Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

XLI Found Buyers At The Equal Legs Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLI ETF, published in members area of the website. As our members know we have been favoring the long side in XLI. Recently we got a pull back that has made a clear 3 waves […]

-

Best Stop Loss Strategies For Trading in 2025

Read MoreIn online forex trading, avoiding losses is crucial to achieve a profit. But when you’re trading in a highly dynamic market, it’s tricky to keep up with all your different trades – let alone determine the best time to buy or sell. And while it’s certainly ambitious to try raking in obscene amounts of profit […]

-

10 Trading Habits to Adopt in 2025

Read MoreIf you’re an online trader who plans to level up their strategies this year, it’ll take much more than persistence and determination. If you want to see favorable results in the long run, you can’t rely on luck, intuition, or guesswork. Rather, you’ll need to build positive trading habits that improve your ability to read […]

-

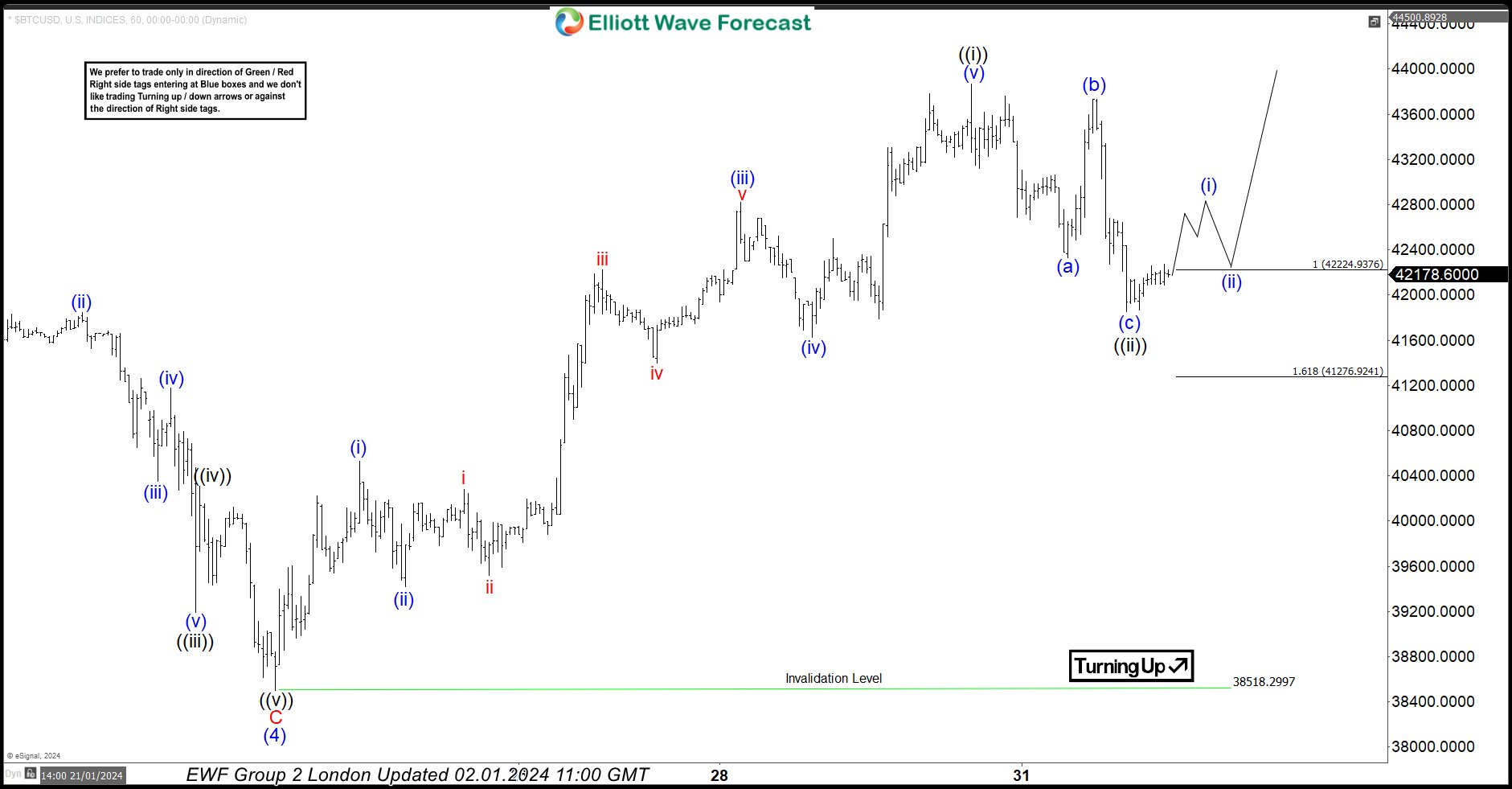

BTCUSD Found Buyers At The Equal Legs Area

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of BTCUSD published in members area of the website. As our members know Bitcoin has given us 3 waves pull back recently that found buyers right at the equal legs area. We have been favoring the […]

-

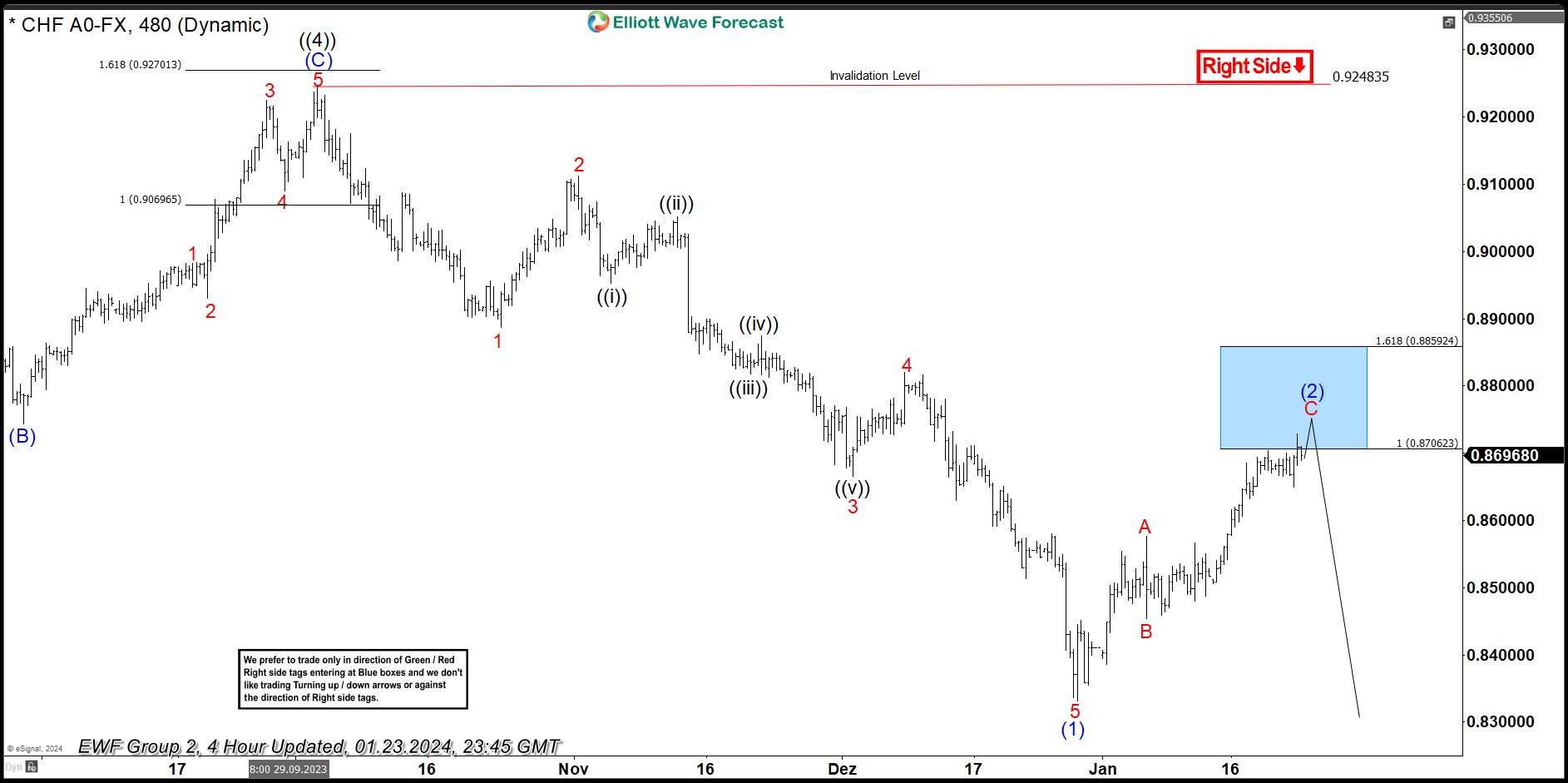

USDCHF Selling The Pair At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of USDCHF published in members area of the website. As our members know, the pair is bearish against the 0.9246 pivot. Our team recommended members to avoid buying , while keep favoring the short side in […]

-

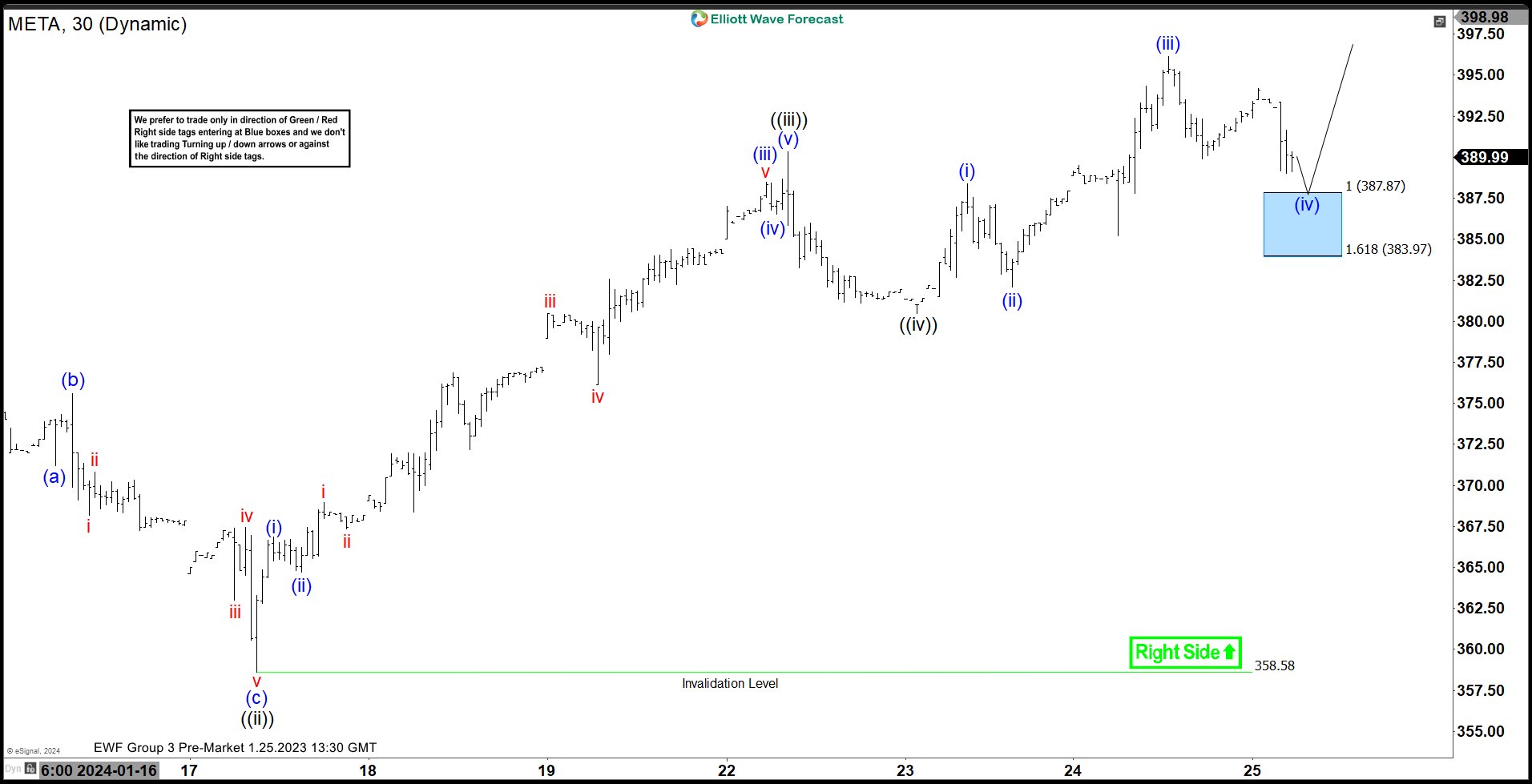

Meta Stock : Another Buying Opportunity After 3 Waves Pull Back

Read MoreHello fellow traders. As our members know Meta Stock has been giving us good trading opportunities recently. In this technical article we’re going to take a quick look at another Elliott Wave trading setup of META published in members area of the website. As our members know, META is showing bullish impulsive sequences in the […]