We issued a sell order in $NZDJPY on April 12, 2018 at market price 79.05 due to the 5 swing bearish sequence from 7.27.2017 high, which favors more downside towards 71.83 – 73.67 area. The 5 swing sequence is part of the 7 swing double three Elliott Wave structure, or also called WXY. Below is the Live Trading Room video clip where we explained the setup and the logic of the trade

Below is the setup that we presented in the trading journal to sell NZDJPY at 79.05, with stop loss at 81, and target 73.8 for a risk to reward ratio of 2.7

NZDJPY Daily Chart 4.12.2018

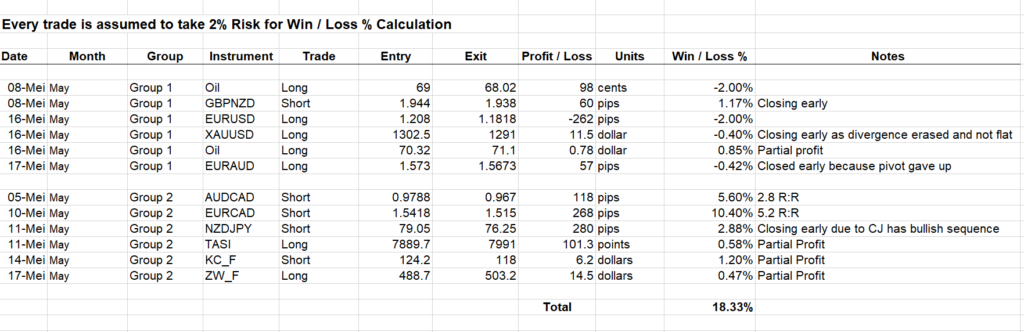

The Daily chart on April 12 is showing that pair has 5 swing bearish sequence from red W high at 7.27.2017. Currently the pair is bouncing in wave (X) as a FLAT Elliott Wave structure and as far as the rally stays below the trend line, it has scope to extend lower. We closed the short position manually at 76.25 on May 11, 2018 for 280 pips and 2.88% profit. Below is the latest Live Trading Room result for the month of May for Group 1 and 2

If you’d like to get more trading ideas like this, Join us in Live Trading Room everyday to get the best trading idea using our unique trading system of 3-7-11 swing. Live Trading Room Group 1 starts at 7 AM EST / 11 AM GMT. Live Trading Room Group 2 starts at 8 AM EST / 12 PM GMT. You can also take 14 days FREE TRIAL without commitment and check our service completely FREE. In addition to Live Trading Room, you will get access to Elliott wave charts in 4 time frames, live sessions, 24 hour chat room, and much more.

Back