The Reality of Market Participation

The Market, as everyone knows, is a combination of buyers and sellers, when every second there are orders being executed on both sides. Many traders, when join this profession, come under the idea of trading every day, every hour and every swing in the market. There is a truth in this profession which is that 95% of the traders do not last more than 1 year and there is a big reason behind that.

The Fatal Mistake Most Traders Make

The Reason is that no Human being can forecast or analyse the Market with 100% accuracy and consequently trading both sides of the market i.e buy and sell will decrease the chances of survival for a trader in their first year and result in a very short trading span. As a founder of www.Elliottwave-forecast.com I noticed that many services which were based only in Trading signals did not last too long and the reason is because selling Trading signals forces those services to trade both sides of the market and hence frequently take counter trend positions.

Discovering the Right Side Concept

It took me years to understand that trading is about been selective but more importantly it’s about finding a system to detect the Right Side or Trend and understand that the Market is controlled by computers or big Banks who decide where a cycle starts or ends, but for sure understanding this nature of the market along with an understanding of the cycles places you in the right side. We keep repeating the phrase The Right Side of Market for a reason and we will explain it further in this blog.

Market Cycles and Sequences

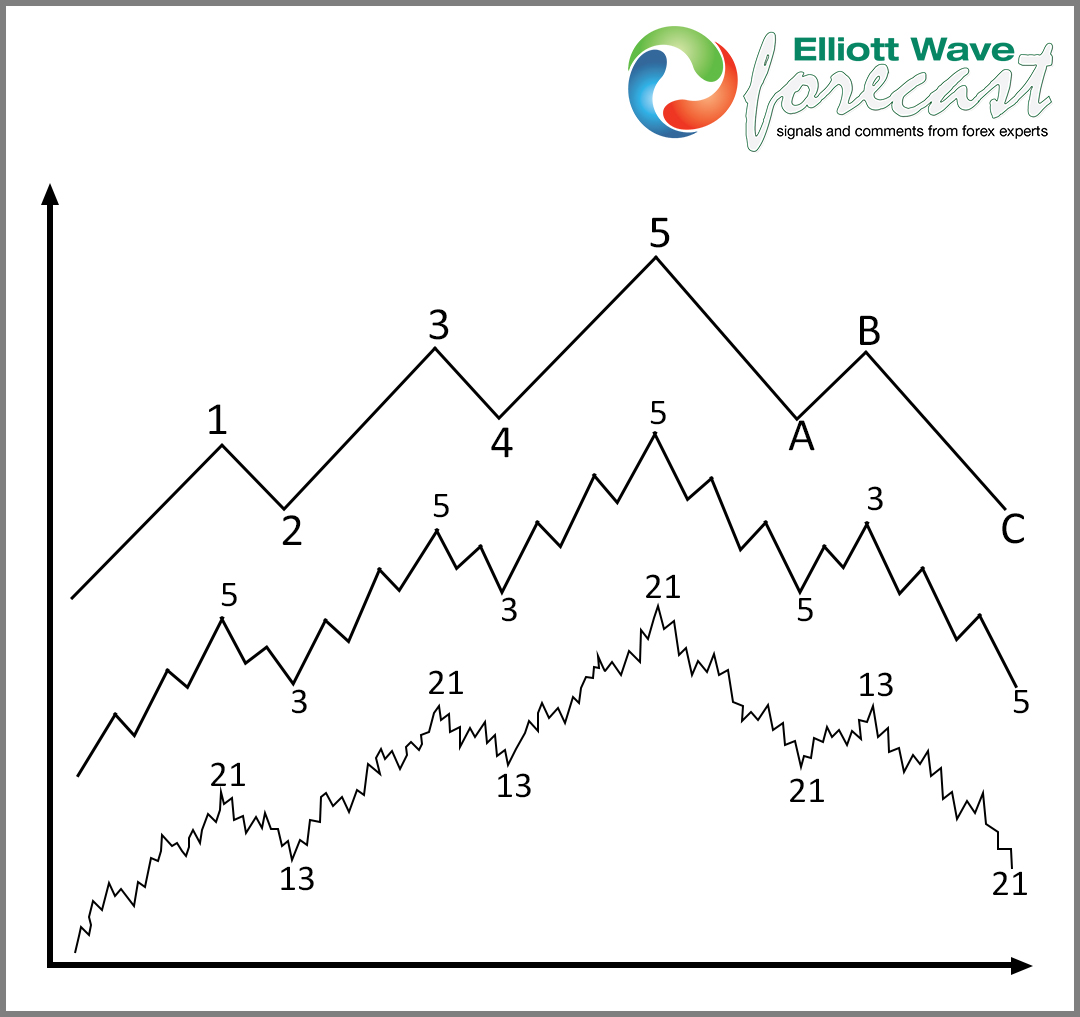

The Market always advance in cycles or sequences of 5-9-13 when the advance is an impulse, as the chart below shows:

Corrective Sequences Explained

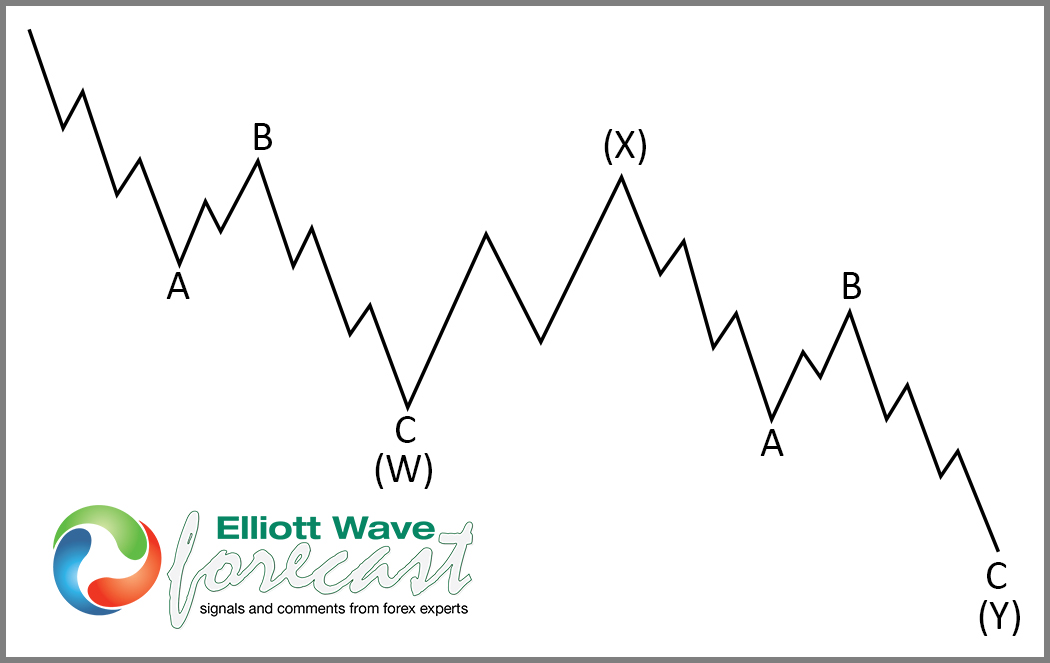

This sequence needs subdivision of 5 waves and will end after showing 5 waves, where one of the 3 main advances need to be extended and provided momentum divergence in wave 5. The other advance comes in a sequences of 3-7-11 and is known as a corrective sequence as we show in the chart below .

.

This sequence happens a lot in the Forex market and should reach a natural target of 100% extension and not show any momentum divergence at the end of the sequence (peak / low).

Practical Application of Sequences

Understanding these two sequences is huge to identify the Right Side of the market. Now, how to apply the sequences, like we have said before a trader needs to combine the time frames and draw a conclusion of which side is the trend and only trade the trend. Many traders see an instrument with huge advance and all they do is picking the end of the cycle when the right side is the advance and what they need to do is keep buying the pull backs in any 3-7-11 swings pull back in an up-trending sequence.

The Power of 3-7-11 Sequences

We mentioned earlier that the Market can advance in two ways, either as impulsive sequences or corrective sequences, but one good thing is that any counter trend move comes in corrective sequences which means mastering the 3-7-11 swings sequences is crucial for a trader’s survival.

Our Approach at Elliott Wave Forecast

We at www.Elliottwave-forecast.com focus a lot in the 3-7-11 sequences and represent in our charts every pullback area, we show in our charts Green (Bullish) and Red (Bearish) sequences tags and provide arrows on all charts to help members understand the right side.

The Problem With Signal Services

Like I said before Trading signal provider services usually have a short life span also because they feel the need to trade every day for members who are paying only for signals and that is impossible. Traders need to understand what the right side of the market is and only trade the right side, because otherwise they won’t last.

Case Study: The SPX Example

We are trying to help and provide guidelines to new traders. Trading the pull backs in 3-7-11 swings in direction of right side is a good trade, let’s think about the SPX, the whole world have been picking the top in the Index and selling but the real traders which make this Market have been buying every 3 swings pull back regardless of the degree of the pull back. We have been recommending the buy because study of cycles and sequences suggests the right side is the upside.

The Logic of Being Right Most of the Time

We do understand that cycles do end one day but looking at other Indices worldwide and sequences, we know the right side is still the upside and many traders selling the peak will get it right one day but as we always said, we like to get it right for the most part and be wrong in the last swing rather than being wrong for the most part and getting it right at the end. It is a very simple logic and like everything in life, simplicity is the best policy.

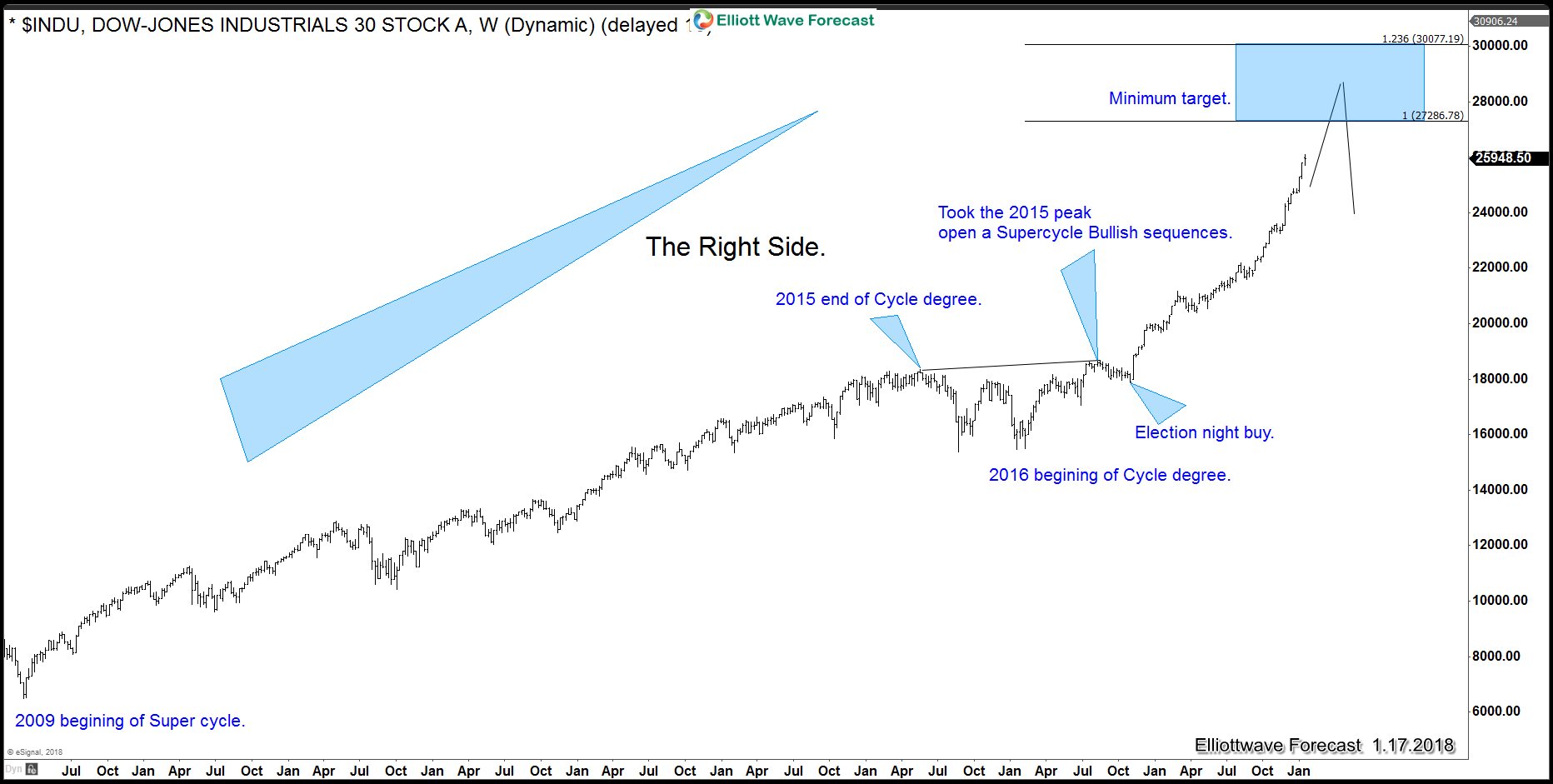

Real Market Example: DOW Jones

The chart below shows the $DOW buying at US Elections night

Sustaining the Right Side

We knew the area and we presented the buying, now the IndEx is trading almost 7700 points higher and we keep buying, why because the right side is still the long side.The following chart shows the advance within the sequences and show The Weekly Bullish sequence from 2009 confirming the right side.

The Final Word on Trading Survival

Learn Trading the Right Side of the market as it’s the only way to survive and be successful in the long run. Otherwise, you could end up being in the 95% who don’t last more than a year.

Back