-

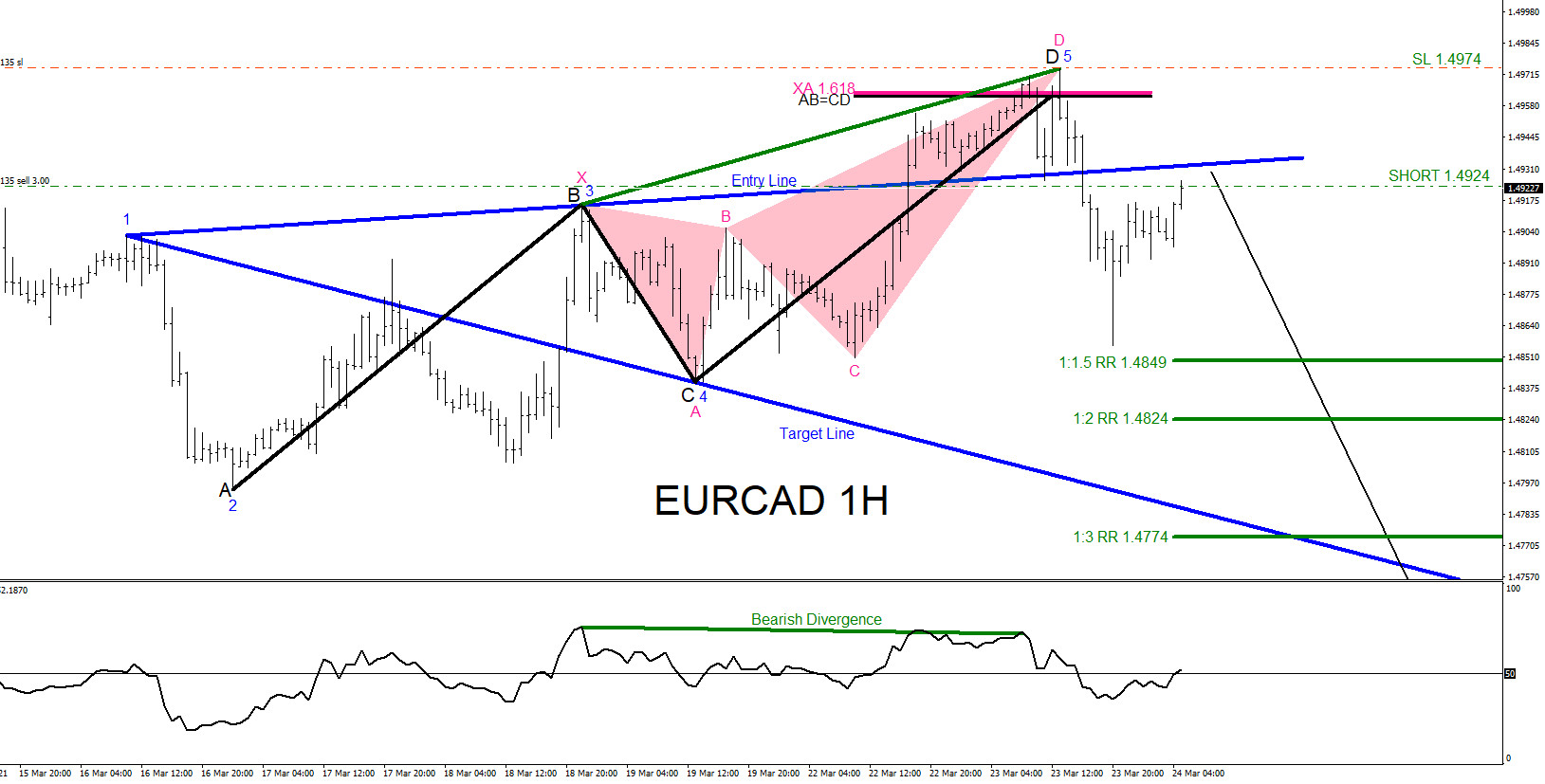

EURCAD : Bearish Market Patterns Calling the Move Lower

Read MoreOn March 23 2021 I posted on social media @AidanFX ” EURCAD as long as price stays below 1.4974 the pair can push lower to retest the 1.48 handle. Will be watching for selling opportunities.” The charts below was also posted on social media @AidanFX March 23 2021 showing several clear bearish market patterns. Black bearish […]

-

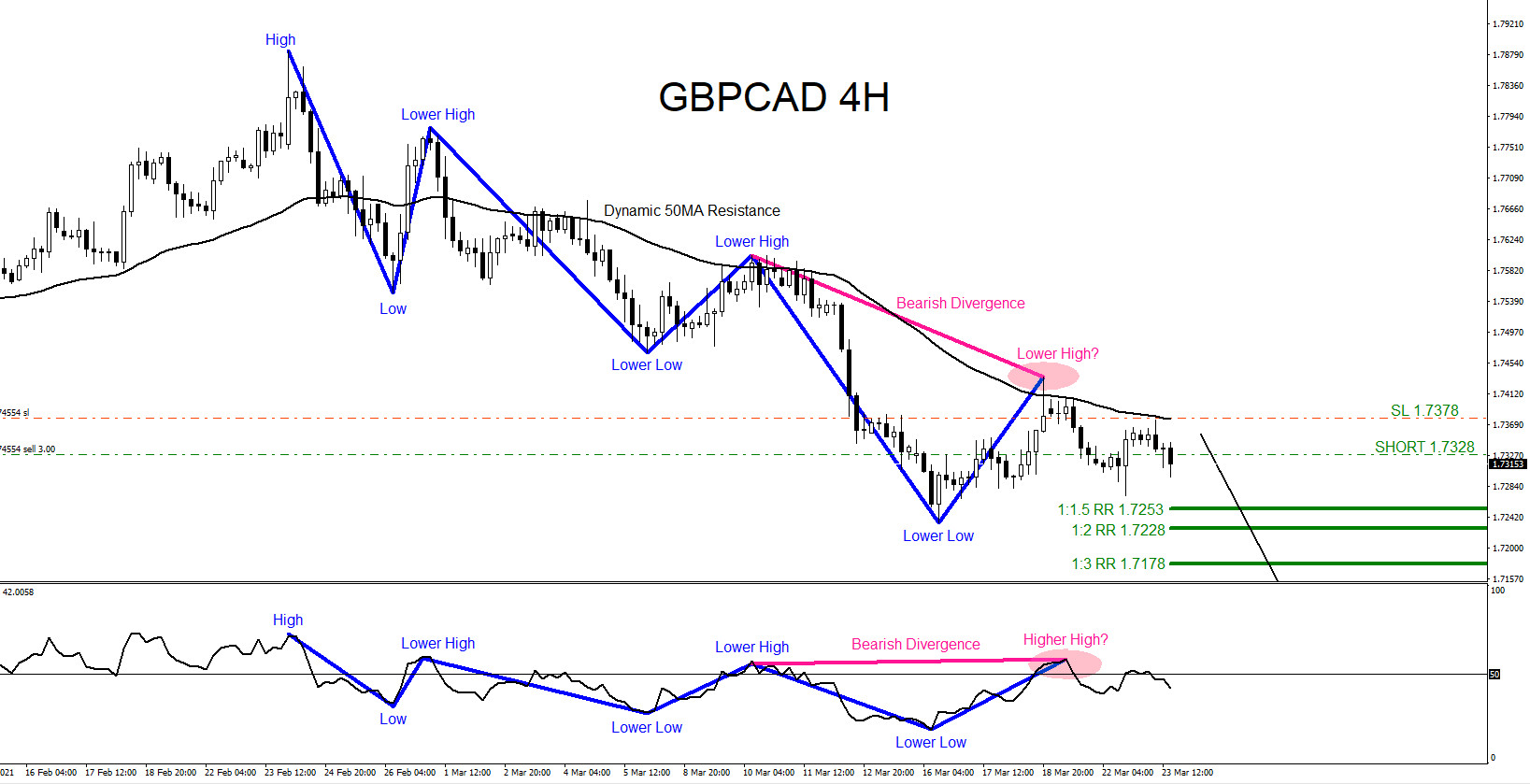

GBPCAD : Catching the Move Lower

Read MoreSince February 24/2021, GBPCAD has been trending to the downside. To determine if a market is trending, price action must be forming higher highs/higher lows in an uptrend and lower lows/lower highs in a downtrend. We at EWF always recommend our clients to trade with the trend and not against it. On March 23 2021 […]

-

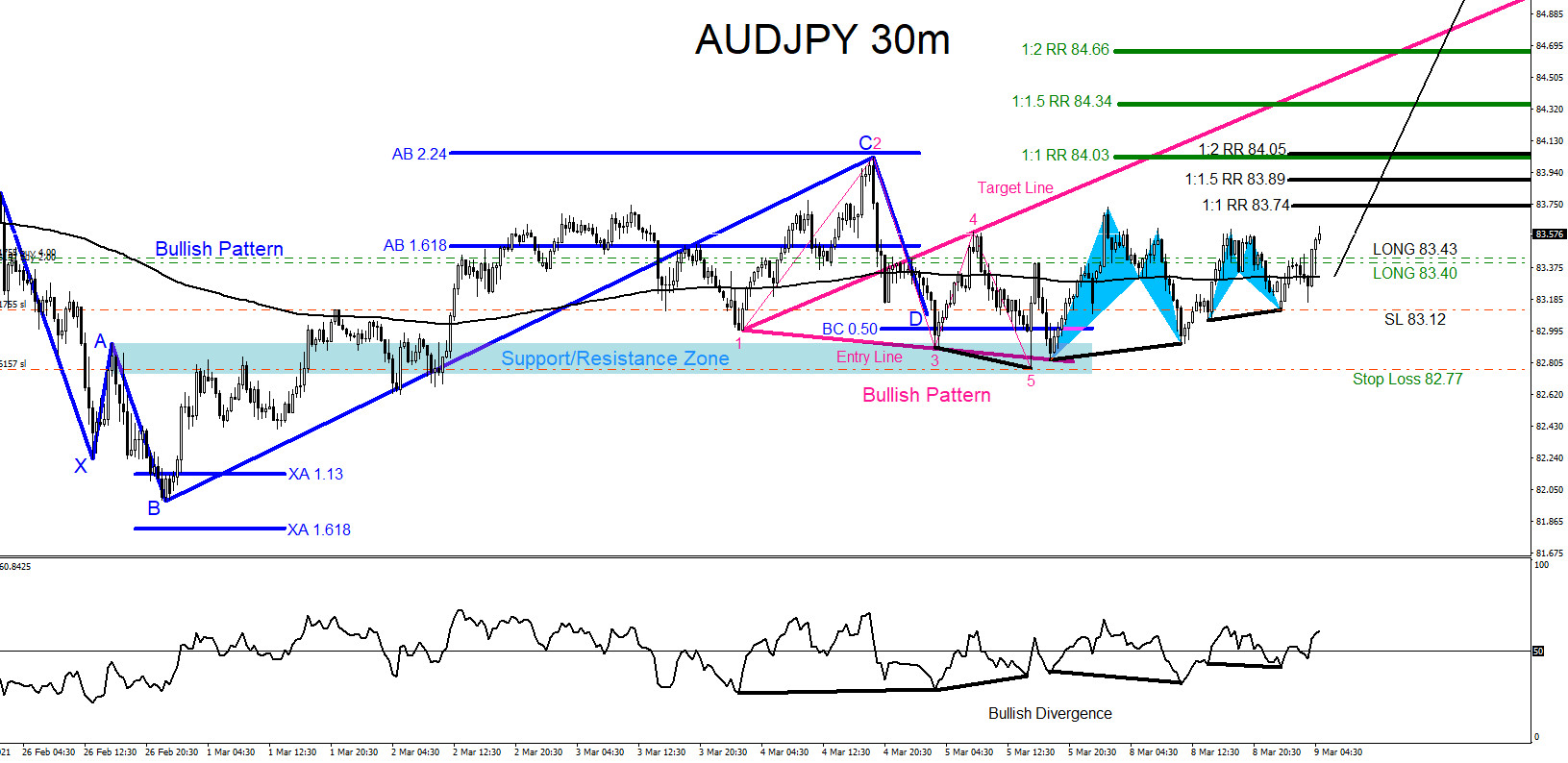

AUDJPY : Bullish Market Patterns Calling the Move Higher

Read MoreOn March 8 2021 I posted on social media @AidanFX “AUDJPY LONG at 83.40 Stop Loss at 82.77 Target 84.03 – 84.34 area.” and “AUDJPY 2nd LONG at 83.43 Stop Loss at 83.12 Target 83.74 – 84.03 area.” The chart below was also posted on social media @AidanFX March 8 2021 showing several clear […]

-

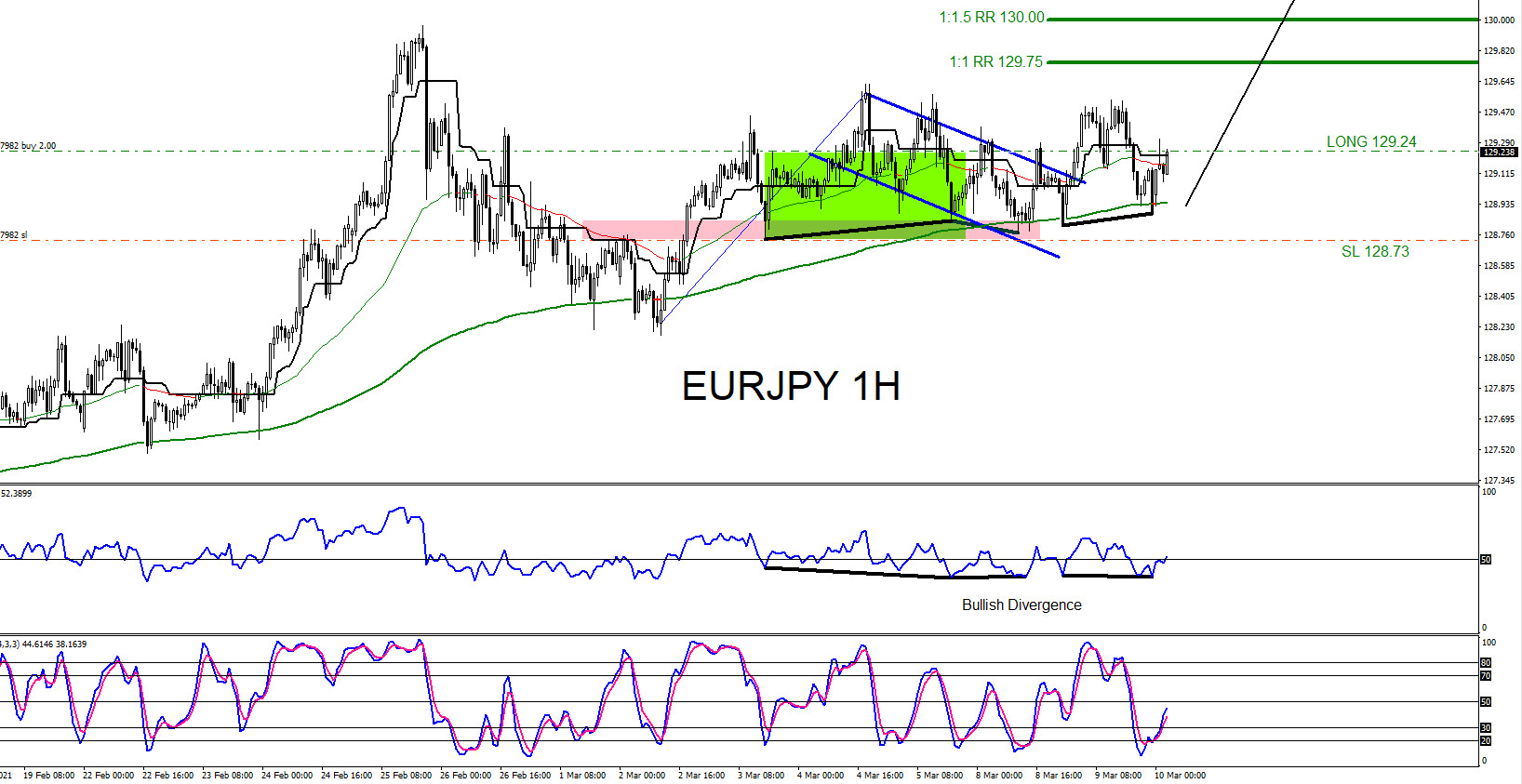

EURJPY : Catching the Move Higher

Read MoreOn March 9 2021 I posted on social media @AidanFX “EURJPY LONG at 109.24 Stop Loss at 128.73 Target 129.75 – 130.00 area.” The chart below was also posted on social media @AidanFX March 9 2021 showing several clear bullish market patterns. The first sign that signalled a trader to watch for BUYING opportunities was […]

-

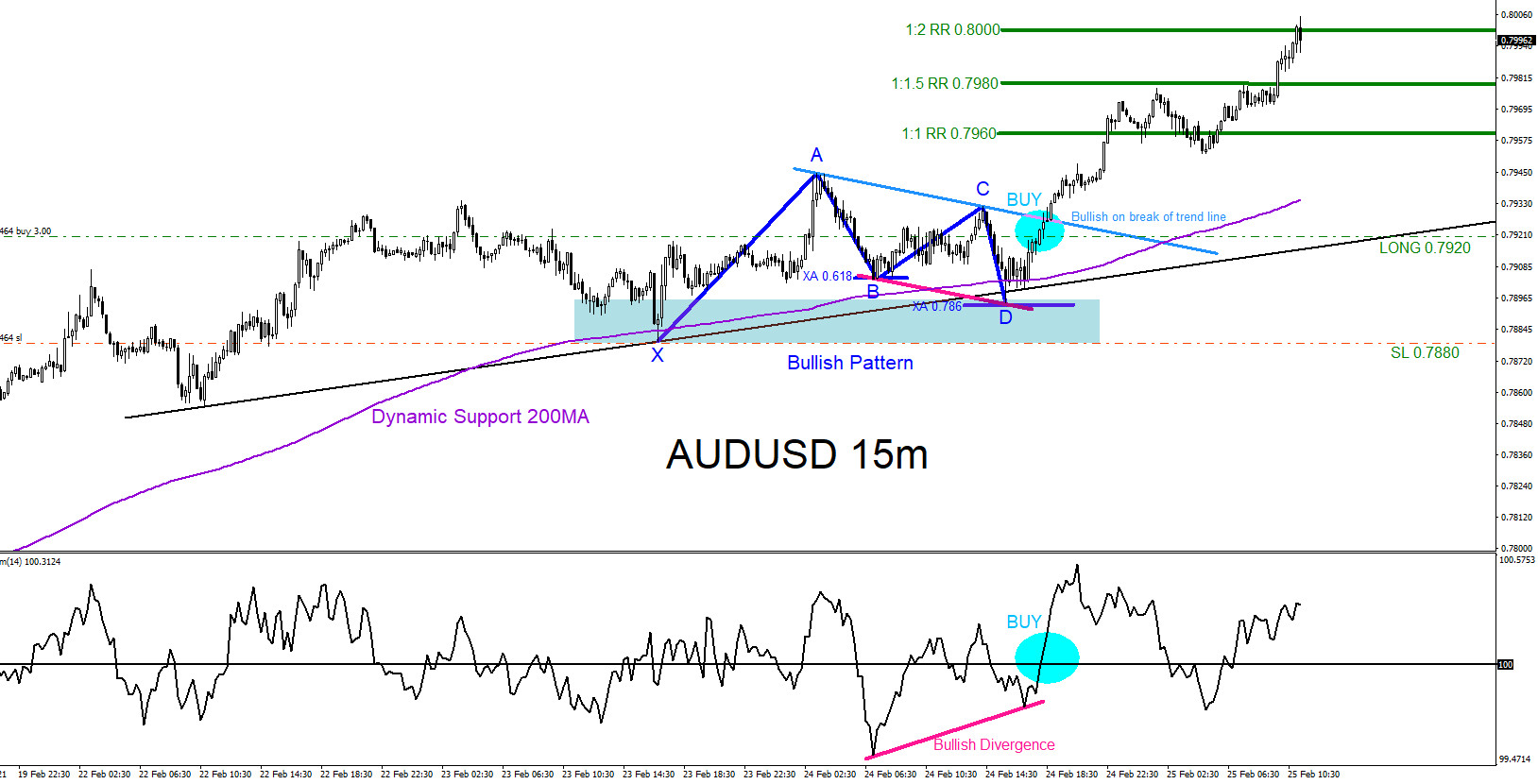

AUDUSD : Trading the Move Higher

Read MoreOn February 24 2021 AUDUSD was showing bullish market patterns that was signalling traders that there was a high probability that the pair would make a move higher. The pair has been trending higher since the March 2020 bottom low and we at EWF always advise our members to trade with the trend and not against […]

-

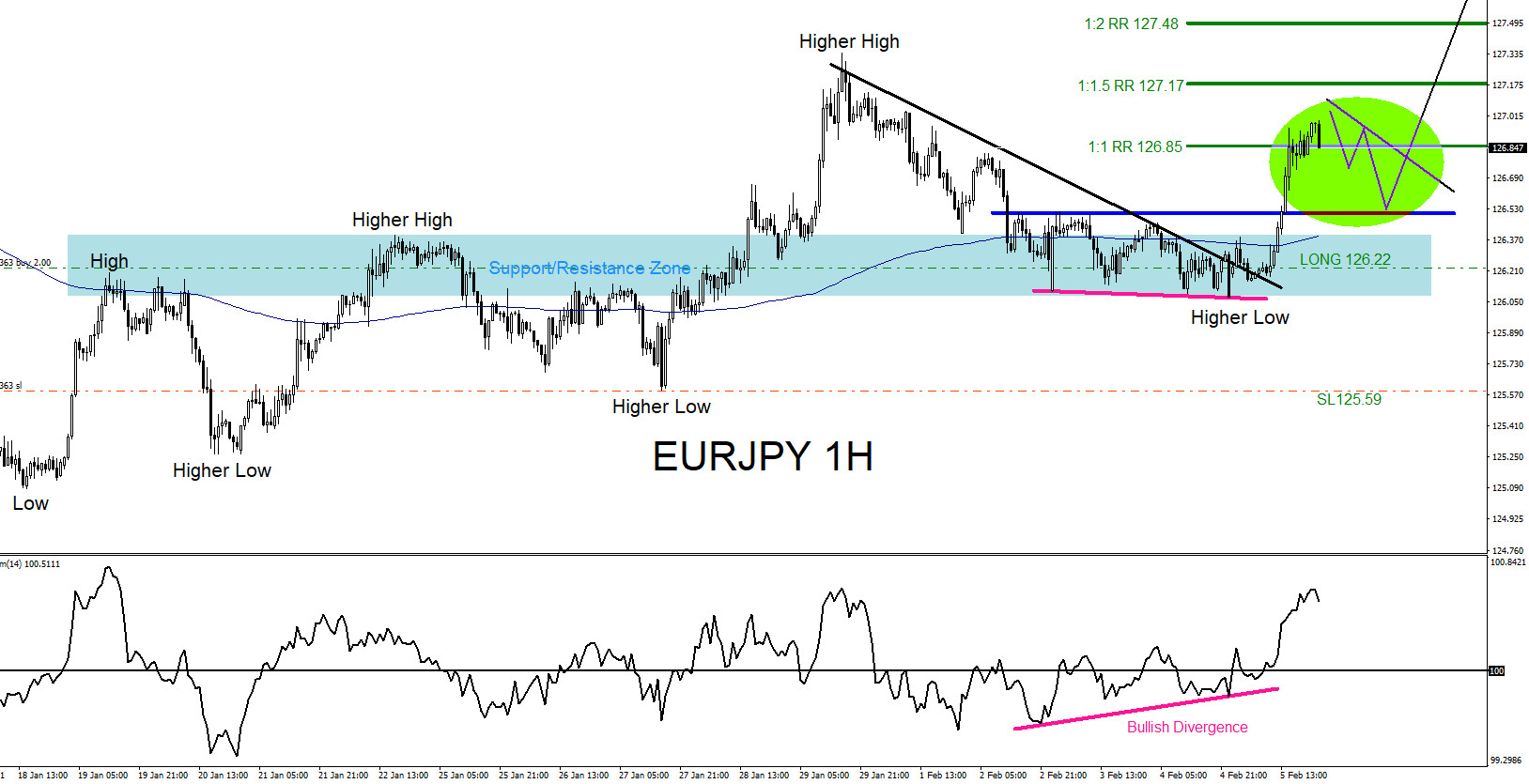

EURJPY : Rallied Higher as Expected

Read MoreOn February 7/2021 I published an article calling for EURJPY to advance higher -> EURJPY : Expecting More Upside . In that article I explained why I entered the first BUY entry (green) at 126.22. In that same article I posted a second trade setup calling for another rally higher once we see a pullback towards […]