-

GOOGL Near Term 4 hour Elliott Wave Analysis

Read MoreHere is the near term Elliott Wave analysis for the Nasdaq stock and company that really needs no introduction, Google based in Mountain View, California, USA. For purposes here in this article I’ll mention this stock is obviously in a larger uptrend since the company inception. This particular labeling of the chart is not to […]

-

Daily Elliott Wave Analysis of Freeport-McMoRan Inc. $FCX

Read MoreFreeport McMoran based in Arizona, USA is the largest copper and molybdenum producer in the world. In 2015 , 67% of revenues were from the sale of copper, 11% were from the sale of petroleum, 10% from the sale of gold, and 5% from the sale of molybdenum. Without doubt the company balance sheets have suffered in the commodity price declines […]

-

$BAC Near Term 4 hour Elliott Wave Technical Analysis for Bank Of America

Read MoreBank of America Corporation $BAC of course is one of the larger market cap stocks in the financial banking sector listed on the NYSE . Most are aware the stock peaked in November 2006 and was sold off heavily during the financial crisis decline then the stock found a low in February of 2009. From […]

-

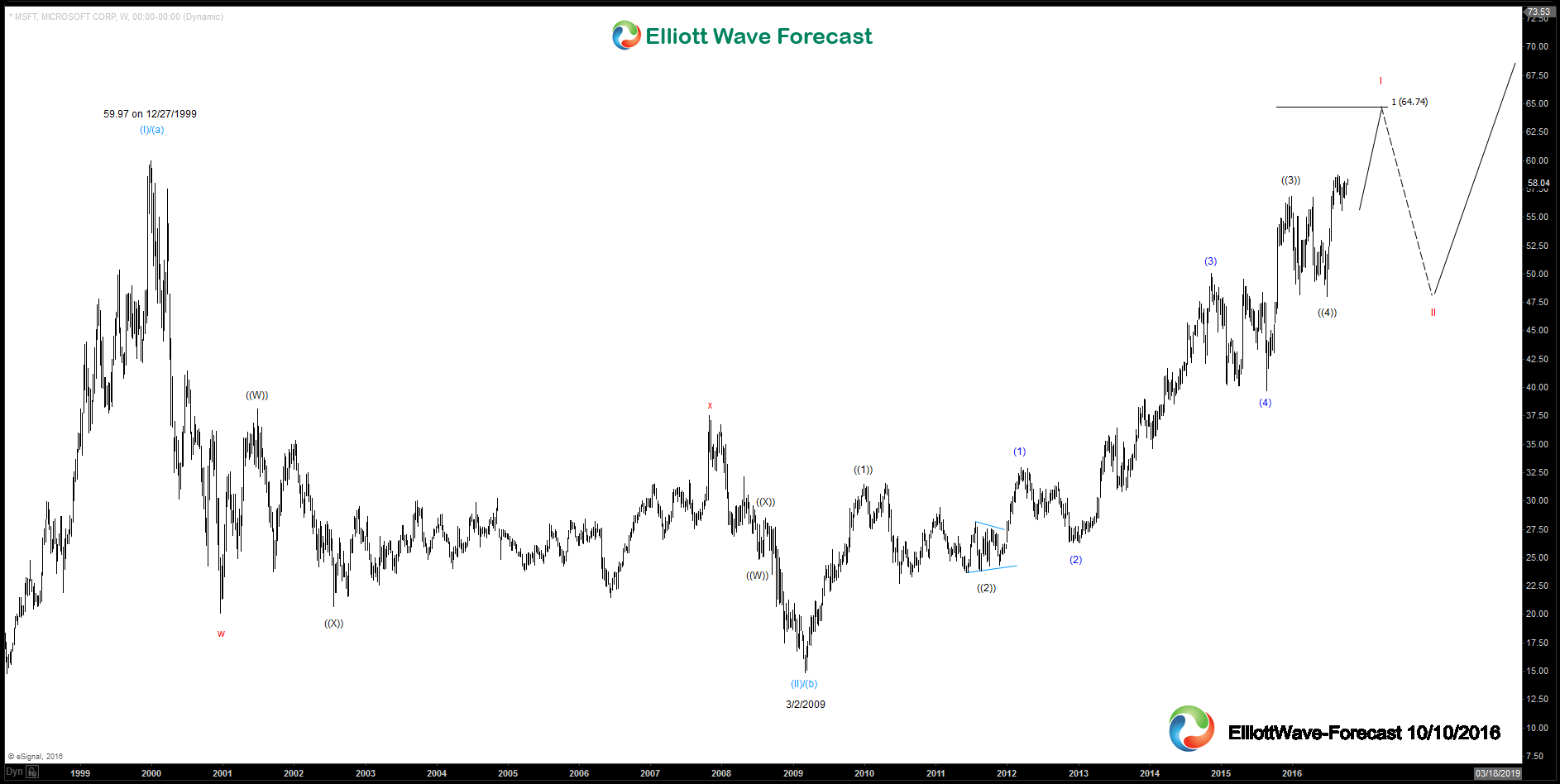

Microsoft Weekly and Daily Elliott Wave Analysis $MSFT

Read MoreMicrosoft Corporation is of course a very well known organization and has it’s large capitalization stock MSFT listed on the Nasdaq and is a component of the Dow Jones Industrial Average, the S&P 500 as well as the Nasdaq 100. In March 1986 the initial public offering price was $21.00 per share. After many stock splits over the […]

-

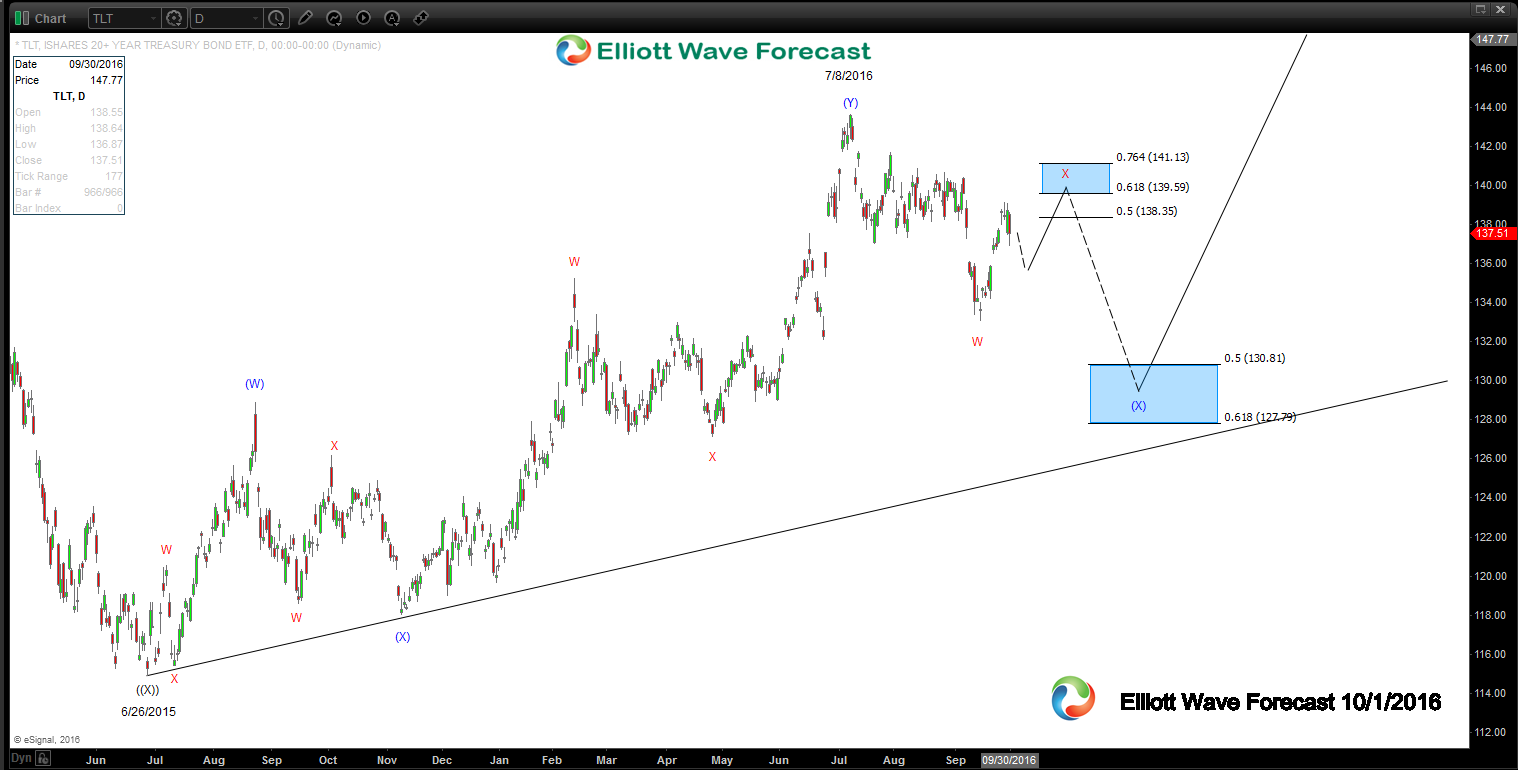

Daily Elliott Wave Technical Analysis for TLT

Read MoreIt has been a while since writing an Elliott Wave analysis piece on this instrument and I would like to start by mentioning this view from October 2015 here . Notice the date 6/26/2015 and lows at 114.88 which is shown there as a blue wave (X) . This current analysis shown below at the lower […]

-

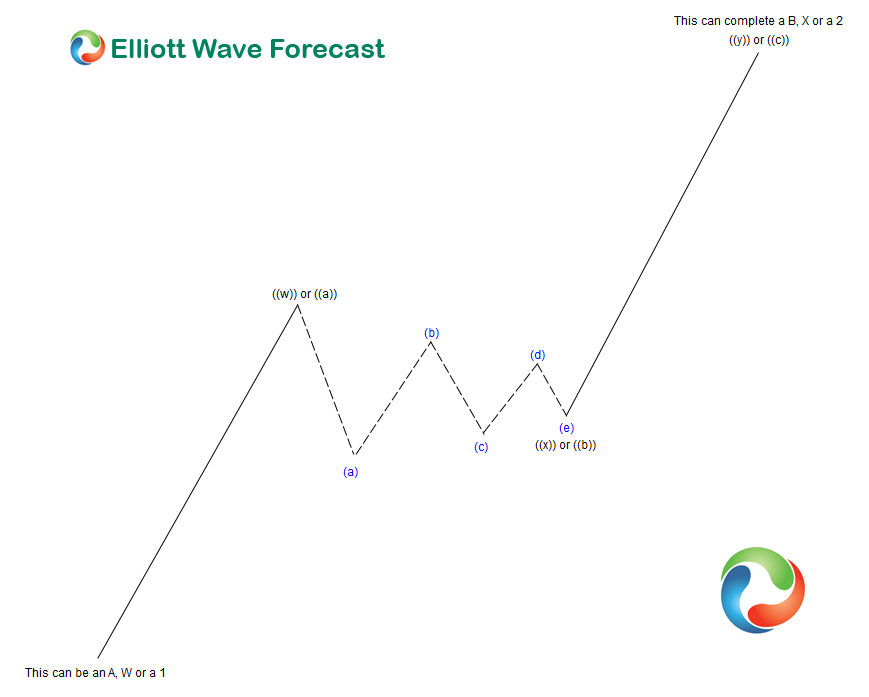

Elliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X

Read MoreElliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X As mentioned here before double three structures are common to see in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending […]