-

The Market Timing and The US General Elections

Read MoreMany World Indices, Stocks and ETFs have been rallying since the March 2020 lows. As we always say at EWF: “Nothing lasts forever nor runs in a straight line – when it comes to the market”. In fact, we believe in the idea that the market trades between defined areas. These areas need to be […]

-

SPY: The Decision Time is Coming Soon

Read MoreSPY: The Decision Time is Coming Soon The Index is within the Grand Super Cycle and is showing a clear five waves structure. The Elliott wave Theory states that after five waves a three waves pullback will happen to correct the entire cycle. The following chart is a representation of the idea, which is the basic […]

-

USDINR: The Pair Is Sending A Warning to $USDX

Read MoreThe USDX has been trending higher since the lows in 2008. However, in trading, nothing lasts forever. New traders generally do not last very long in this field, thus most traders only know a strong $USDX due to recency bias. However, in reality, nothing lasts forever, so we at EWF track many different instrument to be able […]

-

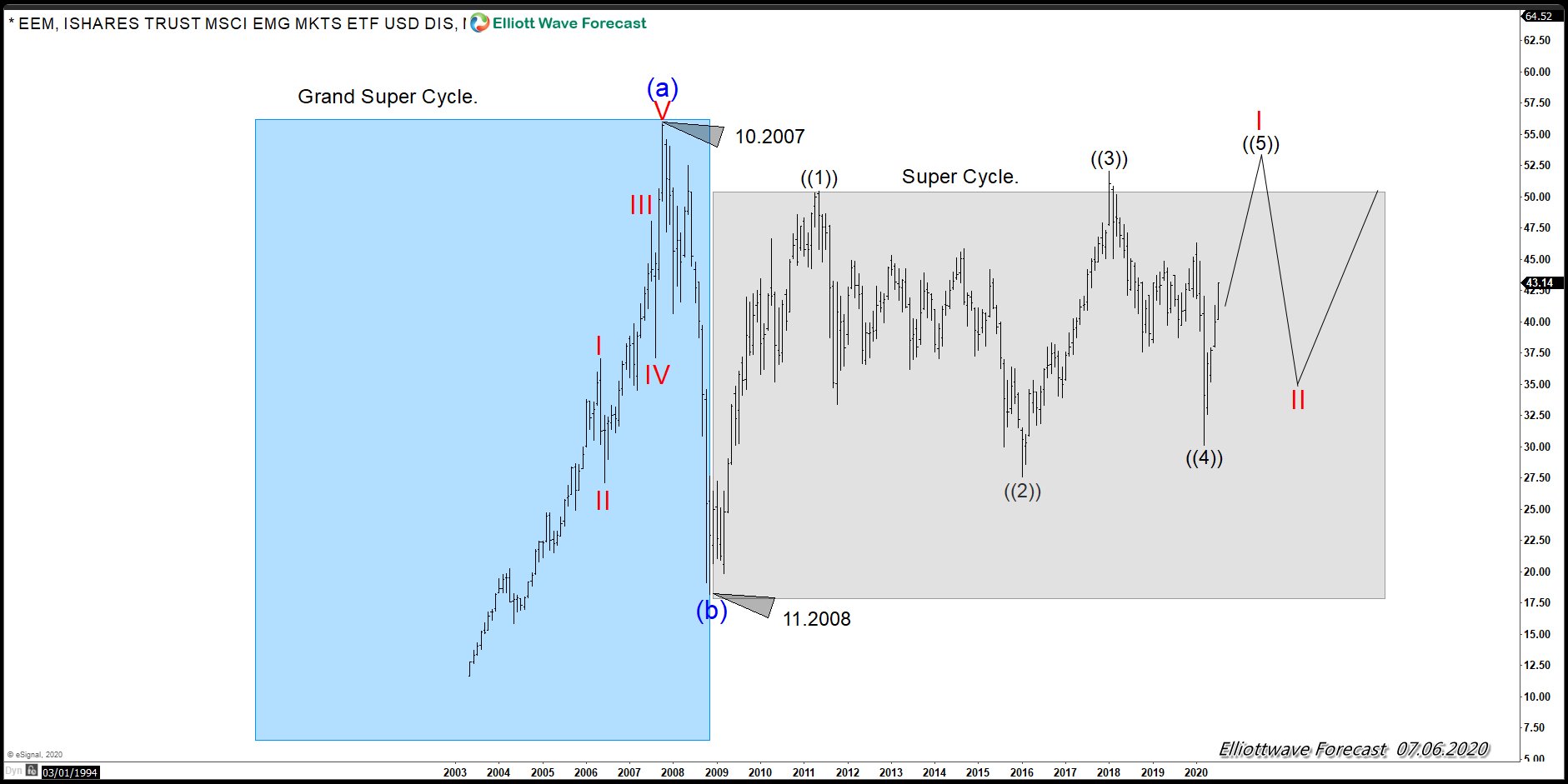

EEM Emerging Markets Getting Ready For A Big Move.

Read MoreEEM (The Emerging Market ETF) could be getting ready for a huge move higher. The ETF has been sideways since the peak in 2007. EEM looks weaker when compared to the rest of the World Indices because of its inability to break above the 2007 highs, whereas almost every indices have already broken above that high. […]

-

JP Morgan Chase ( NYSE: JPM) Soon Will Define The Path

Read MoreJPM Chase & Corporation, as many World Indices is showing an incomplete impulse since the all-time lows. The Instrument is showing a Grand Super Cycle propose impulse which is showing a wave (I) ending at 2000 peak. Then a nine years correction into 2009 lows and an amazing reaction higher since until this year peak. […]

-

American Airlines (AAL): A Turn Higher Taking Place

Read MoreIn this article, we will take a look at American Airlines (AAL). Currently, the instrument could be within the process of turning to much higher levels. American Airlines (AAL) was hit with selling pressure during the financial market sell-off in March 2020. Nevertheless, the whole Transportation Sector was already within a correction cycle before Covid-19 […]