-

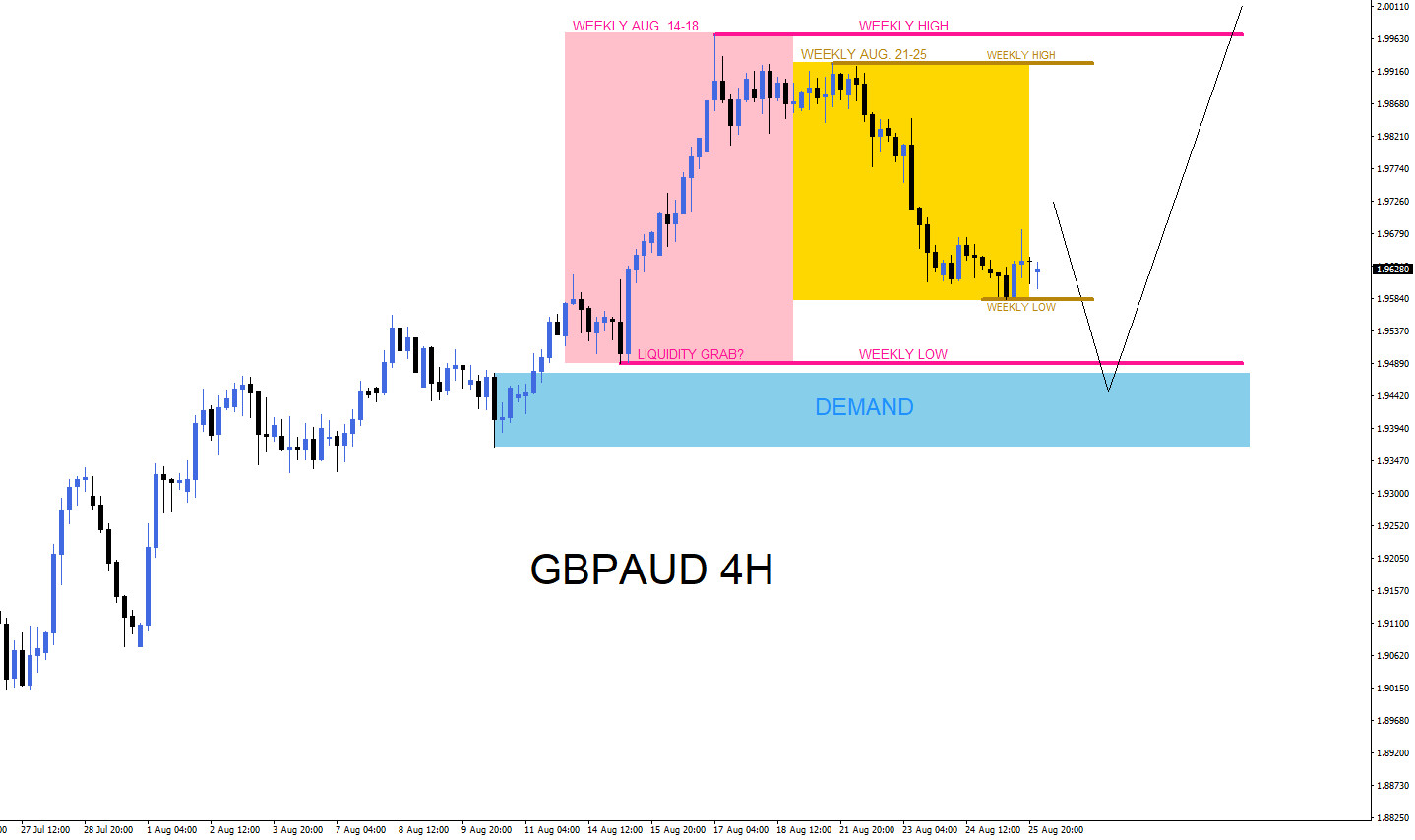

GBPAUD : Watch for Buying Opportunities

Read MoreThe GBPAUD pair is on a clear uptrend making higher highs and higher lows on the 4 hour time frame. Currently price is trading in the August 14th to 18th Weekly candle range (Pink). We, at EWF, always encourage our members to trade with the trend and not against it. In the chart below there […]

-

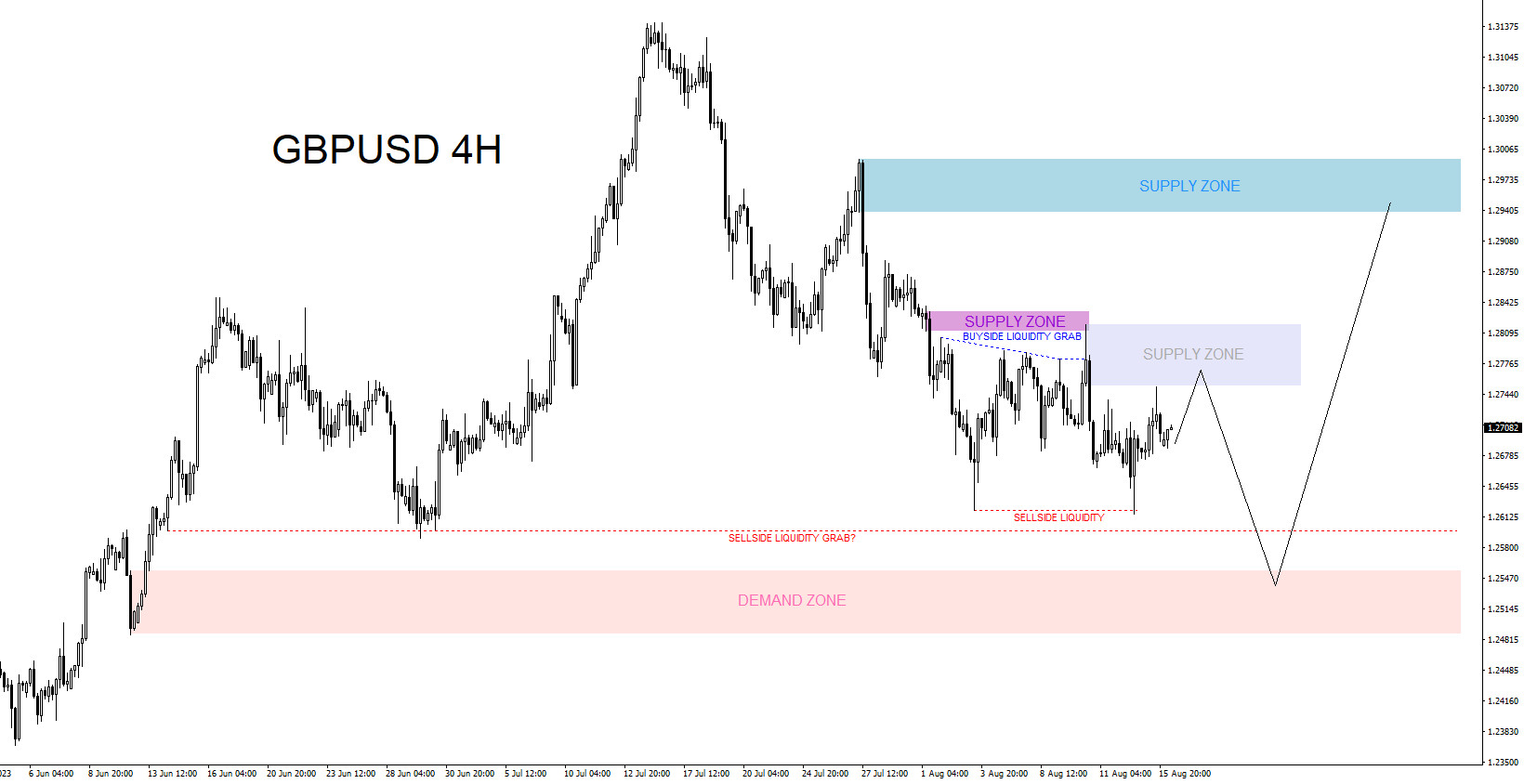

GBPUSD : Trading Zones

Read MoreAt the moment GBPUSD is currently pushing lower from the July 2023 high. Looking at the 4 hour chart below we could expect for the pair to continue pushing lower towards the demand zone (pink), but before a move lower watch for selling opportunities in the supply zone (grey) for the pair to find more […]

-

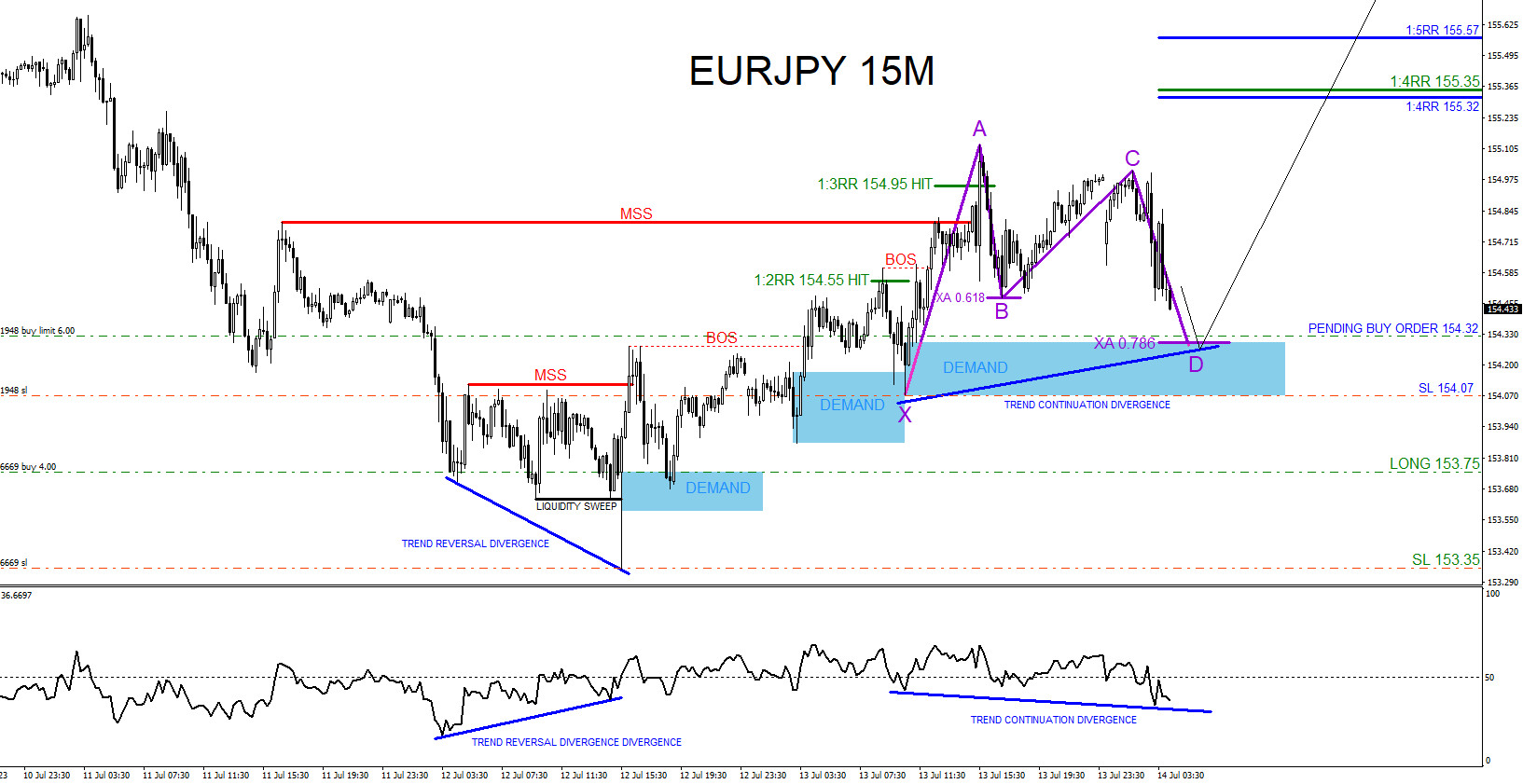

EURJPY : 2 Buy Trades Hits Targets

Read MoreOn July 12 and 13 2023, I posted 2 separate EURJPY buy trade setups on social media @AidanFX . July 12 2023 1st BUY entry (Green) “LONG/BUY EURJPY at 153.75 Stop Loss at 153.35 Target at 154.55 (1:2RR) 154.95 (1:3RR)” and July 13 2023 2nd BUY entry (Blue) “LONG/BUY EURJPY at 154.32 Stop Loss at […]

-

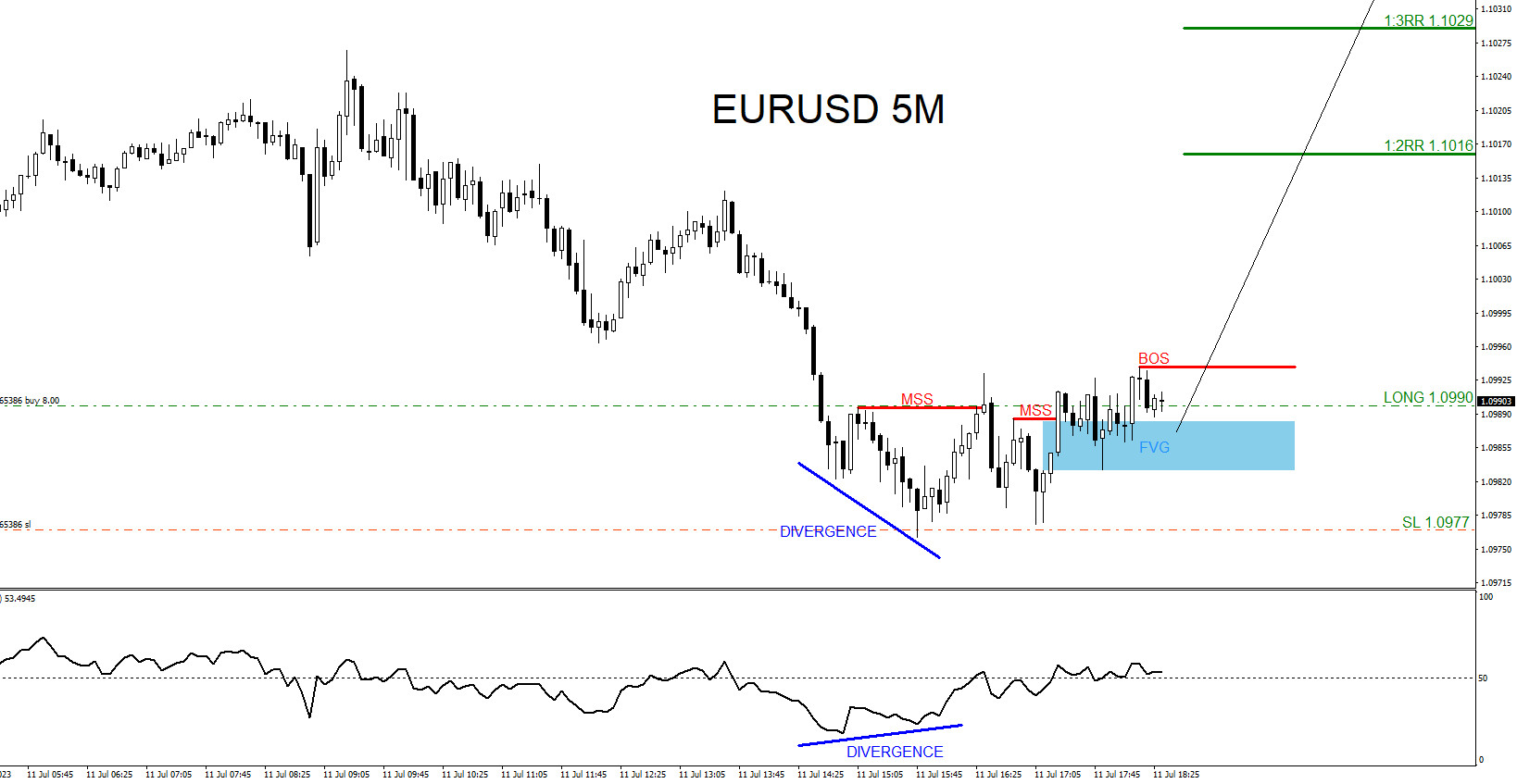

EURUSD : Buy Trade Hits Targets

Read MoreOn July 11 2023 I posted on social media @AidanFX ” LONG/BUY EURUSD at 1.0990 Stop Loss at 1.0977 Target 1.1016 – 1.1029 area.” BUY Trade Setup 1. RSI indicator and price form a bullish trend continuation divergence pattern. (Blue Line) 2. Price breaks above internal structure lower high (Red Line) signalling bearish weakness and […]

-

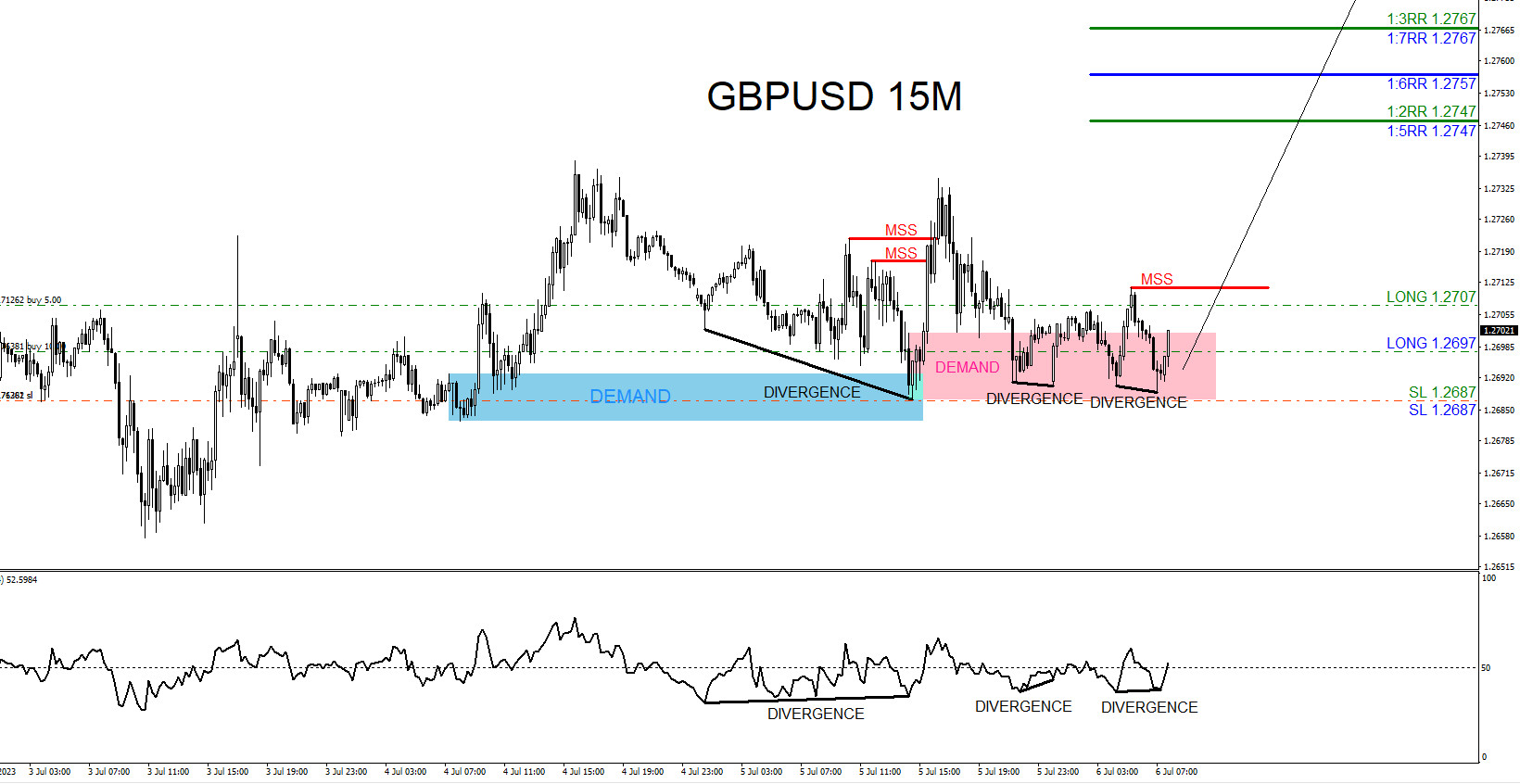

GBPUSD : 2 Buy Trades Hits Targets

Read MoreOn July 5th and 6th I posted 2 separate buy trade setups on social media @AidanFX “LONG/BUY GBPUSD at 1.2707 Stop Loss at 1.2687 Target at 1.2747 (1:2RR) 1.2767 (1:3RR)” and “Added 2nd LONG/BUY GBPUSD at 1.2697 Stop Loss at 1.2687 Target at 1.2747 (1:5RR).” Trades were taken based on demand zones, market structure and the […]

-

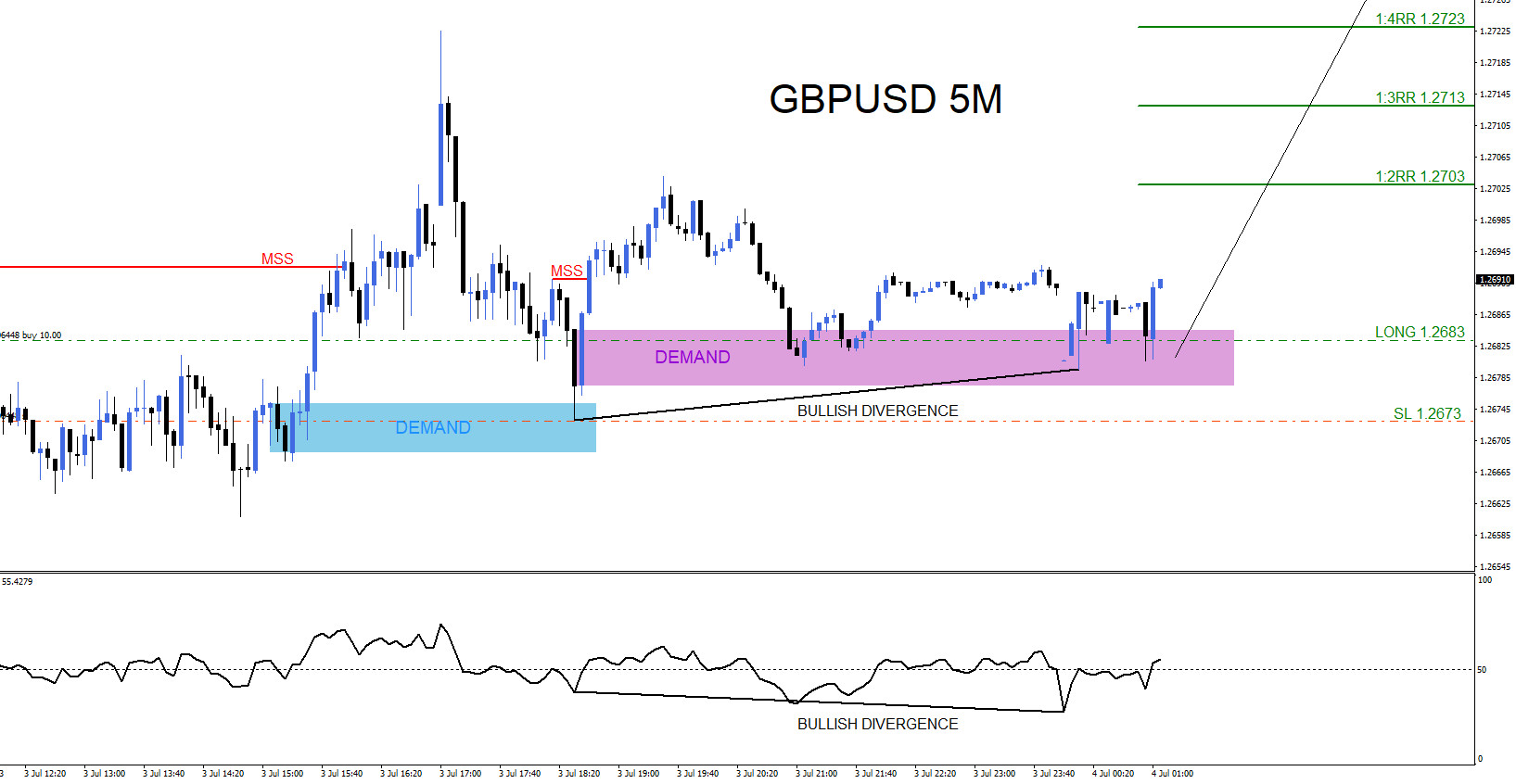

GBPUSD : Catching the Move Higher

Read MoreOn July 3 2023 I posted on social media @AidanFX ” LONG/BUY GBPUSD at 1.2683 Stop Loss at 1.2673 Target 1.2703 – 1.2713 area.” BUY Trade Setup 1. RSI indicator and price form a bullish trend continuation divergence pattern. (Black Line) 2. Price breaks above internal structure lower high (Red Line) signalling bearish weakness and […]