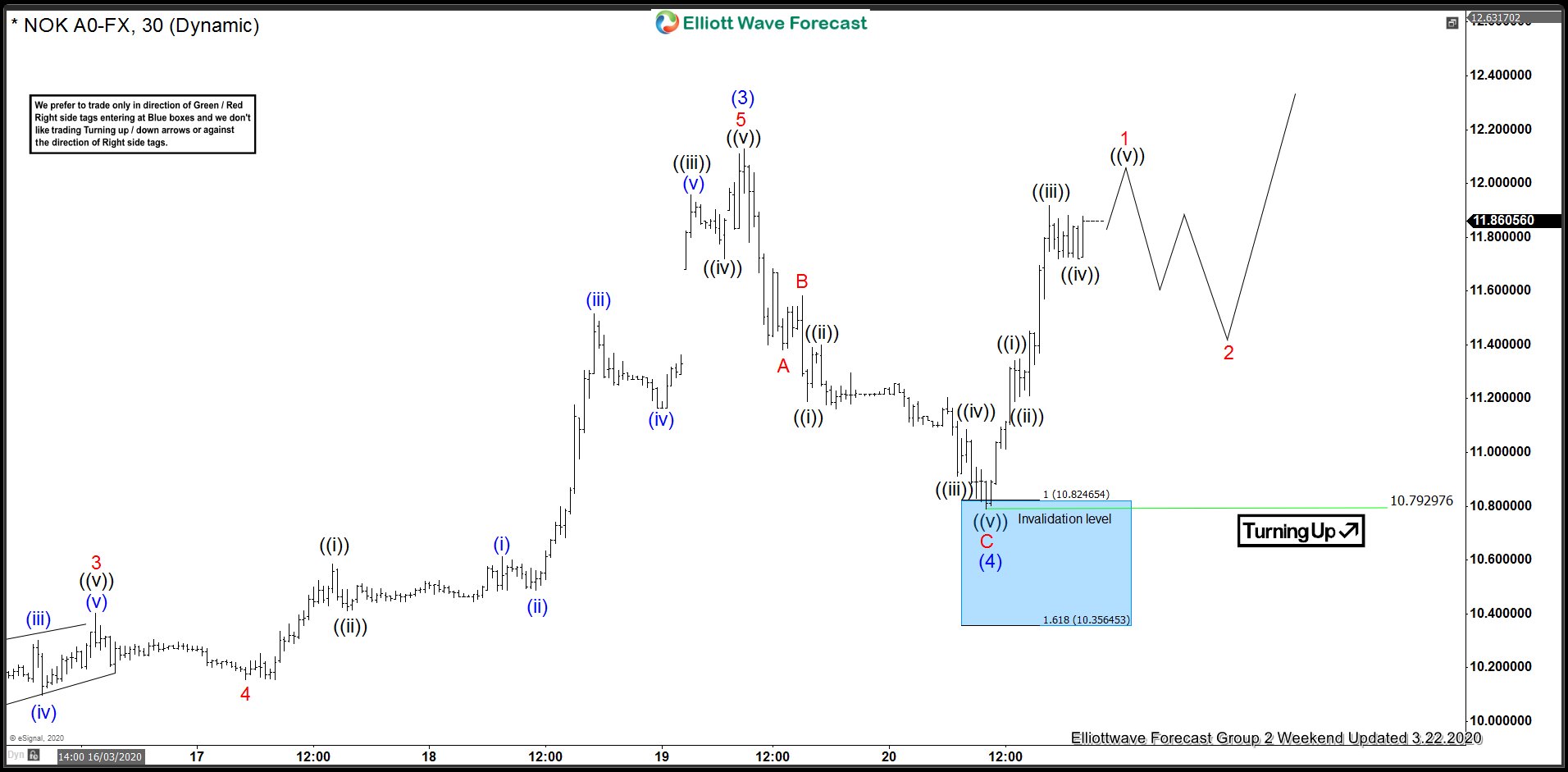

USDNOK Buyers Continue To Respect Blue Boxes

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of USDNOK. The chart from March 13 London update shows that the cycle from March 9, 2020 low unfolded as 5 waves impulsive structure. The rally in wave ((iii)) ended at 10.2785 high. Based on Elliottwave theory, a 3 waves pullback […]

-

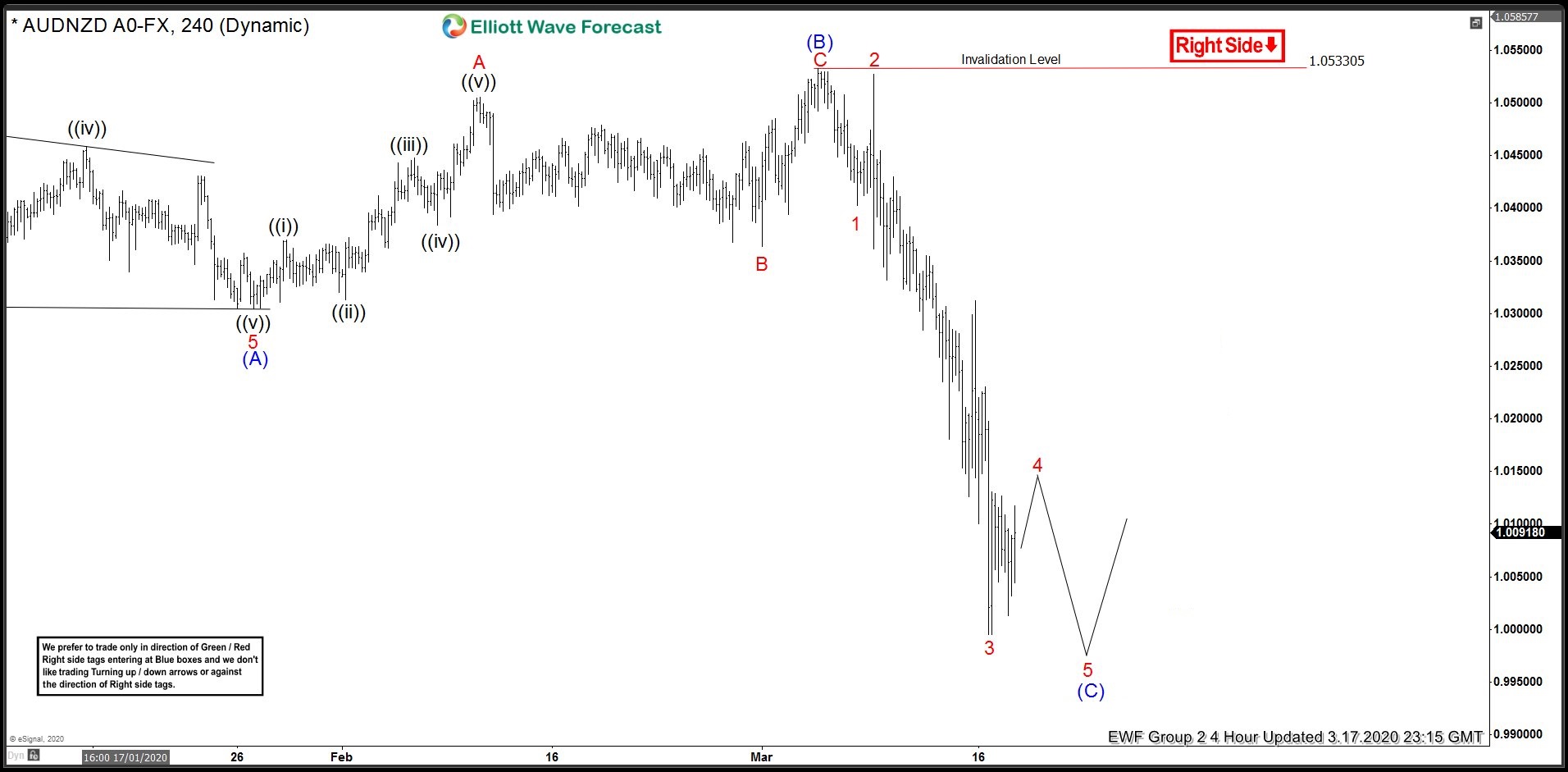

AUDNZD Forecasting The Path Lower

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of AUDNZD. The chart below from March 3 update shows that the cycle from November 8, 2019 high unfolded as 5 waves impulsive structure. The move down in wave (A) ended at 1.0304 low. Based on Elliottwave theory, a 3 waves […]

-

CAD And NOK Biggest Losers As Oil Price Crashed

Read MoreOil price crashed more than 30% and reached a low of $27 earlier this week. OPEC’s failure to agree on further production cuts and Saudi Arabia/Russia price war has driven crude oil to the low last seen in January 2016. Commodity currencies such as Canadian Dollar (CAD) and Norwegian Krone (NOK), which are oil-sensitive, were […]

-

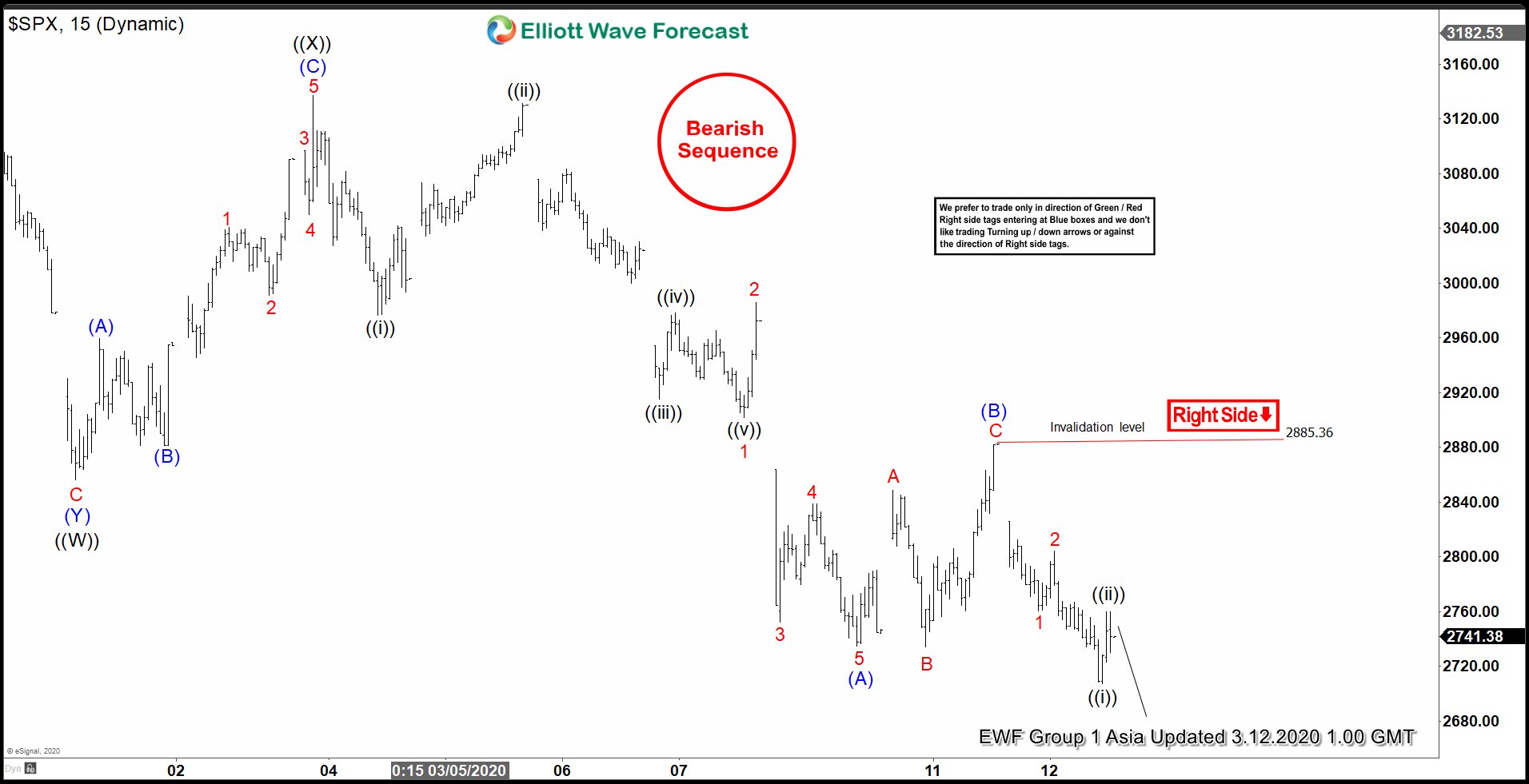

Elliott Wave View : S&P 500 (SPX) Reaching Inflection Area

Read MoreShort term Elliott Wave view in S&P 500 (SPX) suggests cycle from February 19, 2020 high is unfolding as a double three Elliott Wave structure. Down from February 19, 2020 high, wave ((W)) ended at 2855 low. The bounce in wave ((X)) ended at 3136 high. From there, the Index has extended lower and broken […]

-

NASDAQ (NQ_F) Incomplete Sequence Targeting Lower

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of NASDAQ. Based on the daily chart shown below, NASDAQ has ended the rally from 2009 low at 9760.61 high. The index is now correcting that cycle. The correction is unfolding as a double three and has an incomplete sequence. The […]