-

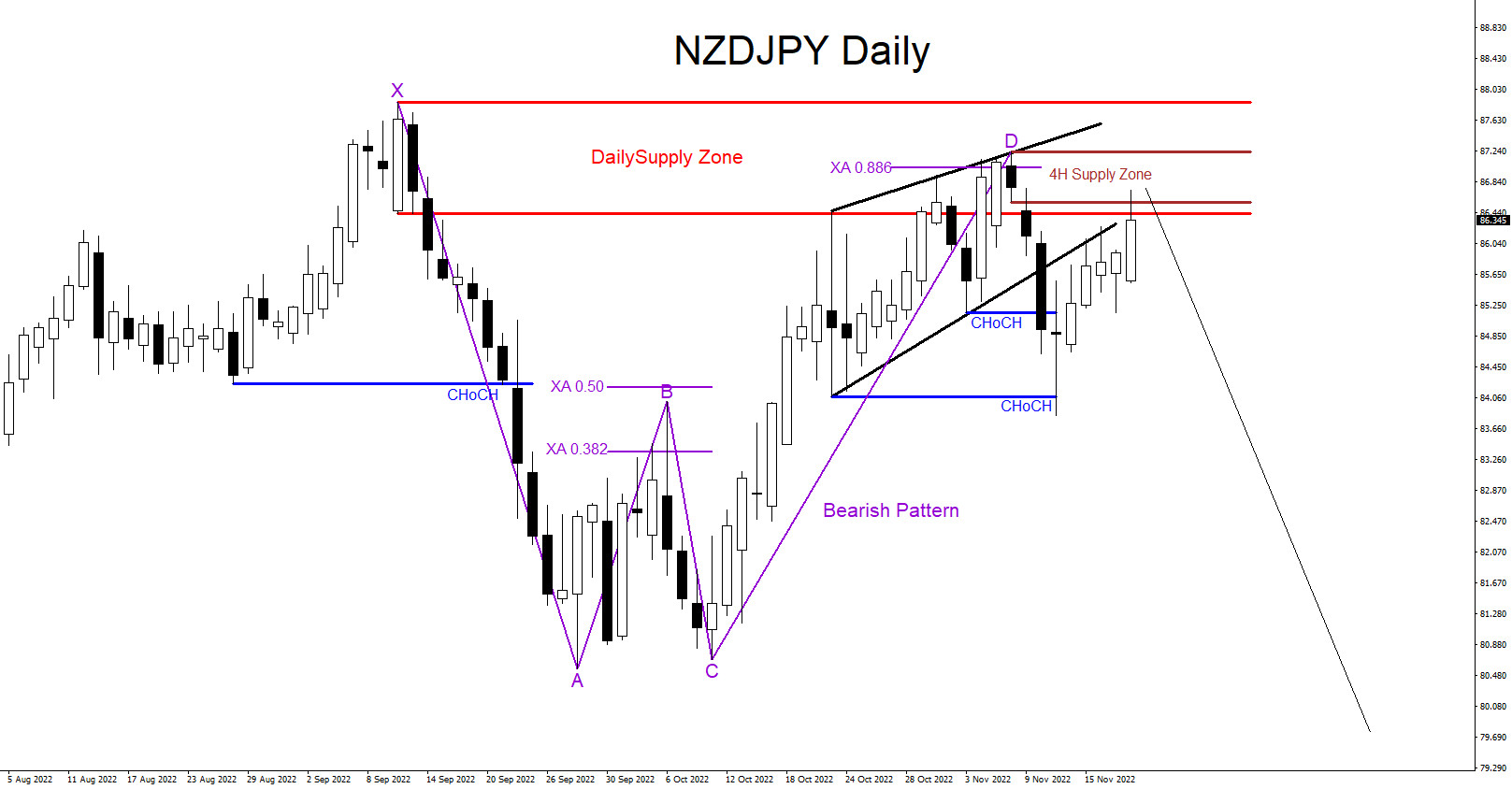

NZDJPY : Possible Move Lower?

Read MoreNZDJPY pair can be signalling for a move lower. There are visible market patterns that can be signalling for this possible scenario lower. As long as price remains below the high of the point D Bearish Pattern (Purple) we can expect the pair to reverse lower. Only time will tell what the pair will. SELL […]

-

GBPCAD : Buy Trade Hits Targets

Read MoreOn November 9 2022 I posted the GBPCAD trade setup on social media @AidanFX “ GBPCAD Watching for possible buying opportunities for a push higher towards the 1.5473-1.5533 area. ” and ” BUY GBPCAD at 1.5353 Stop Loss 1.5293 Target 1.5473 (1:2RR) 1.5533 (1:3RR) ” GBPCAD 1 Hour Chart November 9 2022 Buy Trade Setup […]

-

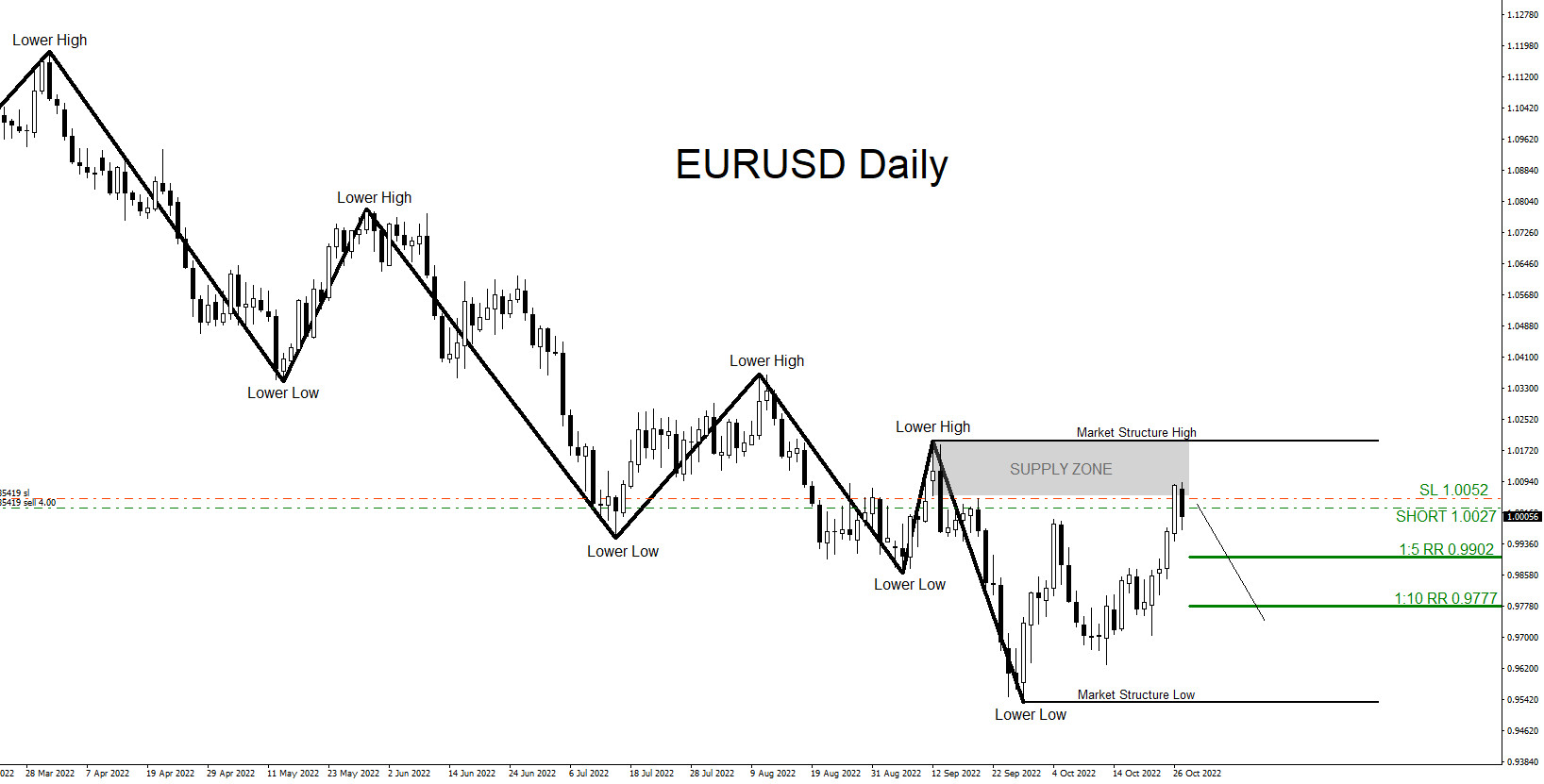

EURUSD : Higher Time Frame Analysis, Lower Time Frame Entry

Read MoreOn October 27 2022 the EURUSD pair entered a supply zone and reacted lower signalling a high probability SELL trade setup. On the daily chart, the pair has been trending lower making lower lows and lower highs. Traders should only be looking for SELL setups following the higher time frame trend and waiting for the […]

-

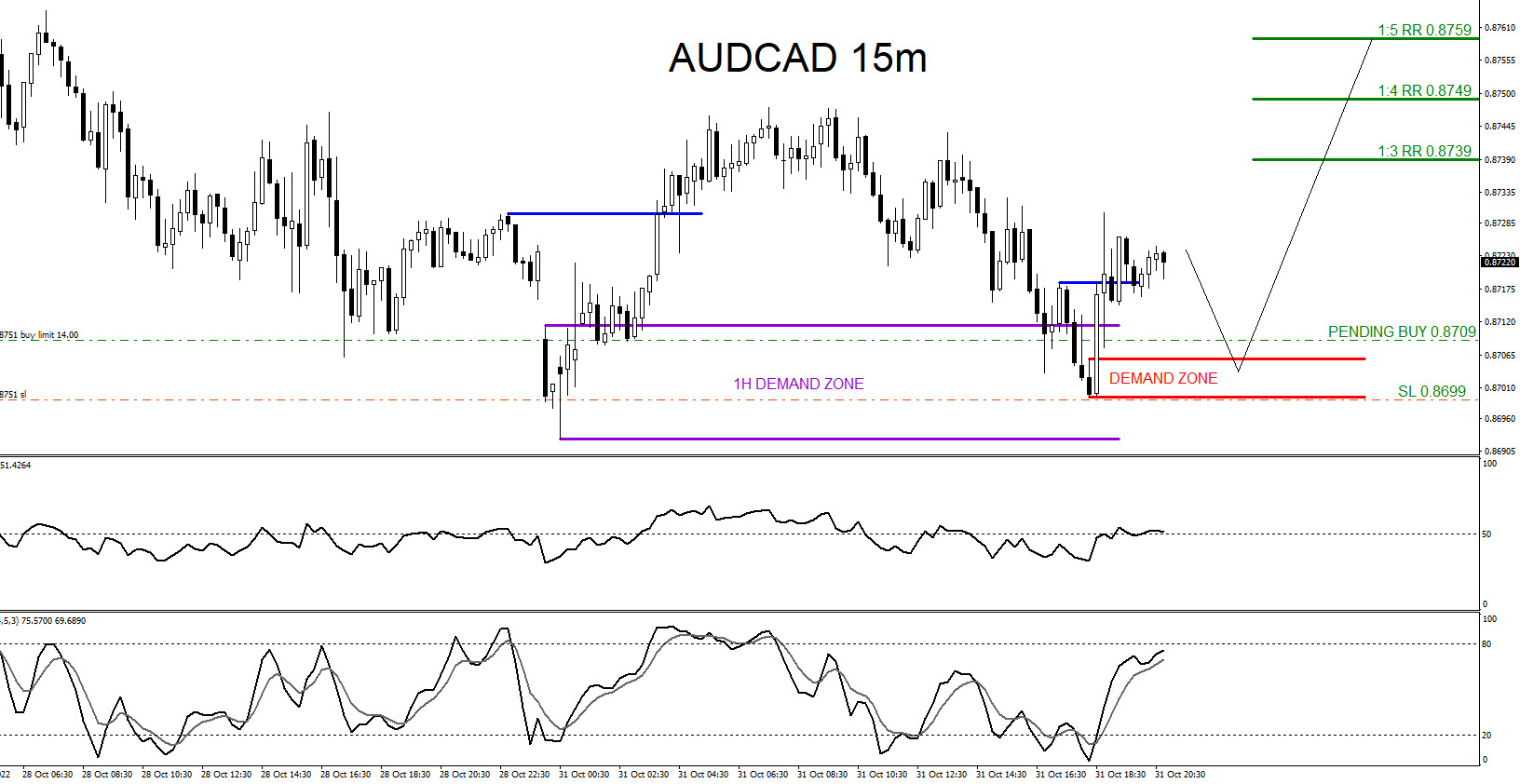

AUDCAD : Buy Trade Hits Targets

Read MoreOn October 31 2022 I posted the AUDCAD trade setup on social media @AidanFX “ LONG/BUY AUDCAD at 0.8709 Stop Loss 0.8699 TP 0.8739 (1:3RR) 0.8749 (1:4RR) 0.8759 (1:5RR)“ Buy Trade Setup 1. Price reacting higher from the 1 Hour Demand Zone signalling possible move higher (Purple) 2. Price broke above the downward Lower Low/Lower […]

-

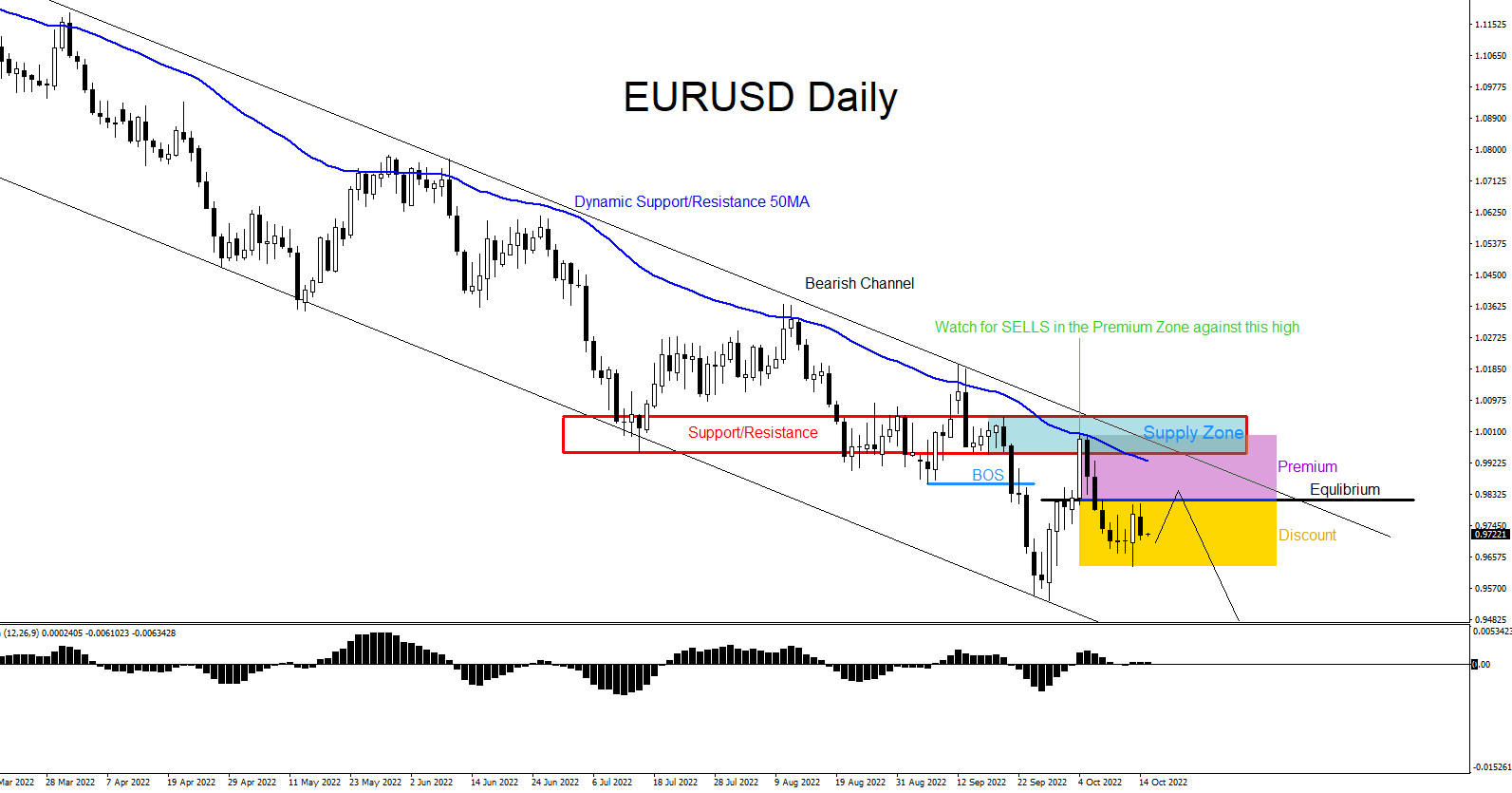

EURUSD : Watch for Sell Opportunities

Read MoreThe chart below of the EURUSD pair is currently trending to the down side making lower lows and lower highs. If looking to trade EURUSD , traders should be patient and wait for price to push higher. Waiting for price to push higher above the equilibrium level (Black) and into the premium sell zone (Purple) […]

-

GBPUSD : Sell Trade Hits Targets

Read MoreOn September 27 2022 I posted on social media @AidanFX “ SHORT/SELL GBPUSD at 1.0788 Stop Loss at 1.0848 TP 1.0668 (1:2 RR) 1.0608 (1:3 RR)“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market […]