Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Soybeans ZS_F , published in members area of the website. As our members know, ZS_F is showing impulsive sequences in the cycle from the April 808’0 low. Consequently we’ve been calling rally in Soybeans. Recently the commodity made pull back that has unfolded as Elliott Wave Zig Zag pattern. In the further text we are going to explain the Elliott Wave Pattern and the trading strategy.

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag pattern.

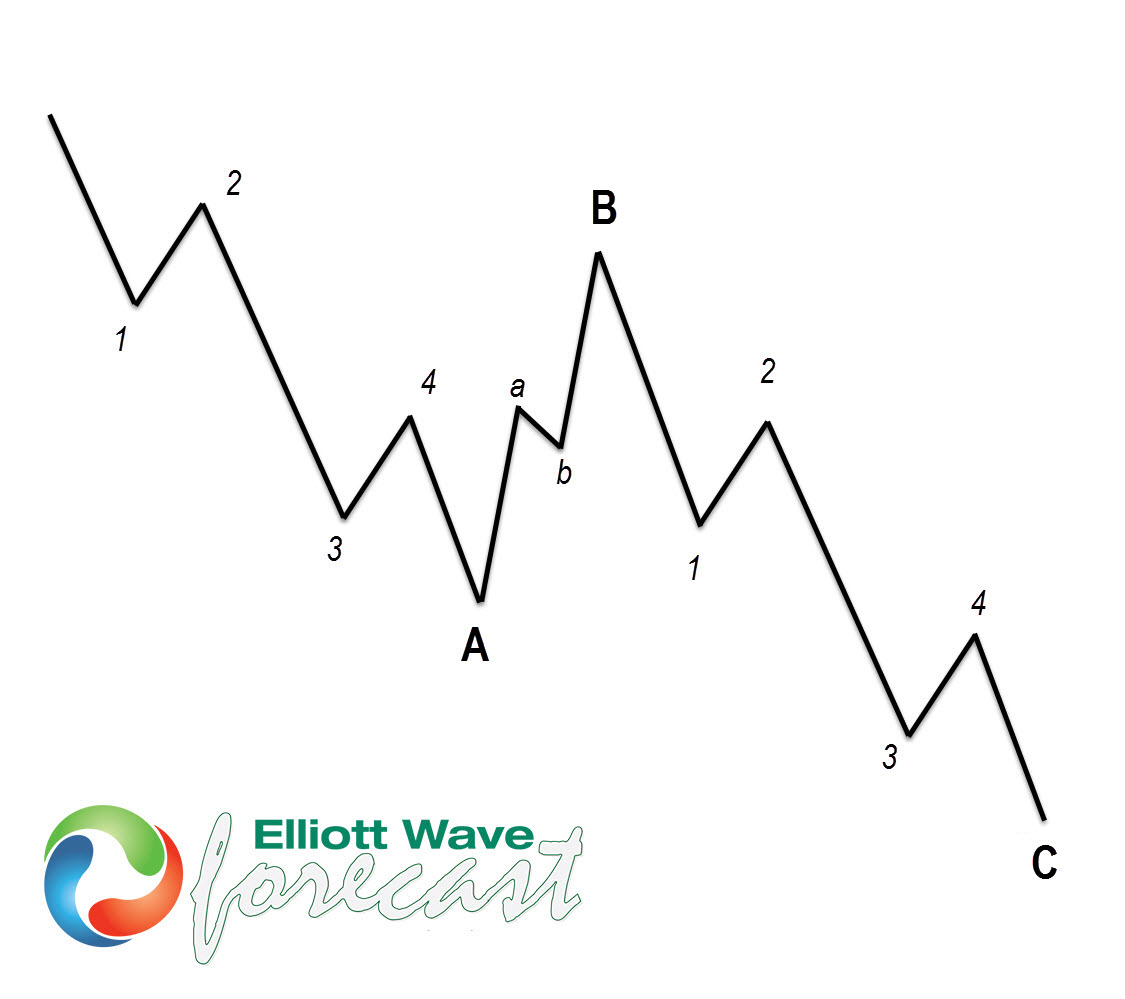

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings which have 5-3-5 inner structure. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions and ideal retracement.

Soybeans ZS_F 1h Hour Elliott Wave Analysis 9.23.2020

Currently we are getting Wave ((iv)) pull back that has form of Elliott Wave Zig Zag pattern. So far we got 5 waves down from the peak, that is labeled as wave (a). Then we got 3 waves bounce in (b) short term recovery and breaks toward new lows. Correction still looks incomplete at the moment, suggesting we can get more short term weakness before rally takes place toward new highs.We expect to see more downside in (c) leg. Proposed extension lower should ideally follow toward 1003’7-983’3 blue box area until it completes 5 waves in (c) leg as well.

We don’t recommend selling the commodity and would like to be buyers at the proposed blue box area. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a bounce.

You can learn more about Elliott Wave Double Three Patterns at our Free Elliott Wave Educational Web Page.

ZS_F 1h Hour Elliott Wave Analysis 10.02.2020

Eventually Soybeans Futures made extension down an found buyers right at the 1003’7-983’3 ( Blue Box area). Pull back ended at the 986’0 low. As far as that pivot holds, wecan see further rally in commodity . We don’t recommend selling and favor the long side from the blue box. As the bounce has already reached 50 fibs against the middle pivot , members who took long positions should be risk free.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences.We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !