Gold Miners Junior (ticker: GDXJ) formed a base at 25.98 on 9.26.2022. From there, the ETF continues to rally for more than 1 year before ending the cycle recently at 41.20. The ETF now is looking to do larger degree correction to cycle from 9.26.2022 low before the next leg higher. Below we will look at the Elliott Wave Count for the ETF in multiple time frames.

GDXJ Monthly Elliott Wave View

Monthly Elliott Wave chart of GDXJ above suggests the decline to 16.14 ended either wave ((II)) or ((b)). The ETF has started a new bullish leg higher in the form of a nest. Up from wave 16.14 low, wave (I) ended at 52.5 and pullback in wave (II) ended at 19.52. The ETF resumes higher again in wave (III). Up from wave (II), wave I ended at 65.95, and pullback in wave II ended at 25.80. As far as the ETF stays above 16.14, expect it to extend higher.

GDXJ Daily Elliott Wave View

Daily Elliott Wave Chart of GDXJ above shows that the ETF ended wave II at 25.80 on September 26, 2022 low. From there, it has resumed higher in wave III. Up from wave II, wave ((1)) ended at 41.16. Wave ((2)) dips is now in progress in 3, 7, or 11 swing to correct cycle from 9.26.2022 low before the rally resumes While dips stay above 25.80, and more importantly above 19.40, expect the ETF to extend higher.

Daily Elliott Wave Chart of GDXJ above shows that the ETF ended wave II at 25.80 on September 26, 2022 low. From there, it has resumed higher in wave III. Up from wave II, wave ((1)) ended at 41.16. Wave ((2)) dips is now in progress in 3, 7, or 11 swing to correct cycle from 9.26.2022 low before the rally resumes While dips stay above 25.80, and more importantly above 19.40, expect the ETF to extend higher.

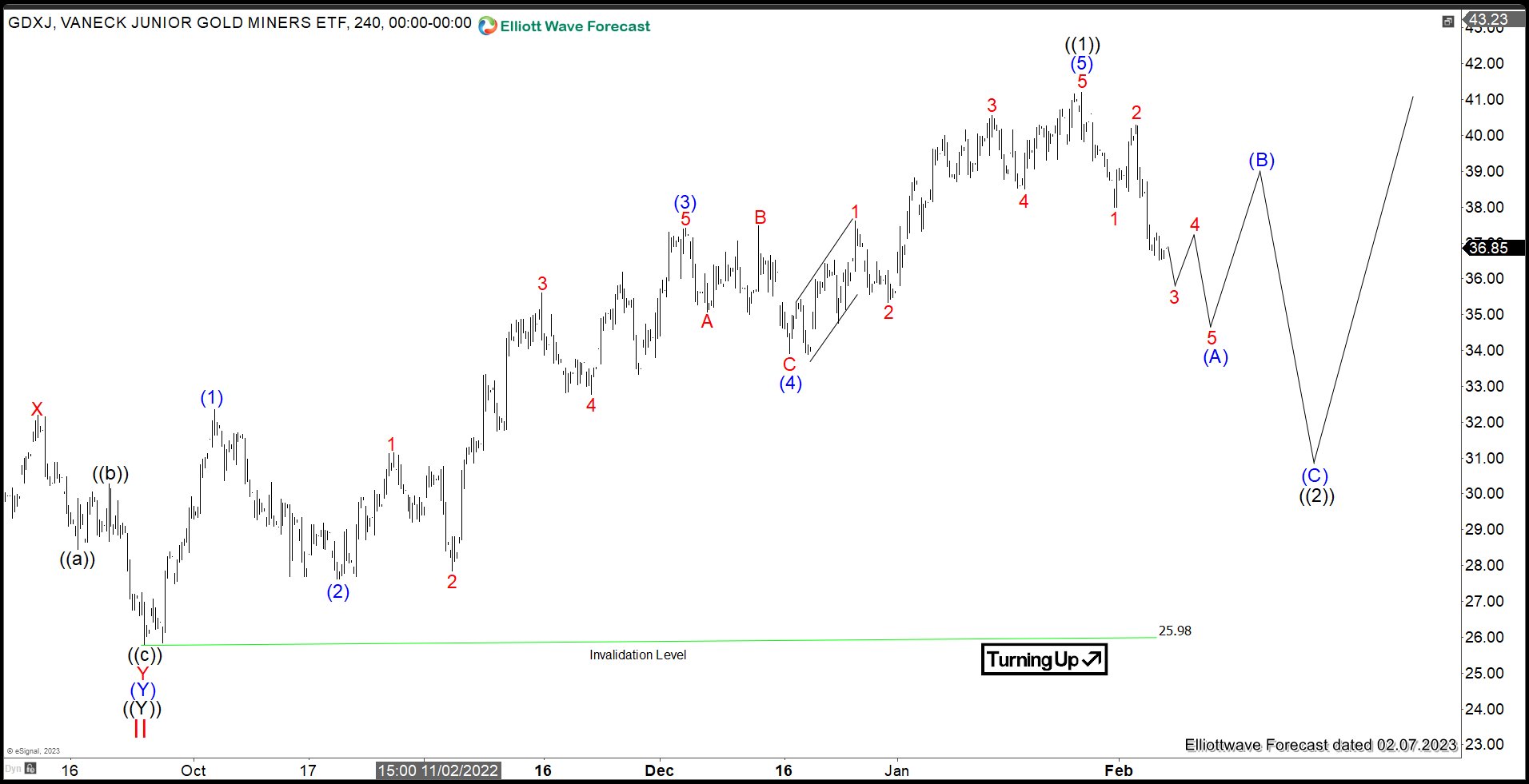

GDXJ 4 Hour Elliott Wave View

4 Hour Elliott Wave chart of GDXJ above shows the ETF ended cycle from 9.26.2022 low. Up from 9.26.2022 low, wave (1) ended at 32.34 and pullback in wave (2) ended at 27.63. The ETF extended higher in wave (3) towards 37.41, and pullback in wave (4) ended at 33.92. Final leg higher wave (5) ended at 41.20 which completed wave ((1)). Pullback in wave ((2)) is now in progress to correct cycle from 9.26.2022 low in 3, 7, or 11 swing before the rally resumes.

GDXJ Video

We do not cover GDXJ as part of our regular service, but we cover GDX, Gold, and other commodities, stocks, forex, and crypto currencies. If you’d like to check our service, you can take our 14 days trial here –> 14 days Trial

Back