Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

USDCAD Elliott Wave : Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. Another instrument we have traded lately is USDCAD. As our members know, we’ve been favoring the long side in USDCAD due to incomplete bullish sequences the pair is showing in the weekly cycle from the 05.30. low . In this technical blog we’re going to take a quick look at the Elliott […]

-

AUDJPY Buying The Dips At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDJPY, published in members area of the website. As our members know, we’ve been favoring the long side in AUDJPY due to incomplete bullish sequences the pair is showing in the weekly cycle from the March 2020 low. […]

-

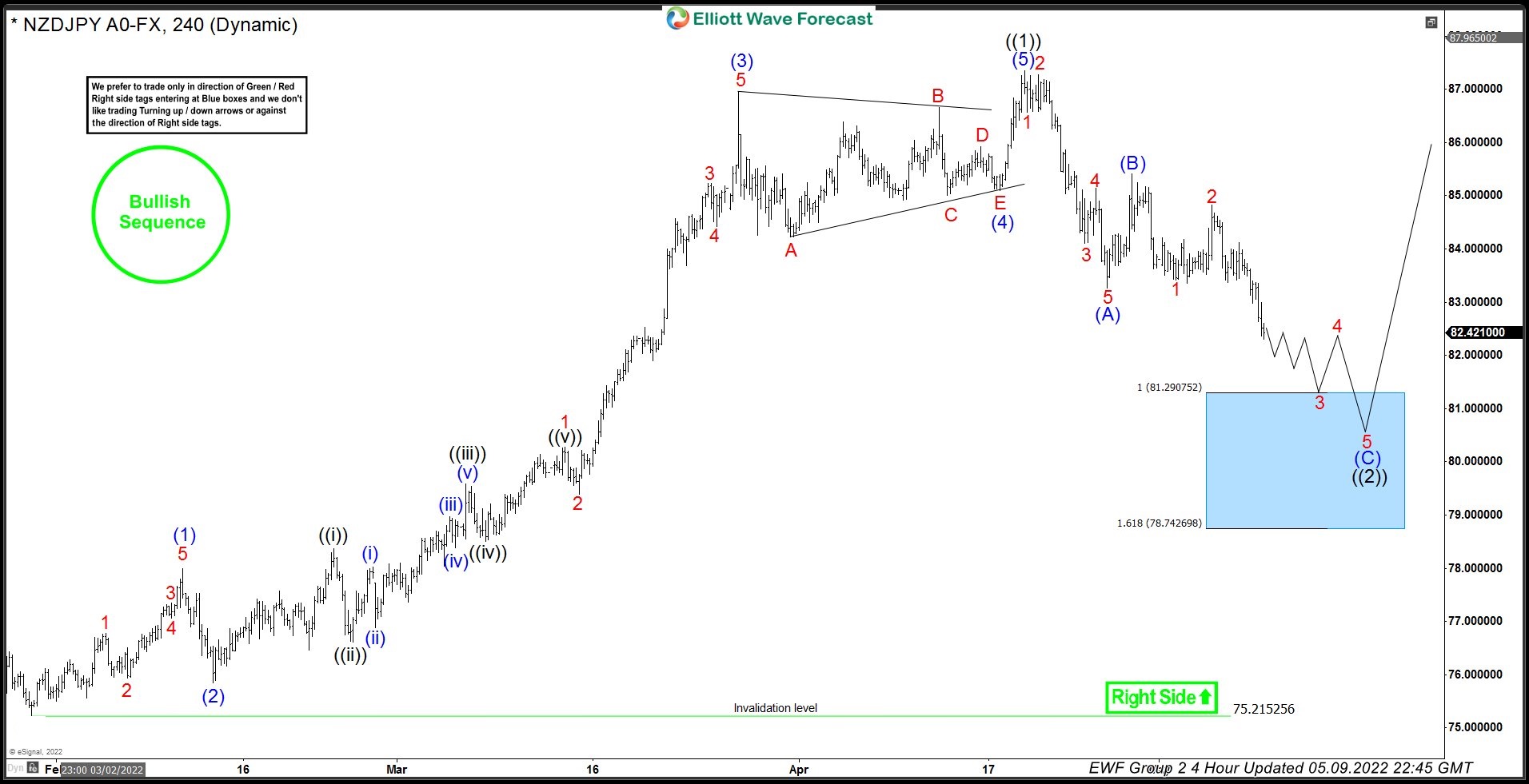

NZDJPY Buying The Dip After Elliott Wave Zigzag Correction

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NZDJPY published in members area of the website. As our members knew, we’ve been favoring the long side in NZDJPY due to incomplete bullish sequences the pair is showing in the cycles from the March 2020 low against January 2022 […]

-

EURUSD Forecasting The Decline & Selling The Blue Box

Read MoreHello fellow traders. Another instrument that we have been trading lately is $EURUSD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD and explain the trading strategy. As our members know, EURUSD has been showing incomplete bearish sequences. Recently he pair has made 3 waves bounce […]

-

NZDUSD Selling The Rallies At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NZDUSD forex pair. As our members know, the pair shows bearish sequences in the cycle from the February 2021 peak. The pair has made 3 waves bounce recently, that has reached our selling zone and gave us good trading […]

-

LTCUSD: Blue Box Shorts Reached The Target

Read MoreLTCUSD has seen tremendous selling over the last few weeks. It recently hit 100% Fibonacci extension down from February 10, 2022 peak down to February 24, 2022 low projected lower from March 30, 2022 peak. In this article, we will look at how our members knew that rally from February 24, 2022 low to March […]