In the video seminar below, we talk about what trading really is and how to do a proper risk management. Below is an excerpt of the video from the opening. You can skip to the video directly if you want to watch the seminar.

Excerpt of the Seminar

Trading is not about being right or wrong, but it’s about seeing the market in probabilities. Trading is a combination of several factors. It is putting one’s hard earned money in the market at the risk of losing it. The trade should take place under circumstances where one has an edge. Traders need to do this under condition of strict risk & money management rules. Trading is not a quick get-rich scheme. Rather, it is about mastering the technique to preserve one’s capital. When one learns how to manage the risk and preserve capital, profit will come naturally. The holy grail in trading is a combination of Trading system that provides an edge, Risk Management and Proper psychology.

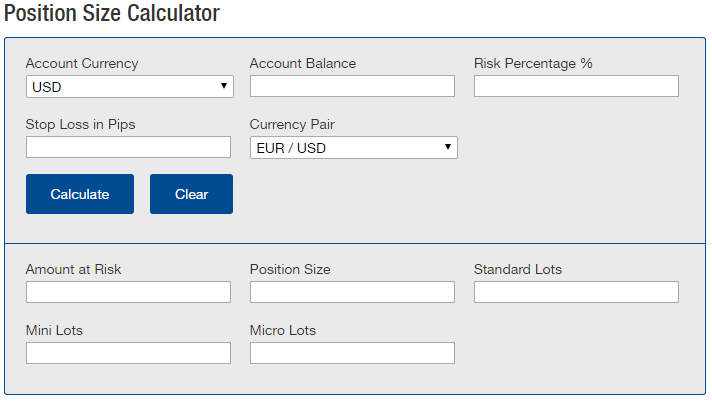

A trader is a risk manager. His / Her job is to protect capital and manage the trading risks. In trading, losses are part of business and thus is a cost of doing business. A business will always have revenues and costs, but as long as the revenue is larger than the cost, then at the end of the day it is still profitable. Trading result depends on a long term series of trades, not a trade by trade basis. New traders ignore risk management due to the unwillingness to take losses, as well as hoping that things get better or positions go back to break even. The number one reason for failure of many trader is poor risk management and inappropriate position size (overleveraging).

Risk Management Technique Seminar Recording

To learn more about how we manage risk at EWF and to learn our trading technique of 3, 7 or 11 swings, sign up for a Free 14 day Trial. At EWF, we cover 52 instrument in different asset classes from forex, commodities, and indices. We provide Elliottwave forecast in 4 different time frames, Live Trading Room, 24 hour chat room, live sessions, and much more.

Back