-

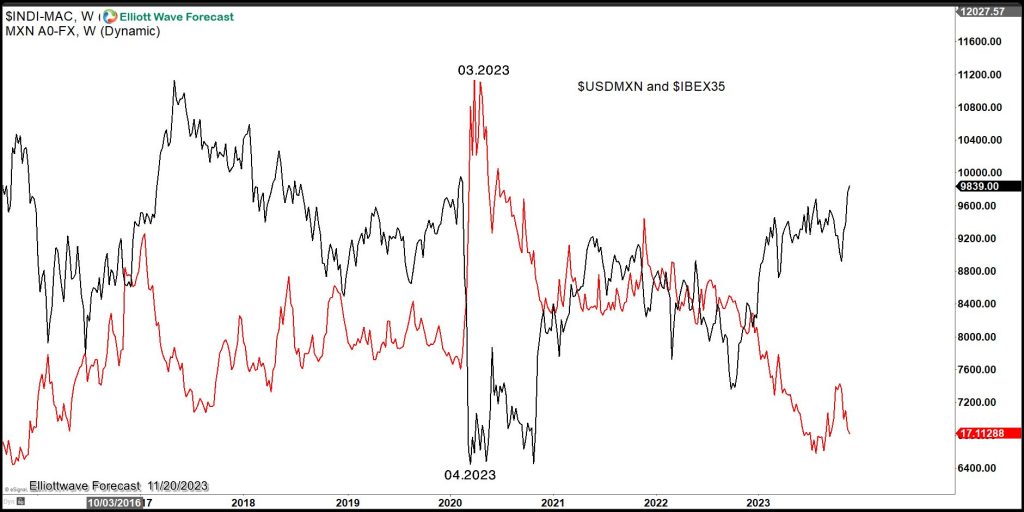

$USDMXN: How the Path of the Pair Correlates with World Indices

Read More$USDMXN has been trading lower since the peak at 04.2020. We have been waiting for the area between $15.98-$12.14 to be reached. The pair is important because of the correlation with the $USDX and the implication across the Market. Here is the Weekly chart for the pair and the $USDX showing the correction and the […]

-

NZDJPY Rally from Extreme Area and Bullish Sequence

Read MoreIn this blog, we will take a look at the reaction from extreme area in NZDJPY, how buyers appeared in the area as expected and produced a strong reaction higher. We will look at how this area was calculated and also look at the current Elliott wave structure of this Yen cross. We will discuss […]

-

$DIS(Walt Disney): The Stock is Trading Within Buying Area

Read MoreDisney has been in a tremendous decline since it peaked at $203.02 back 03.08.2021. The Peak ended a Grand Super Cycle and since then it has corrected in larger pullback. The Elliott Wave Theory provides us with cycle degrees determined by the time each cycle lasts. So the Grand Super Cycle is the highest cycle […]

-

$TNX (10-Year Treasury Bond Yields) New Bullish Market

Read MoreThe 10-year Treasury Bond shows an interesting pattern since the all-time lows. A trader or investor needs to understand bonds market, especially the 10 Years. Due to the ten years maturity, this makes investors enter into a lengthy commitment. Investors track Treasury bond yields (or rates) for many reasons. One of the reasons is because the […]

-

$DJUSRE (U.S Real Estate Index): A Sell-off Can Happen

Read MoreUS Real Estate Market ($DJUSRE) gives potential warning for a correction in coming years. This article and video look at the Elliott Wave path.

-

$CVX (Chevron) : A Nest and Higher Prices Are Coming

Read MoreChevron (ticker symbol: CVX) reacted nicely since we presented the blue box (high-frequency) area to our members at EWF in 2020. You can see the second chart below for the blue box in CVX. The stock since then made a nice five waves advance from the blue box, and now it is correcting the rally. […]