-

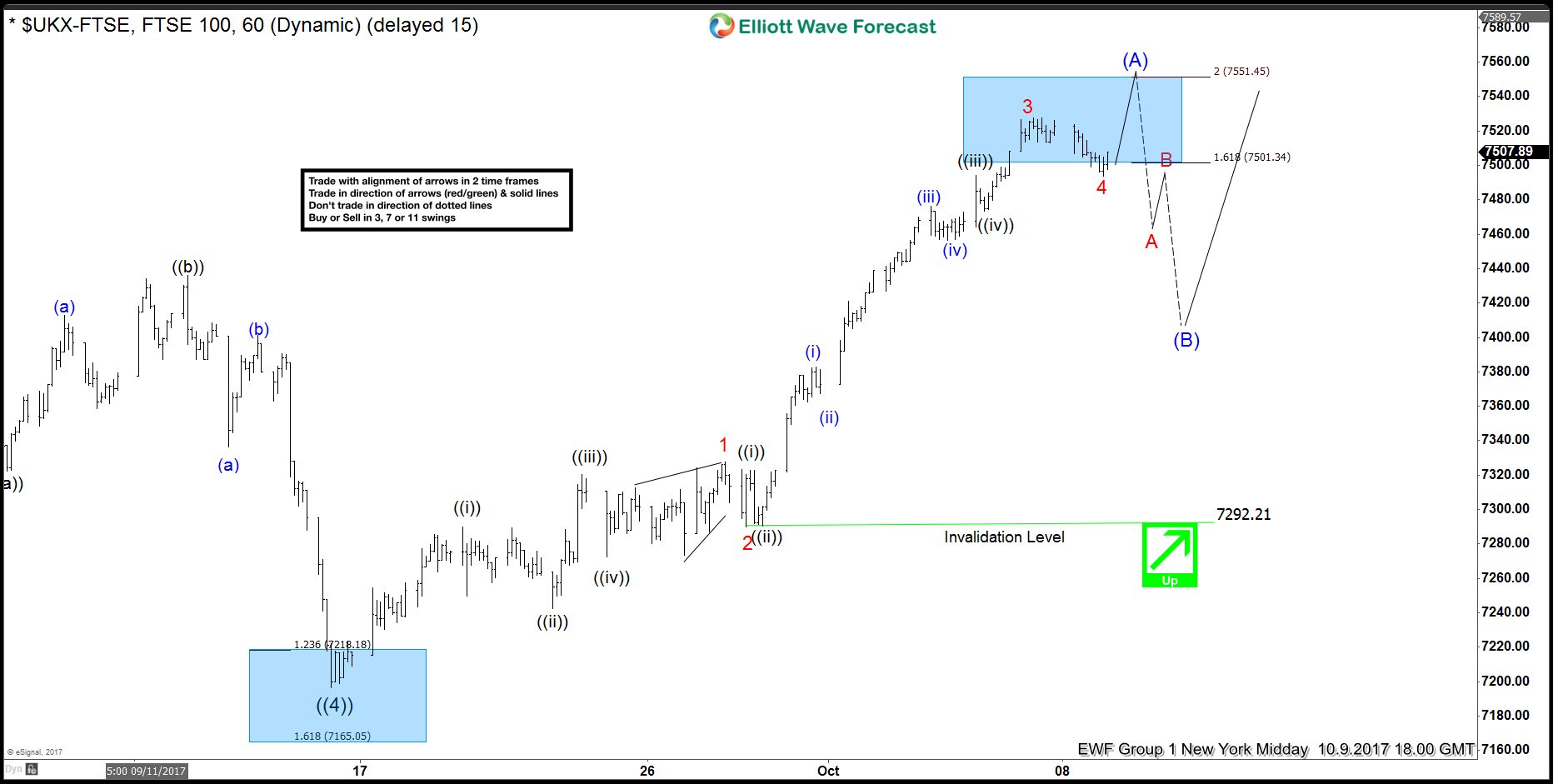

$FTSE 100 impulsive bounce from 9/15 lows

Read MoreThe $FTSE 100 index appears to be showing an impulsive bounce from the 9/15/17 lows. This is part of a larger leading diagonal up from the 2/11/16 lows. In an impulse that is bullish, market prices will go up in an impulsive manner on all time frames of trend. Impulses are always subdivided into smaller degree impulse […]

-

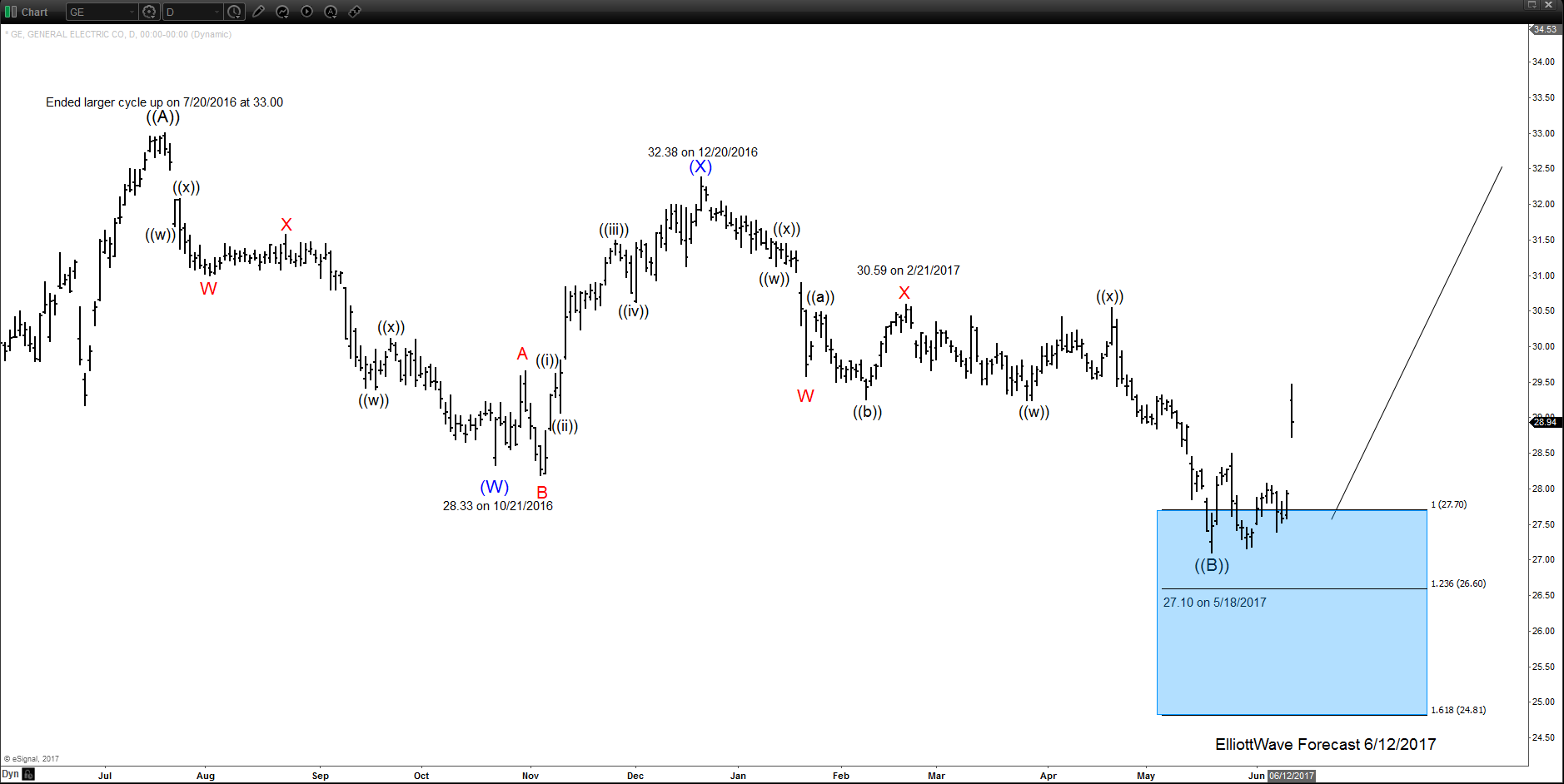

General Electric $GE Bounce is from Technicals or Jeff Immelt’s Resignation?

Read More$GE Bounce is from Technicals or Jeff Immelt’s Resignation? Firstly, I suspect the bounce is technical or at a minimum immaculate timing of the news to go with the technical view. This large multinational organization & conglomerate’s CEO of the past few years Jeff Immelt just announced he would resign from General Electric and there is […]

-

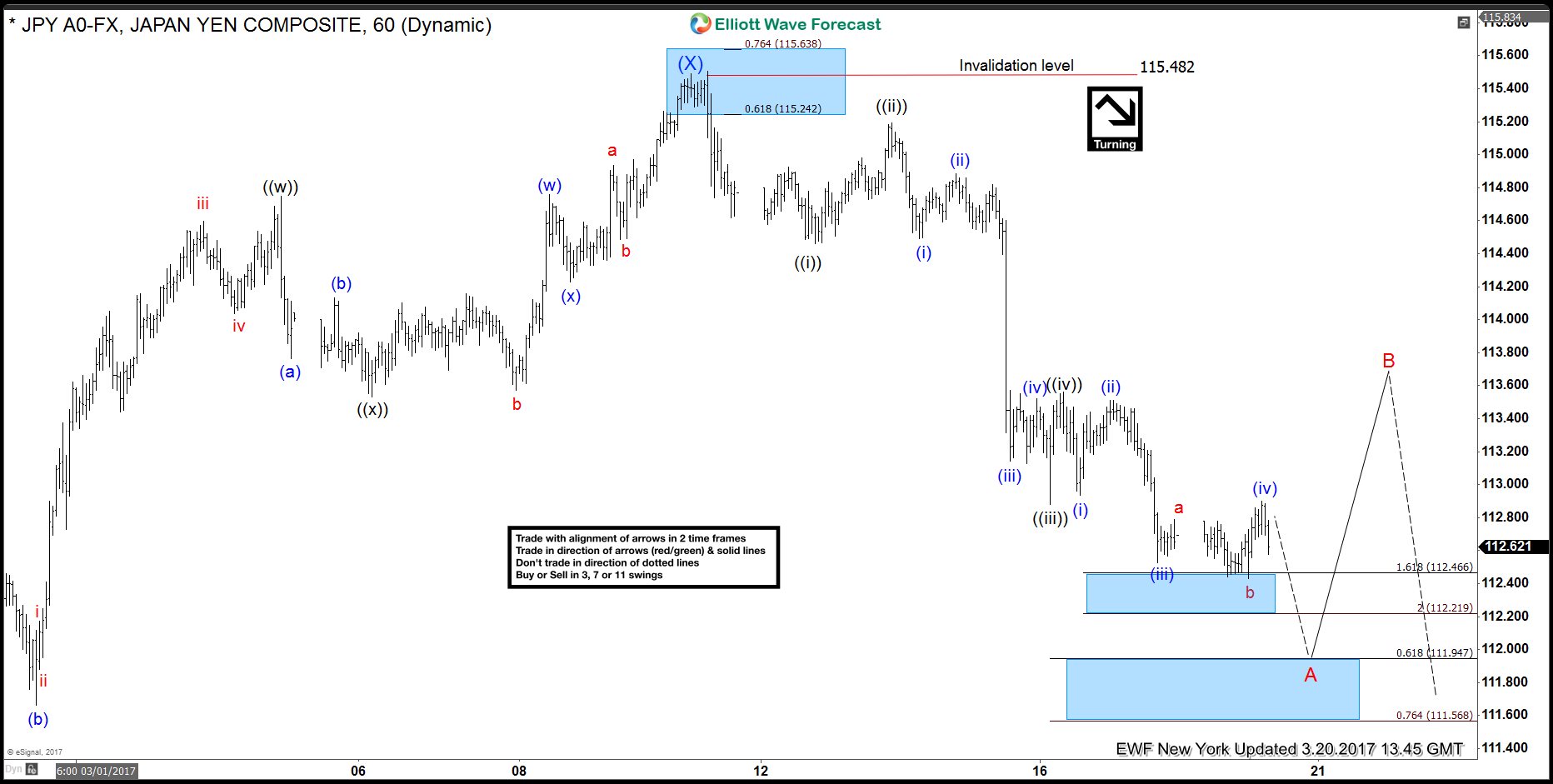

5th Wave Target Area in the $USDJPY move Lower from 3/10

Read More5th Wave Target Area in the $USDJPY move Lower from 3/10 The $USDJPY pair from the 3/10 highs at 115.50 is showing a 5 wave impulse lower that is beginning to look mature. How to get the target area to end the wave ((v)) of A is as follows. I will reference the 3 different […]

-

GBPJPY Shows 5 wave impulse up from 2/17 Lows

Read MoreGBPJPY Shows 5 wave impulse up from 2/17 Lows Firstly in the near term the GBPJPY pair shows 5 waves up from the 2/17 lows. The dip to 139.61 corrected the cycle up from the 2/7 lows. Secondly we favor seeing the pair ending this initial bounce from there in the 142.05 area. That per the […]

-

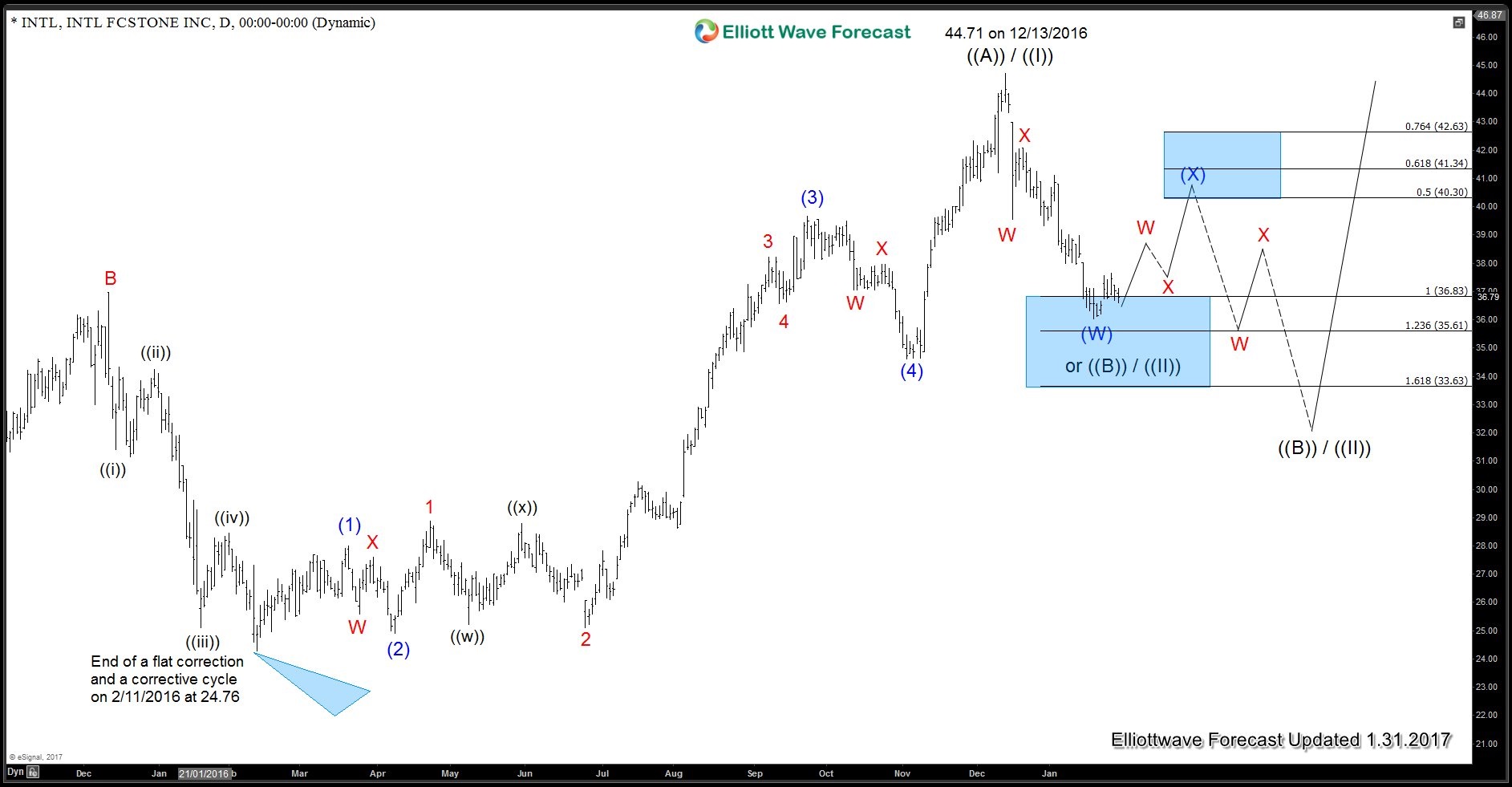

$INTL INTL Fcstone Inc Daily Elliott Wave Analysis

Read MoreThis is a daily Elliott Wave analysis of the aforementioned company. Firstly I will mention some of the company’s past history and merger. INTL Fcstone Inc is a Fortune 500 financial services industry firm listed on the Nasdaq exchange. The company has offices worldwide and is headquartered in New York City, NY in the United […]

-

$QCOM Daily Elliott Wave Analysis

Read MoreHere is a daily Elliott wave analysis of Qualcomm Incorporated based in California, USA. This Nasdaq stock is well below it all time peak back in the year 2000 and did suffer a quite a pullback lower with the rest of the market into 2002 then has traded sideways to higher from there. Most recent larger […]