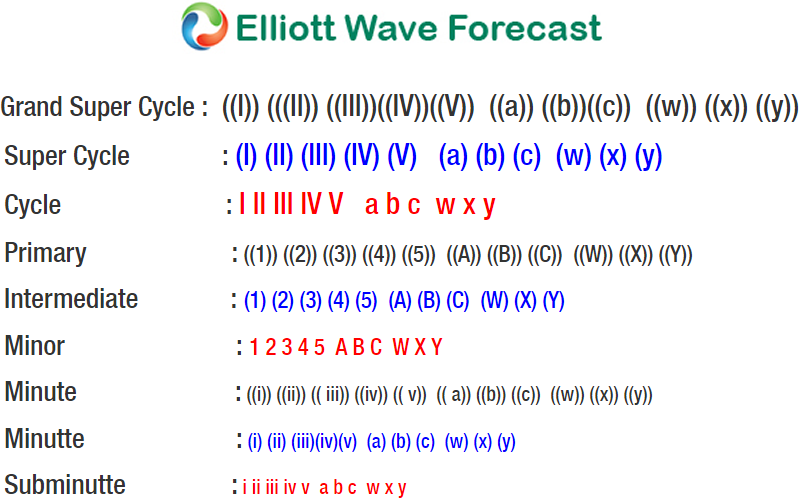

The move higher in DAX from 3/22 low is proposed to be unfolding as a zigzag Elliott Wave structure where the first leg Minutte wave (a) is subdivided in a 5 waves impulse Elliottwave structure and the third leg wave (c) is also subdivided into a 5 waves impulse Elliottwave structure. It’s not a good time to chase long in the Index at this stage as Index has reached short term inflection area where cycle from 3/22 low can end and a 3 waves pullback at minimum can be seen.

Watch the video below to learn more about our analysis

DAX Shot-term Elliott Wave Path Video

DAX Short term Elliott Wave Chart

Short term view of DAX suggests move from 3/22 low is unfolding as a zigzag Elliott Wave structure where Minutte wave (a) ended at 12130.5, Minutte wave (b) ended at 11942.5, and Minutte wave (c) of ((w)) is expected to complete at 12255 – 12351 area, which is the 1.236 – 1.618 extension area of Minutte wave (a) and (b). Expect the Index to pullback from this area in 3, 7, or 11 swing within Minute wave ((x)) pullback before the rally resumes to a new high. Chasing long in the Index is not a good idea at this stage as pair has reached the 100% area in 3 swing.

There are two other possible scenario with DAX. Another scenario is the move from 3/22 low is unfolding as an Impulse Elliott wave structure instead of a zigzag. This scenario can happen if the current move higher gets extended to 1.618 extension (12251). In this case, we can label the move to 12130.5 as Minutte wave (i), the pullback to 11942.5 can be labelled as Minutte wave (ii) and the move higher to 12251 (at least) can be counted as Minutte wave (iii). In an impulse scenario, the Index should pullback in Minutte wave (iv) then extend higher again one more leg before finishing Minutte wave (v) and ending cycle from 3/22 low.

The other scenario is the more bearish one which is an Expanded Flat Elliott wave structure starting from 3/16 high. In this scenario, the move lower to 11877.25 on 3/22 low is labelled as Minute ((a)) and the current move higher in 3 waves will end Minute ((b)). If Expanded Flat is in play, then once current rally ends in Minutte wave ((b)), we can see a strong selloff in wave ((c)) which should be subdivided into 5 waves internally and could go below 11877.25.

As the Index continues to make new high, there’s little reason for us to anticipate a Flat against a bullish background. The key takeaway is

- We don’t like selling the Index as the move higher from 3/22 can get extended into an impulse structure rather than a zigzag

- Chasing long here is risky because Index has reached the 100% area in which if the move higher from 3/22 is unfolding as a zigzag, a correction in 3 waves minimum can be seen soon

Traders who intend to buy DAX therefore needs to wait for a 3 waves pullback before looking for an opportunity to join the longside.

Back