Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

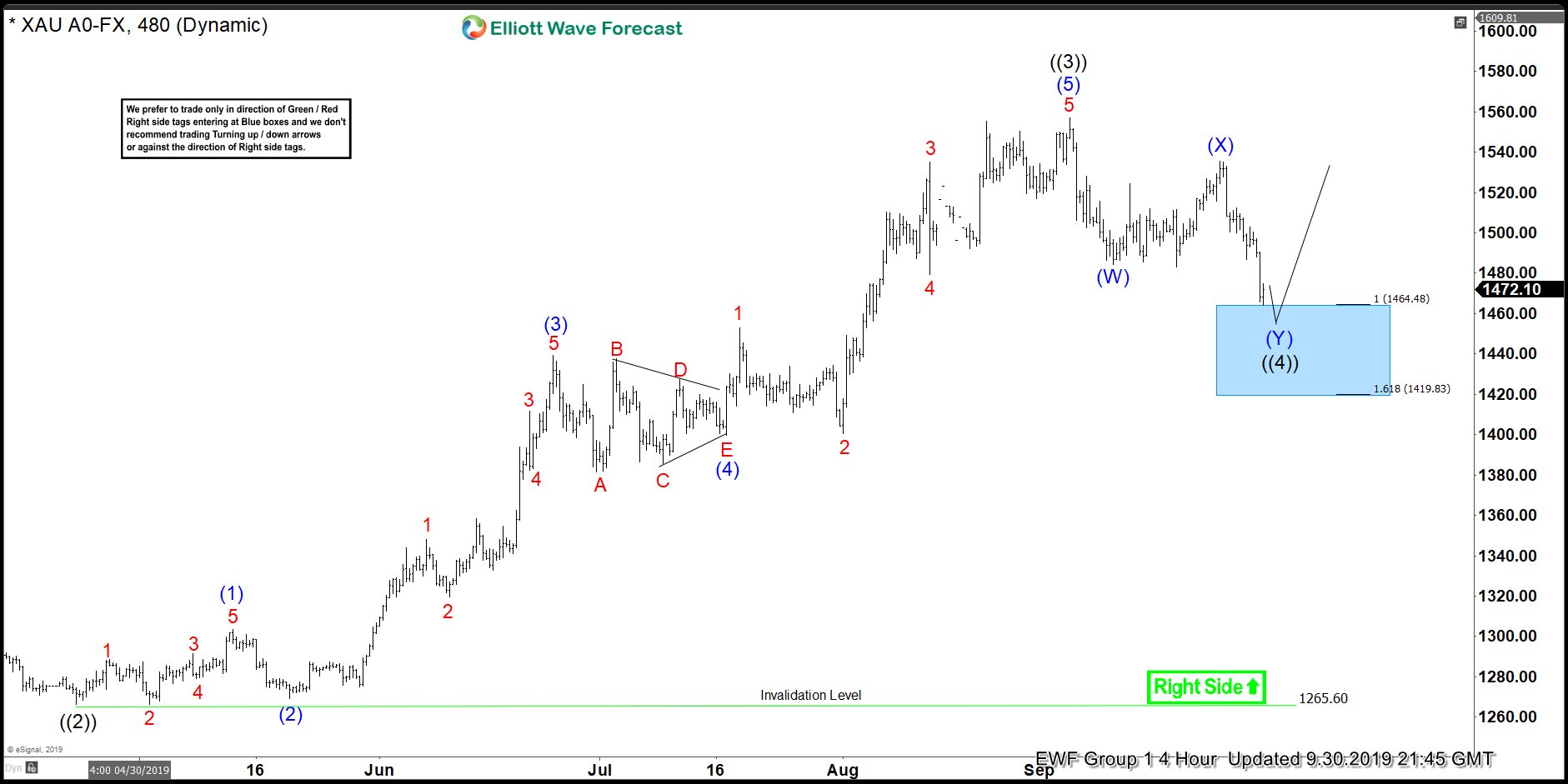

GOLD ( $XAUUSD ) Buying The Dips At The Extreme Zone

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD ( $XAUUSD ), published in members area of the website. As our members know we are favoring the long side in the commodity. We advised members to avoid selling GOLD and keep buying the […]

-

AUDUSD Found Sellers At The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD, published in members area of the website. As our members know, AUDUSD is showing incomplete bearish sequences in the Daily cycle. Besides that, the pair has incomplete bearish sequences in the cycle from the 0.7299 (January 31st) […]

-

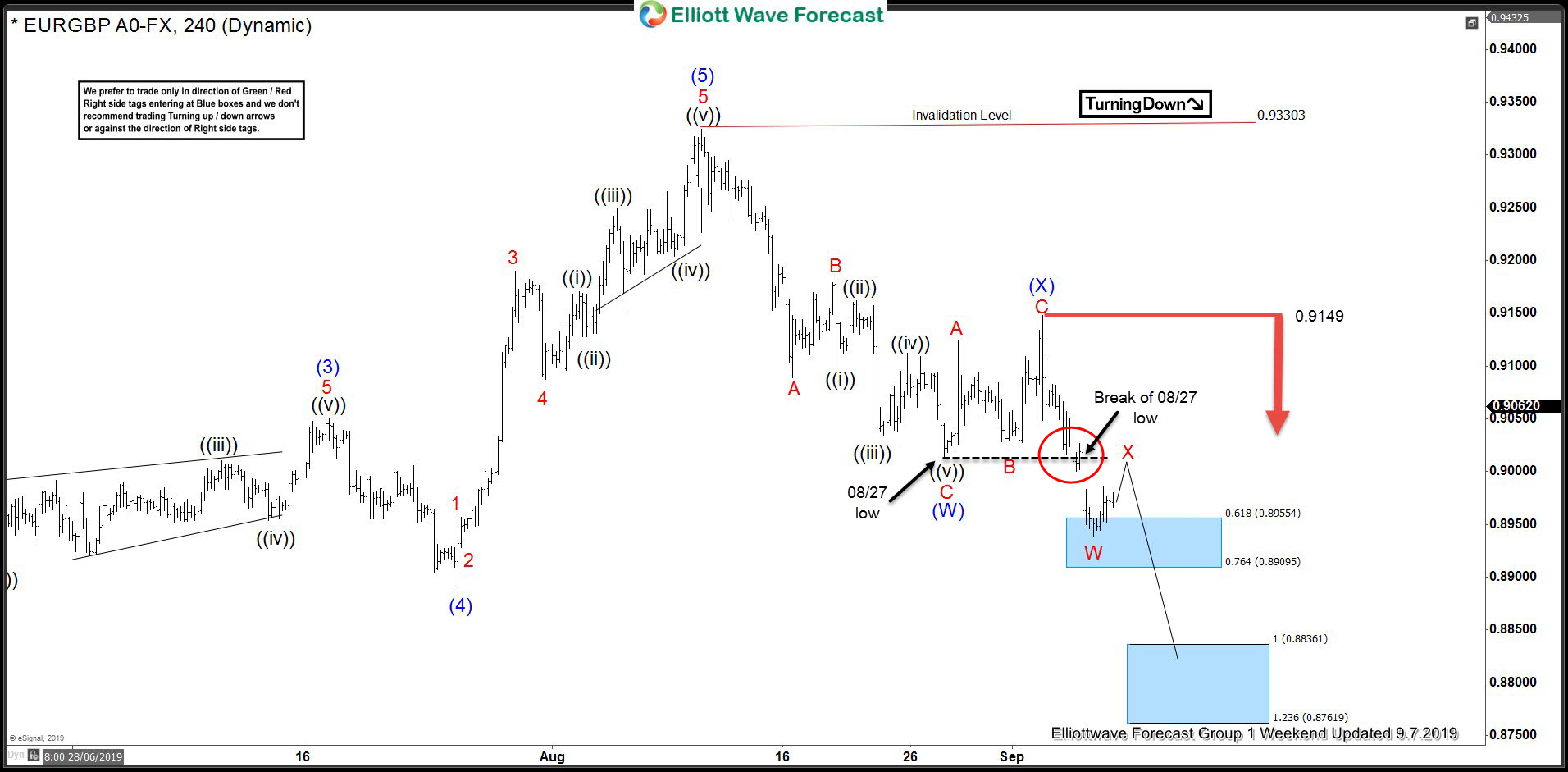

EURGBP Selling The Rallies At The Blue Box

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURGBP. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURGBP, published in members area of the website. As our members know, EURGBP has incomplete bearish sequences in the cycle from the 08/12 peak . […]

-

GOLD ( $XAUUSD ) Buying The Dips At The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD ( $XAUUSD ), published in members area of the website. Break of August 13th peak made cycle from the 08/01 low( 1399.56) incomplete to the upside. Consequently GOLD is bullish against the 1492.49 low […]

-

Ethereum: After the Big Correction, can it reach $1600 area?

Read MoreEthereum has been following a very nice Elliott Wave structure and has been playing out nicely. The Instrument did a 5 waves advance structure from its all-time lows followed by a pullback in a 7 swings Elliott Wave WXY structure. The Following chart represents the basic structure within the Elliott Wave Theory which is the […]

-

Near Term Sequence Analysis of XME Projects Lower Prices

Read MoreS&P Metals & Mining ETF, XME In the immediate term price action for XME we’re seeing an interesting setup that is projecting more lows to come. At EWF we use a proprietary pivot and cycle analytical method that combines with Elliott wave analysis. 5.1.2019 Post Market Chart For a look at how we got to […]