Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

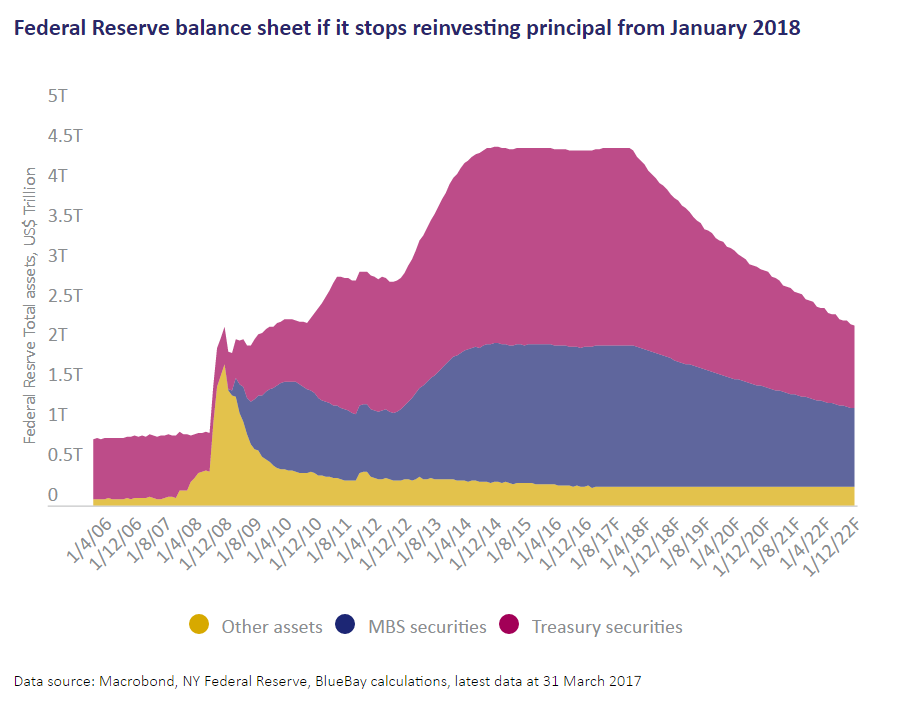

Preparing for Quantitative Tightening

Read MoreThe Fed will soon embark in an uncharted water of Quantitative Tightening (QT). In the aftermath of 2008 global credit crisis, the world central banks went into the biggest experiment in monetary policy called Quantitative Easing (QE). Central banks printed money and bought the government bonds as the primary way for monetary expansion. The combined […]

-

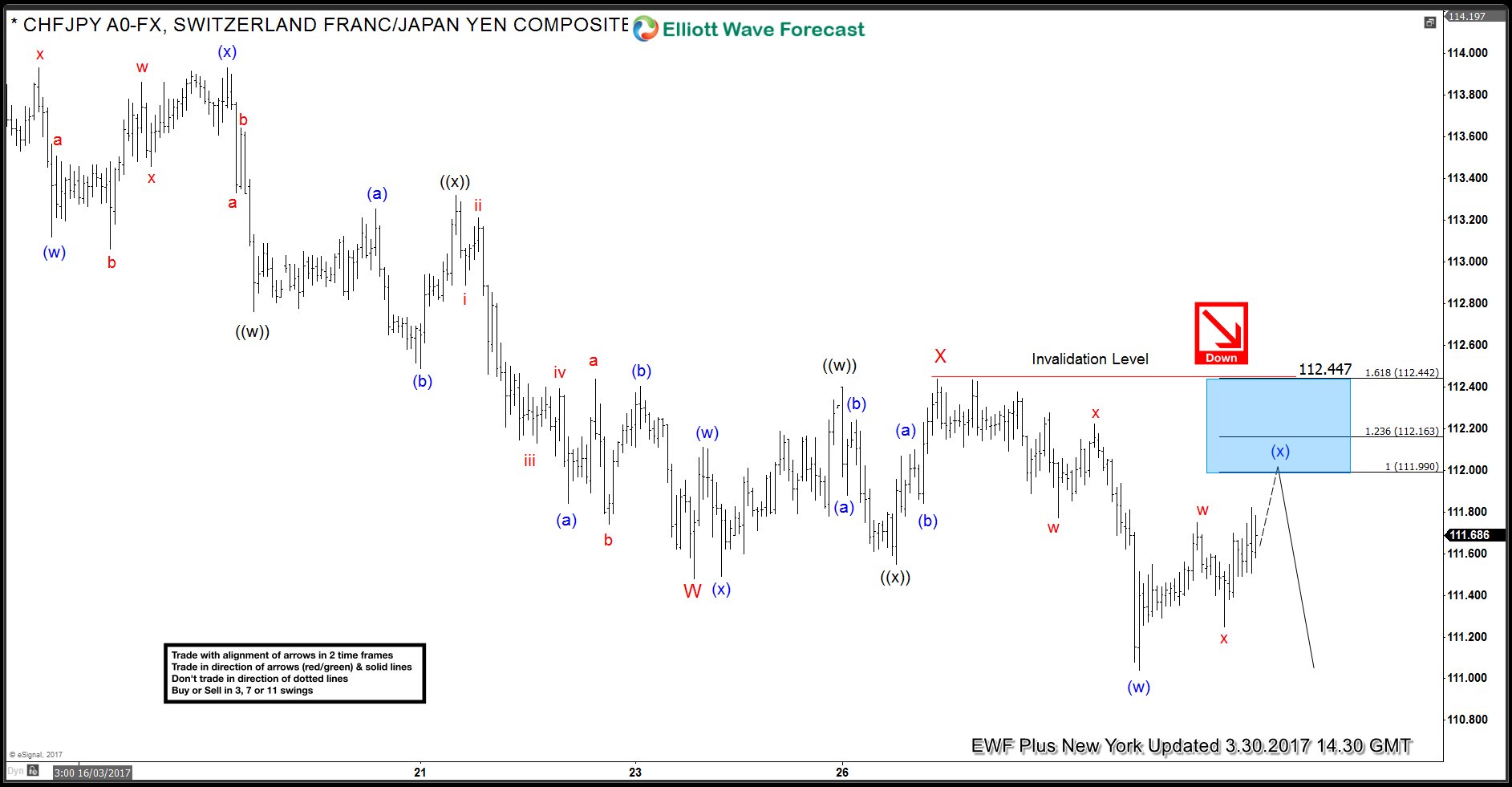

CHFJPY forecasting the decline and selling the rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the another nice trading opporunity we have had lately. The instrument we traded is $CHFJPY. In further text we’re going to explain price structure and reasons why we forecasted the decline. Let’s start explanation by taking a look at past Elliott […]

-

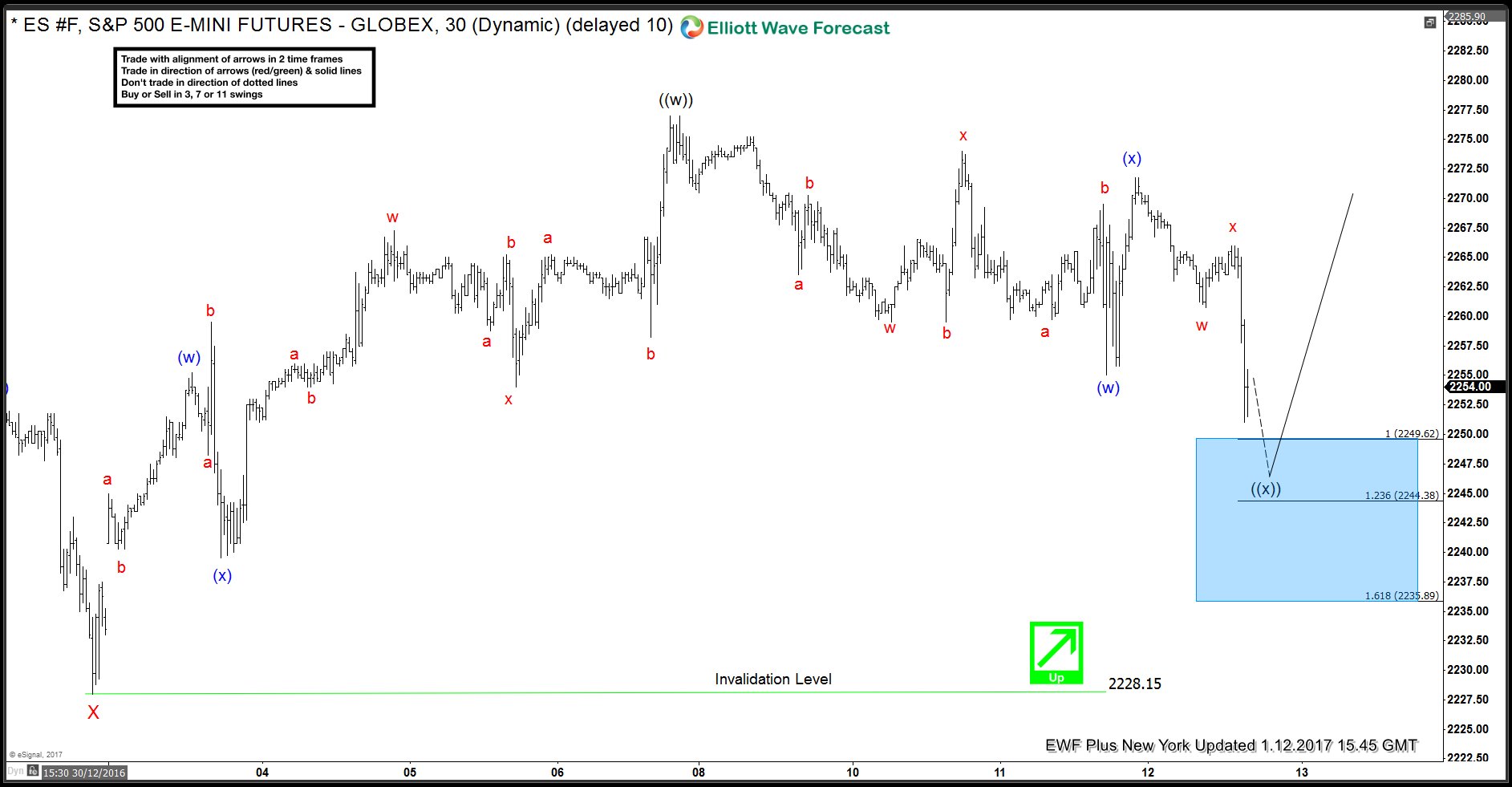

ES_F Strategy of the day, buying the dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at another nice trading example of ES_F. The video below is a short capture from the ES_F Strategy of the day video 01/10/2017 published in members area of www.elliottwave-forecast.com ES_F strategy: S&P 500 E-mini futures is showing an incomplete bullish swing […]

-

Aftermath of December US Non-farm payrolls

Read MoreLast Friday, US added 156,000 job numbers in December Non-farm payrolls followed by a 204,000 rise in November previously, which was bigger than estimated. Whereas the Median forecast for December Non-farm payrolls was estimated at 175,000 jobs. The jobless rate marked up to 4.7 percent as the labor force grew. And wages rose 2.9 percent […]

-

Dow Jones (INDU) forecasting the rally & buying the dips

Read MoreHello fellow traders. Here’s a short capture from the Strategy of the Week video 10/16 2016 held by EWF Senior Analyst Daud Bhatti. Daud presented Elliott Wave count of Dow Jones Industrial Average and explained the swings structure. The Index was having incomplete bullish swings structure in the cycle from the January 21st low. Our […]

-

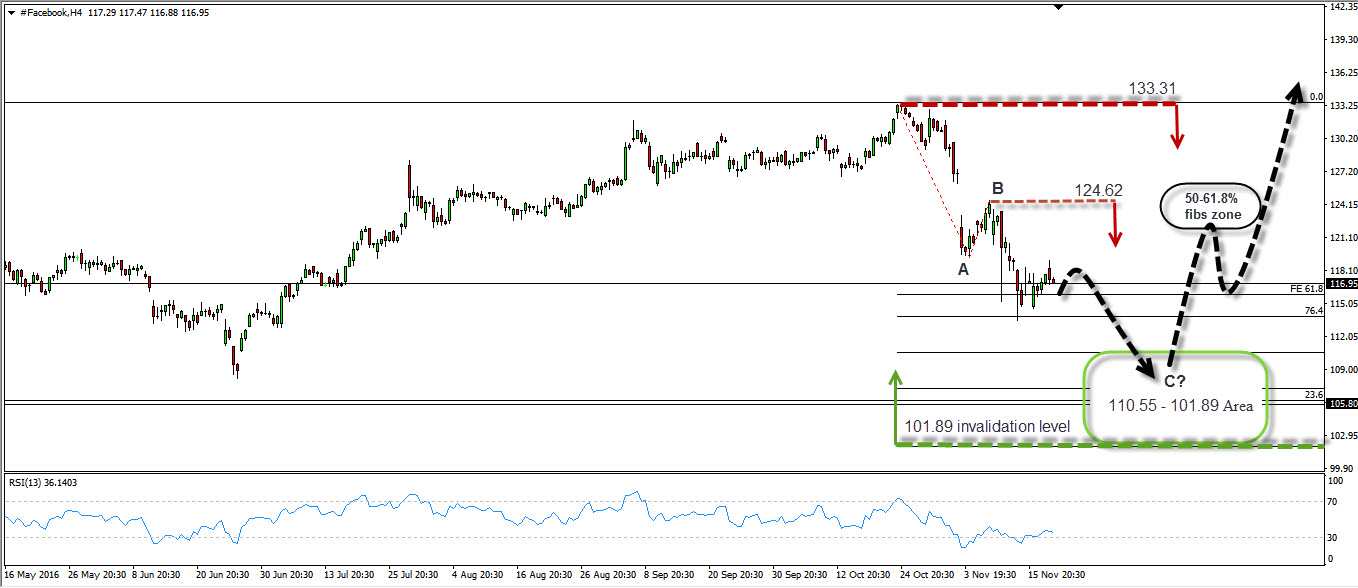

Facebook Inc potential short-term Elliott Wave scenario

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the short term structure of Facebook’s shares price. Facebook began selling stocks to the public in May 2012, as a part of Nasdaq stock exchange with initial price of $38 per share. Eventyaly, the market developed a strong, 3-year-old bullish […]