-

Financial and Banking Sector (XLF) Heading for a Tough Period

Read MoreThe Financial and banking sector (XLF) was all over the news last month. It is currently no longer part of the daily news cycle. We believe trouble is underway for the second part of the year. Price action across the sector points to a massive sell-off after an initial trap. Many traders believe the market […]

-

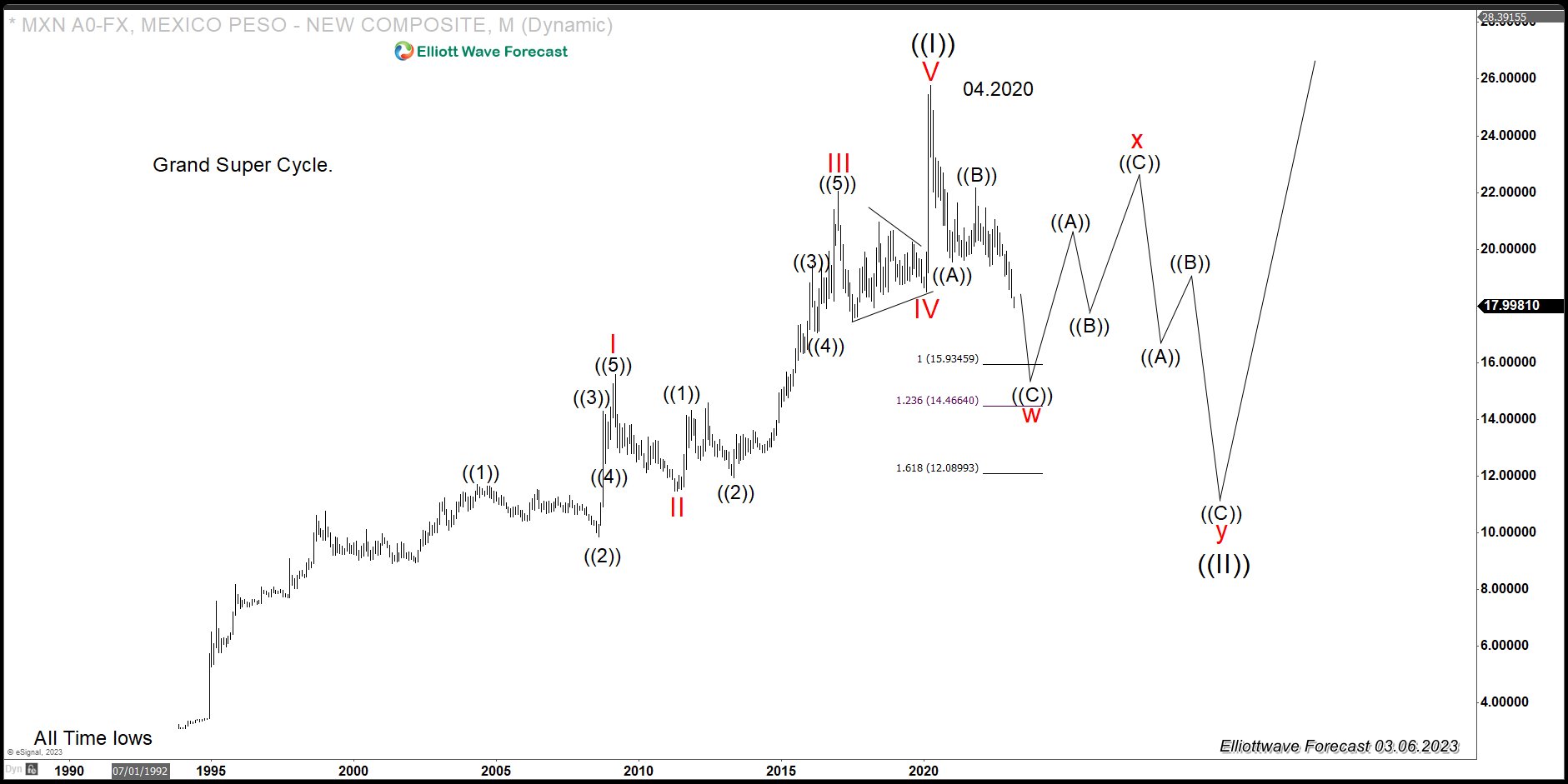

$USDMXN: The Peso Still Needs More Downside, Holding Down The Dollar

Read MoreThe Dollar has been in a fantastic rally since its lows in 2008. It is in the process of ending the cycle as an impulse. This article explains the view and why buying commodities in the dips is a good long-term opportunity. Monthly Dollar Index Elliott Wave Chart The monthly chart above shows the structure of […]

-

Micron Technology Inc ($MU) is The Key To Forecast Indices Weakness

Read MoreThe whole market has advanced in what looks like an impulse off the lows in 2022. One of the essential concepts in the Elliott Wave Theory is that a new trend always comes in fives. However, five waves can also be part of a C wave of a FLAT. We explained the possibility in the […]

-

DIS (Walt Disney Company): A Huge Rally Into $286.00 Might Have Started

Read MoreWalt Disney shares have been trading lower since they peaked on 03.08.2021. Since then, the symbol has been doing a WXY structure which comes with seven swings. This structure most of the time ends when the W equals the Y in relation to X. WXY Double Three Elliott Wave Structure It represents a WXY […]

-

World Indices: Time to Be Aggressive or Smart?

Read MoreIt is very well-known around the trading community that we at EWF has always been very bullish on the World Indices. With every dip over the years, we have been telling members to buy. However, we run a system that provides a warning this time. The Elliott Wave Theory is known for providing alternate views. This […]

-

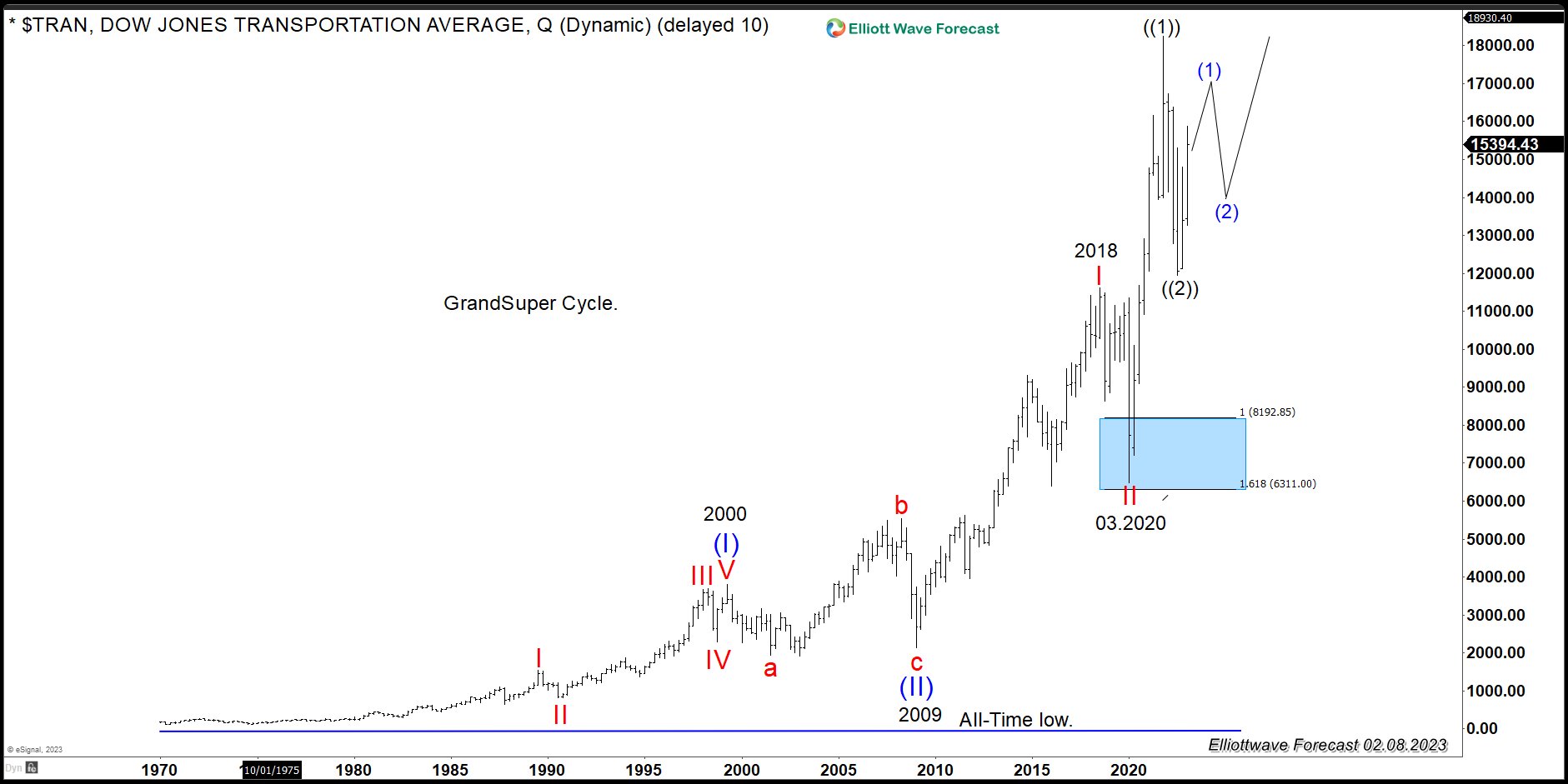

$TRAN (Dow Jones Transportation): The Sector Should Extend Higher Soon

Read More#TRAN (Dow Jones Transportation) is trading in an interesting swing sequence. It shows five swings advance in Grand Super Cycle degree. The idea that five waves or swings develop from the all-time lows make the sector bullish overall. However, we favor a nest, a series of I-II with a higher extension still to come. A […]