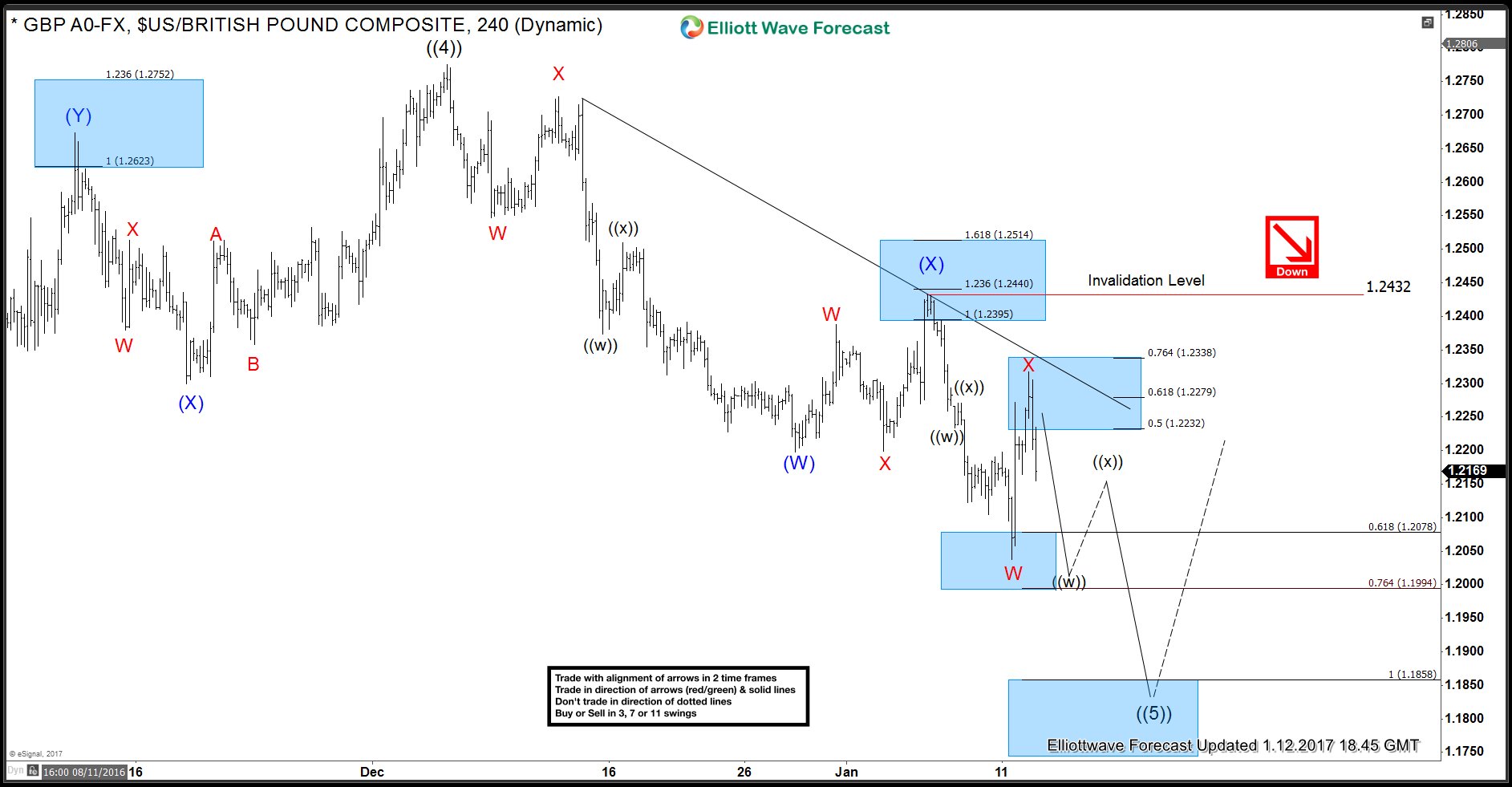

GBPUSD preferred Elliott wave structure suggests pair is in an Ending Diagonal structure where wave ((4)) completed on 12/6 at 1.2775. Each sub-wave of a diagonal pattern sub-divides in 3, 7 or 11 swings. As the chart below shows, wave (W) of ((5)) completed at 1.2198 followed by a 3 wave bounce to 1.2432 which completed wave (X). This bounce failed in 100 – 123.6% extension area of W-X (1.2390 – 1.2435) and offered a selling opportunity there. Pair has since broken below 1.2198 low and is now showing 5 swings down from wave ((4)) high. 5 swings is an incomplete sequence and should result in a bounce and another swing lower to complete 7 swings Elliott wave sequence. That’s why we expected the bounce which started on 11 January 2017 to fail in 3, 7 or 11 swings and turn lower again. As far as (X) high remains in place, we expect the pair to continue lower towards 1.1856 – 1.1720 area to complete 7 swings sequence from 1.2775 peak and then it would have scope to start a larger 3 wave bounce.

GBPUSD Video

GBPUSD 4 Hour chart

GBPUSD 4 hour chart showing the structure and downside target to complete 7 swings which lies between 1.1856 -1.1720 area. Only a break above 1.2432 (X) high would negate the push lower and this structure.

For more free articles, videos, trading ideas and education, feel free to browse our website and take our Free 14 Day Trial (available to new members only) and get forecasts for 52 instruments including Forex, Commodities and Indices. If you wish to speed up your learning curve, visit our Educational Services page.

Back