Vertiv Holdings Co., (VRT) is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE.

VRT favors bullish sequence in weekly & expects push higher against 11.21.2025 low. It favors rally between $215.3 – $232.75 area within April-2025 sequence.

VRT – Elliott Wave Latest Daily View:

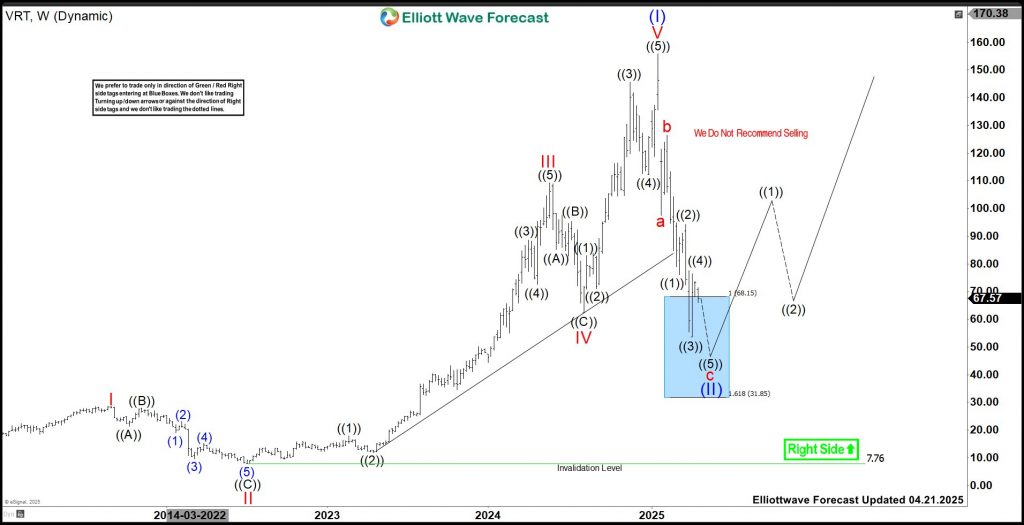

In weekly, it ended (I) impulse sequence at $155.84 high in January-2025 & (II) at $53.60 low in April-2025. Above there, it favors rally in I of (III) & expect another push higher against 11.21.2025 low. Within I, it placed ((1)) at $153.50 high, ((2)) at $118.70 low, ((3)) at $202.45 high, ((4)) at $149.11 low & favors upside in ((5)). The structure is overlapping & expect final push higher to end the structure in diagonal as I, if the high comes with momentum divergence. But if it erase the divergence, it can be nesting as alternate view. Within ((1)), it placed (1) at $70.35 high, (2) at $60.67 low, (3) at $133.52 high, (4) at $119.10 low & (5) at $153.50 high.

VRT – Elliott Wave Daily View From 8.11.2025:

The ((2)) was corrected in 3 swings at 0.382 Fibonacci retracement of ((1)). Within ((3)), it ended (1) at $152.45 high, (2) at $133.85 low, (3) at $184.44 high, (4) at $162.68 low & (5) at $202.45 high as ((3)). It ended ((4)) as 3 swings pullback as 0.618 Fibonacci retracement, overlapped with ((1)). Above there, it appears ended (1) at 189.66 high & expect pullback in (2), which should hold above 11.21.2025 low to continue rally in (3). It favors rally into $215.3 – $232.75 area, which confirm above 10.30.2025 high. We like to buy the pullback in (2) in 3, 7 or 11 swings at extreme area. Better opportunity will be II correction to buy at extreme area against April-2025 low.

VRT is not the part of regular service at EWF. But we provide time to time updates on instrument under blog section. Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try our services for 14 days at $9.99. Also, you can check out the Educational section to learn Elliott wave theory & its application through different packages available & 1-1 coaching for doubts.