-

Allegiant Air Elliott Wave View: Near a Bounce

Read MoreAllegiant Air is an American low-cost airline that operates scheduled and charter flights owned by Allegiant Travel Company (NASDAQ: ALGT) . The Company offers low-cost passenger air travel to residents of small, under-served cities in the U.S. and last year is started flying to Newark Airport. On January, the airline announced 17 new routes that will begin service by […]

-

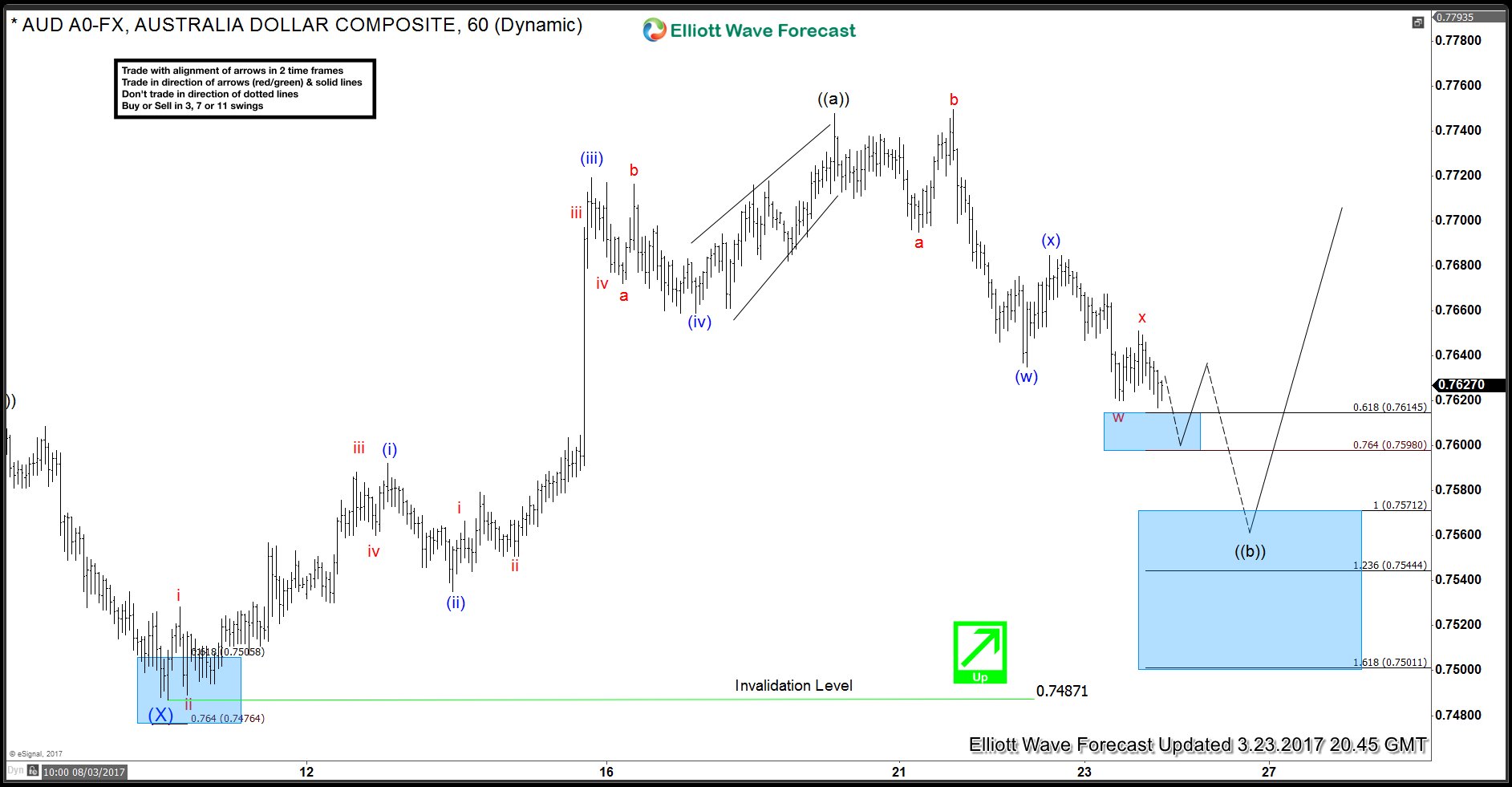

AUDUSD Elliott Wave View: Pullback in progress

Read MoreAUDUSD is showing 5 swings sequence from 12/23/2017 low after it managed to break above 02/23 peak so the sequence is bullish against Intermediate wave (X) low (0.7487). The pair did 5 waves impulsive move from 03/09 low in Minute wave ((a)) which ended at 03/23 peak (0.7749) and currently doing Minute wave ((b)) pullback that’s unfolding as a double three structure. […]

-

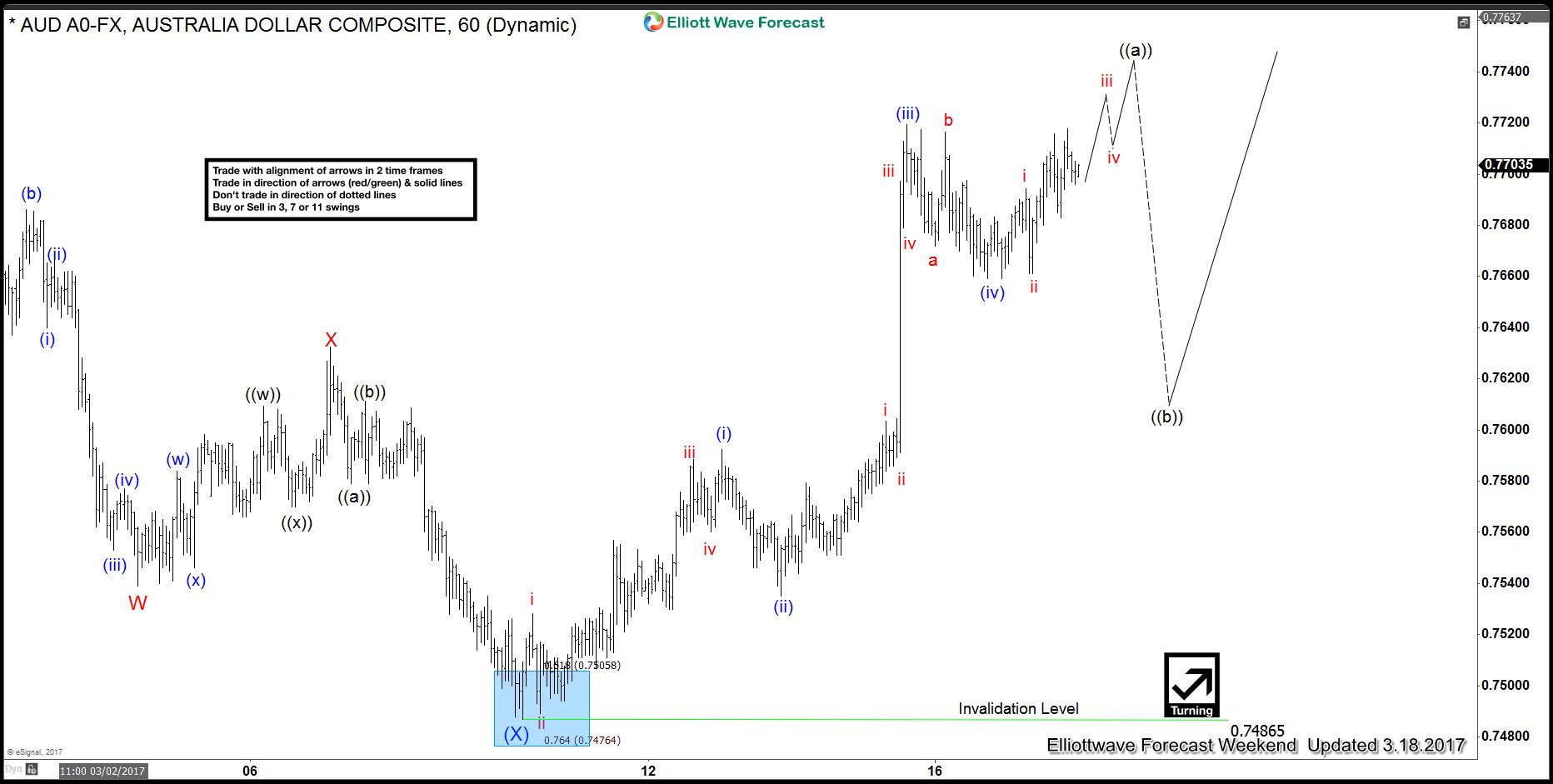

AUDUSD Elliott Wave View : 5 waves move

Read MoreAUDUSD ended the correction in Intermediate wave (X) after reaching 0.7486 and then started rallying from there. With today’s new high the pair is showing 5 waves impulsive move from 03/09/2017 low and has already reached the minimum target area for Minutte wave (v) to end. The minimum target for Minutte wave (v) can be calculated as the […]

-

Energy Stocks preparing a bounce

Read More2016 was a good year for Energy Stocks as Oil & GAS price rose significantly helping the Energy sector to recover from the drop that started since 2014 . However since the recent peak early this year , Oil price stabilised in a tight range and failed to move higher before the recent 9% drop last week […]

-

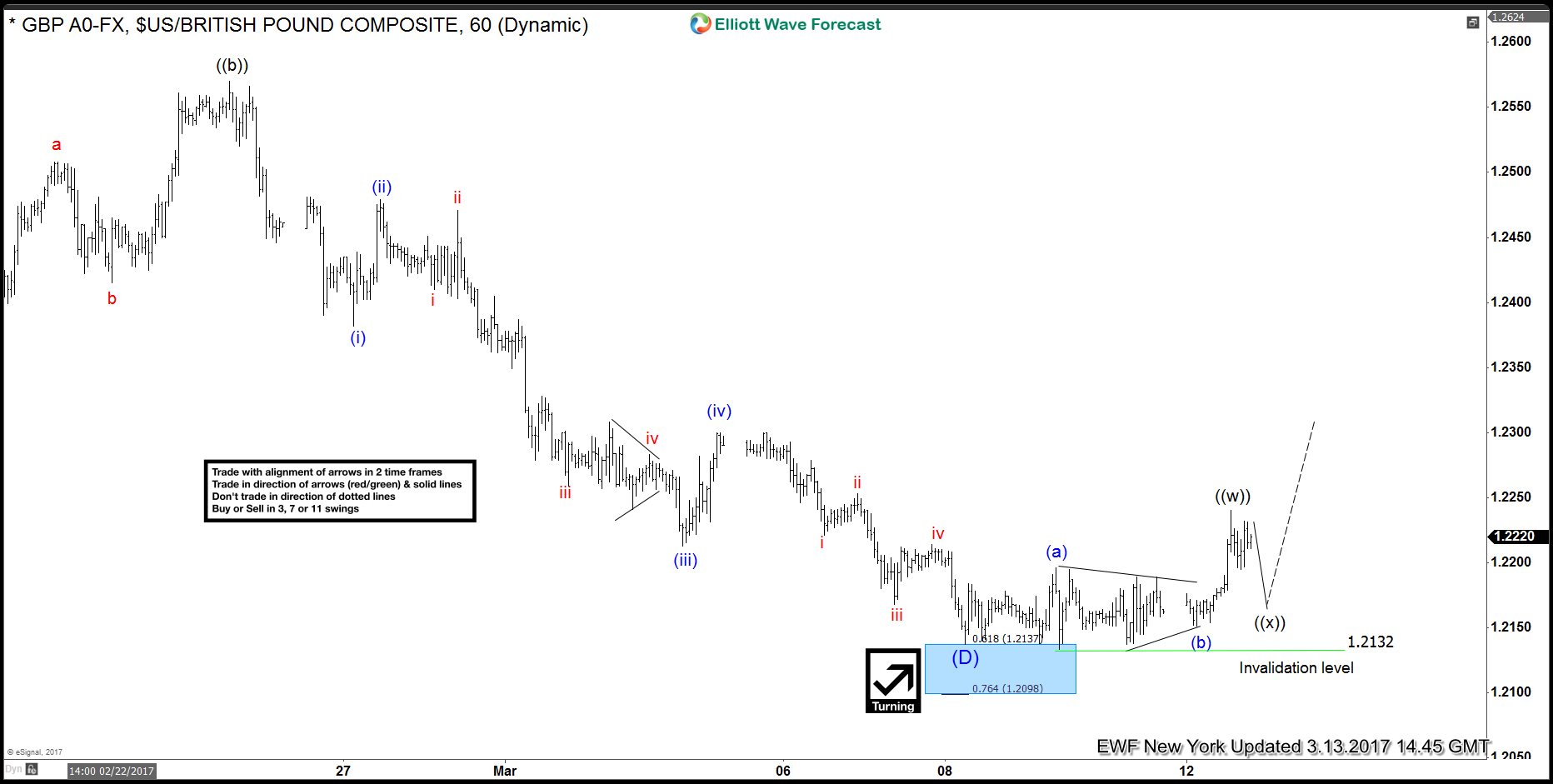

GBP USD Elliott Wave View: Bounce Started

Read MoreLast week , GBP USD ended the cycle from 02/02/2017 peak which unfolded as a double three Elliott wave structure with a FLAT in the Y leg. Pair slightly exceeded 123.6 Fibonacci extension (1.2145) of the first 3 swings lower from 2/2 peak before making a push higher today. With the bounce seen today, it has […]

-

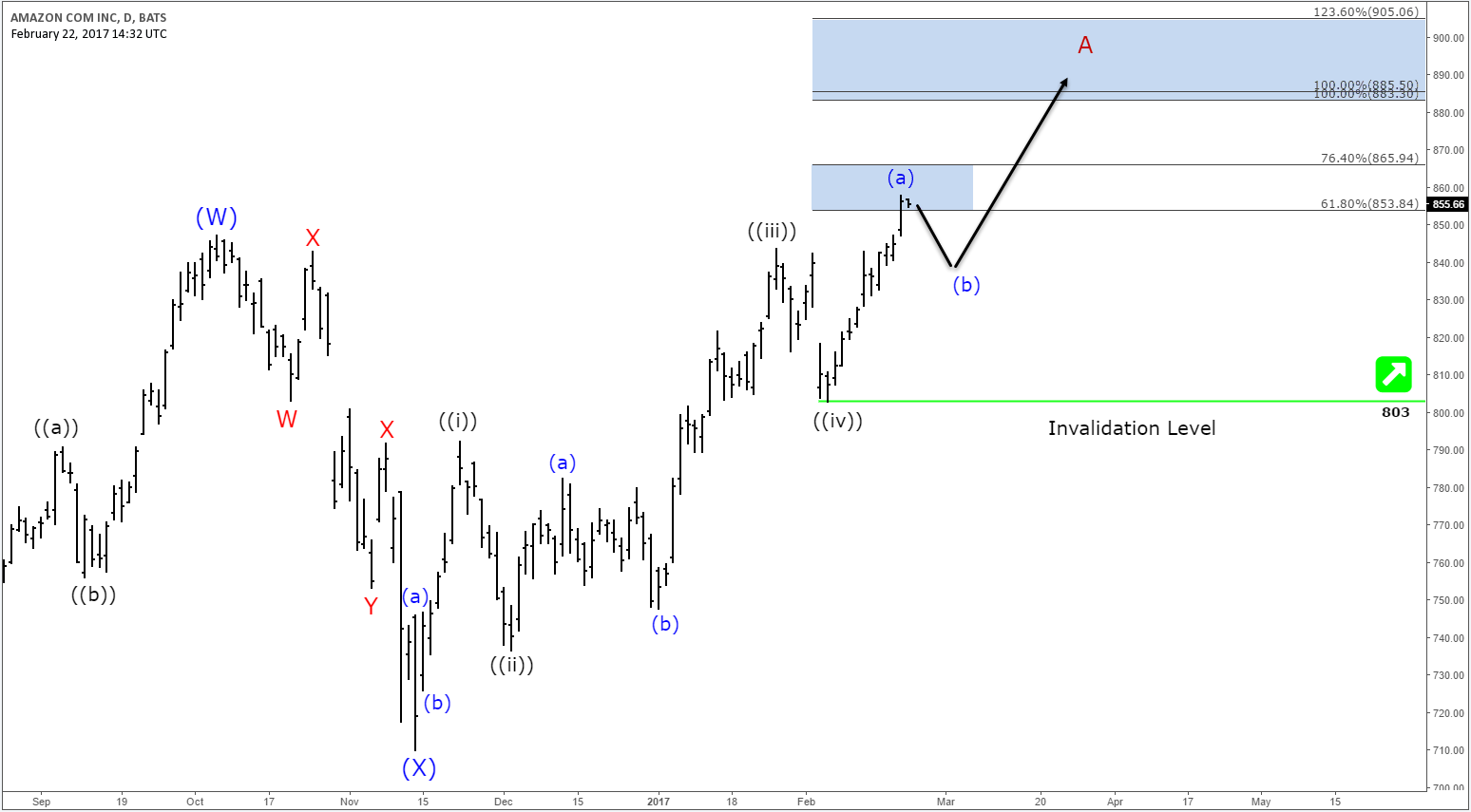

Amazon Elliott Wave Sequence Calling Higher

Read MoreAmazon Amazon (NASDAQ: AMZN) is one of the strongest companies providing positive returns to its investors in the recent decade . Last week AMZN managed to make new all time highs after breaking above October 2016 peak , this move opened an extension higher as the stock is now showing an incomplete bullish sequence from February 2016 low and […]