In this blog, we will have a look at some Elliott Wave charts of Bitcoin which we presented to our members in the past. Below, you can find the 4-hour updated chart presented to our members on the 06/17/18.

Bitcoin ended the cycle from 02/20/18 peak (11751.36) at the low of 04/01/18 (6419.51) in black wave ((W)). Up from there, it ended the correction to that cycle at the peak of 05/05/18 (9956.99) in black wave ((X)). Below from there, it ended the cycle from 05/05/18 peak (9956.99) as a Zigzag structure at 06/29/18 low (7018.16) in blue wave (W). Up from there, it ended blue wave (X) correction at 06/03/18 (7794.69). Below from there, it ended internal black wave ((i)) at 06/05/18 low (7350.11), black wave ((ii)) at 06/07/18 peak (7747.27) and black wave ((iii)) at 06/10/18 low (6609.15). Up from there, it ended black wave ((iv)) at 06/11/18 peak (6917.39) followed by another extension lower in black wave ((v)) to complete a 5 waves impulsive structure in red wave A. Up from there, it already ended the correction from the cycle of 06/03/18 peak in red wave B.

Bitcoin 06.17.2018 1 Hour Chart Elliott Wave Analysis

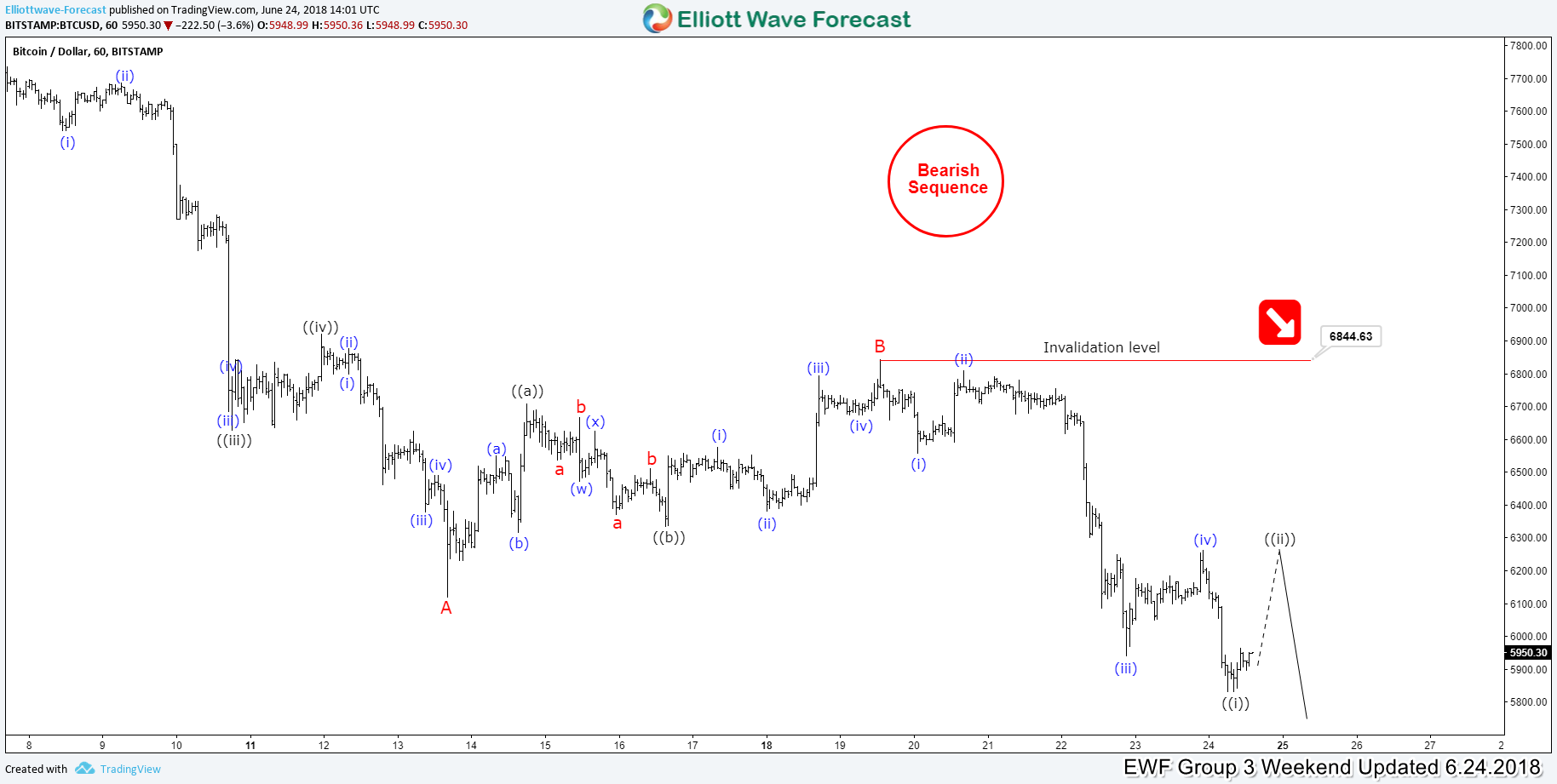

In the last weekend Elliott Wave chart, you can see that the instrument broke already to new lows below red wave A. From the equal legs area from 06/13 low, the crypto pair continued the weakness to the downside. Targeting, now the equal legs area from red wave A-B (5179.49-4788.72). Which is the cycle from 06/03 peak. As long as pullbacks fail below 6844.63. And more importantly, the pivot at 6844.63 holds in our distribution system. We expect bitcoin to continue lower. We don’t like buying it as of now and prefer the downside because of its bearish 1-hour sequence.

Bitcoin 06.24.2018 1 Hour Elliott Wave Chart

I hope you enjoyed this blog and I wish you all good trades and if you interested in learning more about our unique blue box areas and also want to trade profitably. You can join us now for a 2 for 1 promo. Get 2 month for the price of 1 on all plans. Limited time only!

We believe in cycles, distribution, and many other tools in addition to the classic or new Elliott Wave Principle.

Back