Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

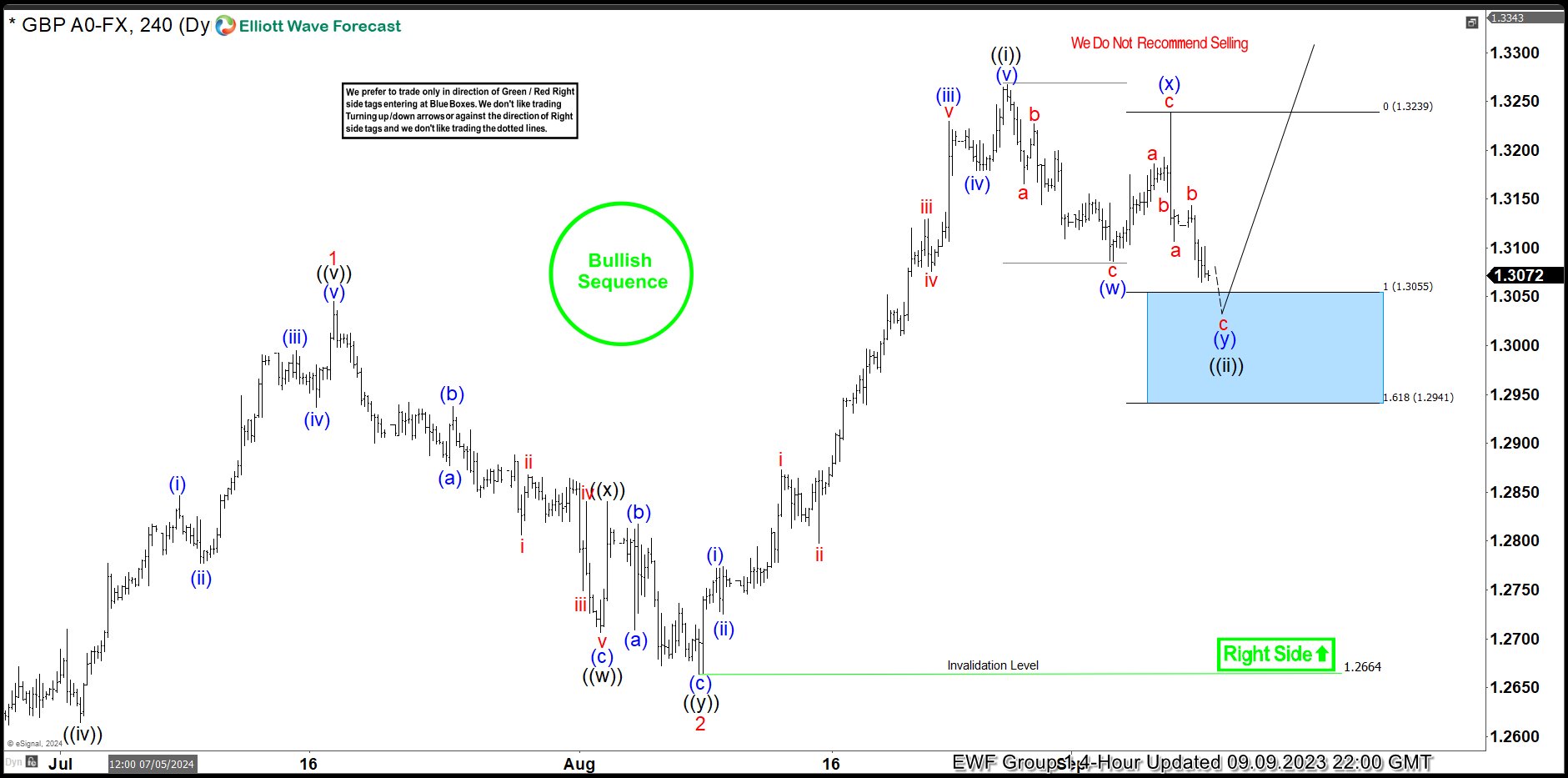

GBPUSD Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of GBPUSD Forex Pair , published in members area of the website. As our members know, GBPUSD has recently given us correction against the 1.2664 low. The pair reached our target zone and completed correction right at the Equal […]

-

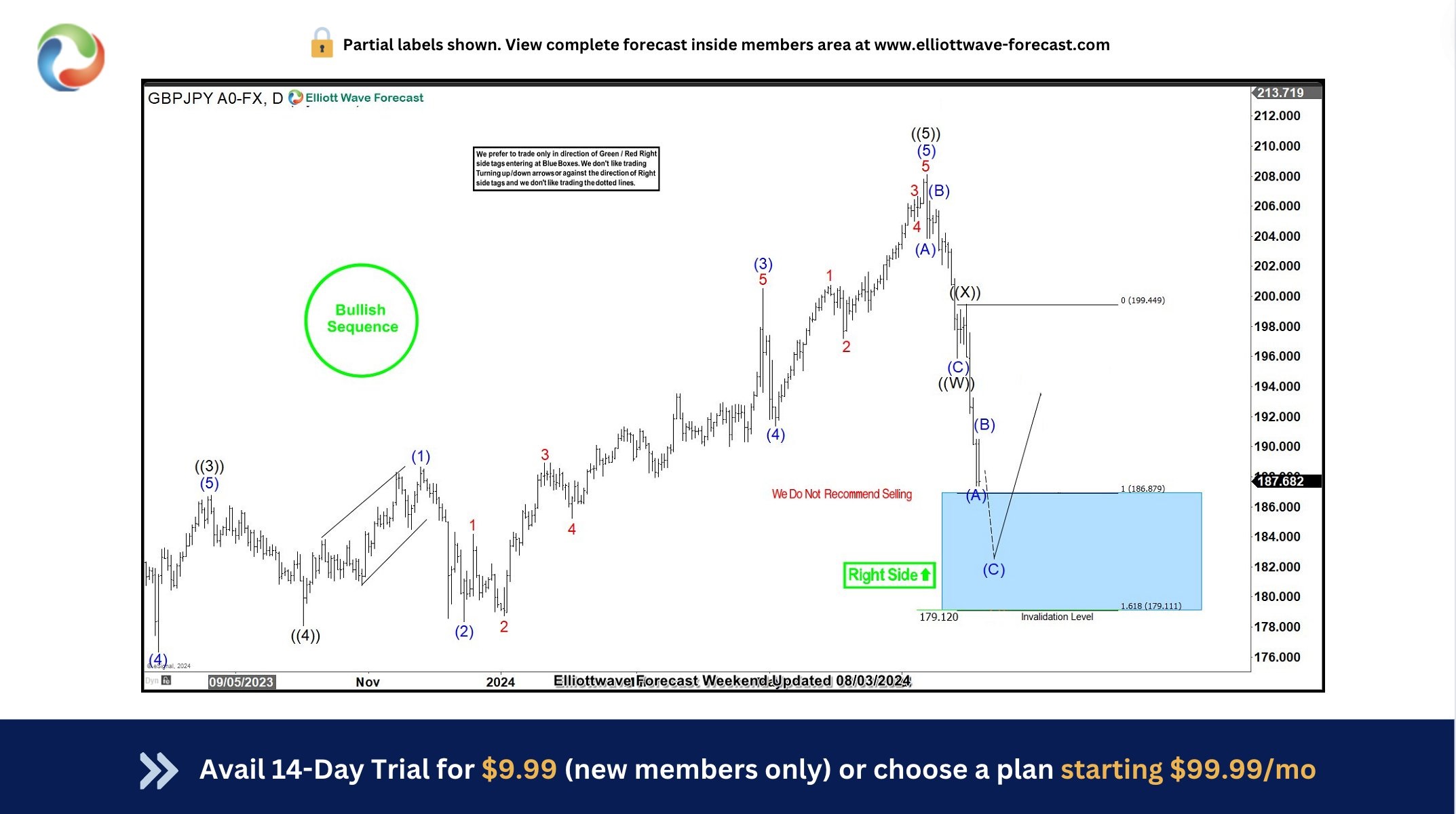

GBPJPY: Buying The Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of GBPJPY Forex pair , published in members area of the website. As our members know, GBPJPY has recently given us daily correction. The pair reached our target zone and found buyers right at the Equal Legs zone ( […]

-

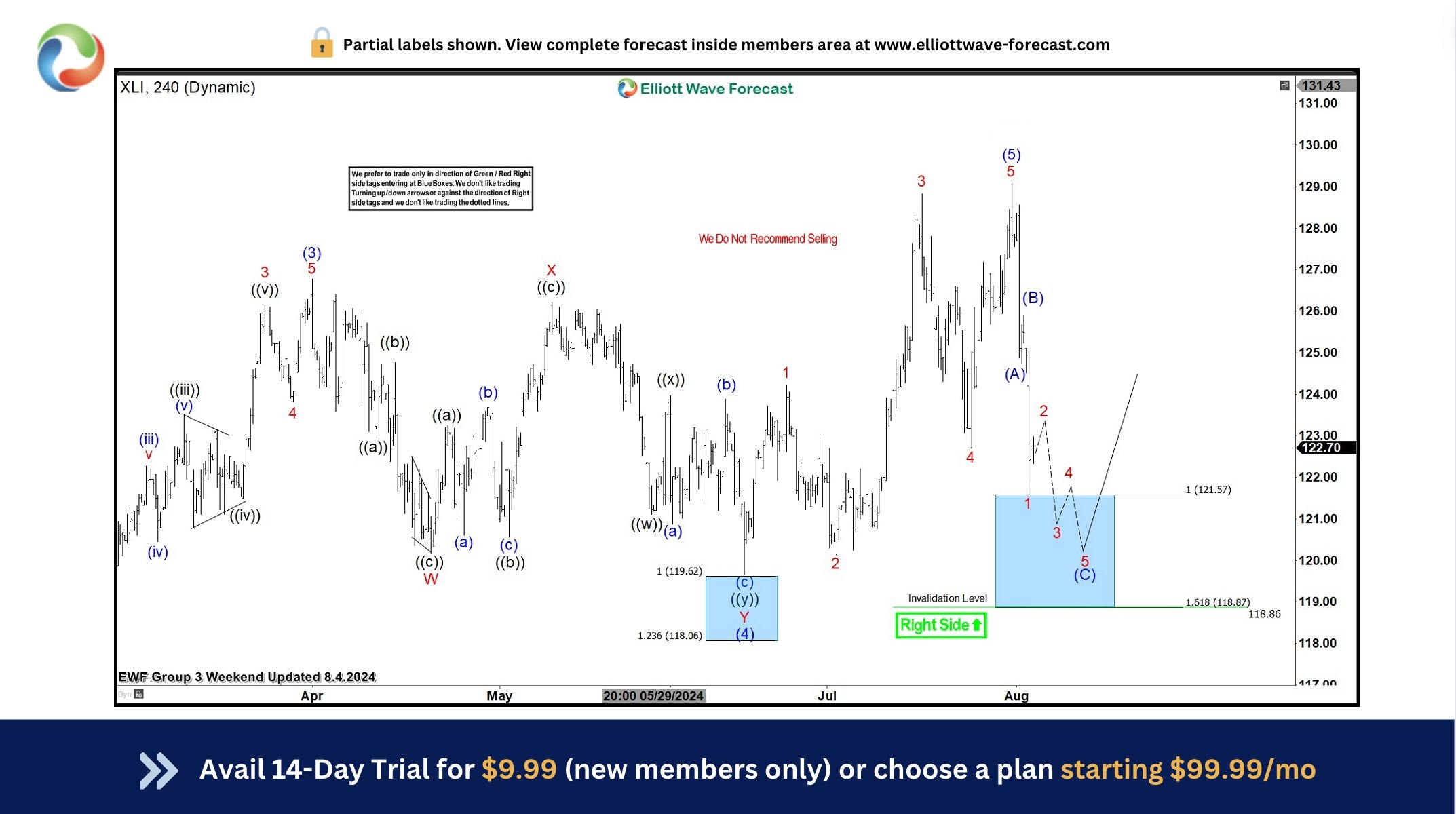

SPDR Industrial ETF (XLI) Found Buyers At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the weekly Elliott Wave charts of SPDR Industrial ETF (XLI) , published in members area of the website. As many of our members are aware, the ETF has given us good buying opportunities recently. XLI hit our buying zone and […]

-

The Golden Rule of 2% – Why you should Risk a little to make a lot.

Read MoreRisking 2% can quite literally save your trading account. By risking too much your trading can be at risk of large drawdowns. But why is this? We searched across the interweb and found several reasons to keep risk low: Surviving losing streaks: Risking 2% per trade allows you to withstand a series of losses without […]

-

Apple Stock (AAPL) Elliott Wave : Buying the Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the weekly Elliott Wave charts of Apple Stock (AAPL) , published in members area of the website. As many of our members are aware, the stock has given us good buying opportunities recently. AAPL hit our buying zone and completed a correction at […]

-

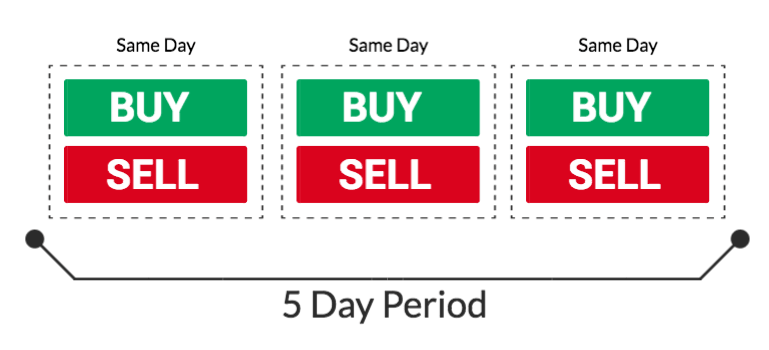

How to Start Trading with a Small Account – Avoid Pattern Day Trader Rule

Read MoreWhen I started out trading back in 2020, there was the allure of starting with a small amount of money and turning it into a large fortune. Since then I have learned several ways of starting with a small amount of money, and growing it exponentially, without having to deal with the Pattern Day Trader […]