Elliott Wave FLAT structure is one of the most common corrective patterns nowadays, after Double Three WXY. As you might already know, there are 3 types of Flats: Regular,Running and Expanded. In todays lesson, we’re going to explain Expanded flat pattern. Before we continue, short reminder: check out New EWF blogs and Free Elliott Wave charts.

Expanded Flat is a 3 wave pattern which inner subdivision is labeled as A,B,C. Waves A and B have forms of corrective structures like zigzag, flat, double three, triple three and so on… Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern.

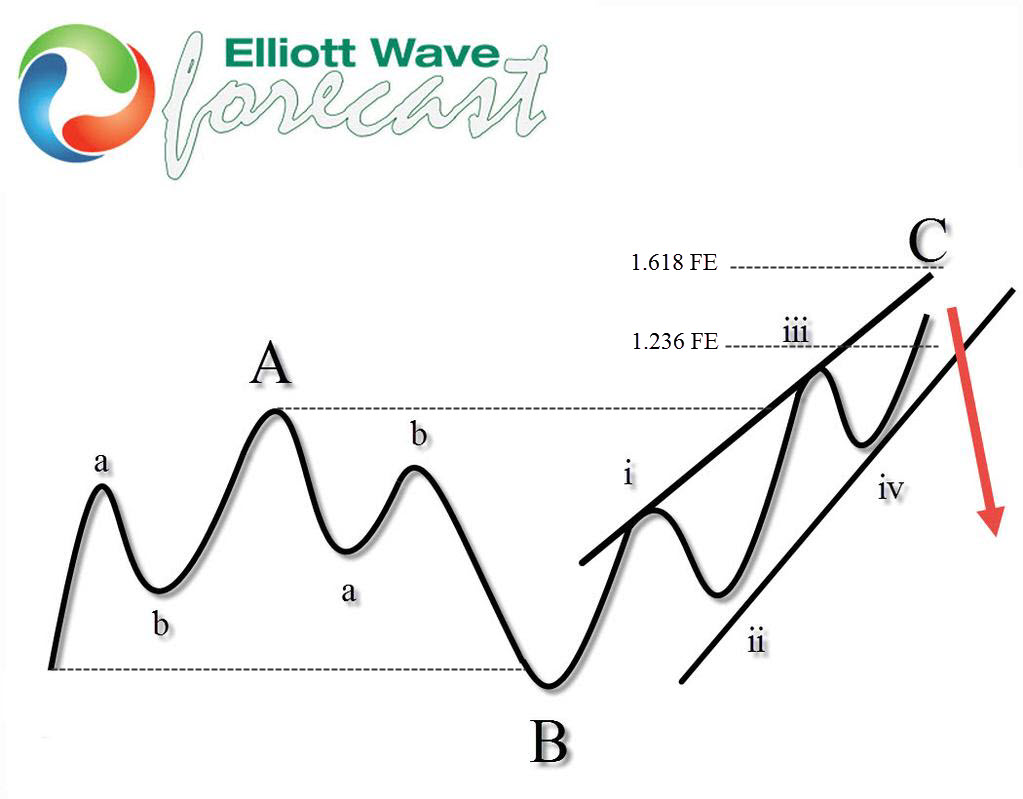

At the graphic below, we can see what Expanded Flat structure looks like.

Inner structure has ABC labeling, where wave B completes below the start point of wave A, and wave C ends above the end point of wave A which makes it Expanded. It’s useful to remember that wave C of expanded flat usually completes at 1.236-1.618 fibonacci extension A related to B.

In theory pattern looks clear, but sometimes it could be tricky to find it in the real market. Let’s take a look what real example looks like

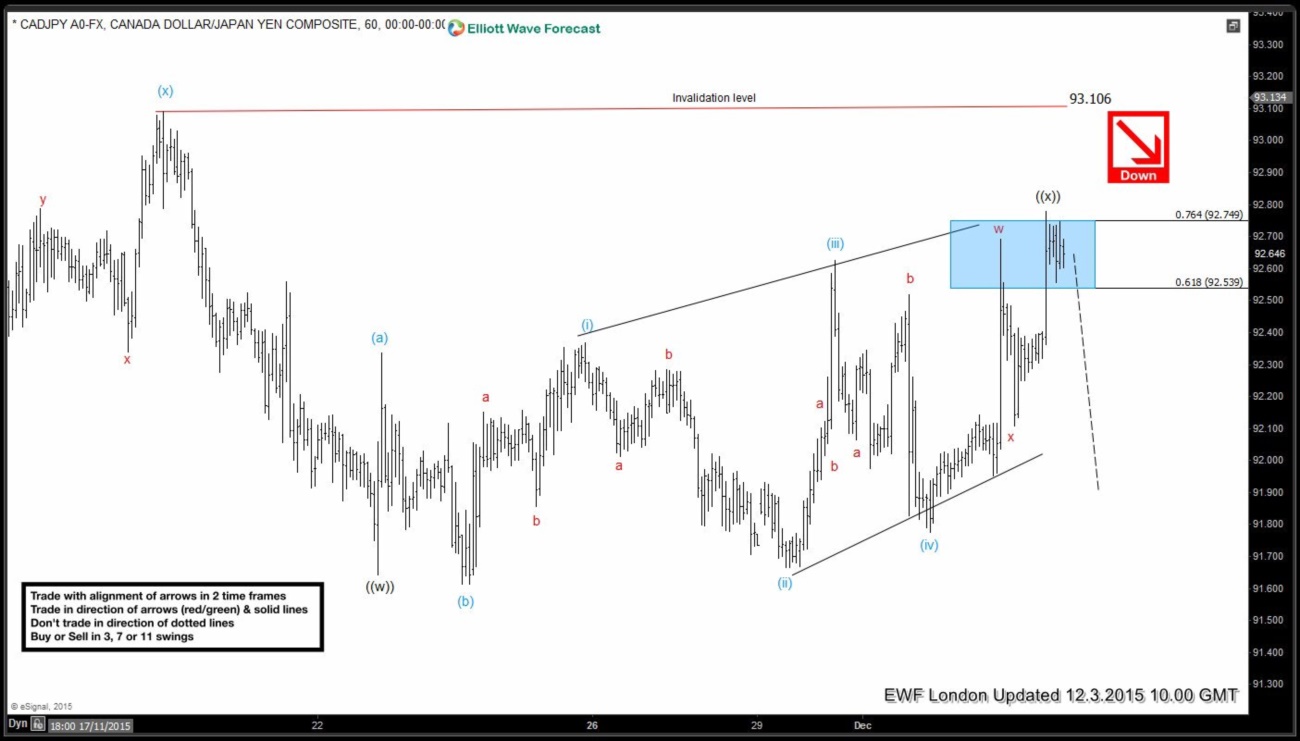

$CADJPY 12.03.2015 London Update The best reading of the cycles suggests that pair ended wave ((x)) recovery as Expanded Flat Structure at 92.77 high. While below that high and more importantly while below 93.16 high, further decline is expected.

If you pay attention to labeling, you will see that all conditions are there. Wave (b) completed below the start point of wave (a), and wave (C),completed above the end point of wave (a). Wave (c) has the form of ending diagonal and it has reached 1.236-1.618 fib extension area of (a)-(b) and 61.8-76.4 fibs retracement zone of previous cycle as well.

Proper Elliott Wave counting is crucial in order to be a successful trader. If you want to learn more on how to implement Elliott Wave Theory in your trading, feel free to join us. You will get access to Professional Elliott Wave analysis in 4 different time frames,2 live webinars by our expert analysts every day, 24 hour chat room support, market overview, daily and weekly technical videos and much more…

If you are not member yet, use this opportunity and sign up now to get your Free 14 days Premium Plus Trial.

Welcome to Elliott Wave Forecast !

Back