-

Which one is a Better Buy: Silver or Gold?

Read MoreGold (XAUUSD) and Silver (XAGUSD) should be trading higher in 2023 after reacting off the buying areas in 2022. The metals were in a correction over the last two years since 2020, and now they are turning higher. An acceleration higher should happen soon. A trader or investor always needs to know which symbol or […]

-

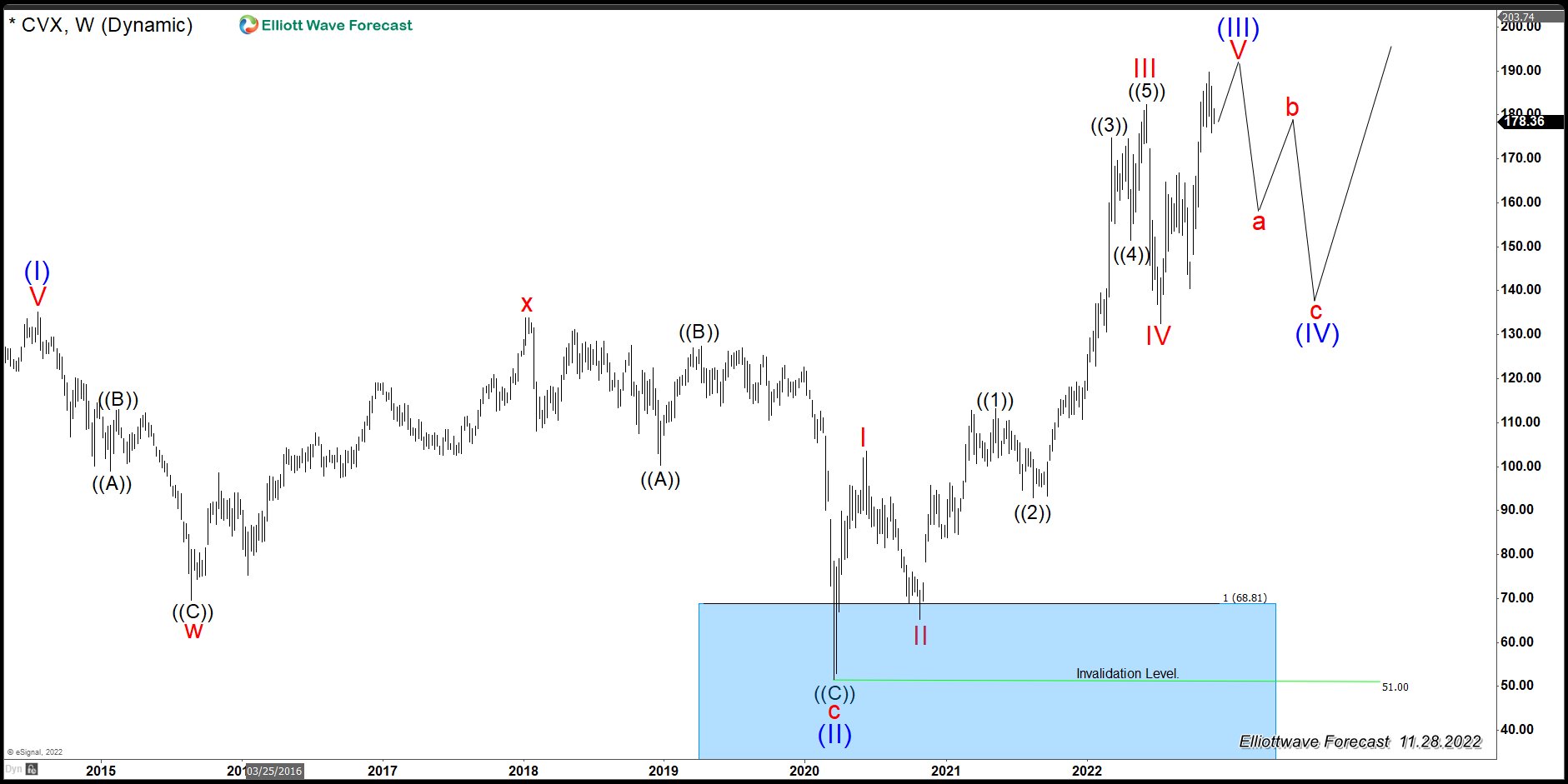

CVX (Chevron): The Symbol Might be Ending a Cycle.

Read MoreThe Elliott Wave Theory’s main pattern is that the market advances in five waves and corrects in three waves. The five waves advance is easy to identify. Most of the time the rally is well-defined and the subdivision is visible. Also, the powerful wave three creates separation making the sequence clear and easy to label. […]

-

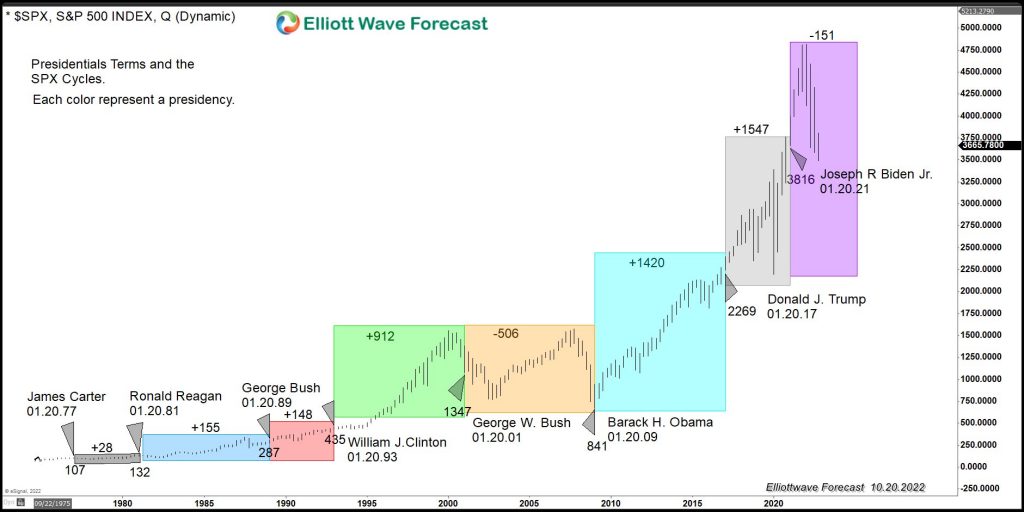

US Presidential Cycles and the SPX Performance

Read MoreA lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

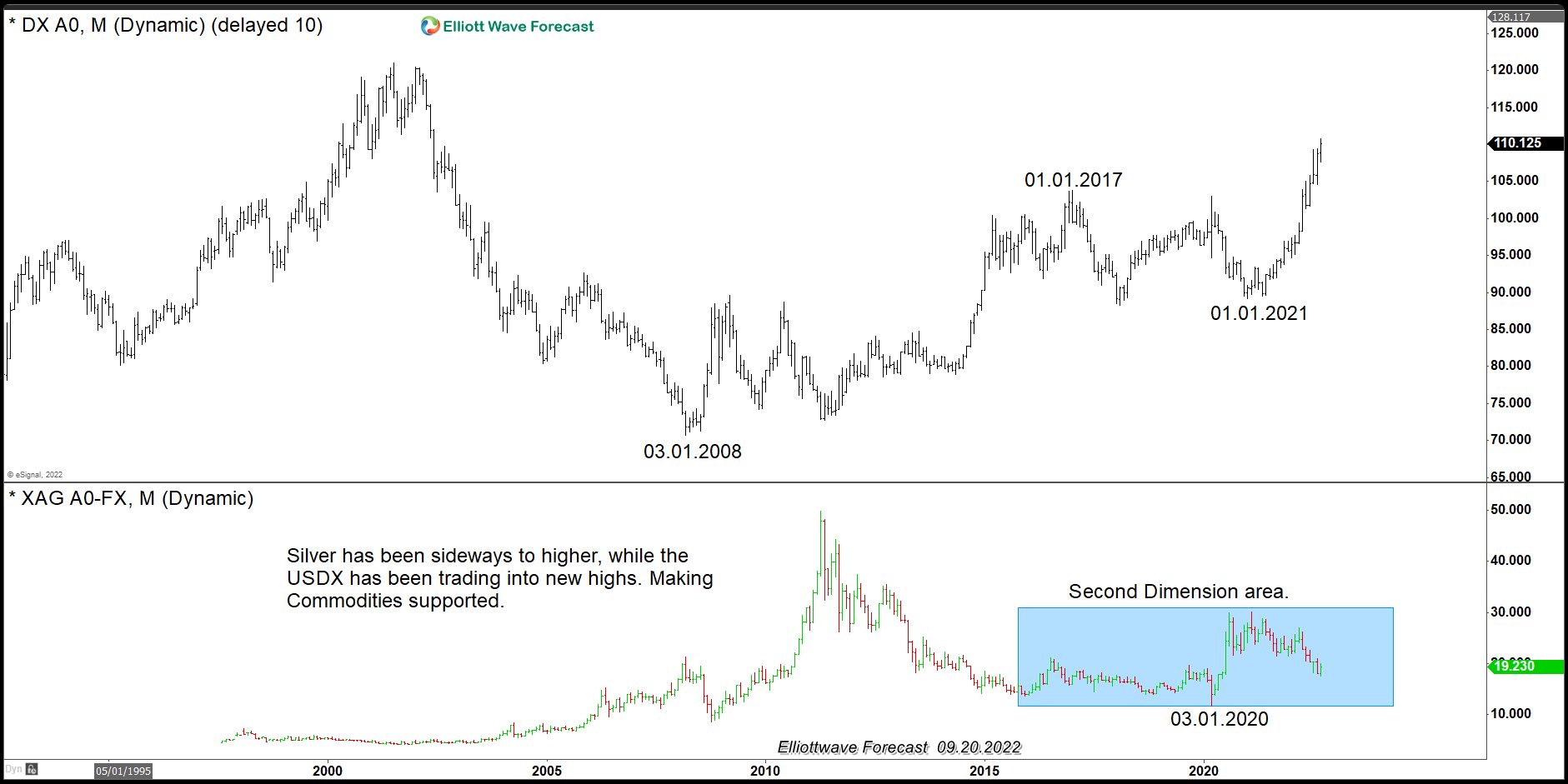

$USDX: The Index Structure Showing an Opportunity to Buy Commodities

Read MoreThe Dollar Index ($USDX) shows five waves since the low on 03.01.2008, which will provide many signals across the Marketplace. Below is a monthly chart of the Dollar Index $USDX Monthly Elliott Wave The monthly chart above shows the five waves advance from 3.1.2008 and the different degrees within the cycle. The idea is overall […]

-

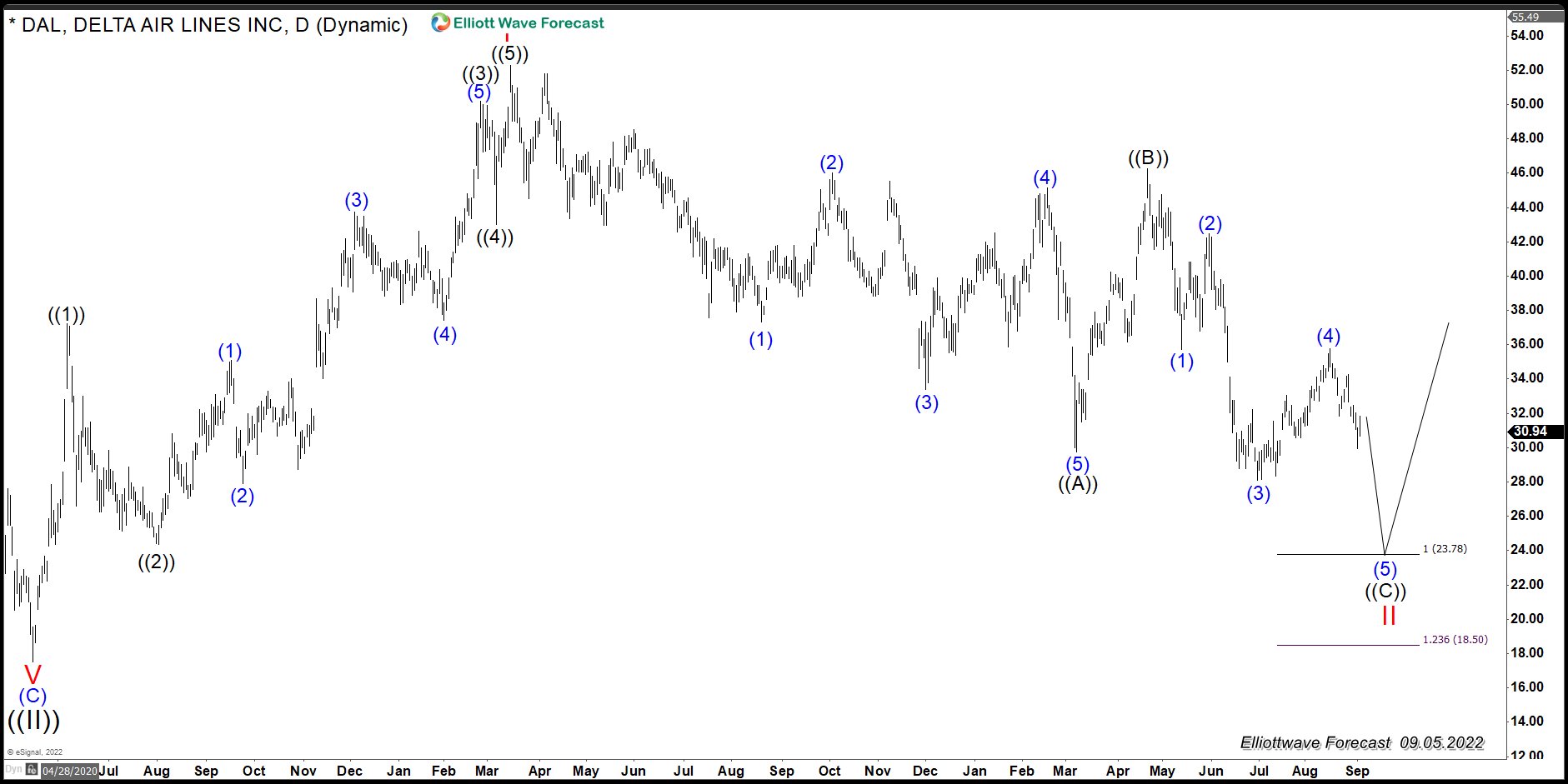

$DAL (Delta Air Lines INC): Another Buying opportunity In the Horizon

Read MoreDelta Airlines (DAL) shows an impulse from all-time low and 2020 low & should give a buying opportunity soon. This article looks at the Elliott Wave chart.

-

GCC (Wisdomtree Commodity Strategy Fund) Calling For Higher Commodities

Read MoreGCC (Wisdom Tree Commodity Strategy Fund) is a great indicator for commodities direction. This Fund is positively correlated with Oil. Previously, we have mentioned the idea that the Fund reached the blue box area back in 03.2020. Since then, it has started a rally which looks like a nest. A nest is a series of […]