Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

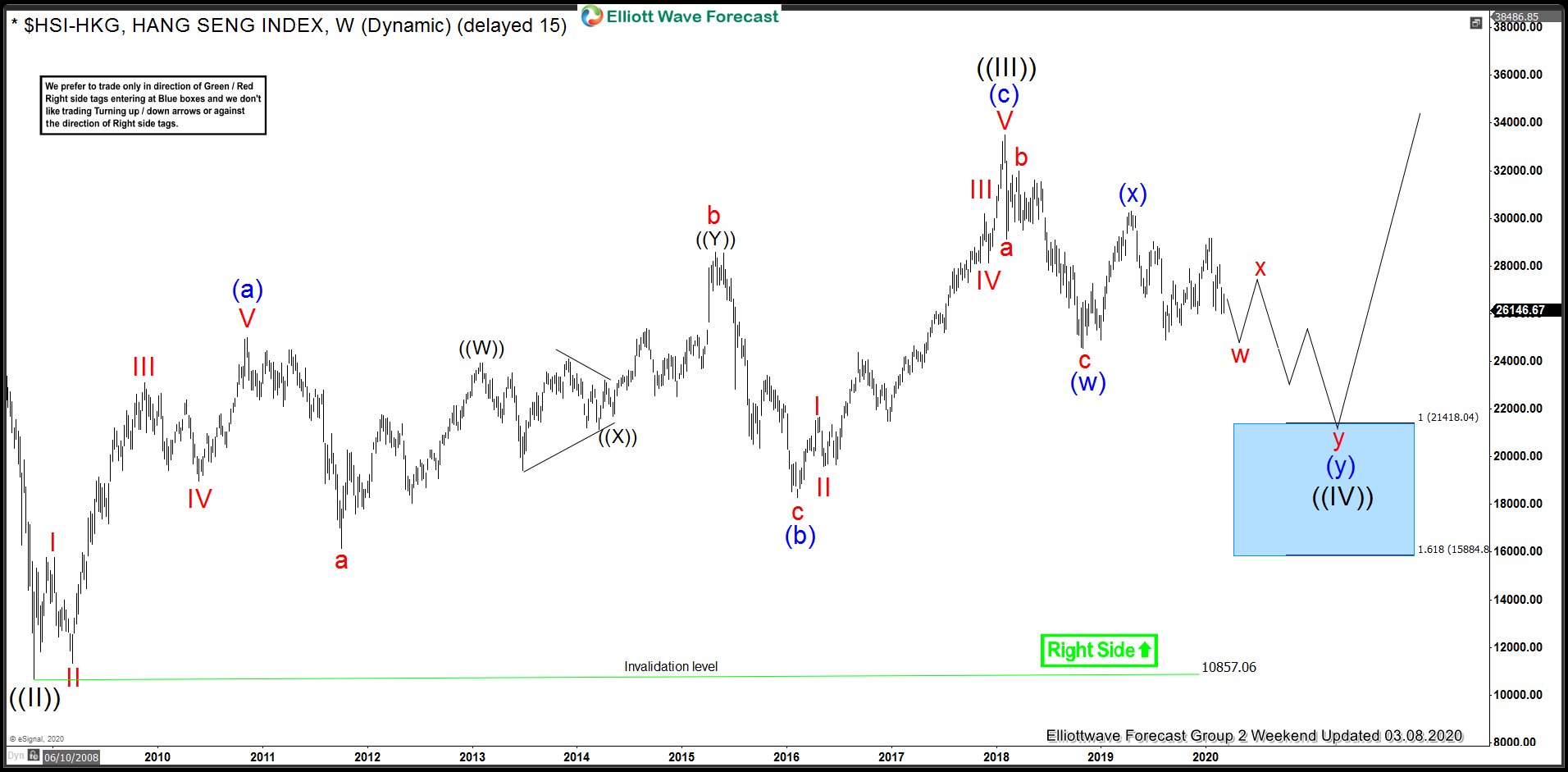

HSI-HKG (Hangseng) Buying The Weekly Correction

Read MoreIn this blog, we take a look at the price action in Hangseng Index since March 2020. Initial decline from January 2018 peak to October 2018 low was in 3 waves and was labelled as a zigzag to complete wave (w). This was followed by a sharp rebound to 30280 level in April 2020. Index […]

-

S&P 500 E-Mini Futures ( ES_F ) Found Buyers At The Blue Box Area

Read MoreHello fellow traders. Another instrument that we have been trading lately is S&P 500 E-Mini Futures (ES_F). In this technical blog we’re going to take a quick look at the Elliott Wave charts of $ES_F , published in members area of the website. As our members know, $ES_F has recently broken June 9th peak which made […]

-

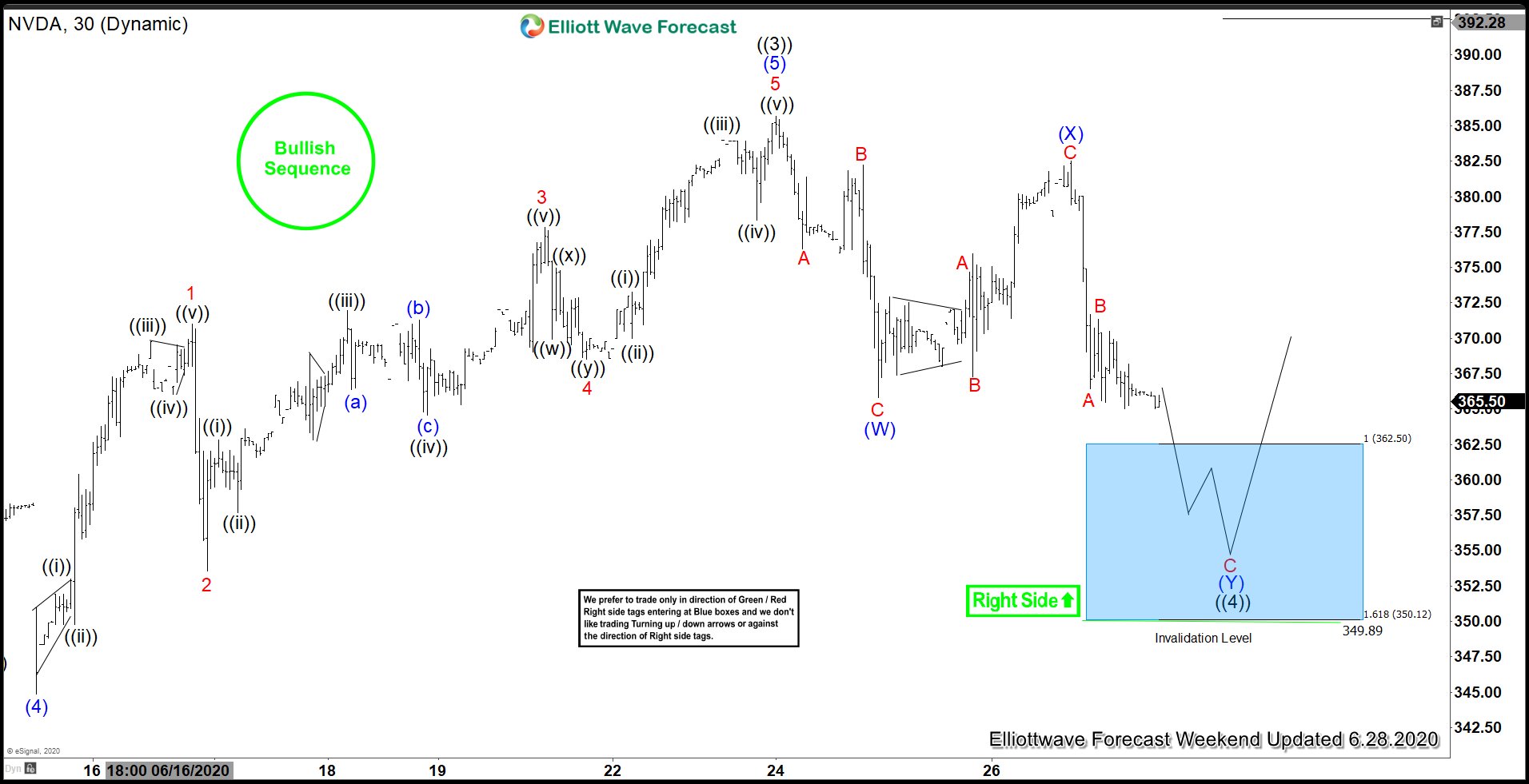

Nvidia ( $NVDA ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. Another instrument that we have been trading lately is Nvidia ( $NVDA ) stock. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $NVDA , published in members area of the website. As our members know, NVDA is showing Impulsive sequences in the cycle […]

-

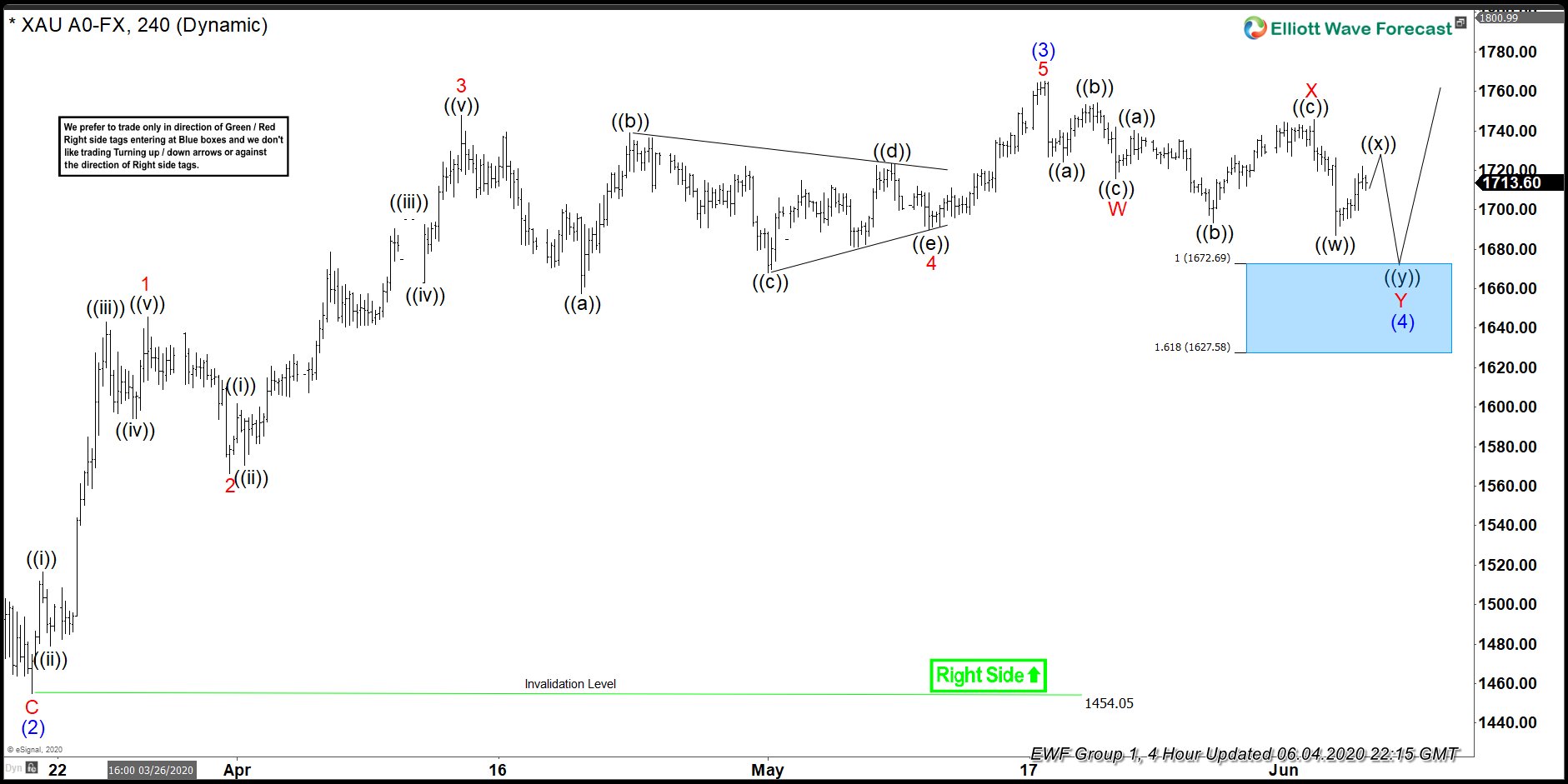

GOLD ( $XAUUSD ) Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. GOLD is another instrument that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD, published in members area of the website. As our members know, GOLD is trading within the cycle from the March 16th low . […]

-

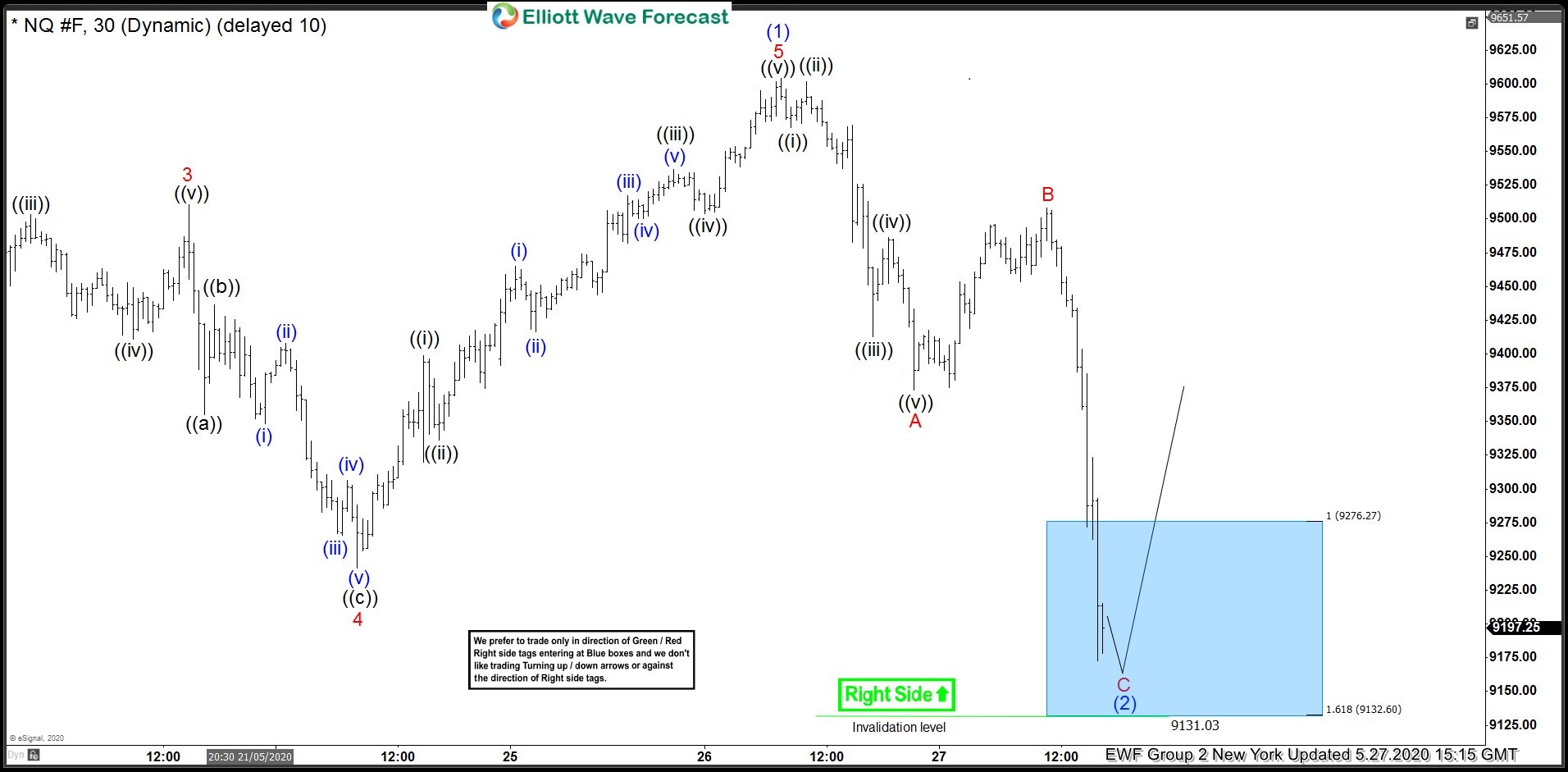

Nasdaq Futures: Buying dips in Elliott Wave Blue Box

Read MoreNasdaq Futures made a sharp decline yesterday before reacting higher strongly into the closing for the day. In this article, we would take a look at the charts we presented to clients yesterday and the blue box area we highlighted for 3 waves decline to end and buyers to appear for the rally to resume […]

-

Google ( GOOGL ) Found Buyers At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGL, published in members area of the website. As our members know, Google is trading within the cycle from the March 1009.6 low. Proposed cycle is unfolding as 5 waves structure, when its last leg […]