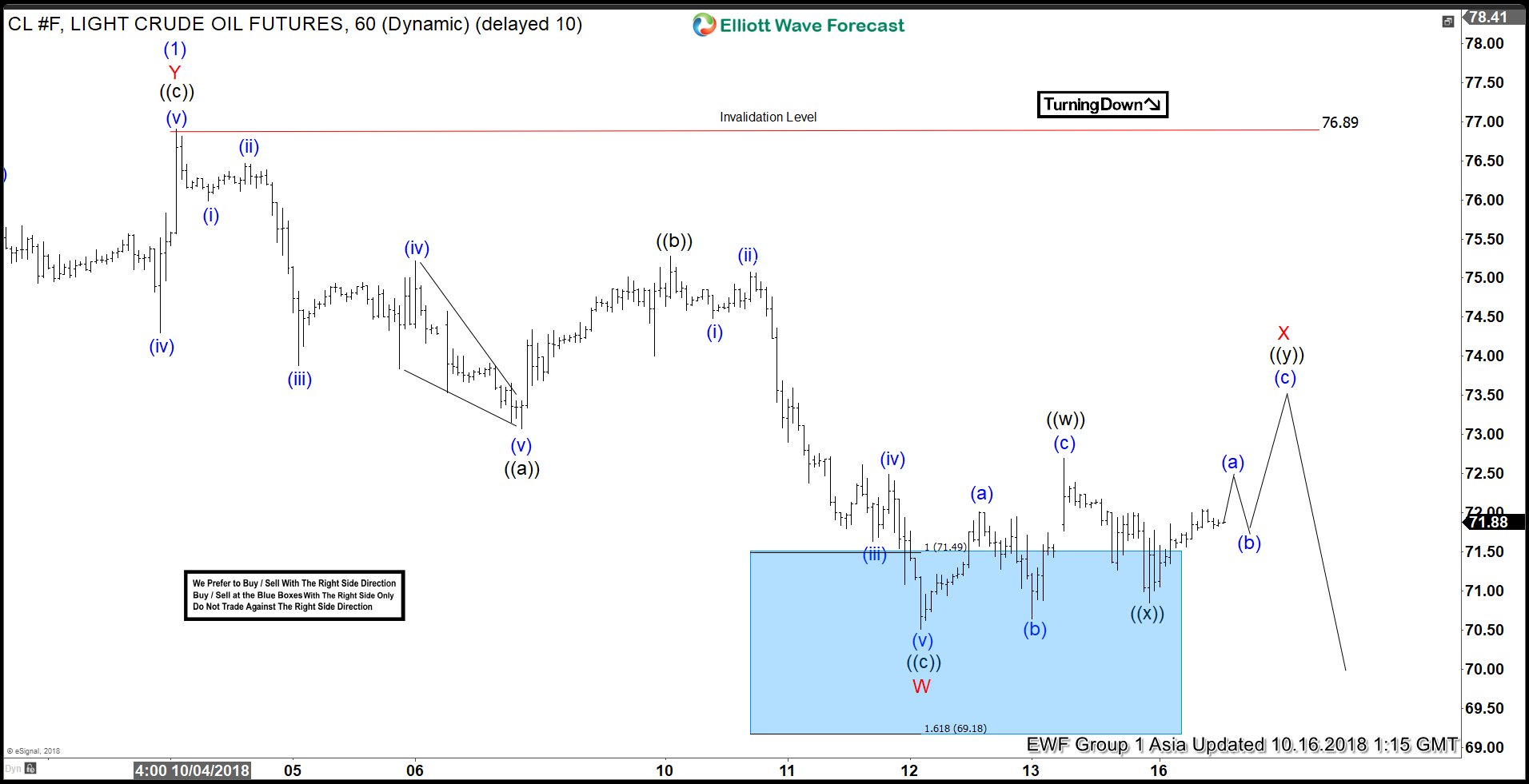

OIL ticker symbol $CL_F short-term Elliott wave view suggests that a rally to 76.89 high ended the cycle from 8/15/2018 low in intermediate wave (1). The internals of that rally higher unfolded in a corrective structure thus suggests the instrument can be doing ending diagonal structure in primary wave ((5)) higher. Down from there, intermediate wave (2) pullback remain in progress in 3, 7 or 11 swings to correct 8/15 cycle before upside renew.

Below from 76.89 high, the OIL declined lower in 3 swings & ended Minor wave W at 70.50 low, after reaching the blue box area at 71.49-69.18 area. The internals of that decline unfolded as a zigzag structure where Minute wave ((a)) ended in 5 waves at 73.08. A bounce to 75.25 high ended Minute wave ((b)) and Minute wave ((c)) completed at 70.50 low. Up from there, Minor wave X remain in progress to correct the cycle from 76.89 high as double three before another leg lower in Minor wave Y of (2) is seen. We don’t like selling the instrument and expect buyers to appear later on when it reaches the 100%-123.6% Fibonacci extension area of Minor wave W-X.